Last updated on Feb 10, 2026

Get the free pdffiller

Show details

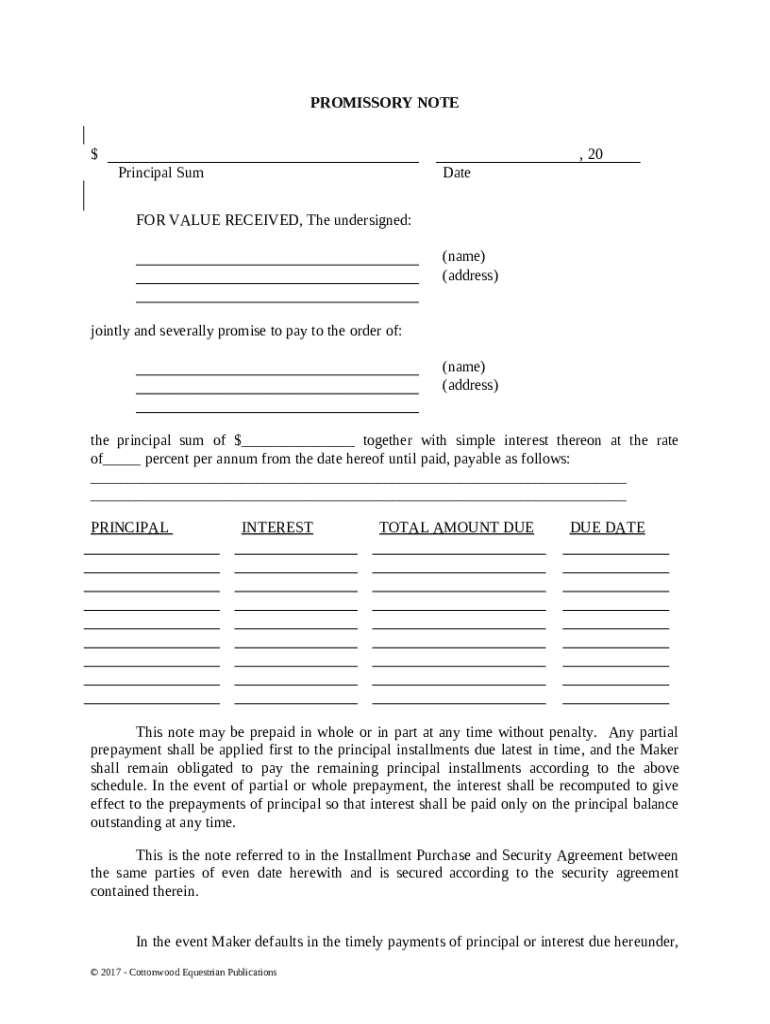

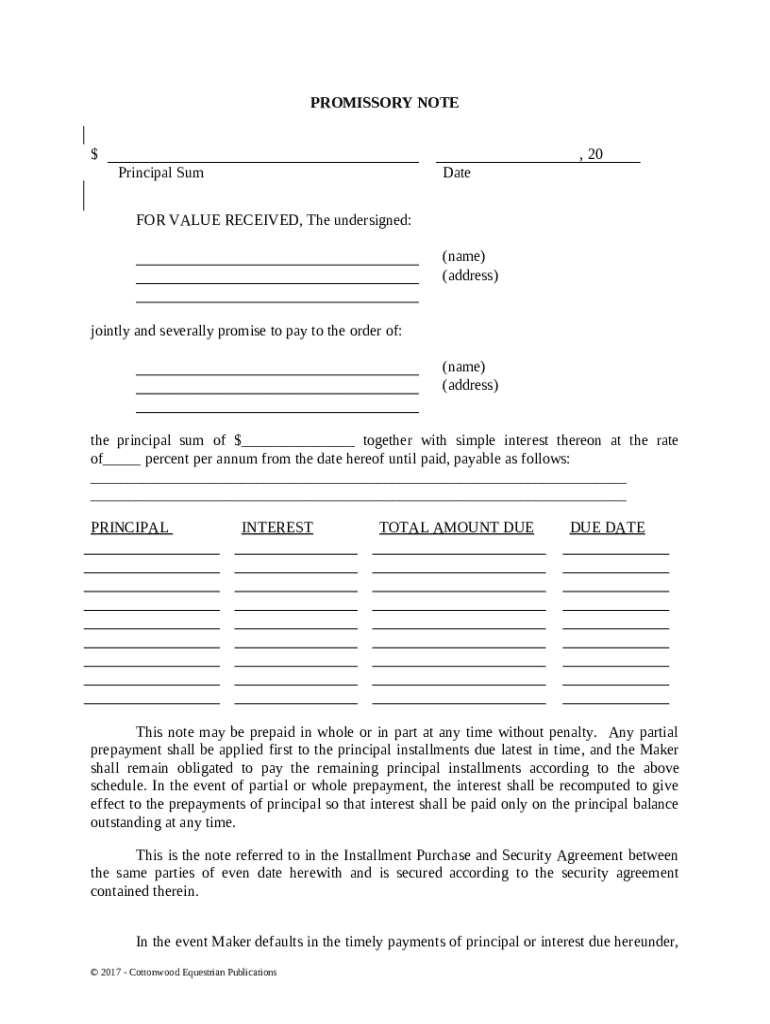

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document in which one party promises to pay another a specific sum of money in exchange for a horse.

pdfFiller scores top ratings on review platforms

this is new for me - I'm learning about the program, and I like all the options the program have

There are some things that could be more user-friendly or convenient but overall it is very effective and useful as a tool for creating and modifying documents. The "preview document" is never accurate, and the ink looks faded after it is scanned in as a template.

It is a very good program! Really helpful!

The quality of this product is beyond my expectations. I look forward to discovering all the features this product has to offer.

So far so good! Just started using it today. Looking forward to creating my own pdfs from now on.

MAKES COMPLETING THE FORM SO MUCH EASIER.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to Effectively Use a Promissory Note

How do you define a promissory note?

A promissory note is a written promise to pay a specified amount to a designated person or entity at a future date or on demand. This legal document outlines the terms of the loan, including the principal sum and interest. It serves both as evidence of debt and a tool for enforcing repayment, making it essential in personal and business loans alike.

What are the key components of a promissory note?

-

The initial amount of money borrowed, which must be clearly stated in the note.

-

The agreed-upon interest rate that will be applied to the principal over time.

-

Details regarding how and when the borrower will make repayments.

What distinguishes secured and unsecured promissory notes?

Secured promissory notes are backed by collateral, meaning that if the borrower defaults, the lender can claim the collateral. In contrast, unsecured promissory notes do not have such backing, relying solely on the borrower's promise to repay. Understanding this distinction is crucial for both lenders and borrowers in assessing risk.

How can you fill out the promissory note form?

Filling out a promissory note requires careful attention to detail to ensure all necessary information is captured accurately. Starting with a clear understanding of the loan terms will make filling out the form efficient.

-

Determine the amount borrowed: Enter the total amount of money you are borrowing.

-

Specify the loan date to document when the agreement goes into effect.

-

Fill in your name and address accurately to ensure correct identification.

-

Enter the lender’s name and address to establish who is providing the loan.

-

Select and enter the appropriate interest rate, based on the agreement.

-

Define the schedule for principal and interest payments to avoid confusion later.

How to manage and edit your promissory note?

After filling out the promissory note, management and edits may be necessary as circumstances change. Tools like pdfFiller allow for easy modifications, ensuring your document remains current.

-

Utilize pdfFiller’s editing features to update any details conveniently.

-

Integrate electronic signatures for quick and secure document authentication.

-

Keep your completed documents securely in the cloud for easy access.

-

Share the promissory note with others for review and input, enhancing accuracy.

What should you know about default and payment issues?

Being aware of default implications can help borrowers avoid serious consequences. Default occurs when payments are not made according to the agreement, leading to legal action or damage to credit.

-

Understand what default means for your credit and financial standing.

-

Recognize the responsibilities of the borrower in the event of missed payments.

-

Be aware that default may result in interest recalculations and additional fees.

-

Learn the steps to correct a default situation, including timelines and potential negotiations.

What are the legal compliance and local considerations?

When creating a promissory note, it is crucial to understand the local legal requirements to avoid invalid agreements. Laws vary by region and can affect interest rates and repayment terms.

-

Be informed about what legal codes apply to your promissory note based on your jurisdiction.

-

Recognize how local laws can influence your interest rates and loan terms.

-

Adhere to established practices to ensure your promissory note meets legal standards.

What additional components should a promissory note include?

Including additional components can provide clarity and flexibility in your agreement. Options such as prepayment clauses or installment payment provisions can affect obligations.

-

Define conditions under which early repayments can occur without incurring penalties.

-

Outline any provisions for paying in installments and clarify their implications.

-

Establish agreements that provide additional security for the note, if applicable.

What are the key takeaways from filling out a promissory note?

Successfully completing a promissory note involves understanding legal obligations and documenting clear terms. Utilizing resources like pdfFiller enhances efficiency in both filling out and managing notes, ensuring compliance and security.

How to fill out the pdffiller template

-

1.Open the promissory note - horse PDF template on pdfFiller.

-

2.Begin by entering the date at the top of the document where indicated.

-

3.In the first section, fill in the full name and contact details of the borrower (the person or entity buying the horse).

-

4.Next, provide the lender's (the seller's) full name and contact information.

-

5.Specify the amount to be borrowed, which is the purchase price of the horse, in the designated field.

-

6.Identify the horse being purchased by including its name, breed, age, and any other distinguishing characteristics.

-

7.Outline the repayment terms, including the interest rate (if any), payment schedule, and due dates.

-

8.Include any additional terms or conditions regarding the sale or the repayment process as needed.

-

9.Carefully review the completed form for accuracy and completeness before signing.

-

10.Have both parties sign the document to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.