Get the free Foreign Corrupt Practices Act - Corporate Policy template

Show details

This is a corporate policy document designed to meet the standards of the Foreign Corrupt Practices Act, a provision of the Securities and Exchange Act of 1934. FCPA generally prohibits payments

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is foreign corrupt practices act

The Foreign Corrupt Practices Act (FCPA) is a U.S. law that prohibits companies and individuals from bribing foreign officials to gain or retain business.

pdfFiller scores top ratings on review platforms

ONLY BAD THING IS THE PRICE

ONLY BAD THING IS THE PRICE

Good one

Good one, I really love this

Using pdfFiller is seamless!

Using pdfFiller has been a seamless process! Love that there is a 30-day free trial. Dashboard is easy to navigate. Also love multiple send options (including fax). Great tool to use at work and for personal tasks!

great

it is very nice and user-friendly

Worked perfect for me.

Worked perfect for me.

Great Product

Great Product. I work in a small office. This program is just enough to make great forms for applications and requests. It is easy to use and makes my documents look professional.

Who needs foreign corrupt practices act?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Foreign Corrupt Practices Act (FCPA) Form

How do you understand the Foreign Corrupt Practices Act?

The Foreign Corrupt Practices Act (FCPA) is a crucial piece of legislation for businesses operating in international markets. It aims to prevent bribery of foreign officials and ensure transparency in global business operations. Understanding the FCPA is vital for companies to mitigate risks associated with corrupt practices and maintain ethical standards.

-

The FCPA prohibits U.S. entities from bribing foreign officials to gain a business advantage. It applies to all U.S. persons and entities, making its scope broad in the context of international business.

-

Enacted in 1977, the FCPA arose from growing concerns regarding U.S. companies engaging in corruption abroad. The statute has since evolved, responding to the globalization of trade and the necessity for ethical conduct.

-

Compliance with the FCPA is not just a legal obligation; it fosters trust and credibility with stakeholders. Implementing compliance measures can enhance a company's reputation and operational sustainability.

What is the FCPA compliance landscape?

Navigating the FCPA compliance landscape requires a firm grasp of its key provisions. Companies must understand what constitutes a violation and the severe implications of failing to comply.

-

The FCPA outlines strict prohibitions against bribery. Companies must implement internal controls and maintain accurate records to adhere to its requirements.

-

A violation occurs when an entity offers, promises, or gives something of value to influence a foreign official. This broad definition emphasizes the importance of thorough compliance training.

-

Violating the FCPA can lead to significant fines, legal action, and reputational damage. Companies often face heightened scrutiny and loss of business.

What are the responsibilities for organizational compliance?

Organizations must take proactive steps to comply with the FCPA, starting with the roles and responsibilities defined for managers and employees.

-

Leadership is critical in establishing a culture of integrity. Officers must lead by example and implement policies that promote FCPA compliance.

-

It is essential for employees to report any suspected violations without fear of retaliation. Transparency within the organization can prevent potential issues.

-

Engaging with business partners requires clear communication of compliance obligations. Organizations must ensure that third parties are equally committed to FCPA adherence.

How can employees and partners be guided?

Understanding FCPA compliance is a shared responsibility among employees and business partners. Providing general guidance is crucial for fostering a culture of compliance.

-

Organizations should offer training programs that help employees recognize compliance risk factors and the importance of adherence.

-

Documentation of compliance training and certifications can serve as proof of commitment to ethical practices.

-

Providing real-life scenarios can help employees identify red flags and respond appropriately when faced with ethical dilemmas.

What interactive tools can help manage FCPA-related documentation?

Utilizing effective tools for document management can streamline compliance processes. Tools like pdfFiller offer integrated solutions for handling FCPA documentation.

-

pdfFiller allows users to easily edit and update FCPA documents, ensuring they are always compliant and accurate.

-

The platform provides eSignature capabilities that simplify the process of signing compliance documents.

-

With customizable templates, organizations can adapt the FCPA corporate policy form to meet their specific requirements.

How can organizations foster a culture of compliance?

Creating a culture of compliance involves ongoing education and open communication about ethical practices and policies.

-

Regular training sessions for employees reinforce the importance of FCPA compliance and update them on any changes in legislation.

-

Organizations should cultivate an environment where employees feel safe discussing compliance concerns without fear.

-

A dedicated compliance team can offer ongoing support and guidance, ensuring that employees have the resources they need.

What are sample certifications and documentation templates?

Having access to sample certifications and templates can simplify FCPA compliance processes for organizations.

-

Sample certifications can provide guidelines for employees to assert compliance, improving overall accountability.

-

pdfFiller offers a range of customizable templates that ensure your FCPA documentation meets regulatory requirements.

-

Accurate and timely documentation helps businesses avoid legal complications and enhance operational transparency.

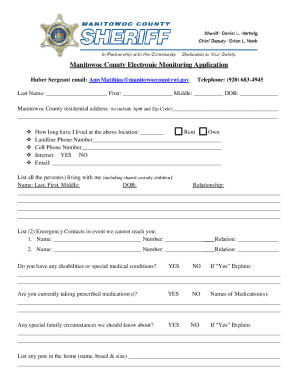

How to fill out the foreign corrupt practices act

-

1.Start by downloading the FCPA form from pdfFiller.

-

2.Open the form in pdfFiller, ensuring you have access to edit and fill it out.

-

3.Fill in your entity's name and address at the top of the document.

-

4.Provide necessary financial information as requested in the form, including details of any potential transactions and involved parties.

-

5.Complete the sections that require you to disclose any known violations of the FCPA.

-

6.If applicable, include information on compliance training conducted within your organization.

-

7.Review the form for completeness and accuracy, ensuring all required fields are filled.

-

8.Save your progress frequently to avoid any loss of data.

-

9.Once completed, use pdfFiller to electronically sign the form if required.

-

10.Finally, submit the filled form as directed by the agency or keep it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.