Get the free pdffiller

Show details

Generally, a homestead is deemed to be the dwelling house in which a family resides, with the usual and customary appurtenances, including outbuildings that are necessary and convenient for the family

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is homestead affidavit

A homestead affidavit is a legal document that verifies a property's primary residence status to claim homestead exemption benefits.

pdfFiller scores top ratings on review platforms

I'm a new user so I am still need to experience more.

Excelent

good

I would very much like to learn more about PDFfiller, however my Father just recently passed away and I'm currently overwhelmed with his legal matters and don't have a single free moment, at this time. I did LOVE the product!

it is easy to use

Awsome

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to fill out a homestead affidavit form form

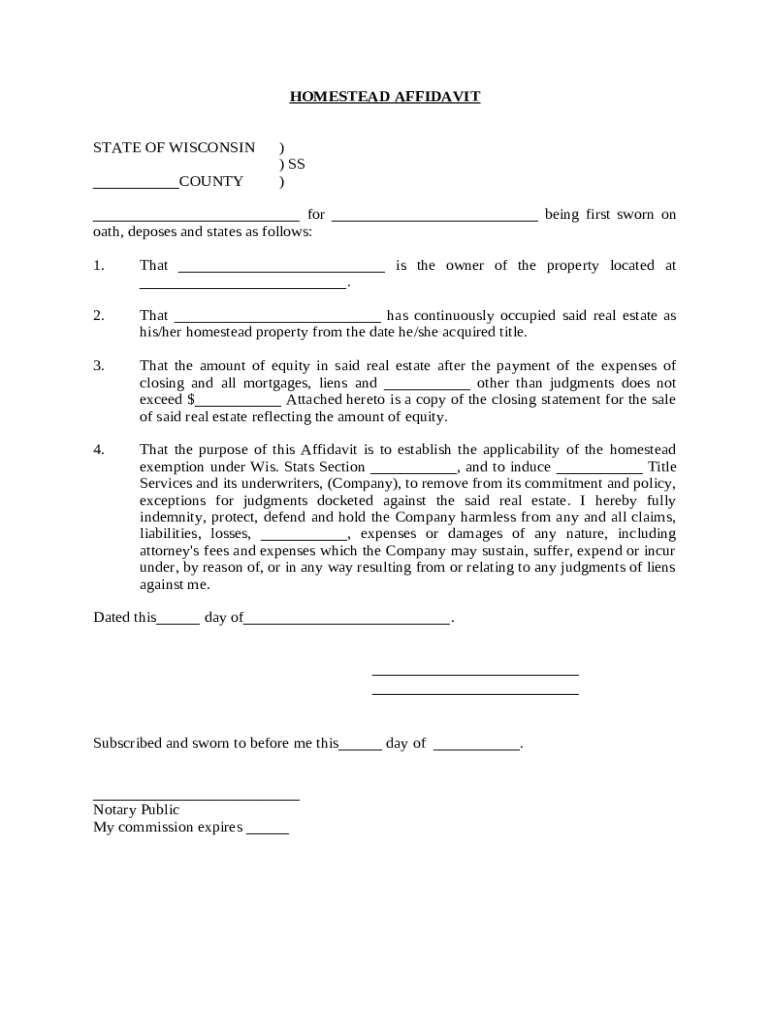

Understanding the Homestead Affidavit in Wisconsin

A homestead affidavit is a crucial legal document for property owners in Wisconsin. This form provides a declaration of your primary residence, which is important for obtaining property tax exemptions. By completing a homestead affidavit, property owners affirm their ownership and eligibility for certain benefits tied to their homes.

-

A homestead affidavit is a sworn statement confirming that a specific property is the owner's primary residence.

-

It serves to verify homeownership for tax purposes and helps in assessing eligibility for various tax exemptions.

-

Submitting an inaccurate affidavit can result in penalties, including loss of tax exemptions or legal disputes.

Key Components of the Wisconsin Homestead Affidavit

The Wisconsin homestead affidavit comprises several critical components that must be accurately filled to avoid delays and issues during processing. Each part of the form serves a specific function that contributes to verifying your claim for property tax benefits.

-

This includes full name, contact information, and any additional identifiers necessary for verification.

-

Provide the complete address, including any unit numbers, to ensure proper identification of the property.

-

This section asks if you live in the property as your primary residence, influencing tax exemptions.

-

Detail any equity in the property to prove eligibility for homestead exemptions.

-

Clarify how the affidavit will affect your property taxes, ensuring all potential benefits are highlighted.

Filling Out the Homestead Affidavit Form

Filling out the homestead affidavit form requires careful attention to detail. Here’s a straightforward step-by-step guide to help you through the process and avoid common pitfalls.

-

Begin by reading through the entire form. Fill in all required fields meticulously, ensuring all entries are accurate.

-

Input accurate dates on which you purchased the property and state the exact amounts regarding property value.

-

Double-check spelling of names and addresses. Ensure values match those on tax documents to prevent discrepancies.

Using pdfFiller to Edit and eSign Your Affidavit

pdfFiller offers a user-friendly platform that simplifies the process of editing and signing your homestead affidavit. With advanced features, users can streamline their document management entirely online.

-

You can edit text, add or delete sections, and insert necessary signatures in a seamless manner.

-

Simply drag and drop your form into the pdfFiller platform, then proceed to edit as needed.

-

eSigning saves time and allows for instant delivery of your affidavit to the concerned authorities.

-

Share documents with colleagues for verification or approval before finalizing and submitting your affidavit.

Submission Process for the Homestead Affidavit

Once your homestead affidavit is filled out and signed, it’s crucial to know how and where to submit it. Proper submission ensures you won’t miss out on any tax benefits.

-

Typically, the affidavit should be submitted to your local county assessor’s office, either in person or by mail.

-

Check if notarization is necessary; some regions require signatures to be notarized before submission.

-

Make sure to submit the affidavit by the specified deadlines; late submissions could lead to losing your tax exemptions.

Understanding Exemptions and Benefits

Understanding the various exemptions available through a homestead affidavit can help maximize the financial benefits of home ownership in Wisconsin.

-

These exemptions vary based on property value and ownership status.

-

Certain exemptions apply specifically to owner-occupied properties, while others may apply to rental properties.

-

By filing the affidavit, you can access different tax benefits that reduce your overall tax burden.

Resources and Support for Completing Your Homestead Affidavit

When filling out the homestead affidavit, having the right resources at your disposal can simplify the process considerably.

-

Reach out to local title services for assistance or clarification on completing the affidavit.

-

Utilize websites and online tools that guide you through the forms and potential exemptions applicable to your situation.

Additional Considerations for the Homestead Affidavit

In addition to the basics of filing your homestead affidavit, it's essential to understand additional factors that may impact your property ownership and tax obligations.

-

Become aware of how misstatements may lead to legal issues down the line.

-

Consider hiring a legal expert if your case involves complexities.

How to fill out the pdffiller template

-

1.Open pdfFiller and upload the homestead affidavit form you need.

-

2.Begin by entering your personal information, including name, address, and contact details.

-

3.Specify the property's details by filling in the address and legal description fields accurately.

-

4.Indicate your ownership status; select whether you own the property outright or have a mortgage.

-

5.Provide the dates of your residence at this property and ensure they match the required residency period for exemption.

-

6.Affirm your eligibility by signing and dating the document in the designated section.

-

7.Review the completed affidavit for any errors or missing information.

-

8.Once verified, download or print the document directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.