Get the free Mortgage Note Buyer to Seller template

Show details

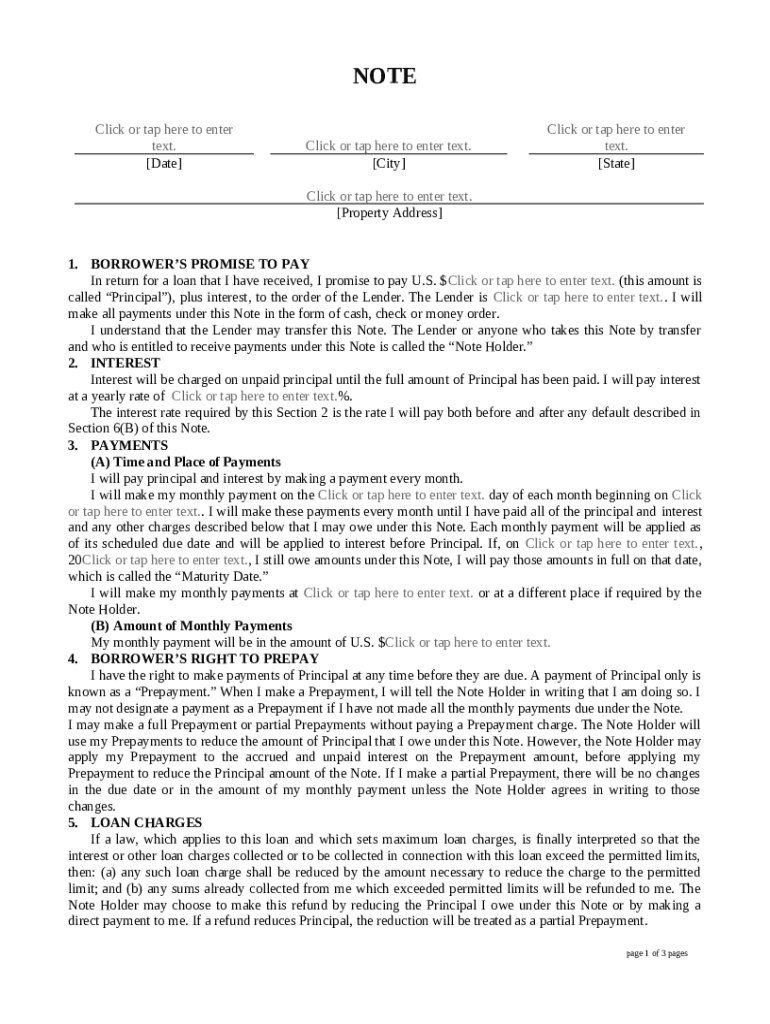

A mortgage note is a promissory note promising to repay a specified sum of money plus interest at a specified rate and length of time to fulfill the promise. The collateral for the Note is a Mortgage.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is mortgage note buyer to

A mortgage note buyer is an individual or entity that purchases mortgage notes from lenders or sellers, allowing them to receive a lump sum payment while providing liquidity and investment opportunities.

pdfFiller scores top ratings on review platforms

I like the fact that the site keeps a copy, which makes changes much easier.

I just miss dirct picture insertion (as a signature)

I've only been using PDFfiller for a little while and, so far, I am completely satisfied.

I love the quick and easy fill-in ability

Good, interesting, and a little confusing

I love the ease and speed I can convert docs to fillable pdf files. I am not so happy with repeatedly being asked to rate the features, take a survey and attend a webinar.

Who needs mortgage note buyer to?

Explore how professionals across industries use pdfFiller.

How to fill out a mortgage note buyer form effectively

Understanding mortgage notes and note buyers

A mortgage note is a legal document that outlines the terms of a loan secured by real property. It specifies the borrower's obligations to repay the loan according to the defined schedule. Understanding this document is pivotal in real estate transactions as it acts as evidence of the debt owed.

Note buyers, on the other hand, are individuals or companies that purchase these mortgage notes, allowing sellers to convert their notes into cash. By engaging with a mortgage note buyer, sellers benefit from a fast sale and avoid the risks associated with prolonged repayment timelines.

What are the advantages of working with a note buyer?

-

One significant advantage is the ability to convert your mortgage note into cash quickly. Unlike traditional sales, which may take weeks or months, working with a note buyer can expedite this process.

-

Sellers can also avoid long and costly foreclosure processes. Engaging a note buyer may help you mitigate financial losses by providing a swift alternative.

How do you evaluate a good note buyer?

-

Look for note buyers with a proven track record, extensive knowledge, and relevant experience in the industry.

-

Ensure the buyer is transparent in their processes. Ask about fees and potential costs involved in the sale.

-

Check reviews and testimonials from previous clients to gauge their reliability and performance.

How does a note buyer assess a mortgage note?

The valuation process is essential as it determines the price at which the mortgage note can be sold. Key factors influencing mortgage note value include the borrower’s payment history and the interest rate attached to the loan. Buyers will often discount future cash flows based on current market conditions, which directly affects the offered price.

Understanding these assessment criteria can help you negotiate better terms with potential buyers.

Should you keep or sell your mortgage note?

-

In cases where liquidity is a pressing concern, selling your mortgage note might be more beneficial than holding onto it for long-term payments.

-

Conversely, if stability and steady income are your primary goals, retaining your mortgage note could be advantageous.

-

Evaluate the risks involved in potential foreclosure or defaults before making your decision.

What are the essentials of a business note vs. a mortgage note?

Business notes and mortgage notes serve different purposes; a mortgage note secured by real estate ensures that the lender can claim the property if the borrower defaults. Business notes, however, are often unsecured and may have varied terms depending on the agreement between companies.

Being aware of these differences is crucial for sellers looking to navigate the landscape of note buyers effectively.

What services do note buyers offer?

-

Many note buyers offer initial consultations to discuss your options and how the process works.

-

Some buyers may provide financing options to facilitate the closure of the sale, allowing sellers to receive the cash they need.

-

Services like those provided by pdfFiller can be invaluable as they help in preparing the necessary paperwork, ensuring all aspects of the transaction are correctly handled.

What are best practices for creating a mortgage note?

-

Ensure all terms, including interest rates and payment schedules, are clearly specified to avoid future confusion.

-

Consider consulting a legal expert or using reliable forms to draft your mortgage notes effectively.

-

Do not overlook essential details, such as borrower information and property descriptions, which could lead to complications later.

How to fill out the mortgage note buyer to

-

1.Begin by downloading the 'mortgage note buyer to' template from pdfFiller.

-

2.Open the document in pdfFiller and read the instructions carefully.

-

3.Fill in the buyer’s name and contact information at the top of the document.

-

4.Input the seller's information, including their name, address, and phone number.

-

5.Detail the specifics of the mortgage note: include the principal amount, interest rate, and payment terms.

-

6.Provide any relevant identification numbers or property details associated with the mortgage note.

-

7.Sign the document where indicated and date it appropriately.

-

8.Review all filled information for accuracy and completeness.

-

9.Save the document and share it via email or print it for physical delivery.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.