Last updated on Feb 17, 2026

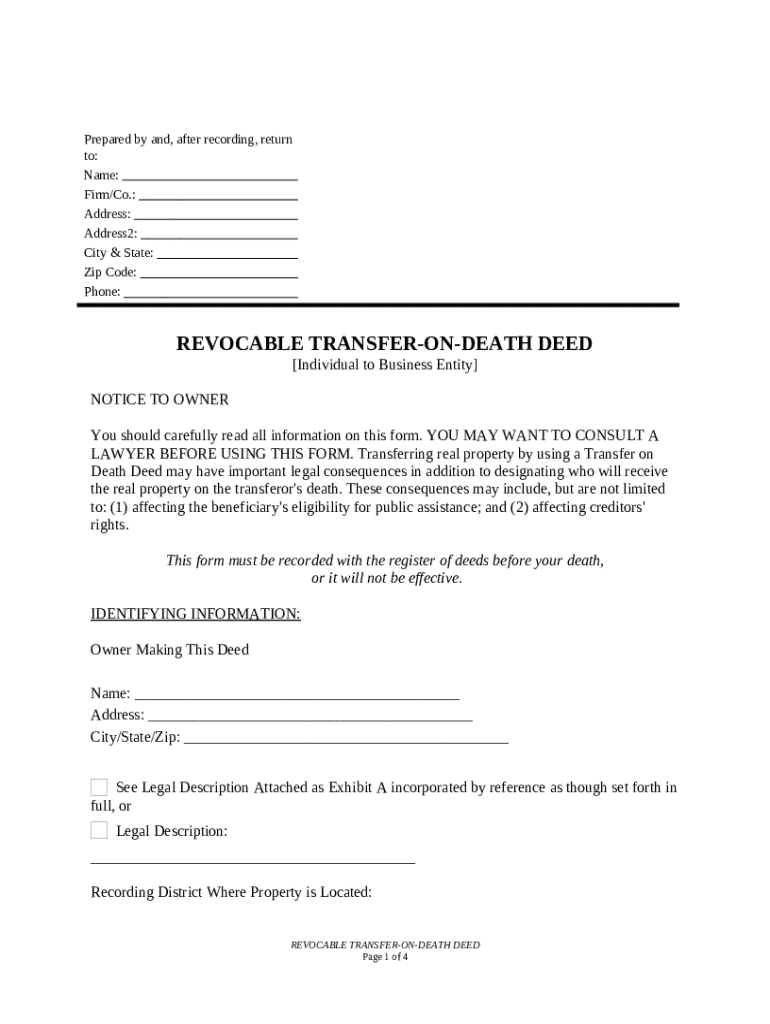

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity...

Show details

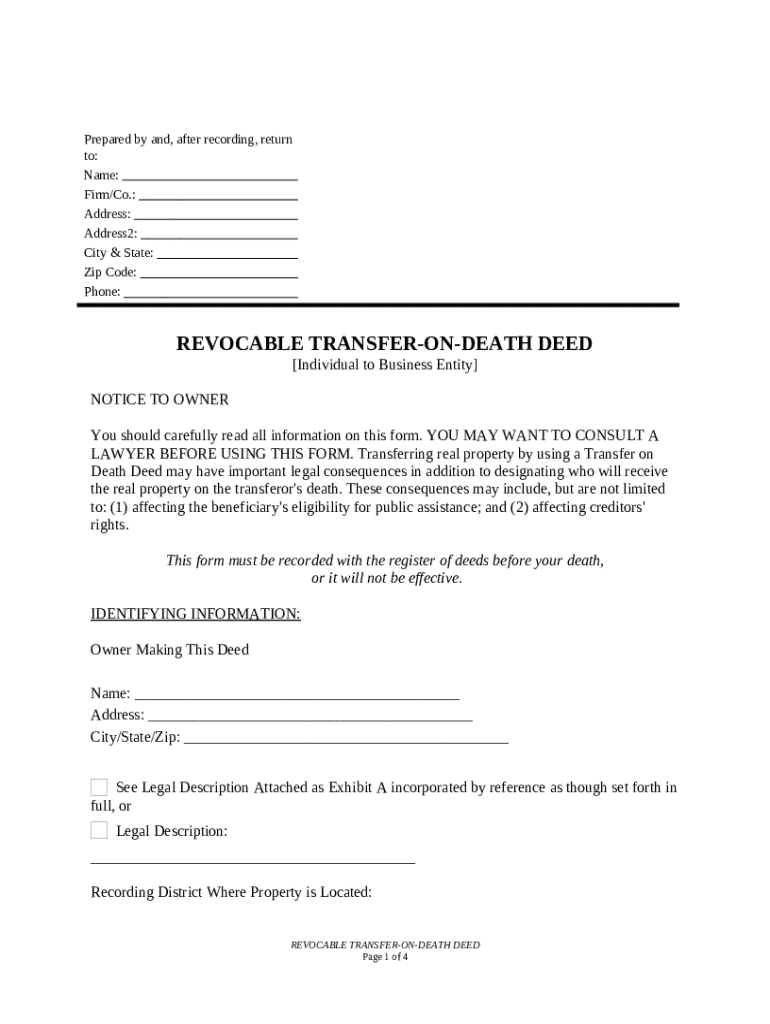

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to pass their real estate property to a designated beneficiary upon their death, avoiding probate.

pdfFiller scores top ratings on review platforms

Very versatile software for editing (specifically filling in) PDF documents. I looked specifically for software to fill out tax forms and PDFfiller exceeded my hopes and expectations. Good job.

Easy to use but wish i could print more than one at a time.

It's much more streamlined than I expected, the steps are basic and easy to work while still looking like a quality program.

Helpful in finding fillable forms, but had to find my way around

It was so easy and took awhile to get used to it but once I did, it was great. The documents looks great too.

I think you should make it more clear that we must pay to print the documents!! I do hope this includes a printed signature! What do I get for $72?

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Transfer on Death Deed Form

What is a Transfer on Death Deed?

A Transfer on Death Deed (TOD deed) allows the owner of a property to designate one or more beneficiaries to inherit the property upon the owner’s death without going through probate. This mechanism provides a straightforward way to transfer ownership while avoiding lengthy legal processes.

-

A TOD deed is a legal document that transfers ownership of a property to beneficiaries upon the owner's passing.

-

The deed must be recorded in the appropriate jurisdiction to be legally binding and effective.

-

Unlike a will, which may require probate, a TOD deed directly transfers property and generally avoids court involvement.

-

Benefits include simplicity, avoidance of probate, and often faster transfer of assets.

What are the important legal considerations?

Understanding the legal implications of a Transfer on Death Deed is crucial to ensure proper use and compliance. Consulting with an attorney is strongly recommended to navigate specific state laws and regulations.

-

Legal advice can help clarify the implications of the deed and ensure it meets the necessary legal standards.

-

Transferring property via a TOD deed can impact a beneficiary's eligibility for public assistance and creditors' rights.

-

Improper execution can lead to disputes or invalidation of the deed.

How do you complete the form step-by-step?

Filling out the Transfer on Death Deed form requires careful attention to detail to ensure all necessary information is included correctly. Below is a step-by-step guide to assist you.

-

Begin with accurate identification of the property owner, including full name and address.

-

Provide a full legal description of the property, which can often be found in the property deed.

-

Clearly fill out the names of beneficiaries, including their relationship to the owner.

-

Consider including alternate beneficiaries in case the primary beneficiary is unable to inherit.

What are the form requirements and guidelines?

To ensure that the Transfer on Death Deed is legally effective, specific requirements must be met. It is essential to adhere to guidelines set forth by your jurisdiction.

-

The deed must be recorded with the local county clerk or recorder’s office in the county where the property is located.

-

If the property exists in more than one county, it must be recorded in each relevant county.

-

The owner must sign the deed in the presence of a notary public to validate the document.

What are the post completion steps?

After completing the Transfer on Death Deed form, several important steps follow to ensure that the property transfer occurs as intended.

-

Submit the completed and signed deed to the appropriate county office for recording.

-

Check back with the recording office to verify that your deed has been officially recorded.

-

If you need to make changes, such as revocations or updates to beneficiaries, consult a legal professional.

What common mistakes should you avoid?

Awareness of common pitfalls can help ensure that your Transfer on Death Deed serves its intended purpose without legal complications.

-

Double-check owner and beneficiary information for accuracy to prevent disputes.

-

If a previous Transfer on Death Deed exists, be sure to formally revoke it to avoid confusion.

-

Failure to follow specific recording guidelines can lead to invalidation.

How can pdfFiller assist you with your Transfer on Death Deed needs?

pdfFiller offers a diverse platform for editing and signing documents, including the Transfer on Death Deed form. Utilizing pdfFiller enhances your document management process.

-

Use pdfFiller’s user-friendly tools to easily edit and electronically sign your forms.

-

Collaborate with others by sharing the document for review and input.

-

Access and manage your documents anytime from any cloud-connected device.

How to fill out the transfer on death deed

-

1.Download a blank transfer on death deed form from pdfFiller.

-

2.Open the form in pdfFiller and start by entering your full name as the property owner.

-

3.Provide your address to identify the property clearly.

-

4.Designate the beneficiary by entering their full name and relationship to you.

-

5.Specify the type of property being transferred, including any legal descriptions required.

-

6.Review the form for accuracy and ensure all fields are correctly filled.

-

7.Sign the form in the presence of a notary public to ensure validity.

-

8.Save the completed deed and provide a copy to the beneficiary and keep one for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.