Get the free Bankruptcy Assessment Survey template

Show details

This form is an initial screening questionnaire for the purpose of trying to catch some of the problems that might make a bankruptcy more difficult for you.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bankruptcy assessment survey

A bankruptcy assessment survey is a tool used to evaluate an individual's financial situation before filing for bankruptcy.

pdfFiller scores top ratings on review platforms

no issues

amazing and easy access to make my daughters homeschool transcript

Thank you

Great program

super!

EASY to use with many many choices

Who needs bankruptcy assessment survey template?

Explore how professionals across industries use pdfFiller.

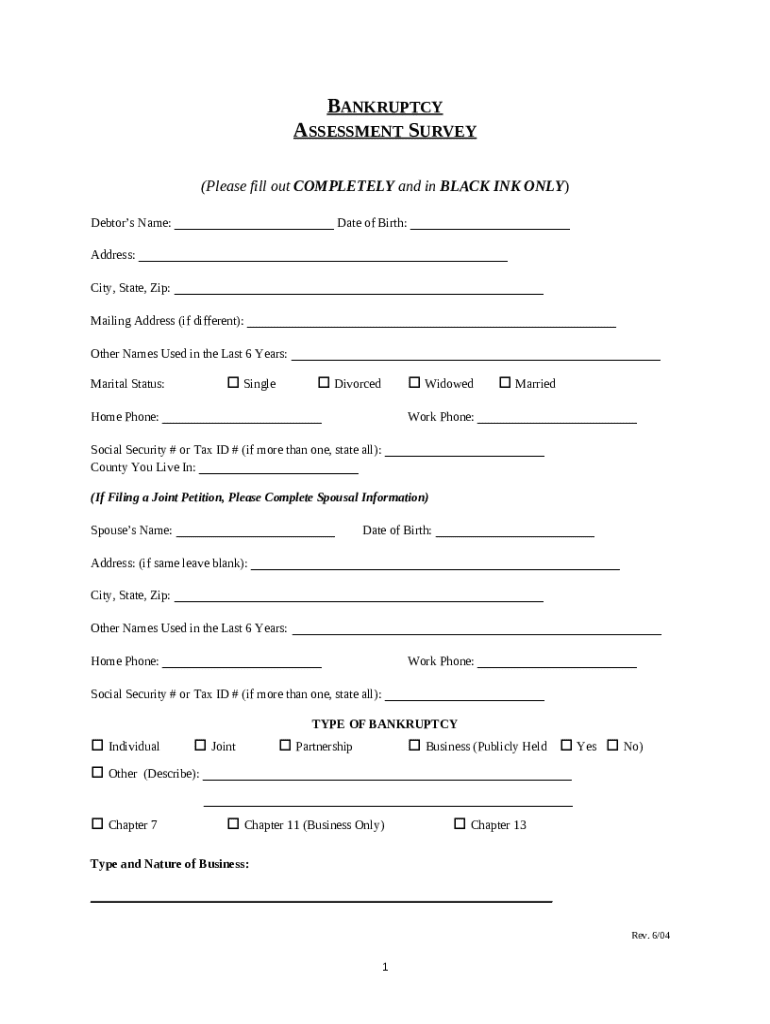

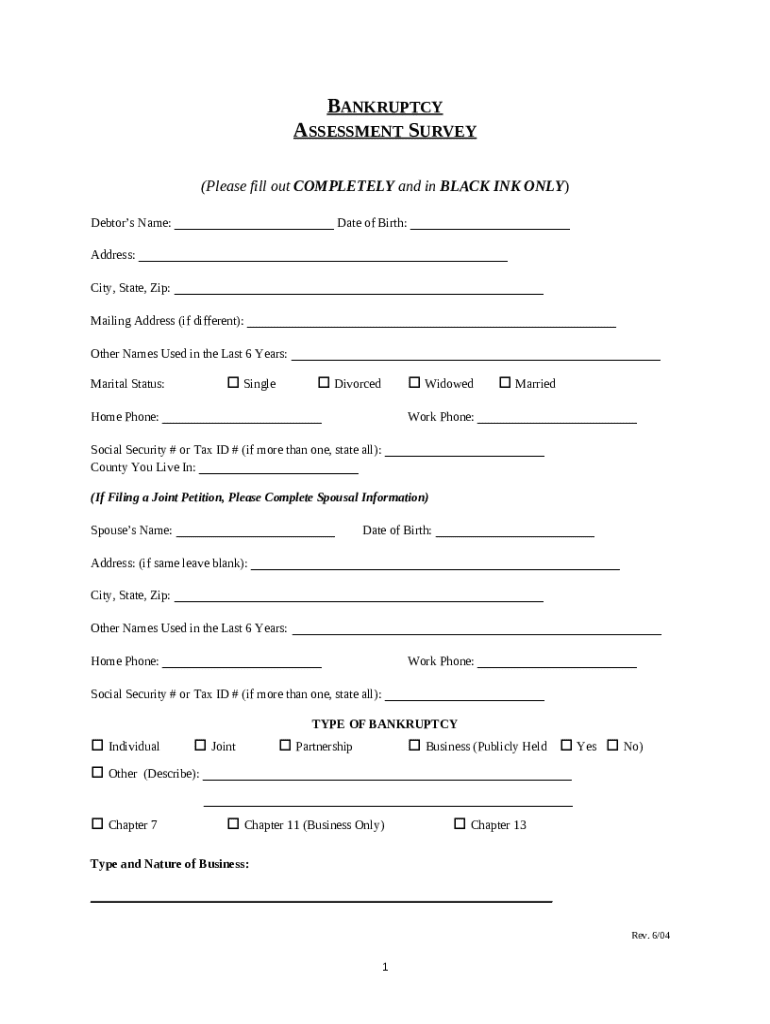

Comprehensive Guide to the Bankruptcy Assessment Survey Form

What is the bankruptcy assessment survey?

The bankruptcy assessment survey is a critical tool used to evaluate a debtor's financial situation prior to filing for bankruptcy. Its primary purpose is to assess the debtor's assets, liabilities, and overall financial health. Accurate and comprehensive information is fundamental, as it aids legal professionals in understanding the case's viability.

Using platforms like pdfFiller can significantly streamline the survey process. With intuitive features that facilitate editing and sharing, users can ensure that all necessary information is accurately captured and submitted promptly.

What personal information do you need to provide?

-

Clearly state the debtor's full name, phone number, and email address for correspondence purposes.

-

Indicate whether you are single, married, or in another arrangement, and provide details about your current living situation.

-

Ensure forms are completed using black ink to maximize clarity and meet compliance standards required by the court.

What are the different types of bankruptcy?

Understanding the various types of bankruptcy is essential for accurate reporting on the bankruptcy assessment survey form. Individual bankruptcies pertain to personal debt relief, while joint filings may involve marital assets and liabilities. Business bankruptcies differ significantly, requiring more extensive disclosures.

Additionally, chapter classifications, such as Chapter 7 and Chapter 13, dictate how asset liquidation or repayment plans operate. Awareness of publicly held bankruptcy stipulations is crucial for corporations and their stakeholders.

How to report property and assets information?

-

Include all owned properties, detailing addresses, market values, and the nature of ownership (joint, sole, etc.).

-

Different types of ownership can affect how assets are treated in bankruptcy proceedings, requiring careful classification.

-

Utilize comparative market analysis or appraisals to determine accurate property values.

-

The platform allows users to create, edit, and manage documents related to property valuations conveniently.

How to disclose debts and financial obligations?

-

Make clear distinctions between debts backed by collateral (secured) and those that are not (unsecured).

-

Provide comprehensive information about mortgage lenders, including contact details and current payment status.

-

Employ tools like pdfFiller to efficiently collate, edit, and present financial information in a well-organized manner.

What should you know about filing history and additional liabilities?

When completing the bankruptcy assessment survey form, it is crucial to disclose any history of previous filings. This transparency can assist the court in understanding your financial behavior and may influence the outcome of your current filing.

Follow guidelines for accurately completing this section to maintain the integrity of your submission and prevent potential legal issues.

How can collaborative tools aid in filing?

-

Platforms like pdfFiller offer tools for team collaboration, enabling multiple individuals to provide input on the assessments.

-

Users can easily track edits and version history, ensuring everyone is on the same page throughout the filing process.

-

Ensure that all documents are signed securely, benefiting from cloud storage that keeps everything organized and protected.

What’s the final review and submission process?

Before submitting the bankruptcy assessment survey, create a checklist of required documents and verifies that all sections are completed correctly. Utilizing platforms like pdfFiller simplifies the submission, allowing for direct electronic filing.

Certain situations may arise that require follow-ups or additional documentation, hence it's prudent to stay organized and maintain clear lines of communication with your legal counsel.

What are post-submission considerations?

After submission of the bankruptcy assessment survey form, one can expect various outcomes, including the approval of the bankruptcy filing or requests for more information. Understanding the potential next steps is vital to navigate this complex process.

Accessing tools like pdfFiller facilitates ongoing document management, allowing users to maintain organized records and make necessary adjustments should the need arise.

How to fill out the bankruptcy assessment survey template

-

1.Access the PDF of the bankruptcy assessment survey on pdfFiller.

-

2.Begin by reviewing the introductory section to understand the purpose of the survey.

-

3.Fill in personal information including your full name, address, and contact details in the specified fields.

-

4.Proceed to list your current debts, including credit cards, loans, and any outstanding bills, ensuring accuracy with amounts and creditors' names.

-

5.Next, provide information about your income sources, distinguishing between salary, benefits, and any additional earnings.

-

6.Include details about your assets, such as property, vehicles, and savings accounts, if applicable.

-

7.Answer any additional questions or provide information as requested to reflect your financial situation.

-

8.Review all entries for accuracy and completeness, making adjustments as necessary.

-

9.Once filled out, save the document to your device and submit it according to the outlined instructions on pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.