Get the free Selected Consequences of Public Company Status Memorandum template

Show details

As a result of the public offering of securities by the company, the company will be obligated to file various periodic reports with the SEC. This memorandum lists all those reports (10-K, 10-Q,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is selected consequences of public

Selected consequences of public refers to the specific outcomes and impacts that public actions or policies may have on communities or society at large.

pdfFiller scores top ratings on review platforms

I've just started using it. appreciated the easy fill in documents.

Good product. Wish it would have been around for many years.

A great help! Has helped me tremendously, understanding and filing all my divorce documents.

Great program. Has made current AIA project much easier!

Its very helpful for training I am giving!

Easy to use and easy to understand. This is a great product!

Who needs selected consequences of public?

Explore how professionals across industries use pdfFiller.

Selected Consequences of Public Company Status

Understanding the selected consequences of public company status is essential for any business considering the transition from private to public. This guide will explore various aspects of public company status, including reporting requirements and compliance challenges.

What defines a public company?

A public company is defined as a corporation whose shares can be publicly traded on a stock exchange. This designation allows for capital raising from public investors but comes with increased regulatory scrutiny.

Key differences between public and private companies

-

Public companies have numerous shareholders and must adhere to SEC regulations, whereas private companies are typically owned by a small group.

-

Public companies must disclose their financial performance, management practices, and significant decisions, while private firms enjoy greater confidentiality.

-

Public companies can raise capital through the sale of stock, allowing for larger amounts of funding, unlike private companies, which mostly rely on private investments.

Why does a company go public?

Companies go public to access a broader pool of capital. The increased funding potential can drive growth, while public status enhances prestige and visibility.

Overview of SEC reporting obligations

The Securities and Exchange Commission (SEC) requires public companies to file regular financial reports to ensure transparency and protect investors. Compliance with these obligations is imperative.

Frequency and types of reports required

Public companies must submit several types of reports, including quarterly (Form 10-Q) and annual reports (Form 10-K) as well as current reports (Form 8-K) for significant events.

Understanding Form 10-K reports

The Form 10-K provides a comprehensive overview of a company's financial performance, including audits, risk factors, and management analysis. This report is critical for investors.

Potential penalties for non-compliance

-

Public companies can face substantial financial penalties for failing to comply with SEC reporting requirements.

-

Non-compliance may also result in lawsuits by investors or enforcement actions from regulatory authorities.

-

Falling short of disclosure obligations can damage a company’s credibility, affecting investor trust and stock prices.

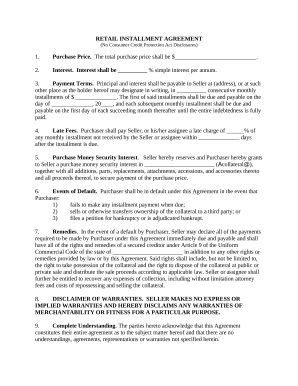

What information must be disclosed?

Public companies must disclose accurate financial data, including income statements, balance sheets, and cash flow statements, as well as any material events affecting operations.

How to ensure compliance with disclosure requirements

To maintain compliance, companies should implement robust financial controls and engage internal or external auditors to validate reported information.

The significance of audited financial statements

Audited financial statements lend credibility and trustworthiness to a company's financial reporting, assuring investors and regulators of accurate disclosures.

Integration with annual reports

Annual reports integrate all necessary financial disclosures into a single document, presenting a holistic view of the company to shareholders.

Understanding conflicts of interest

Conflicts of interest occur when a personal interest interferes with the professional responsibilities of executives and board members.

How financial interests impact shareholder votes

Financial interests may bias decision-making, altering shareholder votes and impacting governance.

Overview of compliance requirements for executives

Executives must disclose any potential conflicts and may need to recuse themselves from relevant decisions to maintain objective governance.

When and why recusal is necessary

Recusal becomes necessary when an executive’s interest may influence a decision, safeguarding the integrity of board decisions.

Process for requesting a conflict of interest review

Executives must formally request a review of potential conflicts to ensure compliance and transparency within organizational practices.

Legal ramifications of failing to recuse

Failure to recuse can result in legal consequences, including lawsuits, penalties, or damage to the company's reputation.

Situations where typical rules may not apply

Some unique situations, such as crises or acquisitions, may prompt deviations from standard obligations, requiring tailored compliance approaches.

Exceptions for startups or small public companies

Certain allowances exist for smaller public companies to ease the burden of exhaustive reporting, promoting growth and innovation.

Navigating unique findings based on the company context

Understanding the nuances of individual company circumstances is vital to adopting the best practices for compliance and governance.

Utilizing tools and platforms for facilitating compliance

Tools like pdfFiller help streamline documentation processes, making compliance management easier through effective editing and signing functionalities.

Consulting with legal advisors or financial professionals

Engaging experienced professionals provides insights into regulatory changes, ensuring companies remain compliant amidst evolving laws.

Continuing education on regulatory changes

Staying informed of regulatory developments is crucial for public companies, thus fostering a culture of compliance and proactive governance.

Steps to take when unsure of compliance status

Companies should initiate a comprehensive review when compliance status is in question, ensuring all obligations are clearly met and documented.

Choosing the right advisors

Select advisors with extensive experience in public company compliance to navigate complexities effectively and protect shareholder interests.

Documenting advisory requests effectively

Keeping thorough records of all advisory requests helps in transparency and ensures accountability in corporate governance practices.

Introduction to the Public Charge Rule

The Public Charge Rule influences immigration and may have implications for public companies hiring foreign talent, impacting workforce dynamics.

Impact of this rule on public companies and stakeholders

Changes in immigration policies can restrict the hiring of skilled foreign workers, thus affecting public company operations and growth trajectories.

Strategies for mitigating risks associated with this rule

Public companies should develop strategic frameworks to navigate legal implications effectively, ensuring compliance while preserving corporate interests.

Common pitfalls in compliance and reporting

Public companies often face challenges in accurately reporting their financials, risking penalties and damaging their reputation.

Best practices for avoiding regulatory scrutiny

Establishing a culture of compliance and regular training for staff helps prevent oversights and fosters confidence among investors.

Using pdfFiller to simplify document management and compliance processes

pdfFiller offers features such as document editing, e-signatures, and collaborative tools that enhance compliance management efficiency.

How to fill out the selected consequences of public

-

1.Open pdfFiller and upload the selected consequences of public document.

-

2.Begin by filling out the title section with a clear and concise description of the document's purpose.

-

3.Next, identify and outline the key public actions or policies relevant to your analysis.

-

4.For each identified policy, describe its potential positive and negative consequences in bullet points.

-

5.Include specific case studies or examples to illustrate the consequences wherever possible.

-

6.Make sure to reference any relevant statistical data or research to support your claims.

-

7.Review the document thoroughly for accuracy and completeness before saving.

-

8.Finally, download or share the completed document with stakeholders or interested parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.