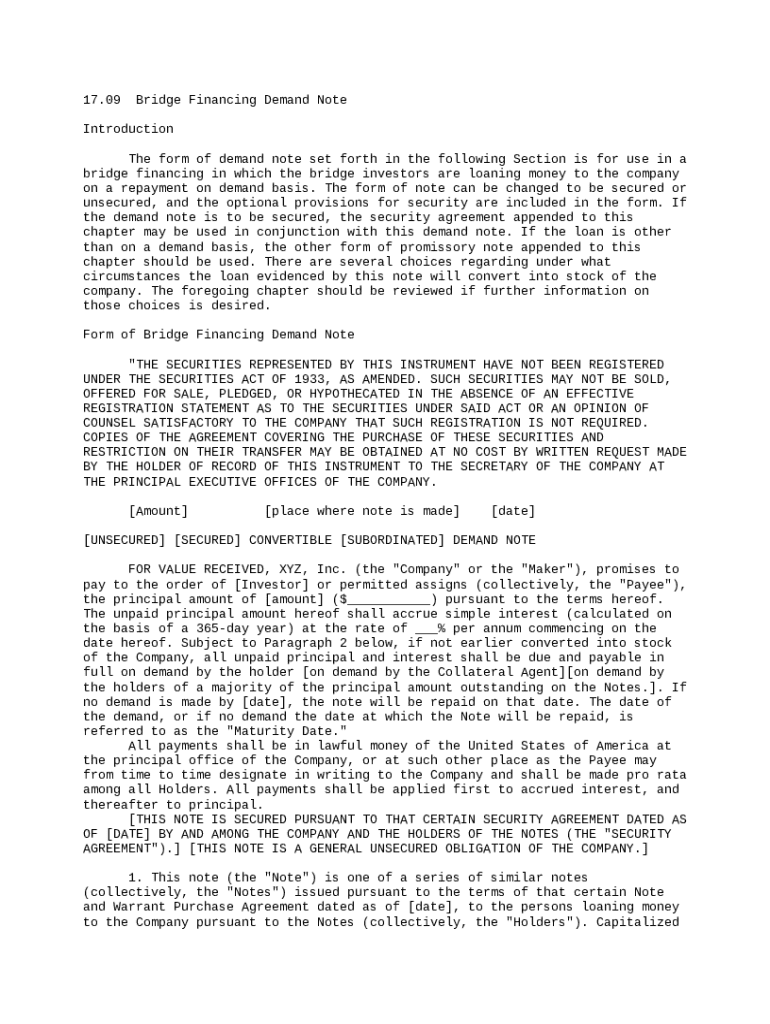

Get the free Bridge Financing Demand Note template

Show details

This Bridge Financing Demand Note is to be used in bridge financing when the bridge investors are loaning money to the company on a repayment on demand basis. The form of note can be changed to be

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bridge financing demand note

A bridge financing demand note is a short-term loan document used to provide immediate funding until permanent financing is secured.

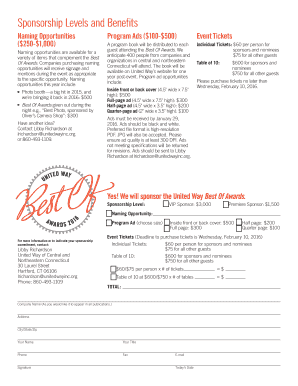

pdfFiller scores top ratings on review platforms

Quick, self explanatory and allows me to print and save without too many clicks.

I'm satisfied with the use of the application thus far. No complaints. I highly recommend to people who fill-out a lot of forms.

Its been a good experience so far. Although I have only used the service approximately 5 times it has been an efficient way to produce some general documents.

GREAT BUT WILL LOVE IT IF YOU DEVELOP DESKTOP VERSION

It's great! Only problem I had was trying to erase a hi-lited area I accidentally added. The software wanted me to pay for an upgrade for the eraser which I think is ridiculous guys. Other than that, awesome.

Extremely easy to use, easy to navigate and includes all the necessary tools to hand including signature. I highly recommend this software which is ideally suited for personal use, small business or corporate with highly competitive rates.

Who needs bridge financing demand note?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Bridge Financing Demand Note Form

How does a bridge financing demand note work?

A bridge financing demand note is a short-term debt instrument that allows a company to secure immediate funding while awaiting longer-term financing or the sale of an asset. Essentially, it serves as a bridge between the need for capital and the availability of more permanent financing. The demand note is repayable on the demand of the investor, which makes it crucial for businesses that may need to cover urgent financial requirements.

-

A demand note in bridge financing is a financial instrument that can be called for repayment at any time by the lender.

-

Its primary purpose is for companies to obtain quick financing on a repayment on-demand basis, allowing flexibility.

-

Bridge financing demand notes can either be secured against company assets or unsecured, impacting interest rates and investor perceptions.

-

Optional provisions may be included to define how security interests are structured, providing additional protections to the lenders.

What are the key components of a bridge financing demand note?

Understanding the foundational elements of a bridge financing demand note is key to effectively utilizing the instrument. Each component plays a crucial role in defining the terms of the agreement and ensuring both parties are protected during the transaction.

-

The total amount that is being borrowed through the demand note. This should align with the immediate financial need of the company.

-

The date on which the demand note is executed, marking the official start of the financial obligation.

-

Details of the borrowing entity (e.g., XYZ Inc.), ensuring all parties are clear about the obligor.

-

Information regarding who will be receiving the payments, ensuring clarity in transactions.

-

Provisions that may allow investors to convert the loan amount into company equity under specific conditions.

-

Options regarding collateral that could be offered to enhance the security of the financing.

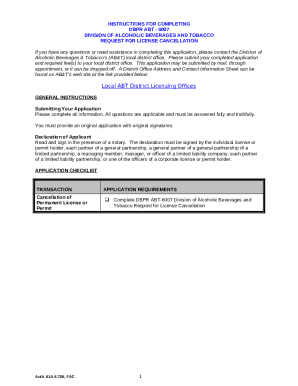

What legal considerations should be addressed?

When dealing with bridge financing demand notes, legal compliance is paramount. Companies must ensure that their agreements adhere to relevant regulations to avoid penalties and legal complications.

-

Companies must understand how the Securities Act applies to their financing and ensure they comply with any necessary registration requirements.

-

Proper registration statements should be filed to affirm that the demand notes are legally recognized financial instruments.

-

Failure to comply with relevant securities regulations can lead to significant financial penalties, damage to reputation, and potential legal action.

-

Investors generally have the right to request copies of the financial agreements, ensuring transparency.

How to effectively use a bridge financing demand note?

Using a bridge financing demand note effectively involves not only knowing how to fill it out but also understanding best practices for managing the document throughout its lifecycle.

-

Carefully follow a structured format to ensure that all required information is completed accurately.

-

Utilize pdfFiller tools to quickly edit and customize the demand note, accommodating specific needs.

-

Incorporate electronic signatures for a streamlined signing process, ensuring all parties can execute the document seamlessly.

-

Encourage team collaboration when filling out and sharing the document to improve accuracy and expedite the process.

What are security and conversion provisions?

Security and conversion provisions play a critical role in defining the risk profile of a demand note, providing options for both the borrower and the lender.

-

Secured loans are backed by collateral, which can protect lenders in the event of non-repayment; unsecured loans carry higher risk.

-

Convertible provisions offer clarity on how and when an investor can convert their loan into company equity, often beneficial in high-growth scenarios.

-

If the demand note is secured, it’s essential to outline how security interests will be established, affecting the terms and cost of financing.

-

Thoroughly understand how conversion options can impact the company’s equity structure and control.

What practical examples illustrate bridge financing demand notes?

Examining real-world cases of bridge financing provides valuable insights into the practical applications and benefits of demand notes in various business contexts.

-

Analyze examples of successful businesses that utilized bridge financing to navigate capital shortfalls during critical phases.

-

Review typical obstacles encountered by companies and the solutions implemented to overcome these issues.

-

Adapt the structure of demand notes to fit specific operational contexts, enhancing effectiveness.

-

Study past instances of bridge financing to understand its evolution and how businesses leverage it over time.

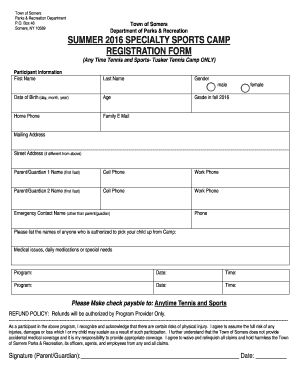

How to fill out the bridge financing demand note

-

1.Download the bridge financing demand note template from pdfFiller.

-

2.Open the downloaded document in pdfFiller to begin editing.

-

3.Enter the date at the top of the document in the specified format.

-

4.Fill in the borrower's name and address in the designated fields.

-

5.Input the lender's name and address where indicated.

-

6.Specify the loan amount and the repayment terms in the appropriate sections.

-

7.Outline any collateral or security provided for the loan, if applicable.

-

8.Review all filled information for accuracy before proceeding.

-

9.Once completed, save the document to your account or download it for printing.

-

10.If needed, send the document to the lender for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.