Get the free pdffiller

Show details

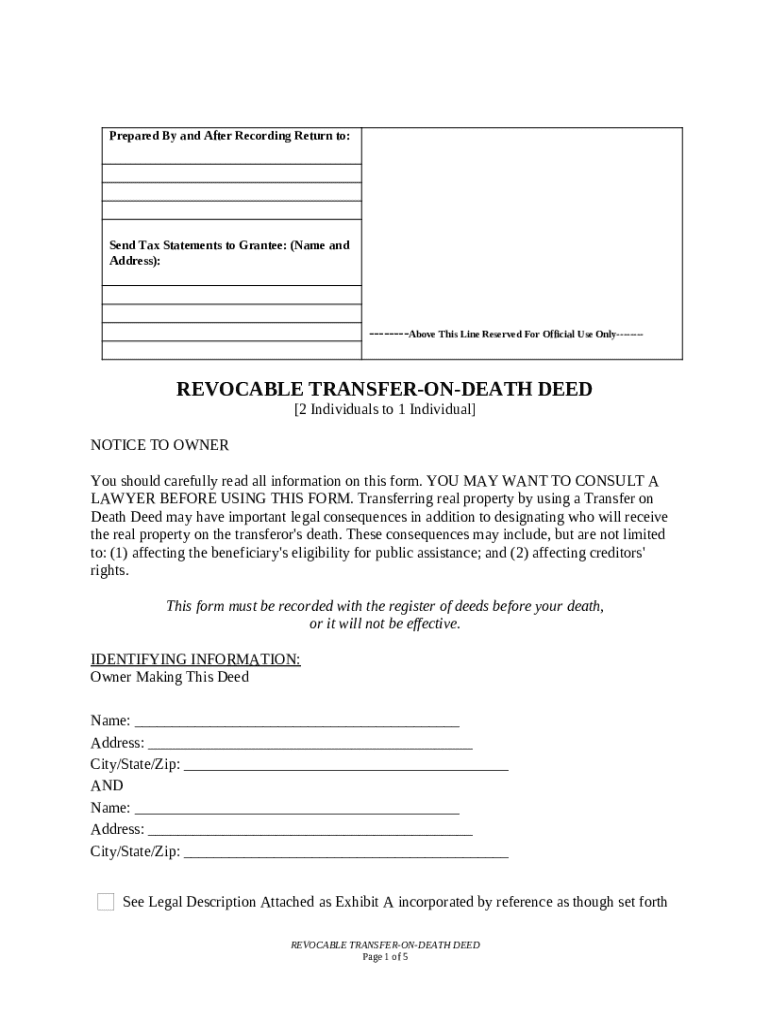

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

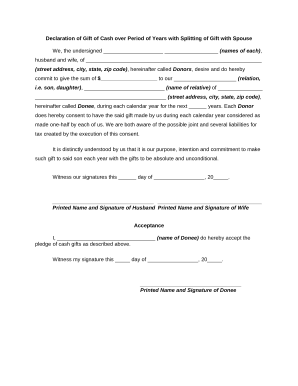

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate upon their death without the property going through probate.

pdfFiller scores top ratings on review platforms

Generally, OK. Frustrating that I have to sign up for a year when I probably only need a few forms.

PDFfiller has been more than I could have asked for and more. A great app.

It works.It is simple.It is effective.It is great value.It works when I am on the go. It works on multiple platforms.

Just started it, but really like it. Good job and good interface.

I wish editing was easier but I do like it

Form filling is straight forward. The signature line needs a size adjustment capability. Auto sum would be a nice time saving feature.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to the transfer on death deed form

How does a transfer on death deed work?

A Transfer on Death Deed (TODD) allows property owners to designate beneficiaries who will inherit the property upon the owner's death, avoiding probate court. This simple yet effective legal tool provides a way for individuals to transfer real estate directly to their loved ones without the complexities of a will or a lengthy probate process. By establishing a TODD, owners can retain full control of the property during their lifetime.

-

A TODD is a legal document that specifies how a property is to be transferred upon the death of the owner.

-

It helps in simplifying the property transfer process and avoiding probate delays.

-

Consulting with a legal professional can prevent potential disputes and ensure compliance with state laws.

-

Always seek advice from a legal expert before creating a TODD to ensure it meets your unique situation.

What steps should you take before filling out the TODD form?

Before completing the transfer on death deed form, it is crucial to ensure that the property qualifies for the TODD. This includes verifying your ownership and understanding local regulations that govern such deeds.

-

Check that the property is eligible for a TODD, as certain types may have restrictions.

-

Collect all relevant documents proving ownership, which may include deeds and tax statements.

-

Seeking a lawyer's advice can help clarify any legal complexities unique to your situation.

-

Laws regarding TODDs can vary by region—ensure you understand these before proceeding.

How do you fill out the TODD form?

Completing the transfer on death deed form involves several key steps to ensure accuracy and legality. By following a structured approach, form fillers can avoid common pitfalls and ensure their form is valid.

-

Provide your name and mailing address, along with details about the property, including its recording district.

-

Name your primary beneficiary and include alternate beneficiaries if desired with their relevant particulars.

-

Clearly show the property conveyance details in the form which is crucial for legal clarity.

-

This section must also be filled out accurately to comply with local recording requirements.

What happens after filing the TODD?

Once the transfer on death deed is filed, it is essential to understand what comes next. This includes recording the deed and recognizing its effective date.

-

The TODD must be filed with the local authority to take effect and be recognized legally.

-

The effective date is crucial, as it determines when the beneficiary's rights begin.

-

Failing to file the TODD can result in the property being subject to probate, negating its intended benefits.

-

Beneficiaries also need to be aware of the estate's tax implications to prepare accordingly.

How can you handle changes to the TODD?

Life circumstances can change, necessitating adjustments to your transfer on death deed. Knowing how to amend or revoke it can ensure that your estate plan remains aligned with your current intentions.

-

To revoke a TODD, a formal written notice must typically be filed with the same office where the original was recorded.

-

Changes in beneficiaries or property details require a new TODD to be filed or an amendment created.

-

Informing beneficiaries about changes is vital to avoid confusion or disputes down the line.

-

Changes could have repercussions on your estate planning approach, so reassess your overall strategy regularly.

How can pdfFiller assist with your TODD management?

Utilizing pdfFiller makes managing your transfer on death deed form efficient and straightforward. The platform offers various features that facilitate editing, signing, and collaboration, which can significantly streamline the process.

-

pdfFiller allows you to fill in and edit your TODD form online, enhancing convenience and accessibility.

-

Share your form with advisors and family members for feedback and collaboration directly on the platform.

-

Securely eSign your completed form, eliminating the need for printing and manual signatures.

-

Easily store and organize your documents in the cloud for access anywhere, anytime.

How to fill out the pdffiller template

-

1.Obtain the transfer on death deed template from pdfFiller.

-

2.Fill in the title of the document at the top to reflect it is a Transfer on Death Deed.

-

3.Enter the full names and addresses of the property owner(s) in the designated fields.

-

4.Provide the legal description of the property, which can usually be found on the property tax statement or deed.

-

5.List the beneficiaries' names, addresses, and their relationship to the property owner.

-

6.Include any specific instructions regarding how the property should be managed or divided among beneficiaries.

-

7.Review the document for accuracy and completeness, ensuring all required fields are filled.

-

8.Sign the document in the presence of a notary public to ensure its validity.

-

9.After notarization, file the deed with the appropriate county office to make it legally binding.

-

10.Keep a copy of the filed deed in a safe place and provide copies to the beneficiaries.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.