Get the free M&A Transaction Term Sheet Guideline template

Show details

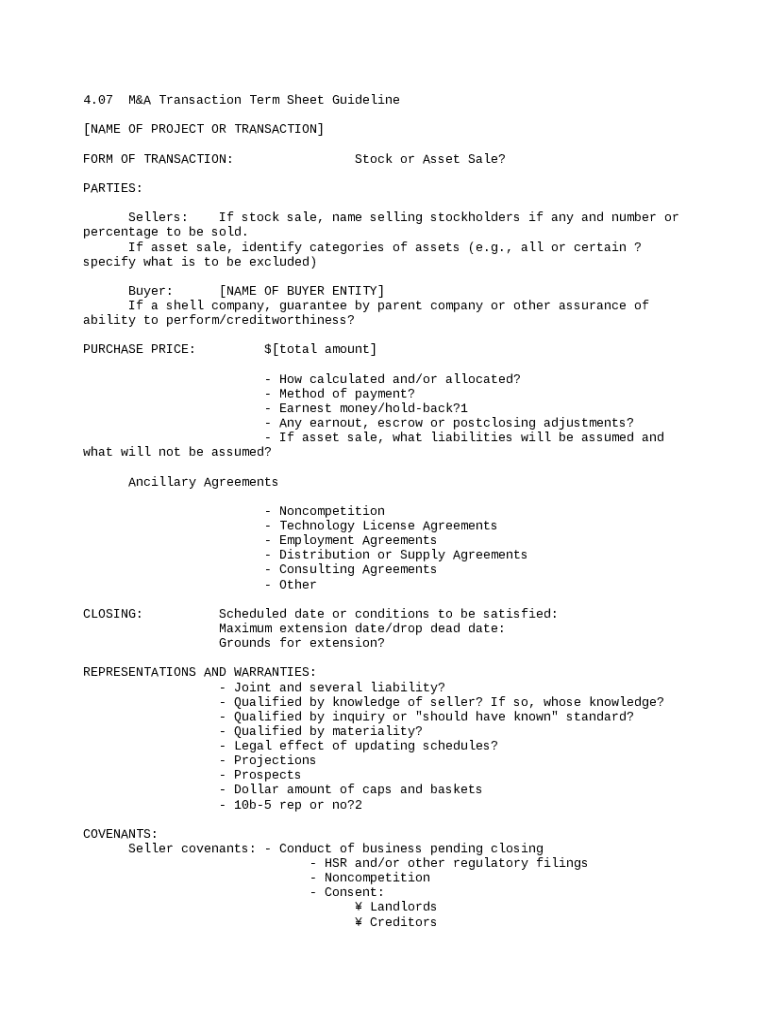

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is ma transaction term sheet

A 'ma transaction term sheet' is a document outlining the key terms and conditions of a proposed merger or acquisition deal.

pdfFiller scores top ratings on review platforms

GREAT

GREAT AND EASY TO WORK WITH

it was great my first time

it was great easy it was my first time using it awesome .

A proper company

PDFfiller apparently thought I wanted a subscription to their service after trying it out once. I did not want that, however, and wrote to them to cancel the payment. They cancelled right away, no questions asked. You know a proper company when that is the procedure.

Works great for a small business

Works great for a small business

easy and quick

easy and quick

First time using pdfFiller

First time using pdfFiller, and was pleased. Will need to get more acquainted with it, but was impressed with all of the options.

Who needs ma transaction term sheet?

Explore how professionals across industries use pdfFiller.

How to fill out an &A transaction term sheet form

Filling out an M&A transaction term sheet form is a pivotal step in the merger and acquisition process, providing a clear framework for negotiations between parties.

Understanding the &A transaction term sheet

A term sheet in M&A transactions serves as an initial agreement outlining the key terms and conditions. It typically includes vital elements, such as the purchase price and the structure of the deal. The term sheet acts as a roadmap, guiding both parties through the negotiation process and ensuring clarity in expectations.

-

A term sheet is a non-binding document designed to capture essential deal terms.

-

This includes pricing, payment methods, and conditions for closing.

-

It sets the framework for drafting definitive agreements and helps prevent misunderstandings.

Project overview: name and structure

Defining the name and the structure of the transaction is crucial for clarity. Accurately naming the transaction helps all parties quickly identify the agreement's focus. Furthermore, the choice between a stock or asset sale directly influences tax implications and liability.

-

Clearly define what the transaction is about to avoid confusion.

-

Determine whether it will be a stock or asset sale based on business strategy.

Identifying the parties involved

Clear identification of the parties involved is essential in any M&A deal. It ensures that all stockholders are accounted for and facilitates due diligence. This formal identification also supports the buyer's creditworthiness evaluation, leading to a more straightforward transaction.

-

Identify stockholders and the percentage of shares they are selling.

-

Assess the buyer's identity and establish assurances for their creditworthiness.

-

Accurate identification protects against future disputes regarding ownership and responsibility.

Evaluating the purchase price

Evaluating the purchase price is a critical step that involves understanding the full value being exchanged. This can consist of multiple payment methods such as earnest money and post-closing adjustments, which need to be documented precisely. Additionally, distinguishing between assumed liabilities and those being excluded is crucial to protect all parties involved.

-

Define the total price and how it is allocated among different assets.

-

Include various forms of payment, like cash, stocks, or seller financing.

-

Outline what liabilities are being assumed in the transaction.

Ancillary agreements: essential components

Ancillary agreements enhance the protection offered in the M&A process. Types of agreements may include noncompetition clauses and employment contracts. Each type should be carefully structured to guard the interests of both buyers and sellers.

-

Noncompetition, employment, and licensing agreements are crucial in M&A.

-

These agreements mitigate risks associated with the sale.

-

Structuring these agreements demands thorough negotiation and legal oversight.

Setting the closing conditions

Closing conditions need to be meticulously outlined. Specify requirements for the scheduled closing date and any potential extension conditions that could arise. This clarity is vital to ensure the transaction is lawful and valid.

-

Define the conditions that must be met to close on the specified date.

-

Establish valid reasons for extending the closing date, if necessary.

Representations and warranties in detail

Representations and warranties add a layer of protection for both buyer and seller. Understanding joint and several liabilities is essential in determining responsibilities among sellers. Furthermore, updates to these representations can affect materiality and lead to adjustments in the agreement.

-

Clarify how liability is allocated among sellers in the transaction.

-

Assess the seller's qualifications and the implications of materiality.

Establishing covenants for sellers and buyers

Covenants play a significant role in protecting the interests of both buyers and sellers. Seller covenants might include maintaining confidentiality and compliance with regulatory filings, while buyers may have obligations towards conducting due diligence.

-

Outline conduct expectations from sellers during the transition.

-

Define buyer obligations post-agreement to safeguard the deal.

Conditions to closing: ensuring a smooth transition

To ensure a seamless transition, it’s important that there are no breaches in warranties, representations, or covenants. Outlining material adverse changes and ensuring due diligence completion are critical checkpoints in a successful transaction.

-

Establish criteria for what constitutes a breach prior to closing.

-

Identify what constitutes a material change that affects the transaction.

Indemnification clauses explained

Indemnification clauses protect parties from potential claims after closing. These clauses define minimum claim amounts and stipulate conditions under which indemnification can be sought. Understanding thresholds and caps is crucial for ensuring balanced risk sharing.

-

Set minimum claim amounts that trigger indemnification responsibilities.

-

Define legal concepts like baskets and caps in indemnification agreements.

Tips for filling out the &A transaction term sheet

Filling out the term sheet requires attention to detail. Employing tools like pdfFiller enables seamless editing and managing of documents. Ensuring accuracy and compliance is vital for protecting your interests and achieving a successful transaction.

-

Follow a structured approach to fill out each section efficiently.

-

Leverage pdfFiller's features for document management and e-signing.

Explore related templates and resources

There are numerous resources and templates available to facilitate the M&A process. These include various transaction types, which can be accessed through pdfFiller's platform. Consultation with legal experts is advisable when tackling more complex contractual issues.

-

Find additional templates for diverse transaction types directly within pdfFiller.

-

Utilize interactive tools within pdfFiller to improve document management.

How to fill out the ma transaction term sheet

-

1.Open pdfFiller and upload your 'ma transaction term sheet' document.

-

2.Begin by reviewing the pre-filled details to ensure accuracy.

-

3.Fill in the basic information fields such as the names of the parties involved in the transaction.

-

4.Next, detail the transaction structure, including whether it is an acquisition, merger, or another format.

-

5.Specify the purchase price in a clear numerical format, and include any contingencies or conditions that apply.

-

6.Outline the timeline of the transaction, indicating milestones and deadlines for completion.

-

7.Provide sections for confidentiality and exclusivity agreements, ensuring all parties agree to the terms.

-

8.Add any necessary signatures from authorized representatives of each party to validate the document.

-

9.Once completed, review the entire document for accuracy and completeness before saving or exporting it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.