Get the free pdffiller

Show details

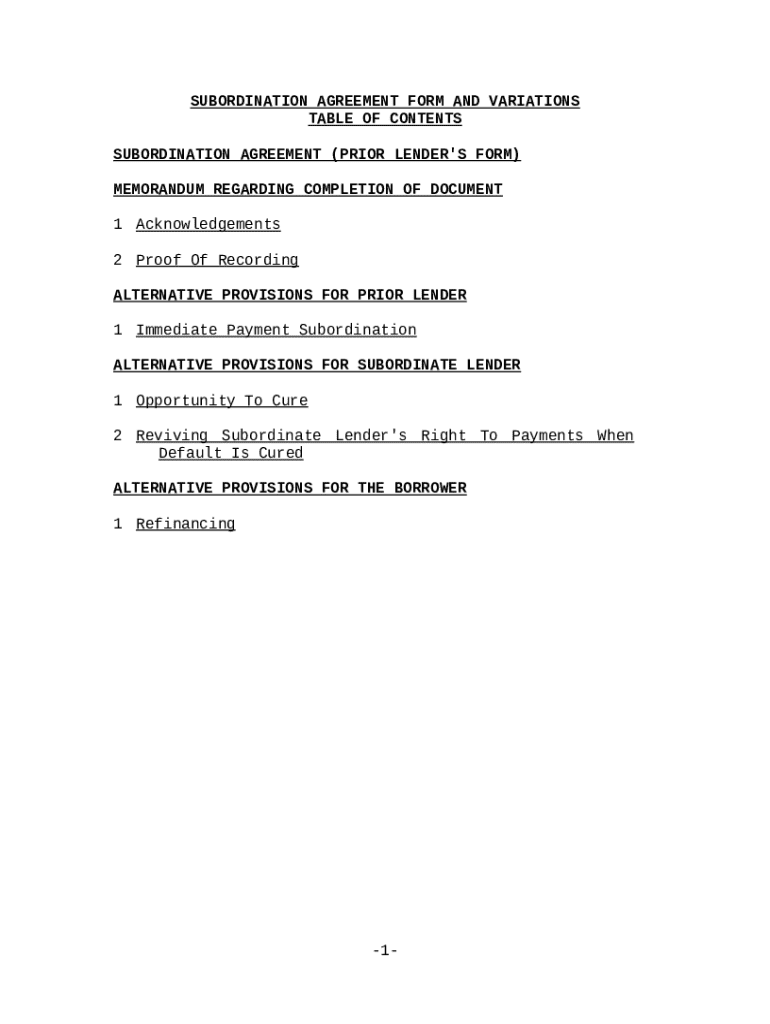

"Subordination Agreement Form and Variations" is a American Lawyer Media form. This is a subordination agreement with variations form.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordination agreement form and

A subordination agreement form is a legal document that establishes the priority of debts, allowing one party's claim to take precedence over another's in case of default.

pdfFiller scores top ratings on review platforms

this is the best

all good

all good i love it make work easy

A little slow loading but good

Easy interface

Additional services like notary service and mailings put it above

I own rental property, and have found PDFfiller very helpful when signing agreements from a distance.

1000x better than Adobe Acrobat!

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Subordination Agreement Form

What is a subordination agreement?

Understanding the fundamentals of a subordination agreement is essential for anyone involved in property financing. A subordination agreement is a legal document that establishes the priority of claims against a property. Its primary purpose is to help clarify the order in which debts will be repaid if the borrower defaults, making it an important tool in lending scenarios involving multiple loans.

-

This document helps manage the hierarchy of debts effectively, which is crucial during foreclosure or borrowing situations.

-

These scenarios include refinancing or when a borrower takes on additional loans secured by the property.

-

They provide security for lenders, ensuring they know their rights in case of outstanding debts.

What are the key components of a subordination agreement?

Recognizing the essential elements of a subordination agreement allows participants to understand their rights and obligations. The primary parties involved include the borrower, the subordinate lender, and the prior lender, each of whom plays a crucial role in the arrangement.

-

Identifying these parties establishes responsibility, accountability, and authority in the agreement.

-

Detailing the property and any collateral provides clarity about what is at stake.

-

These specifics help all parties understand their financial exposure and commitments.

How do you fill out the subordination agreement form?

Completing the subordination agreement form is a critical step that requires attention to detail. This guide simplifies the filling process into manageable steps. Ensuring accuracy is vital to prevent potential legal issues down the line.

-

Follow a structured approach to ensure all necessary information is included.

-

Understanding which fields are critical will help avoid mistakes that could invalidate the agreement.

-

Identify frequent pitfalls to ensure that your agreement is enforceable.

What are the modifications and alternatives in subordination agreements?

Flexibility in subordination agreements can be necessary for different financial scenarios. Lenders may opt for specific provisions that address their unique circumstances, which can impact the overall responsibility and risk associated with the loans involved.

-

These may include specific benefits or rights that need to be negotiated for the prior lender.

-

Differences in these subordination types can significantly affect risk for the parties involved.

-

This provision may allow subordinate lenders a chance to rectify missed payments to preserve their interest.

Why is proper documentation critical?

Documenting completions and processes is crucial for legal validation. Maintaining records of all agreements, especially in financial transactions, ensures that rights are preserved and obligations are met.

-

Incorrect documentation can lead to disputes or loss of rights.

-

Recording documents appropriately provides evidence of the prioritization of claims.

-

Acknowledgments affirm that all parties agree to the terms and conditions of the agreement.

What should you know about subordination agreement templates?

Using templates can simplify the creation of subordination agreements. Platforms like pdfFiller offer customizable templates that adapt to specific needs, making the process more efficient.

-

Explore templates to find the best fit for your needs.

-

These tools enhance user experience by allowing personalization.

-

Implement strategies to manage documents effectively for easier access and legal reliability.

What legal implications should be considered?

Awareness of legal aspects concerning subordination agreements is crucial for all parties involved. Understanding federal and state regulations helps in minimizing risks and ensuring compliance, which is particularly important in real estate transactions.

-

Regulatory compliance is vital for the enforceability of agreements.

-

Improperly executed agreements can lead to costly legal disputes.

-

Seeking legal advice can provide reassurance and guidance on complex issues.

How do subordination agreements differ?

Analyzing different types of subordination agreements can shed light on their varied applications and implications based on the specific circumstances of the parties involved.

-

Different parties bring unique considerations and terms, affecting the agreement.

-

Analyzing real-world examples helps illustrate how different contexts influence agreements.

-

Local laws can significantly affect the stipulations outlined in the agreements.

How to fill out the pdffiller template

-

1.Start by opening the subordination agreement form on pdfFiller.

-

2.Read the instructions carefully to understand the purpose of the form.

-

3.Enter the names of the parties involved, including the lender and the borrower, in the designated fields.

-

4.Fill in the specific details of the debt obligations, noting any relevant loan or mortgage numbers.

-

5.Indicate the property address or asset involved in the agreement.

-

6.Specify the terms of subordination, including the priority of claims and any stipulations regarding payment sequencing.

-

7.Review all entered information for accuracy, ensuring all necessary fields are completed.

-

8.Sign and date the form digitally, if required, or prepare it for printing and manual signatures.

-

9.Download or save the completed form for your records, and consider sharing it with involved parties as necessary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.