Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Tr...

Show details

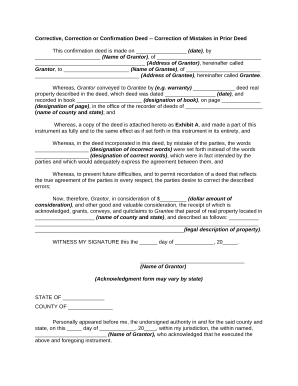

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate assets to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

only problem is that I could not figure out to change the size of signatures, they all came out too big.

It needs to be made clearer before you want to save a PDF that there is an annual fee

It's easy to fill out the form with no hustle. I don't need to order the expensive 1099 form any more separately.

TOOL IS VERY EASY TO USE EVEN WHEN ADDING NEW FORMS. EASY TO FOLLOW AND USE.

This is wonderful! Saves time and headaches and very easy to use and understand! Thank you so much!

Love this program, very east to use and makes my life easier.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

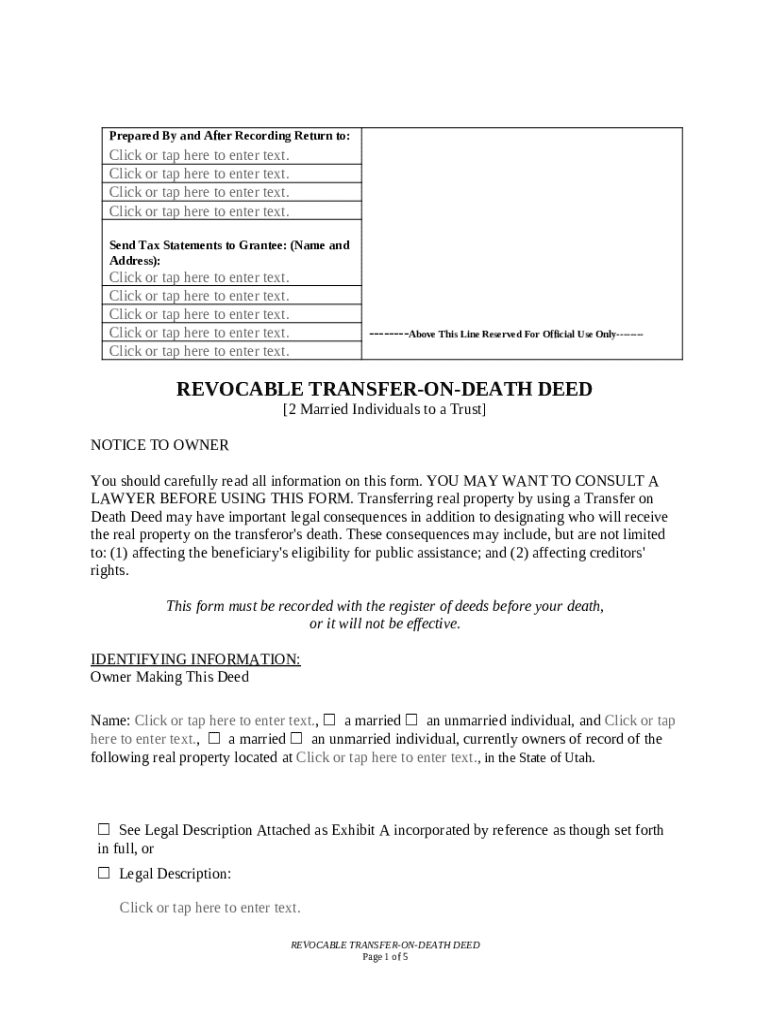

A comprehensive guide to filling out a transfer on death deed form

What is a transfer on death deed?

A transfer on death deed (TOD deed) is a legal document that allows individuals to designate a beneficiary to receive their property upon their death without going through the probate process. This arrangement can simplify property transfer and provide peace of mind regarding asset distribution when the owner passes away. Utilizing a TOD deed ensures that your loved ones can inherit property directly, streamlining the transition and reducing administrative burdens.

-

This deed legally designates a beneficiary who will receive the specified real estate upon the death of the owner.

-

Implementing a TOD deed may avert the lengthy probate process, but failure to adhere to specific regulations can complicate claims.

-

This option is ideal if you wish to transfer your property seamlessly to loved ones while retaining control of the asset during your lifetime.

-

A TOD deed transfers property directly to the beneficiary without court involvement, while wills generally go through the probate process.

Who can utilize a transfer on death deed?

Eligibility to create a TOD deed varies by jurisdiction, but generally, adults (including individuals and couples) can use this tool to manage their property transfer. It's crucial to review the specifics within your state to ensure compliance. For instance, in Utah, there are particular regulations that dictate how these deeds must be structured and filed to be valid.

-

Most jurisdictions allow individuals over 18 and legally competent couples to establish a TOD deed.

-

Depending on the type of co-ownership, a TOD deed may affect how property is transferred among co-owners and beneficiaries.

-

Each state, including Utah, has unique laws governing the execution and validity of TOD deeds, requiring careful adherence to local statutes.

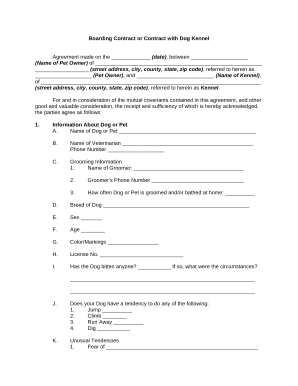

What steps to follow when completing a transfer on death deed form?

Filling out a transfer on death deed form requires careful attention to detail to avoid errors and ensure legality. Begin by gathering all necessary personal information and property details to complete the form accurately. A guided walkthrough can be beneficial to understand the specific requirements of each section on the form.

-

You will need the legal description of the property, owner details, and beneficiary information.

-

Each section typically includes identifying owners, describing the property, and designating beneficiaries.

-

Ensure all names are spelled correctly and all signatures are obtained to validate the deed effectively.

What are the key sections of the transfer on death deed form?

An understanding of the key sections in a TOD deed form is crucial for effective completion. Each part of the form serves a distinct purpose in documenting legal property transfer and beneficiary designation.

-

This section outlines important instructions on how and where to submit the deed.

-

Accurate identification of property owners is essential to avoid disputes.

-

Clearly state the names of beneficiaries and provide a precise property description.

-

Depending on the jurisdiction, notifying certain parties about the deed may be mandated.

What legal considerations should keep in mind?

Before proceeding with a transfer on death deed, it is paramount to consult with a lawyer. This step can help clarify potential legal consequences, including how the deed may impact public assistance benefits or creditor rights. Proper legal advice can secure your interests and ensure the deed is structured according to applicable laws.

-

Professional legal advice is vital for avoiding costly errors and ensuring compliance.

-

The creation of a TOD deed can influence eligibility for some healthcare and financial assistance programs.

-

Transferring property through a TOD deed can affect how creditors may claim debts posthumously.

How to record your transfer on death deed?

Recording a transfer on death deed is a crucial step to ensure its legality. This process protects the deed's validity and establishes public record of the beneficiary's rights upon the owner's death. There are specific steps involved in the recording process to ensure compliance with local laws.

-

Recording secures the beneficiary's claim to the property and avoids disputes.

-

Follow local regulations for filing to avoid any delays or rejections.

-

Most jurisdictions have specific timeframes that homeowners must respect when recording the deed.

How to manage your transfer on death deed after creation?

Once a transfer on death deed is established, it's essential to manage it actively, especially in light of life changes. Amending or revoking the deed may be warranted after significant events, such as marriage, divorce, or changes in financial situations. Keeping your documents updated can prevent potential legal challenges.

-

Follow state-specific procedures to ensure that changes are legally binding.

-

Life events such as marriage or the birth of a child may necessitate amendments to your deed.

-

Documentation may vary based on the nature of the changes, needing care to ensure legal legitimacy.

How can pdfFiller facilitate the transfer on death deed process?

pdfFiller provides a seamless platform for users looking to create and manage their transfer on death deed forms. With interactive tools designed for easy editing and collaboration, pdfFiller enables users to fill out and sign documents electronically, ensuring a legally binding agreement with minimal hassle. This convenience is especially beneficial for individuals and teams seeking efficient document management solutions.

-

Create, edit, and manage forms conveniently on a cloud-based platform, making it easy to keep documents up-to-date.

-

pdfFiller's eSignature tool ensures your documents are signed securely and validly, streamlining the process.

-

Collaboration features let users work on documents together, promoting efficiency and clarity in the completion process.

How to fill out the transfer on death deed

-

1.Go to the pdfFiller website and log in or create an account.

-

2.Search for the ‘transfer on death deed’ template.

-

3.Select the template to open it in the editor.

-

4.Fill in the property owner's information, including their name and address.

-

5.Provide details about the property being transferred, such as its legal description and address.

-

6.Enter the name of the designated beneficiary and their relationship to the owner.

-

7.Review all entered information for accuracy and completeness.

-

8.Add any necessary signatures or witness lines as required by your state’s laws.

-

9.Save your filled form, and you may download or print for signing.

-

10.Ensure that the document is properly signed and notarized, if required by state law.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.