Get the free Release of Mortgagor template

Show details

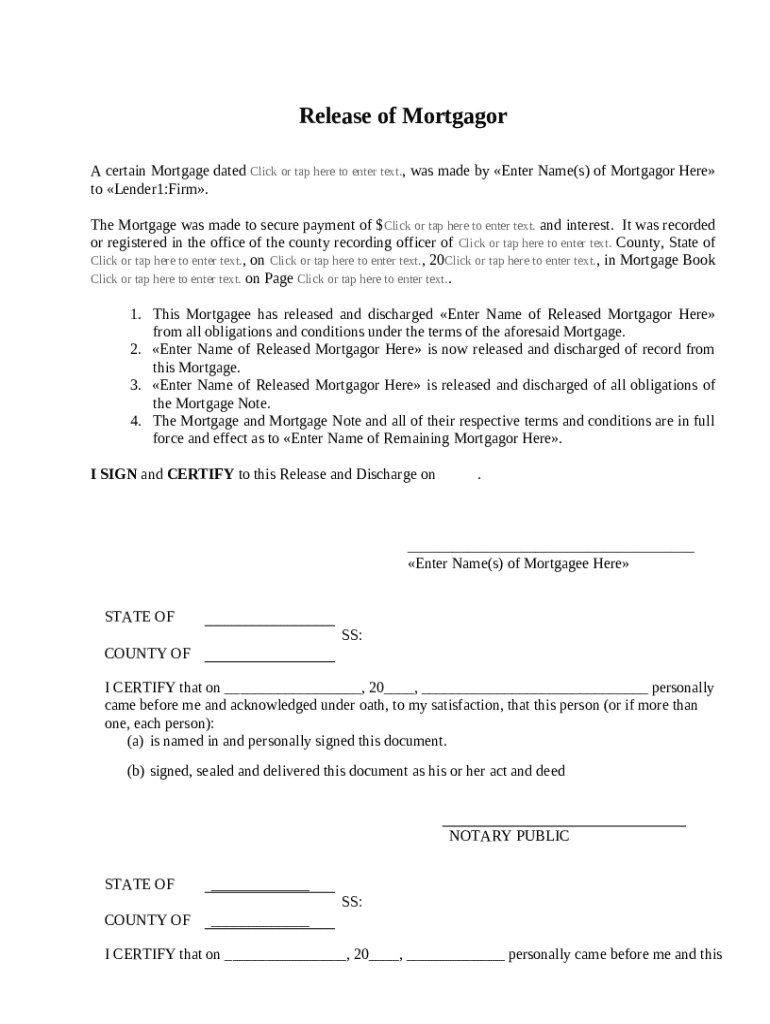

This Release of Original Mortgagor form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is release of mortgagor

A release of mortgagor is a legal document that discharges the mortgage obligation of a borrower upon full repayment or fulfillment of the mortgage terms.

pdfFiller scores top ratings on review platforms

You guys are the best, saving us a ton of time.

Thank you

ONE OF THE MOST USER FRIENDLY PROGRAMS OUT THERE

I've just purchased PDFfiller, so far I love it!

Very well-designed, very intuitive program that took minutes to learn. Great value!!

The PDFfiller is a really great application. It's very easy to use and makes the process of filling out an online form quick and easy.

I had a wonderful experience with PDFfiller. Try it and I know you will like it to.

Who needs release of mortgagor template?

Explore how professionals across industries use pdfFiller.

Understanding the Release of Mortgagor Form

The release of mortgagor form is crucial for property owners who wish to formally terminate a mortgage agreement. This document serves as proof that a lender has relinquished claims on the property, thereby clearing the title for the mortgagor.

Here’s how to fill out a release of mortgagor form: first, gather necessary information like the mortgage date and the involved parties’ names. Next, complete the sections regarding interest and payment, and follow the notarial certification process to finalize the document.

What is a Release of Mortgagor Form?

A release of mortgagor form is a legal document that formally discharges a mortgage lien on a property. This release is important as it signifies that the mortgagor has fulfilled their obligations under the mortgage agreement. Without this form, the mortgage may still appear active, affecting future ownership or sale of the property.

-

This form is necessary to discharge the mortgage lien, making the property free and clear.

-

To ensure that the new owner takes over without any mortgage encumbrance.

Key Components of the Release of Mortgagor Form

The release of mortgagor form must contain critical information to be legally binding. Primarily, it requires details about the mortgage date and names of the mortgagor and lender, essential for identifying the parties involved.

Additionally, the form should outline how payments and interests are secured, often needing a reference to the original mortgage agreement. Important recording details must also be included, specifying the county and state where the release will be filed.

Step-by-Step Guide to Filling out the Release of Mortgagor Form

-

Input the date the mortgage was established to help legate the transaction.

-

Provide full names and addresses of both parties to ensure clear identification.

-

Detail how the interest was satisfied, confirming all financial obligations are met.

-

Include the county and state where the release will be filed for proper public notice.

-

Have the document notarized to validate authenticity and facilitate acceptance.

Common Mistakes to Avoid When Completing the Form

-

Leaving out necessary information can delay or invalidate the release.

-

Incorrect county or state details can complicate the filing process and lead to legal challenges.

-

Without notarization, the form may lack legal standing, undermining the release process.

How pdfFiller Enhances Your Form Experience

pdfFiller offers intuitive PDF editing capabilities that simplify the process of completing a release of mortgagor form. With integrated eSigning features, users can efficiently sign documents directly within the platform, avoiding the hassle of printing and mailing.

Additionally, collaboration tools are available for teams, ensuring everyone can manage and edit documents together. Accessing documents through the cloud provides users with the convenience of managing their files from anywhere.

Post-Completion Steps After Submitting the Form

-

Verify that the form has been correctly filed with the county office to maintain public record integrity.

-

Regularly check back to confirm that the release has been officially recorded.

-

Store copies of the released document and any payment confirmations safely for future reference.

How to fill out the release of mortgagor template

-

1.Open the release of mortgagor form on pdfFiller.

-

2.Enter the mortgagor's full name in the designated field.

-

3.Provide the mortgage information including the loan number and property address.

-

4.Indicate the date the mortgage was satisfied or paid off.

-

5.Fill in the lender's information, including name and address.

-

6.Review all entered information for accuracy.

-

7.Add the signatures of both the lender and the mortgagor where required.

-

8.Include the date of signing in the appropriate section.

-

9.Save the completed document to your pdfFiller account.

-

10.Download or print the release of mortgagor for submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.