Get the free Assumption and Loan Modification Agreement

Show details

Assumption and Loan Modification Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is assumption and loan modification

Assumption and loan modification is the process through which a borrower takes over an existing mortgage from the original borrower, often involving changes to the loan terms.

pdfFiller scores top ratings on review platforms

so far so good just using fora short time

The billing is bogus and felt dishonest, but customer service fixed my problems after an email. These save well as pdfs but not as docs. I think the service should be less expensive, given apps with similar functionality.

It has been very helpful and pleasant to use PDFfiller.

Nice program. Was able to learn without reading the guide much. Would like the option to pay per document instead of subscribing via monthly or yearly.

Your guy was good - but I really didn't get the result from the program I expected. I thought it would convert to word exactly. I understand why it didn't - just makes the program less than what I had thought I was buying. I don't do this type of work often and will probably just discontinue the program.

I travel all the time and all over and PDFfiller makes it so easy for me to stay on top of my business. Thanks!

Who needs assumption and loan modification?

Explore how professionals across industries use pdfFiller.

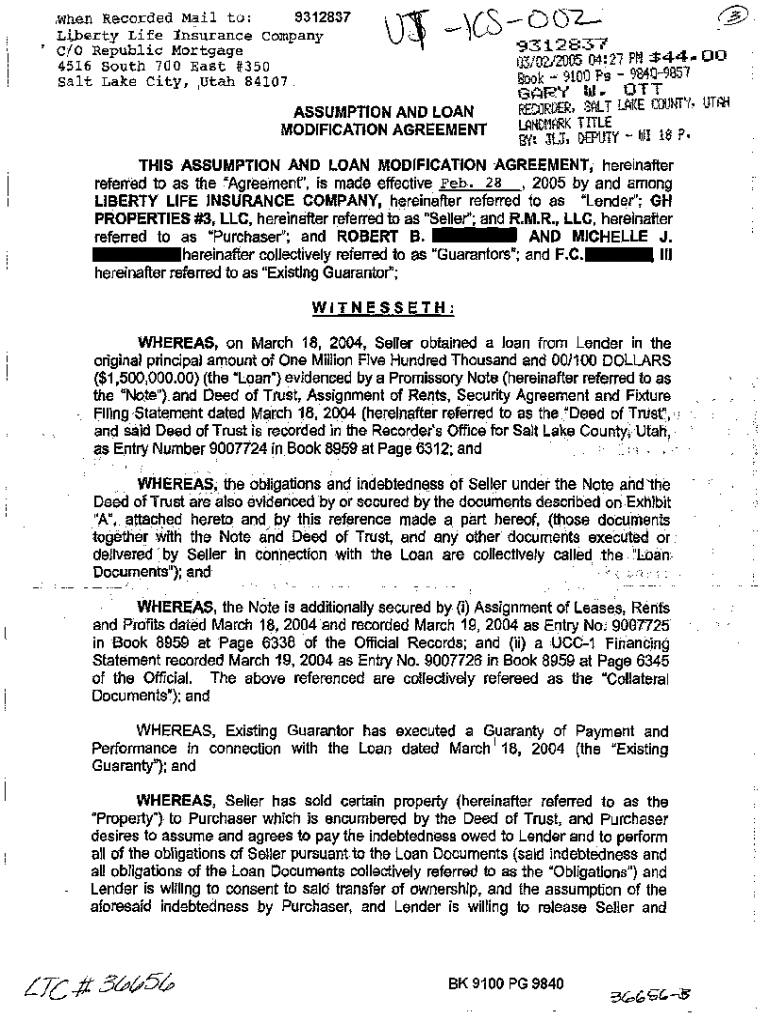

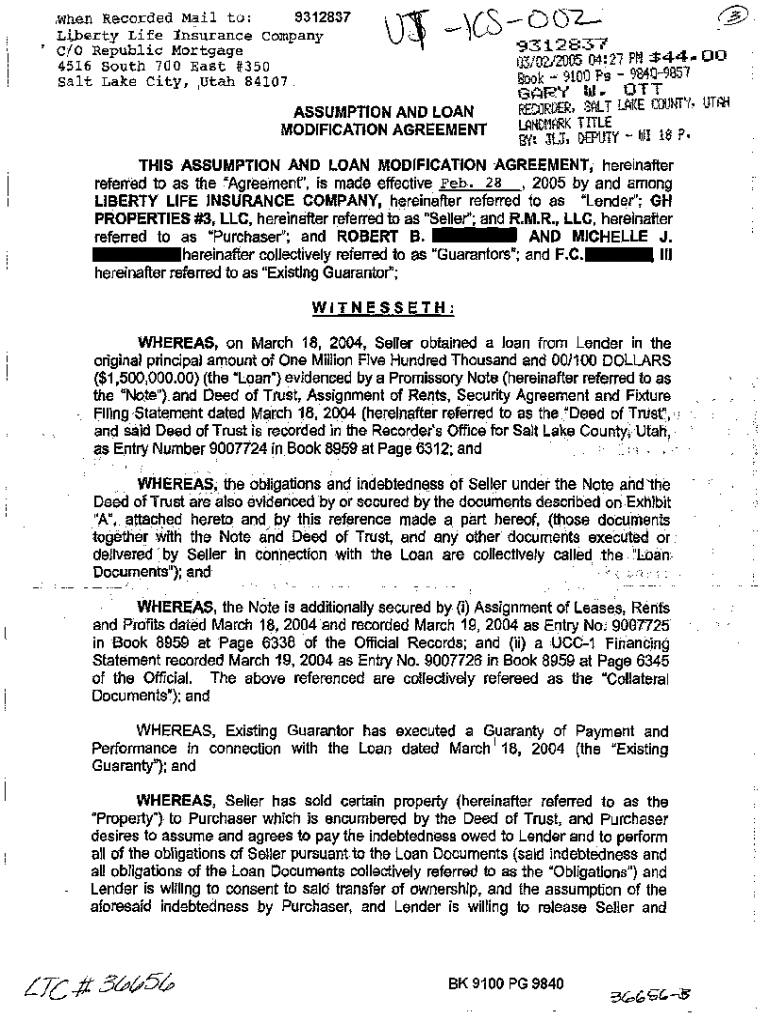

Comprehensive Guide to the Assumption and Loan Modification Form

In this comprehensive guide, we will explore the assumption and loan modification form, a critical document for anyone looking to refinance or transfer loan obligations. This guide is designed to help you understand the form's components, proper filling techniques, and the use of pdfFiller to streamline the process.

How can you define the assumption and loan modification form?

The assumption and loan modification form is a legal document utilized by borrowers and lenders during the refinancing or transfer of a loan. This form can change the terms of an existing loan or transfer the loan obligation to another party, facilitating smoother transitions in ownership or repayment structure.

What is the purpose of this form?

The primary purpose of the assumption and loan modification form is to officially document changes to a loan agreement. This may include adjusting interest rates, extending payment terms, or transferring the debt to another borrower. It ensures all parties are aligned and legally protected during this process.

When might you need to use this form?

Individuals and teams might need this form during various situations, such as when someone is taking over payments on an existing loan, or if the original borrower wants to modify the loan terms due to financial hardship. Understanding when and why to use this form can greatly influence financial planning.

What are the key components of the assumption and loan modification form?

-

Includes the original loan amount, current balance, and interest rate.

-

Identifies all parties involved, including names and contact details.

-

Specifies new terms such as payment schedule, interest adjustments, or release of obligation.

What common terms and legal jargon should you understand?

Legal terminology in the assumption and loan modification form can be daunting. Familiarity with terms like 'default', 'debt-to-income ratio', and 'escrow' will aid borrowers in comprehending their obligations. Knowledge of these terms can prevent misunderstandings related to loan management.

What are the implications of the information provided in each section?

Each section of the form carries significant legal implications. For instance, inaccuracies in the borrower information can lead to issues in repayment responsibilities, while errors in loan details could cause disputes. Proper diligence and accuracy are paramount.

How can you fill out the form successfully?

Filling out the assumption and loan modification form requires careful attention to detail. Using tools such as pdfFiller can simplify this process. Start by reviewing each section carefully and providing accurate information to avoid processing delays or legal complications.

-

Utilize pdfFiller’s guided tools to complete each section accurately.

-

Double-check all entries for correctness, especially on financial details.

-

Look at completed forms provided by pdfFiller for reference.

How to edit and customize your form with pdfFiller?

PdfFiller’s editing tools allow users to modify the assumption and loan modification form easily. Whether it’s adding comments or changing fields, these features enhance customizability for different borrower needs.

-

Highlight sections that need attention or require discussions with a co-signer.

-

Work with team members or stakeholders in real-time within the platform.

What are the steps for eSigning the form in pdfFiller?

Signing the form electronically can simplify its submission and ensure faster processing times. PdfFiller provides a seamless solution for eSigning, promoting efficiency in finalizing agreements.

-

Use pdfFiller’s built-in eSigning capabilities to secure your signature.

-

Understand that eSignatures carry the same legal weight as handwritten ones.

-

Utilize pdfFiller's options to securely share your signed document.

How do you manage your loan modification documents?

Managing documents effectively can ensure quick access and maintain order. PdfFiller’s cloud storage solutions facilitate easy storage and retrieval of loan modification documents.

-

Keep organized folders in the cloud for easy access and retrieval.

-

Utilize version control to monitor modifications over time.

-

Be aware of common challenges, such as lost documents or version discrepancies.

What compliance considerations should you keep in mind?

Understanding local regulations regarding loan modifications is crucial to avoid legal pitfalls. Compliance ensures modifications meet both lender and borrower requirements, facilitating smoother transactions.

-

Stay informed about laws specific to your region regarding loan modifications.

-

Ensure your modifications comply with established practices to minimize risks.

-

Be aware of frequent mistakes that could jeopardize the modification process.

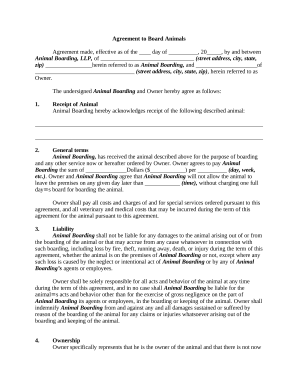

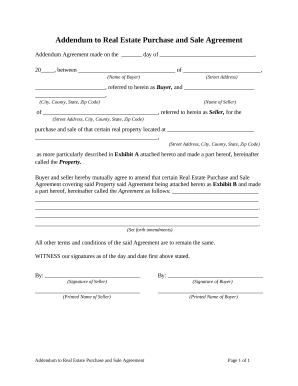

What related document types should you be aware of?

In addition to the assumption and loan modification form, other relevant documents may include refinance applications and releases of liability. Understanding these forms can be beneficial, as they might be applicable in similar financial situations.

-

Used when seeking new terms from a lender for an existing mortgage.

-

Utilized to free a borrower from obligations once the loan is assumed by another party.

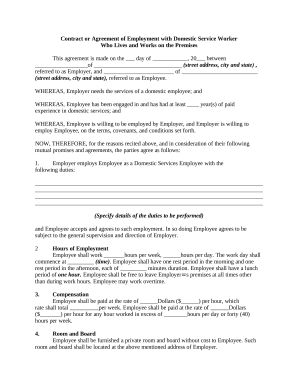

How to fill out the assumption and loan modification

-

1.Obtain the assumption and loan modification form from your lender or download it from their website.

-

2.Carefully read the instructions on the form to understand what information is required.

-

3.Fill out your personal details in the designated fields, including your name, contact information, and property address.

-

4.Input the original loan details, such as the loan number, amount, and current interest rate.

-

5.Provide information about the new borrower, if applicable, including their financial details and credit history.

-

6.Review the loan modification terms, ensuring you agree with any changes or additional requirements stated in the form.

-

7.Sign and date the form where indicated, and have any co-borrowers also sign if needed.

-

8.Submit the completed form to your lender, along with any required documentation, such as proof of income or credit history.

-

9.Keep a copy of the completed form for your records, and follow up with your lender to confirm they received your submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.