Get the free Partial Release of Mortgage Property template

Show details

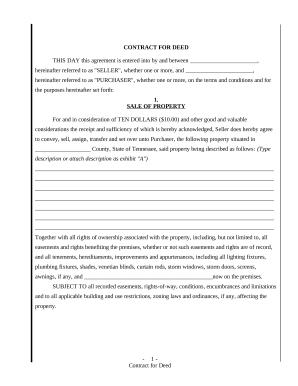

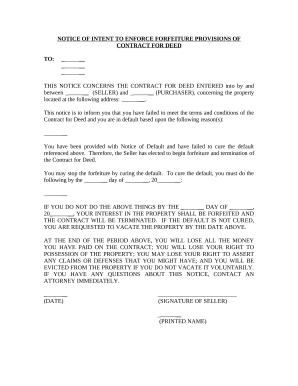

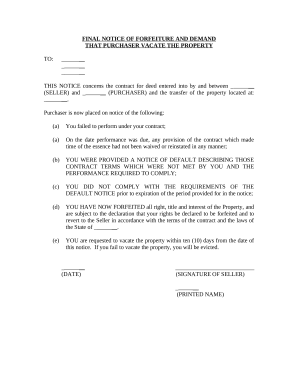

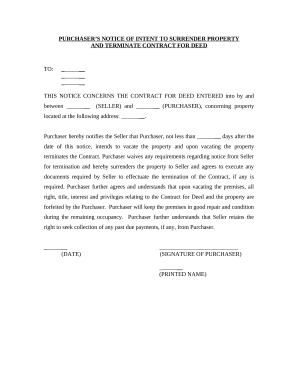

This form provides boilerplate Partial Release of Mortgage Property clauses that outline the consequences and contingencies that will apply under a contract agreement. Different language options may

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

It was easy to use and made the documents look very professional

I like that I can fill out the form print and save. I appreciate the access to professional documents.

It is easy and convenient to use! A real lifesaver!

pdfFilller is a great place to learn how to put togther all the documents necessary in the construction business

A little difficult navigating. There is no clear description of what some of the functions are. Would be helpful to maybe add a description as you hover over a button, or at least give a description of what the function does when you click on it.

Some of the W2 forms want a 5 digit zip code, but your directions won't accept the five digit zip code and keep coming up add valid zip code,

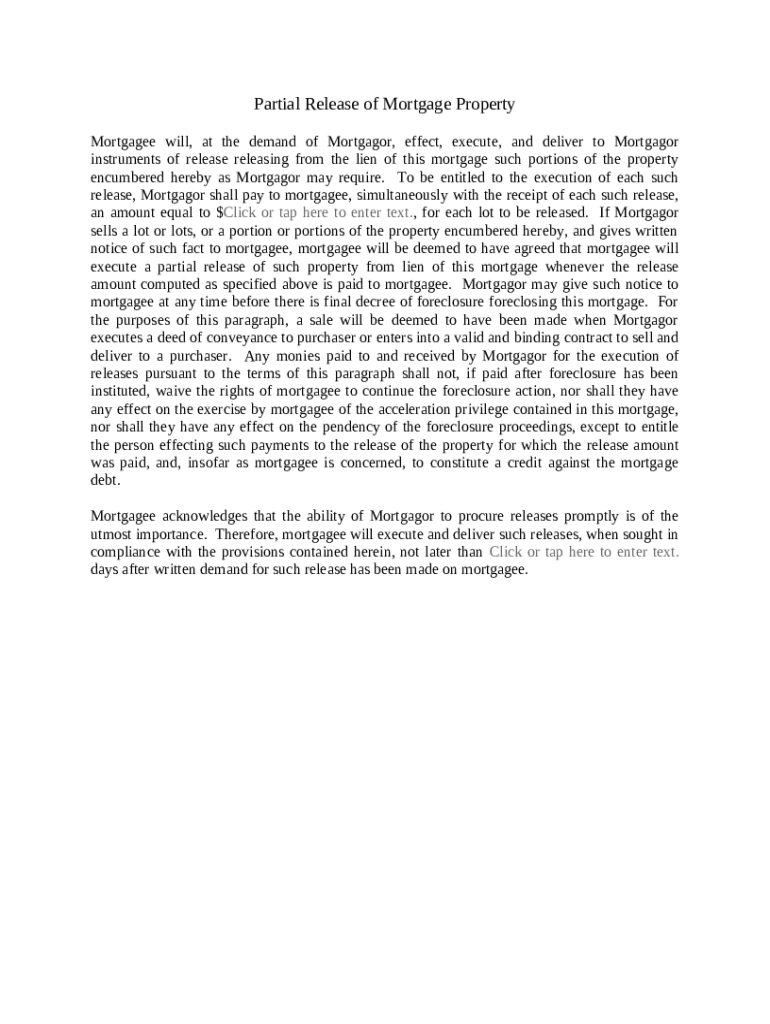

Complete guide to partial release of mortgage form

How to fill out a partial release of mortgage form?

Filling out a partial release of mortgage form involves several crucial steps that ensure your property transaction progresses smoothly. Start by collecting necessary details about the mortgage and property. This guide will provide a comprehensive overview of the entire process, helping you effectively navigate and manage your documentation.

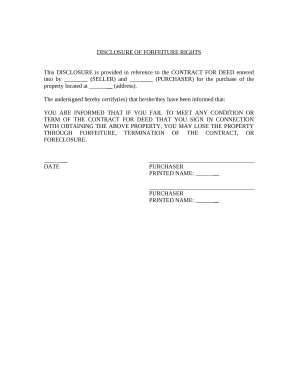

Understanding the partial release of mortgage

A partial release of mortgage refers to the process of releasing part of a mortgage lien from a property. This could occur when the property owner sells a portion of the property, allowing the financial institution to release their interest in that section. It is crucial for both mortgagor (the borrower) and mortgagee (the lender) to understand how this form aids in protecting their interests.

-

The partial release of mortgage is a legal document that allows the borrower to remove a specified area of a mortgaged property from the mortgage lien, while the rest of the property remains encumbered.

-

This release is vital in real estate transactions, ensuring that buyers receive clear titles to the portion of the property being sold.

-

The partial release helps maintain clarity in property ownership and can also aid in refinancing efforts.

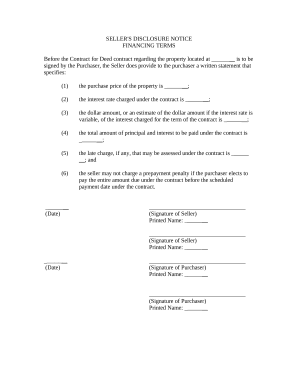

Key components of the partial release form

When preparing a partial release of mortgage form, several critical components must be included to ensure its validity and effectiveness. Details such as property descriptions, involved parties, and conditions of release are essential.

-

Make sure to include the names of the borrower and lender, loan number, and property address.

-

Important clauses may outline what portion of the mortgage is being released and any terms relevant to the transaction.

-

Include any fees associated with the release, any payments made to achieve the release, or conditions necessary for the execution.

Step-by-step guide to completing the form

Completing the form requires careful attention to detail. It's essential to gather all necessary information before beginning the process.

-

Collect documents related to the mortgage, proof of ownership, and any related sale agreements.

-

Follow the instructions on the form carefully. Fill out each section accurately to avoid processing delays.

-

Review all fields to ensure accuracy. Mistakes can lead to complications and delays in processing.

Regional variations in the partial release of mortgage

Different states may have unique requirements and practices regarding the partial release of a mortgage, which can significantly impact the process.

-

Certain states may require additional documentation or specific forms to be filled out for a partial release.

-

Understanding local practices can help streamline the process.

-

Each state may have its own laws governing property releases, which should be checked before initiating the process.

Submitting the partial release of mortgage form

Once completed, the next critical step is submitting the partial release form correctly. This process can vary depending on local regulations and the platforms used.

-

Using pdfFiller allows for efficient submission and signing of documents. Make sure to follow the online instructions provided.

-

After submitting, monitor the progress of your request to ensure it is processed promptly.

-

Be prepared for possible delays; knowing whom to contact can help resolve issues quickly.

What happens after the release is executed?

After the partial release is officially executed, several important outcomes must be addressed.

-

Ensure that documentation is completed correctly and kept for future reference.

-

The property’s title will be clear for the released portion, which is crucial for future transactions.

-

Be aware that knowing the impact on the remaining lien may affect future financing options.

Tips for managing future releases

Future releases of mortgage liens can be managed efficiently with good record-keeping and communication.

-

Maintain a file that includes all related documents to the releases for easy access.

-

Inform all stakeholders about the changes made concerning the property title post-release.

-

Utilize pdfFiller's cloud-based platform for seamless document management and retrieval.

Common questions regarding partial releases

Many common concerns arise concerning partial mortgage releases, from foreclosure implications to fees involved.

-

A partial release does not initiate foreclosure; it is a way to clear title for a portion of the property.

-

Fees may vary based on state laws and the lender; it's essential to check beforehand.

-

Not including all necessary details or failing to follow up on the submission can lead to delays.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.