Last updated on Feb 17, 2026

Get the free Sample Mortgage template

Show details

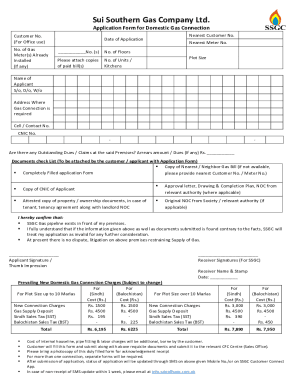

Sample Mortgage for Real Estate Property. The form may be customized to suit your needs.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample mortgage

A sample mortgage is a template agreement outlining the terms and conditions of a mortgage loan between a borrower and a lender.

pdfFiller scores top ratings on review platforms

Its been really helpful to me

great for editing

WOW!!!

WOW!!!! What an awesome service. EASY to use even for novices like me. Would recommend in a heartbeat!!!

good

good pdf filler. very easy to use

Bruce immediately responded to my…

Bruce immediately responded to my concerns, advised me what I needed to do to resolve the issue and followed up to make sure the issue was resolved. I was very pleased with his professionalism, customer service and follow through.

great things

Awesome platform easy use

Who needs sample mortgage template?

Explore how professionals across industries use pdfFiller.

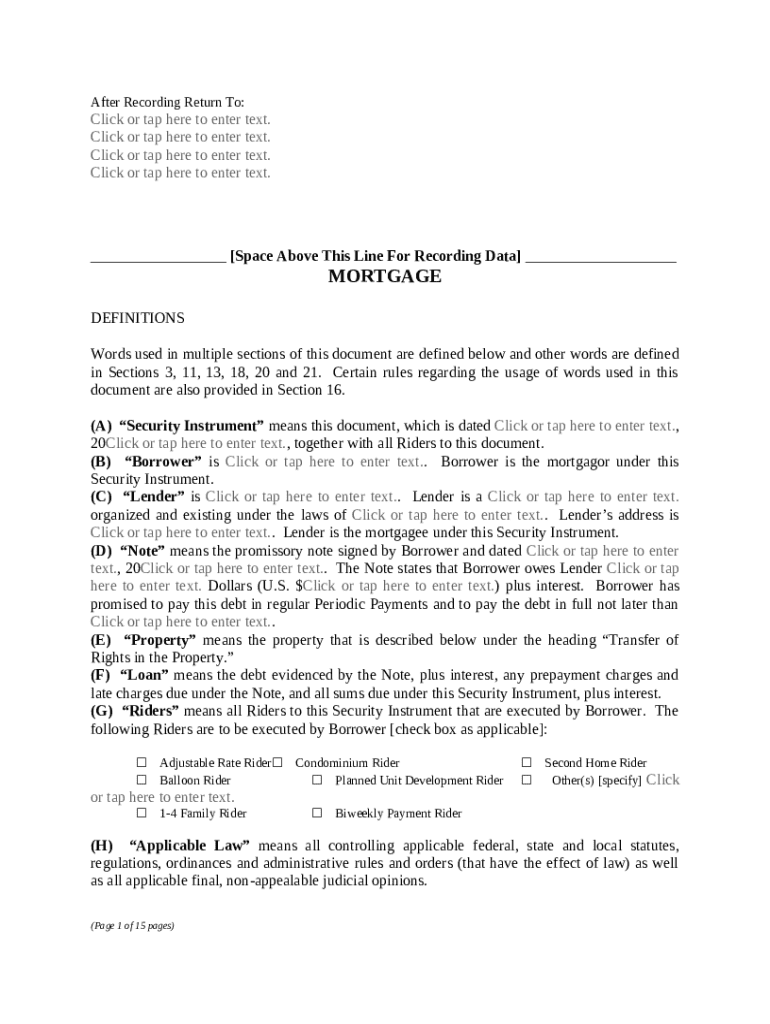

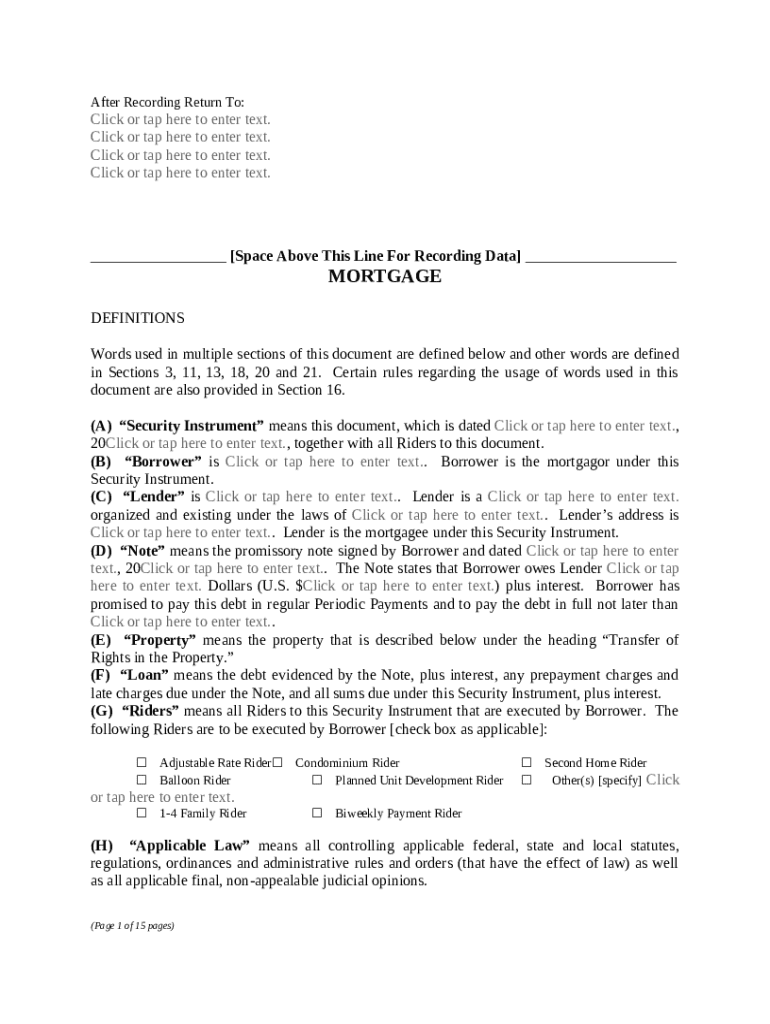

How to fill out a sample mortgage form form effectively

Filling out a sample mortgage form can seem daunting, but understanding each component can simplify the process. This guide reviews the essential sections, terminology, and practical tips for accurately completing your mortgage documentation.

What components are in a mortgage form?

A mortgage form typically includes critical components such as borrower information, property details, loan specifics, and terms of repayment. Understanding each part is vital, as it ensures that the lender accurately assesses your application.

-

This includes your personal and financial information, such as your name, address, date of birth, and Social Security number.

-

Details about the property being financed, including its address, legal description, and current market value.

-

Information on the type of loan, amount requested, interest rate, and repayment terms.

Why is accuracy crucial in mortgage forms?

Accuracy is critical when filling out a mortgage form as even minor errors can lead to delays or rejections in the application process. Ensuring that all information is correct helps build trust with your lender and contributes to a smoother approval process.

How do you obtain a mortgage form?

You can obtain a sample mortgage form online through various financial institutions or from pdfFiller, which also offers editing and interactive features for easier completion. These resources typically provide the most current versions of mortgage forms needed for your state.

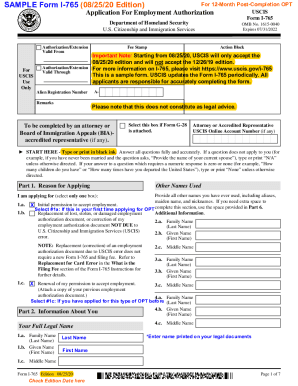

How do navigate the mortgage definitions section?

Understanding the terminology used in mortgage forms is essential. The definitions section often includes terms like 'Borrower,' 'Lender,' and 'Security Instrument,' which define parties involved and their roles.

-

The person or entity applying for the loan.

-

The bank or financial institution providing the loan.

-

A document that secures the loan with the property as collateral.

What is the step-by-step process for filling out the form?

Carefully completing the mortgage form involves several actionable steps. Each section must be filled out meticulously to avoid common mistakes.

-

This section requires you to list where the property title should be sent after the recording process.

-

Double-check for accuracy and clarity in names and property descriptions.

-

Fill out your loan amount, proposed interest rate, and important dates accurately.

What interactive features does pdfFiller offer?

pdfFiller provides several benefits for document management, including interactive tools for filling out and eSigning mortgage forms. These features allow users to collaborate effectively while ensuring compliance with the latest mortgage requirements.

What common mistakes should avoid?

Filing mortgage forms can lead to frequent errors, such as incorrect property data or missing signatures. Understanding these common pitfalls can help you produce a flawless document.

-

Always ensure that all required sections are filled before submission.

-

Double-check all dates related to the mortgage term.

-

Misstating your loan amount or interest rate may lead to significant issues.

What are loan estimates and closing disclosures?

Loan estimates and closing disclosures provide essential information about your mortgage costs and terms. Familiarizing yourself with these documents will aid your decision-making throughout the mortgage process.

What are the final steps in submitting your mortgage form?

Before submission, verify that your mortgage form is complete and accurate. You can submit your form either electronically through secure online platforms like pdfFiller or by mailing a physical copy.

What are local compliance requirements for mortgage forms?

Compliance varies regionally; ensure to review any specific state requirements for your mortgage form. pdfFiller often integrates these compliance checks within their platform.

How to fill out the sample mortgage template

-

1.1. Download the sample mortgage template from pdfFiller or open the existing file in your account.

-

2.2. Begin by entering the borrower's full legal name as it appears on identification.

-

3.3. Specify the property address, including the city, state, and ZIP code.

-

4.4. Input the mortgage amount being requested and the interest rate agreed upon.

-

5.5. Fill in the term of the loan, typically in years, such as 15 or 30 years.

-

6.6. Include details regarding monthly payments, due dates, and any additional fees.

-

7.7. Provide necessary information regarding taxes and insurance as required.

-

8.8. Review the conditions surrounding default or late payments, specifying penalties if applicable.

-

9.9. Both parties should sign and date the document, ensuring all signatures are legible.

-

10.10. Save the completed document and distribute copies to the borrower and lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.