Get the free Bridge Financing Promissory Note template

Show details

This document is for use in a bridge financing in whci the bridge investors are loaning money to the company on a loan basis, rather than on a repayment on demand basis. The form of the note can

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bridge financing promissory note

A bridge financing promissory note is a short-term loan tool that outlines the borrower's promise to repay a temporary loan, typically used to cover immediate expenses until permanent financing is secured.

pdfFiller scores top ratings on review platforms

I first tried PDFfiller with a trial subscription and to be honest, I really just wanted it so I could add text to a document and I didn't plan to extend my subscription. But after trying it, I liked it so much, I continued the subscription after the trial and my subscription expires in 2 days and I plan to renew for another year. I'm a freelance paralegal and often need to add text (and complete forms) in .pdf format. The program is also very easy to use and has many great features (like "erase" and different font styles and sizes). My subscription has more than paid for itself and I would - and do - highly recommend PDFfiller to anyone looking for this type of program.

Really nice to be able to fill this document on-line and print, save or email

Very helpful and easy to navigate awesome program

Need to be able to copy and Paste when needed

I am just beginning to work with it so I don't have much feedback yet

Found it an excellent programme for floor plan mark-up

Who needs bridge financing promissory note?

Explore how professionals across industries use pdfFiller.

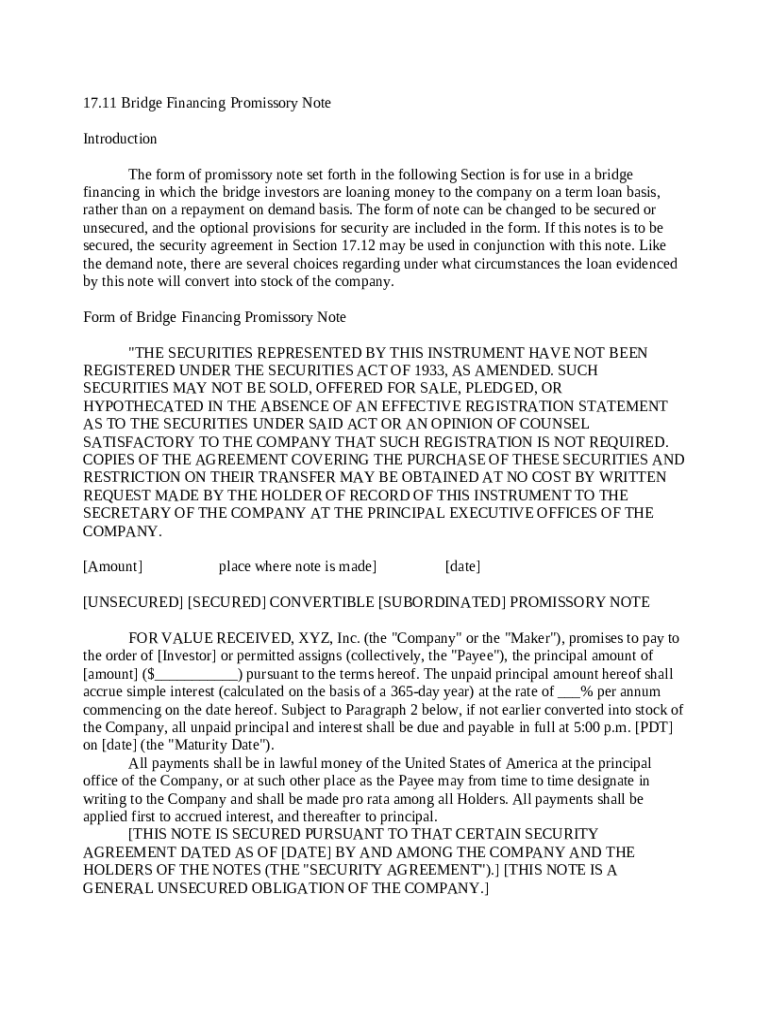

Comprehensive Guide to Bridge Financing Promissory Note

How to fill out a bridge financing promissory note form

Filling out a bridge financing promissory note form requires careful attention to details and understanding of its components. Start by gathering essential information about the loan, the parties involved, and the terms of financing. This guide provides step-by-step instructions to create a comprehensive and legally compliant document.

What is bridge financing?

Bridge financing is a short-term financing option that enables individuals or companies to meet immediate financial needs while awaiting permanent financing or payment. Typically used in real estate, business acquisitions, or personal needs, bridge loans provide quick access to funds. Unlike traditional financing methods, they often have higher interest rates and shorter repayment periods.

-

Examples include purchasing a new property before selling an existing one, financing a business acquisition, or covering short-term operational expenses.

-

Bridge financing usually involves faster approval processes but may come with higher costs compared to longer-term loans.

What are the key components of a bridge financing promissory note?

-

Secured notes have collateral; unsecured notes do not; convertible notes can be turned into equity in the future.

-

These should reflect the risk and investment potential, and clearly laid out repayment terms are critical.

-

Ensure that all securities regulations are followed to protect against legal liabilities.

Understanding the bridge financing promissory note form

-

Include the amount being borrowed, date of the loan, and all parties involved.

-

Clearly state interest rates and a detailed payment schedule to avoid confusion later.

-

Outline any collateral if the note is secured, providing protections to the lender.

-

Include any options to convert the debt into equity, specifying terms if applicable.

How to fill out the bridge financing promissory note form on pdfFiller

Using pdfFiller to complete your bridge financing promissory note form simplifies the process. You can edit directly on the platform, ensuring that you can make any necessary changes quickly. Plus, the option for eSigning and cloud storage allows easy access and collaboration with team members.

-

Follow guided prompts in pdfFiller for a straightforward completion of the form.

-

Ensures a legally binding agreement without the hassle of printing and scanning.

-

Share and edit the document in real-time with your team members remotely.

What compliance and legal considerations should you keep in mind?

Understanding federal and state regulations surrounding bridge financing is crucial to avoid legal pitfalls. Important disclosures must be communicated to investors to ensure transparency. Following best practices from the Securities Act can protect all parties involved in the transaction.

-

Ensure compliance with relevant securities regulations to protect investors.

-

Transparency is key; disclose risks and investment details to ensure all parties are well informed.

-

Engage legal counsel when drafting or finalizing the promissory note to maintain compliance.

What are common mistakes when completing the bridge financing promissory note?

-

Neglecting to double-check interest rates and payment terms can lead to significant disagreements later.

-

Mistakes during eSigning can invalidate your agreement, causing delays in financing.

-

Incomplete or inaccurate forms can result in legal issues, delayed financing, or loss of funding.

How to utilize pdfFiller for ongoing management of documents

pdfFiller offers robust features for the organization and management of your bridge financing documents. With tools for document retrieval and collaboration, it's easier to maintain an orderly digital filing system. Plus, the cloud-based access means you can manage documents from anywhere.

-

Use tags and folders to keep your documents neatly categorized for quick access.

-

Invite team members to comment or edit, promoting a collaborative approach to managing financial agreements.

-

Access your documents from any device, ensuring you're always prepared.

How to fill out the bridge financing promissory note

-

1.Obtain a template for the bridge financing promissory note from pdfFiller.

-

2.Start by filling in the date at the top of the document.

-

3.Include the lender's full name and address in the specified section.

-

4.Next, provide the borrower's full name and address accurately.

-

5.Specify the amount of the loan in the designated area as a numerical value.

-

6.Set the interest rate applicable on the loan, making sure it's clear and agreed upon.

-

7.Outline the repayment terms, including due date and acceptable payment methods.

-

8.Add any additional clauses, such as penalties for late payment or conditions for early repayment.

-

9.Review the filled document for accuracy and completeness.

-

10.Sign and date the note at the bottom, ensuring both the lender and borrower sign.

-

11.Finally, save or print the document according to your needs.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.