Get the free pdffiller

Show details

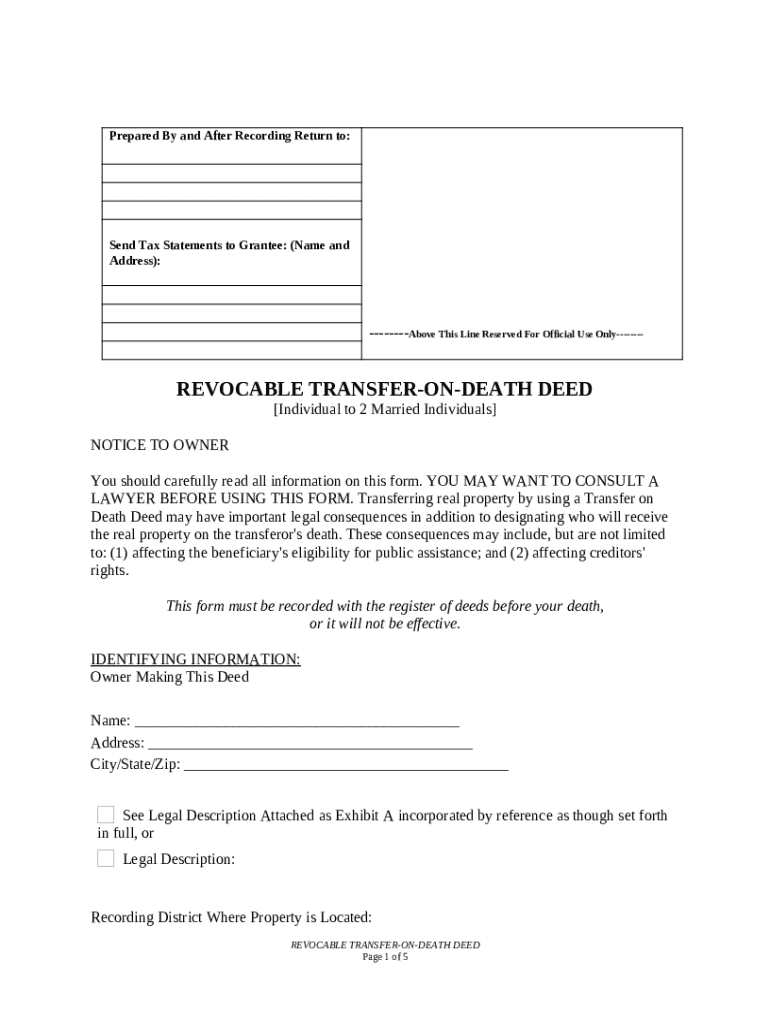

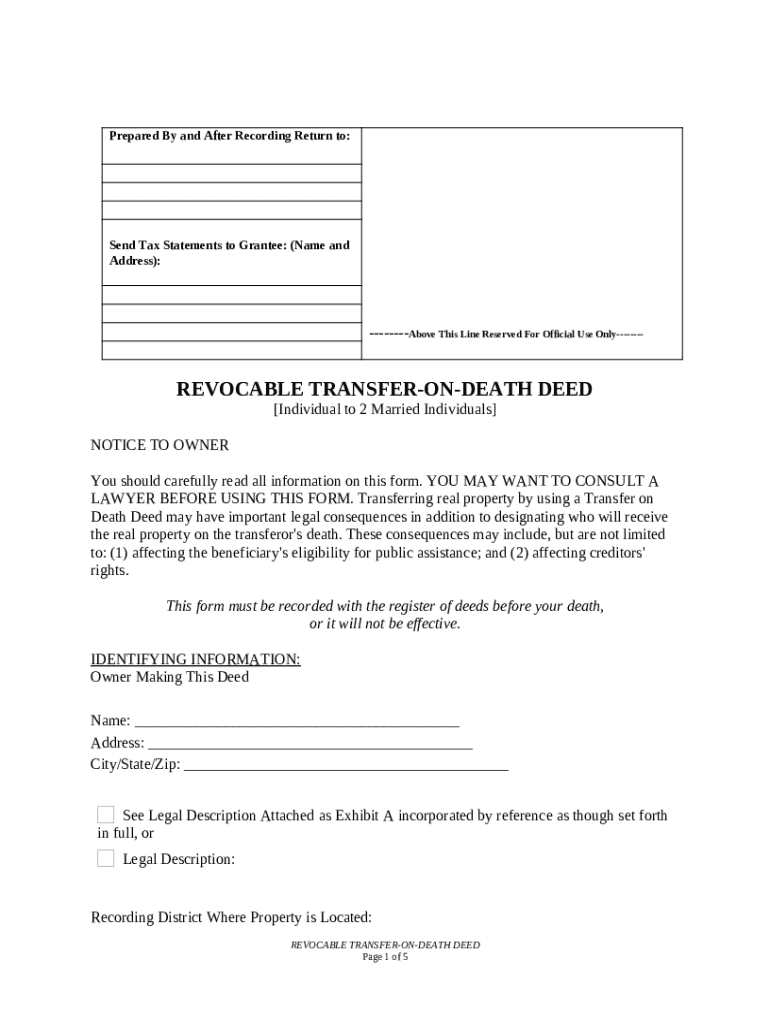

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to transfer ownership of real estate to a designated beneficiary upon the owner's death, bypassing probate.

pdfFiller scores top ratings on review platforms

great services with great results.

my opinion

i love this app

Great thing to use makes life easier…

Great thing to use makes life easier when you dont have a printer

Love it

Love this app! 5 stars

I'M VERY SATISFIED BY USING THIS TOOL…

I'M VERY SATISFIED BY USING THIS TOOL HELPED ME ALOT I RECOMEND IT TO EVERYONE AS A SPECIAL TOOLI REALLY APRECIATED USING ITTHANK YOU

Easy

Easy to use!!!

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guidance

How does a transfer on death deed work?

A transfer on death deed (TODD) is a legal document that allows the property owner to transfer their real estate to designated beneficiaries upon their death, bypassing probate. This deed must be executed and recorded during the owner's lifetime to be effective. Utilizing this form can simplify the transfer of property, making it easier for loved ones.

-

The primary purpose of a TODD is to facilitate the transfer of real estate directly to beneficiaries without the need for probate.

-

Properly identifying beneficiaries is crucial; if not done correctly, the deed may not achieve the desired effect.

-

Failing to adhere to legal guidelines when creating a TODD can lead to challenges in transferring the property.

When should you consider using a transfer on death deed?

Understanding when a transfer on death deed is appropriate can help avoid conflicts later. It is beneficial in situations where the owner wishes to designate a specific person to inherit property directly.

-

A TODD can be especially useful for individuals wanting to ensure their property is transferred without delays after their passing.

-

Since the property transfers upon death, it generally doesn't affect the beneficiary's eligibility for public assistance while the owner is alive.

-

Using a TODD can protect the inherited property from creditors who may pursue the estate.

What are the preliminary steps before completing the deed?

Before completing a transfer on death deed form, it's essential to follow several preliminary steps to ensure accuracy and legal compliance.

-

Engaging a lawyer ensures that the deed is compliant with local laws and accurately reflects your wishes.

-

Collect all required documents, including property titles and beneficiary information, before attempting to fill out the form.

-

Each jurisdiction may have specific regulations regarding TODDs, so it's crucial to understand these before filing.

How do you fill out a transfer on death deed form?

Filling out the transfer on death deed form accurately is paramount to its validity. Follow these steps closely to ensure everything is filled out correctly.

-

Ensure your name and address are recorded accurately in the deed.

-

Properly record primary and alternate beneficiaries to avoid disputes later on.

-

Attach a legal description of the property being transferred to ensure clarity and legal enforceability.

What steps are involved in recording your transfer on death deed?

To ensure your transfer on death deed is effective, it must be properly recorded with the relevant authorities.

-

Locate your local register of deeds and submit the completed form along with any necessary attachments for recording.

-

It's crucial to record the deed before your passing to ensure it operates as intended.

-

Where you file may depend on the property’s location—always check local guidelines.

How can you manage and modify the transfer on death deed?

Life changes may necessitate updates to your transfer on death deed, which is both permissible and advisable.

-

You can revoke or modify the deed at any time, but proper procedures must be followed.

-

Regularly review and update beneficiary designations to reflect changes in personal circumstances.

-

Circumstances such as marriage or divorce may impact the effectiveness of your designated beneficiaries.

What common mistakes should be avoided with transfer on death deeds?

Despite their straightforward nature, several frequent mistakes can undermine the intent of a transfer on death deed.

-

Ensure that you fully comprehend the function of a TODD to avoid legal pitfalls.

-

Any errors can lead to potential disputes, so verify beneficiary information carefully.

-

Not recording the deed promptly can invalidate the transfer upon the owner’s death.

How can pdfFiller assist with your transfer on death deed needs?

Using pdfFiller provides a seamless solution for managing your transfer on death deed, offering editing and organizational tools at your fingertips.

-

pdfFiller simplifies the editing and management of the transfer on death deed form, ensuring accuracy.

-

The platform offers templates and step-by-step guidance to assist you in completing forms correctly.

-

Easily modify and sign documents from anywhere, ensuring your forms are always up to date.

How to fill out the pdffiller template

-

1.Open pdfFiller and upload the transfer on death deed form you wish to complete.

-

2.Begin filling in your name and address in the designated fields at the top of the document.

-

3.Identify the property being transferred by providing its legal description and address in the appropriate sections.

-

4.Designate a beneficiary by writing their full name and relationship to you in the designated box.

-

5.Include a provision for alternate beneficiaries in case the primary beneficiary predeceases you, if desired.

-

6.Check any boxes related to the property that apply, ensuring all legal requirements for your state are met.

-

7.Review the document thoroughly for accuracy to ensure no information is missing or incorrect.

-

8.Sign the deed in the presence of a notary public to give it legal effect, which may vary by jurisdiction.

-

9.File the signed deed with your local county recorder’s office to officially record the transfer on death deed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.