Get the free Installment Purchase and Security Agreement With Limited Warranties - Horse Equine s...

Show details

This Installment Purchase and Security Agreement With Limited Warranties Horse Equine form is an installment purchase and security agreement in connection with the purchase of a horse. It provides

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is installment purchase and security

An installment purchase and security document outlines the terms of a loan for purchasing goods or services, where the buyer makes regular payments over time and provides security for the loan.

pdfFiller scores top ratings on review platforms

Love how easy this makes my life and transactions!!

Just started, but this thing is useful!! Great idea, keep up the good work

pretty good, I wish there was a green color option for symbols.

I really like it, very convenient and easy to use without buying the expensive software

Absolutely no problems! Love it just the way it is.

Makes creating and submitting tax forms very easy

Who needs installment purchase and security?

Explore how professionals across industries use pdfFiller.

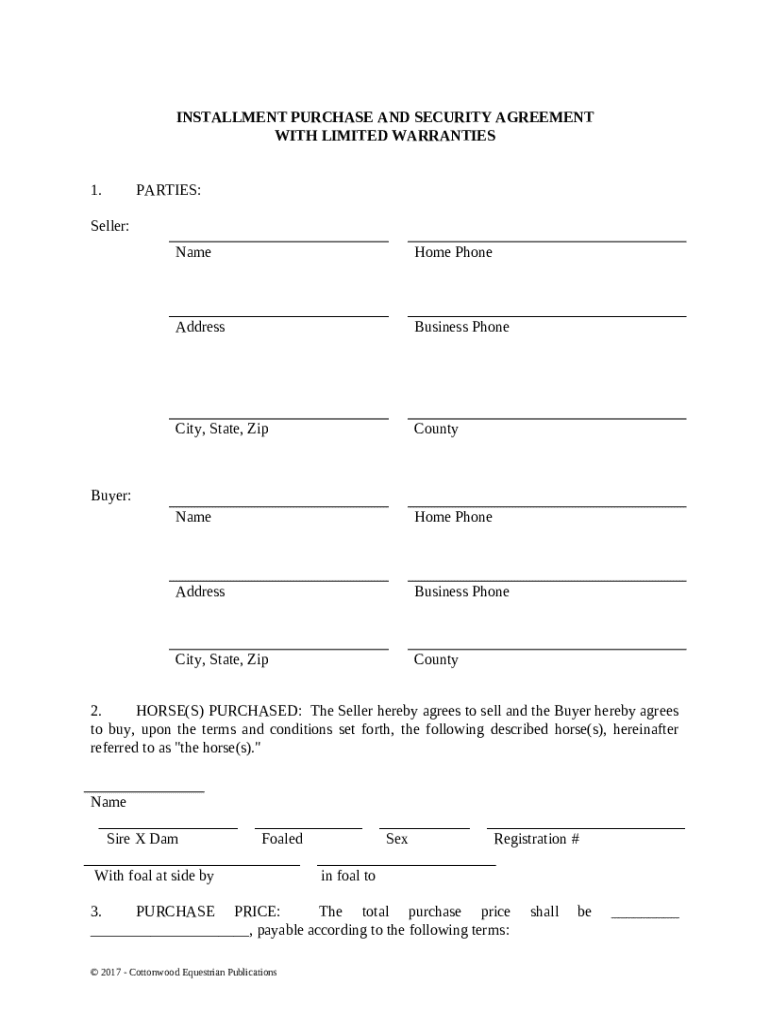

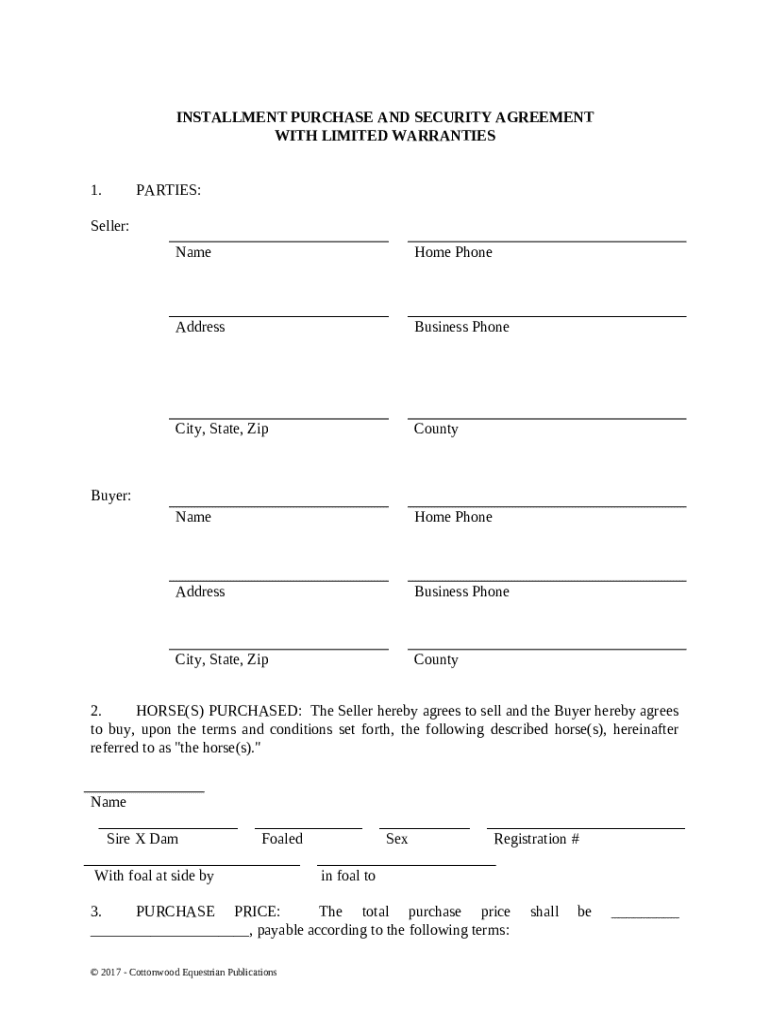

How to fill out the installment purchase and security

-

1.Open the 'installment purchase and security' PDF on pdfFiller.

-

2.Begin by entering your full name at the top of the document.

-

3.Fill in the date of the purchase in the designated space.

-

4.Insert the details of the item or service being purchased, including its price.

-

5.Enter the total loan amount in the respective field.

-

6.Specify the interest rate applicable to the installment purchase.

-

7.Outline the payment schedule: include the number of payments, payment due dates, and amounts.

-

8.Provide the collateral or security details that will secure the loan.

-

9.Read through the terms and conditions carefully, and add your signature at the bottom.

-

10.Save or send the completed document as needed, ensuring all information is accurate and complete.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.