Get the free pdffiller

Show details

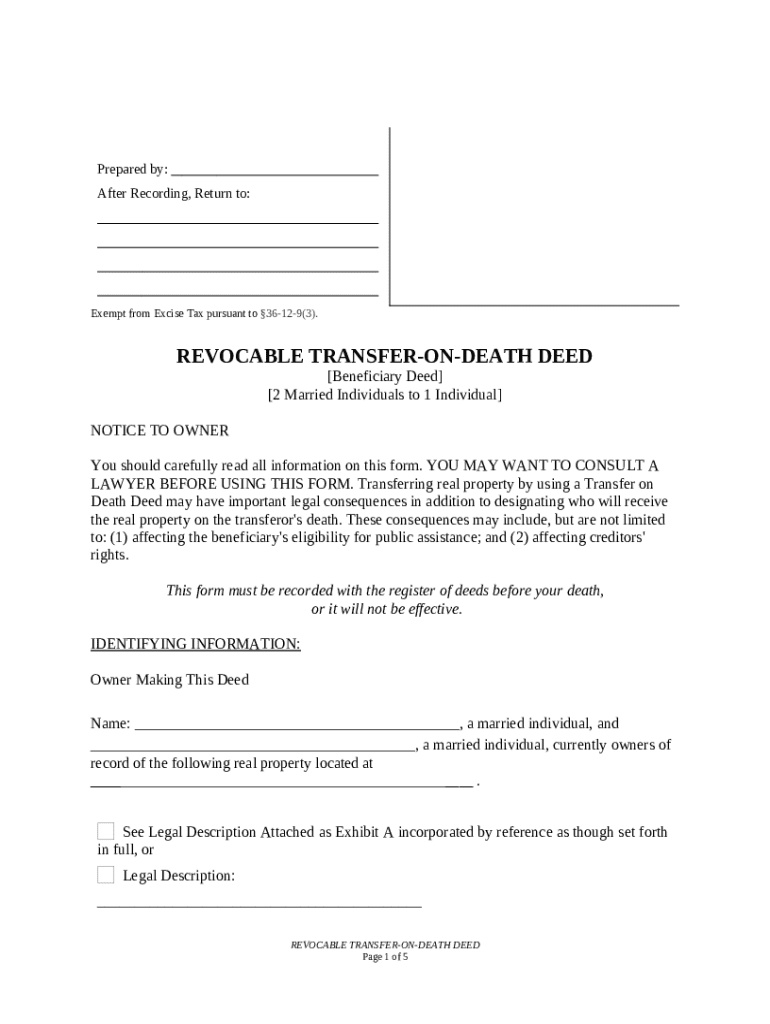

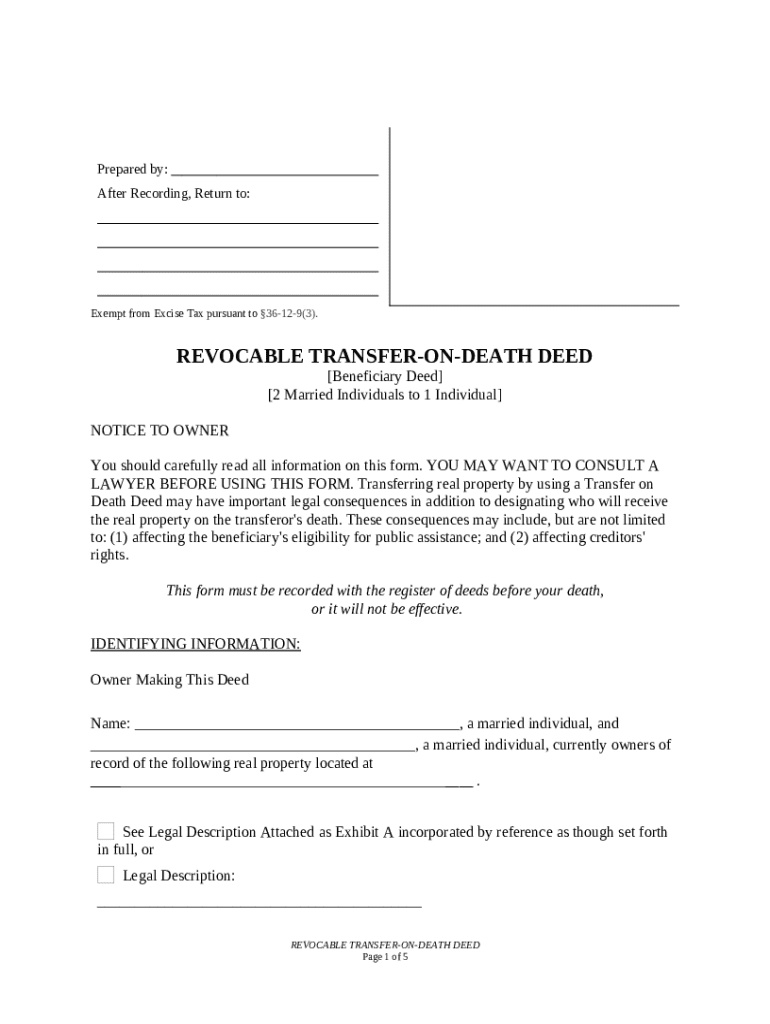

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer their real estate property to designated beneficiaries upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

I love what the program has to offer I'm just going through the learning process on how to fully take advantage of everything.

PDFfiller is extremely user friendly. I have no complaints. I would definitely recommend it to anyone who needs to edit PDF documents.

I am unfamiliar with these programs and so I struggle. I was unable to increase the size of the text in one of my forms and it looks awkward on the form after printed.

I checked so many different editors but PDFfiller is the best.

VERY GOOD CUSTOMER SERVICE. I HAD AN ISSUE THEY FIXED IT WITHIN A HOUR

Would be beneficial to be able to import pdfs or word files as attachments to pdffiller docs

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Complete Guide to the Transfer on Death Deed Form on pdfFiller

A transfer on death deed form allows property owners to pass their assets to designated beneficiaries without going through probate upon their death. This document simplifies the process of asset transfer, making it a valuable tool in estate planning.

In this comprehensive guide, we will explore the various aspects of the transfer on death deed form, how to fill it out, and the benefits of using pdfFiller for document management. Whether you're looking to simplify your estate planning process or ensure a smooth transfer of assets, understanding this form is crucial.

Understanding the transfer on death deed form

The transfer on death deed (TODD) is a legal document that allows an individual to specify beneficiaries for their property, which will be transferred upon their death. Unlike wills, a TODD bypasses probate court, enabling faster access to assets for your loved ones.

-

A TODD is a legal instrument that designates whom a property will go to after the owner's passing without the need for probate.

-

Employing a TODD can prevent the property from entering probate, but it has to be executed correctly to be legally valid.

-

Pros include avoiding probate and quick asset transfer; cons could involve issues if beneficiaries are not updated or if multiple deeds are filed.

Key sections of the transfer on death deed form

-

The TODD must be prepared by the property owner and should meet state-specific requirements.

-

Proper identification ensures clarity; inaccuracies can complicate the process of transferring the property.

-

A detailed legal description of the property must be included to avoid ambiguity.

-

It’s essential to provide accurate names and details of beneficiaries to ensure your wishes are respected.

Filling out the transfer on death deed form

Filling out the TODD is a critical step in the estate planning process. You should approach it carefully to avoid mistakes that could invalidate the deed.

-

Follow detailed instructions for each section to reduce errors; each part of the form should be accurately filled out.

-

Common pitfalls include incorrect beneficiary names or failing to have the deed notarized, which can affect its validity.

-

Using pdfFiller’s interactive form tools simplifies the process, ensuring that all necessary fields are filled out correctly.

Recording the deed: Compliance and execution steps

Once filled out, the TODD must be officially recorded to be effective. This step is vital to fulfill legal requirements and secure the beneficiaries' rights.

-

You should record the deed in the clerk’s office of the county where the property is located; check local requirements for specific rules.

-

Timeliness can affect legal rights—recording the deed soon after execution is advisable to ensure validity.

-

Consider consulting an attorney for specific legal advice especially if your estate has complexities.

Managing changes after filing your transfer on death deed

Life circumstances change, and so might your intentions regarding beneficiaries. Keeping your TODD updated is crucial.

-

To revoke a TODD, you must usually file a new deed that expressly states the old deed is revoked to prevent conflicts.

-

Ensure the new beneficiaries are properly documented, as failure to do so can lead to disputes or complications.

-

Regularly reviewing your TODD can align with current wishes and address any changes in life circumstances.

Enhanced features of pdfFiller for managing your transfer on death deed

pdfFiller offers numerous features to streamline the completion and management of your TODD, enabling you to handle it efficiently.

-

Utilize pdfFiller’s eSign feature to expedite the signing process, reducing delays in document execution.

-

Invite others to contribute their inputs to the form, ensuring accuracy and consensus on all details.

-

With cloud storage, you can access your TODD from anywhere and keep track of edits, ensuring maximum convenience.

How to fill out the pdffiller template

-

1.Access pdfFiller and upload the transfer on death deed form.

-

2.Begin by entering your full legal name at the top of the form where indicated.

-

3.List any joint owners of the property next, if applicable.

-

4.In the section designated for the property description, provide the full address, including street, city, state, and zip code.

-

5.Next, identify the beneficiaries by entering their names and relationship to you.

-

6.Include additional beneficiaries if needed, ensuring you list them clearly and accurately.

-

7.Double-check the completion of all required fields to ensure there are no omissions.

-

8.Once filled out, review the document for accuracy and correctness.

-

9.Sign and date the deed in the designated area, ensuring your signature matches the name written earlier.

-

10.Save and download the completed deed from pdfFiller, and consider consulting a legal professional for final review before filing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.