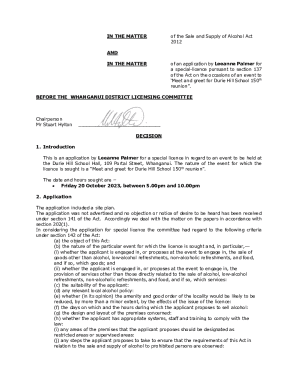

Get the free A14 Report of Trustee and Petition for Approval of Accounting by Trustee

Show details

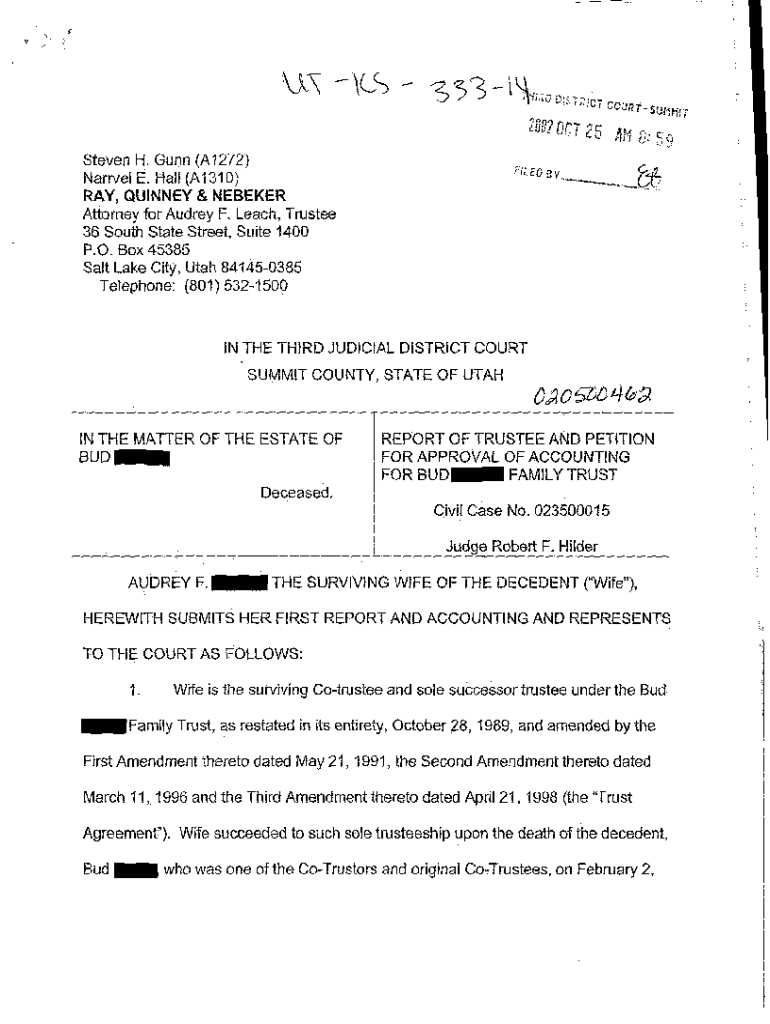

A14 Report of Trustee and Petition for Approval of Accounting by Trustee

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

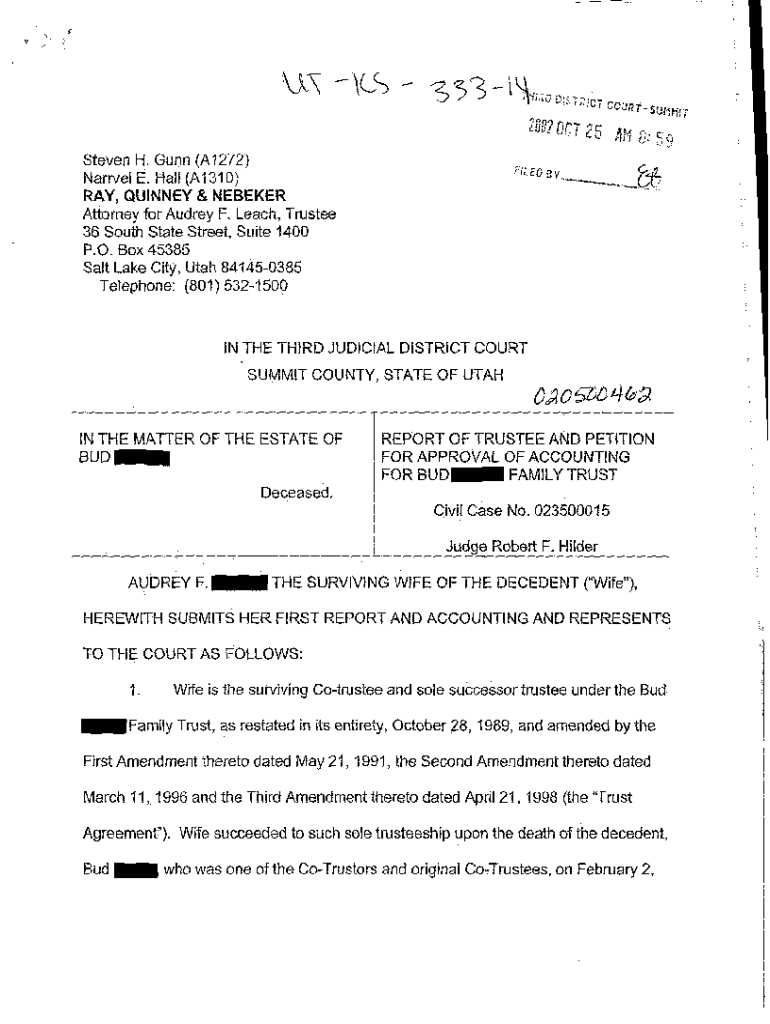

What is a14 report of trustee

An A14 report of trustee is a legal document required for trustees to report on the administration of a trust.

pdfFiller scores top ratings on review platforms

treatment ADLs Caregiver

neat, articulate form

It was a great help in my dire…

It was a great help in my dire situation,

working great

working great

WAS NOT SURE IF THE FORM GOT SENT

WAS NOT SURE IF THE FORM GOT SENT

it's easy and useful for fast changes or edit texts. Just missing options like "number pages"

Awesome

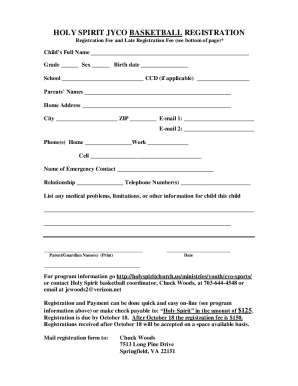

Who needs a14 report of trustee?

Explore how professionals across industries use pdfFiller.

How to fill out an A14 report of trustee form

Understanding the A14 report of trustee form

The A14 report of trustee form serves as a comprehensive document that delineates the activities and financial management of a trust. Its purpose is essential in trust management, ensuring transparency and accountability to beneficiaries and stakeholders. It's crucial that trustees comprehend the general requirements for filling out this report accurately to avoid legal complications.

-

This report is a structured report designed to showcase a trustee's activities and management of a trust, enhancing trust accountability.

-

This document plays a vital role in maintaining transparency within trust management, helping to safeguard the interests of beneficiaries and the integrity of the trustee.

-

Proper understanding of the form’s structure and the related state regulations ensures that the report meets necessary legal standards.

What are the key sections of the A14 report?

The A14 report contains various key sections that ensure comprehensive reporting of the trust's operations. Each section provides critical insights into the performance and management of trust assets, which are invaluable to both trustees and beneficiaries.

-

This section identifies the trustee, all beneficiaries, and any third parties involved, establishing roles and responsibilities.

-

Trustees must report all assets held in the trust, including income generated, thereby providing a complete financial picture.

-

It's important to detail any distributions made during the reporting period, reflecting the performance of trust management.

-

Trustees are required to disclose fees earned and expenses incurred, ensuring full transparency and accountability.

-

This summary encapsulates the essence of trusteeship during the reporting period, outlining any significant decisions or changes.

How to complete the A14 report of trustee form?

Filling out the A14 report requires meticulous attention to detail and adherence to guidelines. By following a step-by-step approach, trustees can improve accuracy and compliance with state regulations.

-

Carefully progress through each section, ensuring that all required information is provided and accurately reported.

-

Trustees should be mindful of incomplete sections or misreported figures, as these errors can lead to significant issues.

-

Trustees must stay updated on state-specific rules regarding the A14 form to ensure legality and adherence to local governance.

How to edit, sign, and manage your A14 form with pdfFiller?

pdfFiller offers comprehensive tools for editing and managing your A14 report efficiently. With features designed for easy collaboration and management, users can enhance their workflow.

-

You can customize your A14 form using an array of editing options that pdfFiller provides, ensuring it meets your needs.

-

Utilizing electronic signatures allows for secure submission and verification, streamlining the process significantly.

-

pdfFiller enables users to easily manage their submitted documents, whether they need to amend or withdraw their entries.

-

The platform also allows storage on a cloud-based system, making access and sharing with relevant parties straightforward.

What are the final steps after submitting your A14 report?

After submitting your report, understanding the review process is vital. It's not just about submission; it's essential to know what follows and how to maintain your records.

-

Typically, submitted A14 reports are reviewed by financial institutions or courts to ensure compliance and accuracy.

-

Financial institutions may require additional documentation or clarification, and courts can request hearings if there are disputes.

-

Trustees should retain records of their A14 submissions and any correspondence related to ensure future compliance.

What are local compliance considerations for the A14 report?

Local compliance is an essential aspect of filling out and submitting the A14 report. Each state may have unique requirements that affect how trustees must handle this form.

-

Each state has its regulations governing the A14 form, necessitating awareness of these variations in order to remain compliant.

-

Trustees must also be cognizant of filing deadlines to avoid penalties, along with any associated fees that may vary by state.

-

Accessing local legal support can provide valuable insights and assistance when navigating state-specific requirements.

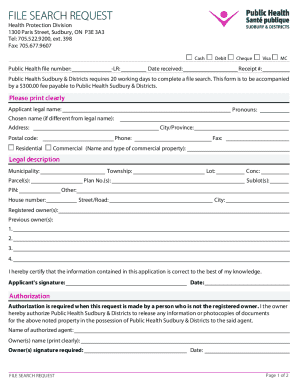

How to fill out the a14 report of trustee

-

1.Open the PDF version of the A14 report of trustee on pdfFiller.

-

2.Review the instructions provided at the top of the form for necessary information.

-

3.Start with section 1, entering the name of the trust and the report period.

-

4.In section 2, provide details regarding the trustee's identity, including name and contact information.

-

5.Section 3 requires a summary of the trust income and expenses; gather accurate financial data before filling this out.

-

6.For section 4, detail any distributions made to beneficiaries during the reporting period, including amounts and dates.

-

7.Make sure all information is accurate before moving to the signature section where the trustee must sign and date the report.

-

8.Once completed, use the 'Save' button to retain a copy, and if required, use the 'Print' option to create a hard copy for submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.