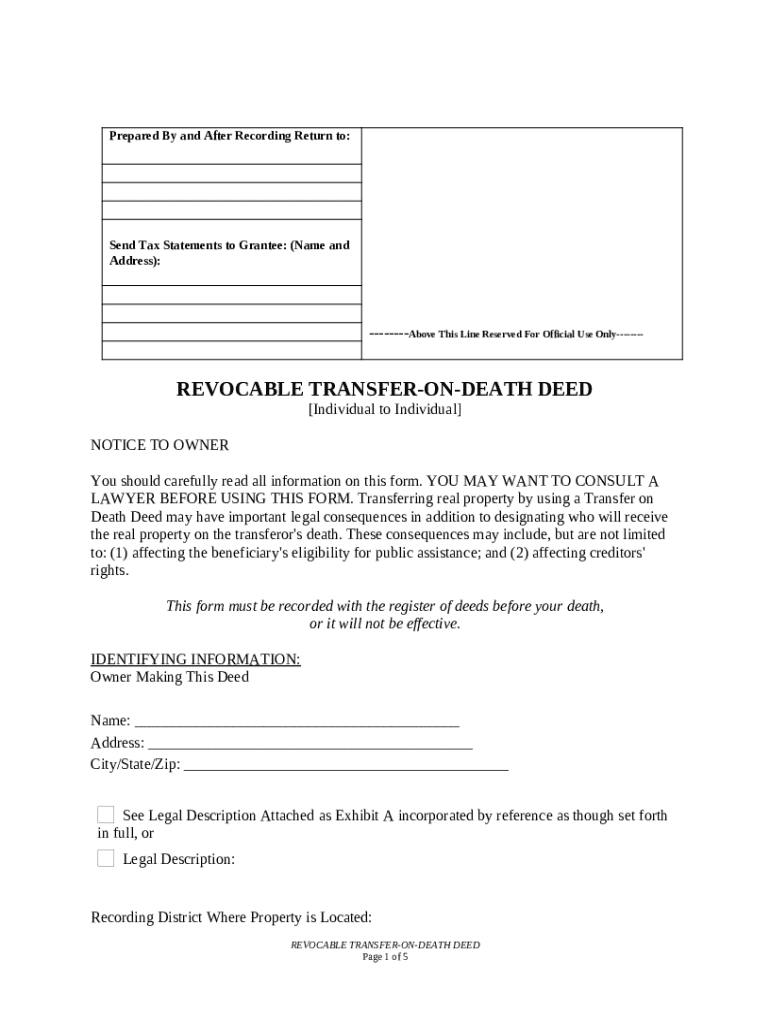

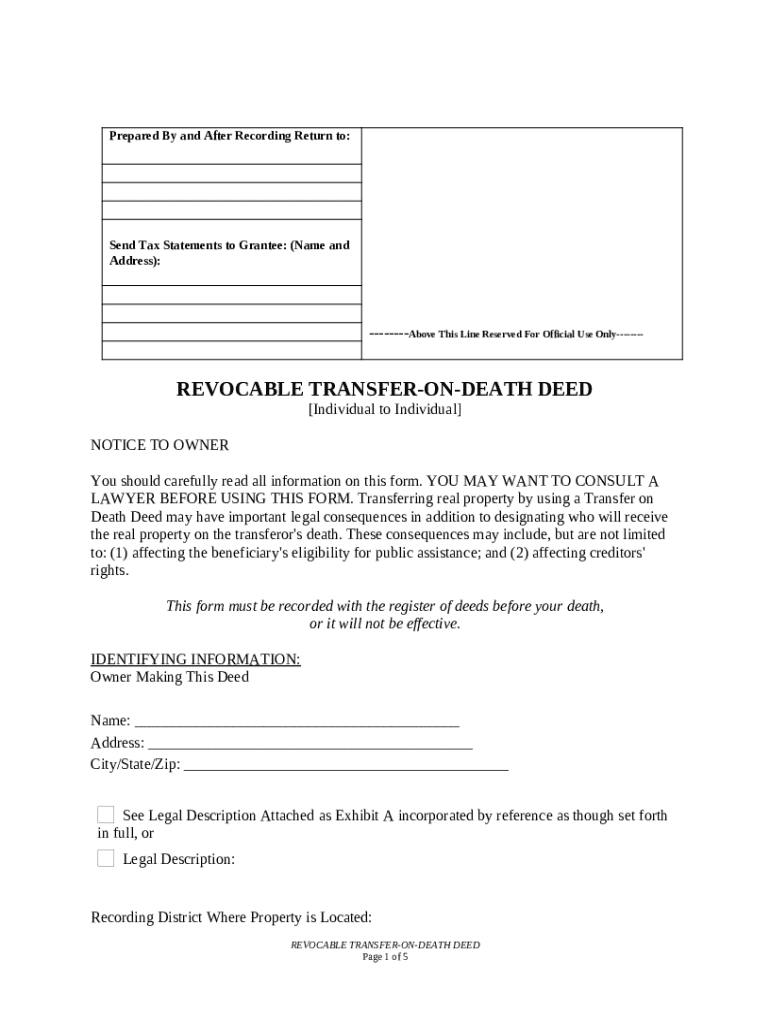

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual template

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to transfer their real estate to one or more beneficiaries upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Love it

Love it - nothing else

Works great so far.

Works great so far.

NO ISSUES AND EASY TO NAVIGATE

NO ISSUES AND EASY TO NAVIGATE

I like that I don not have to decide…

I like that I don not have to decide how big the text box needs to be, it does it automatically. I use it for work to fill out my time sheets or edit PDF files and it works like a charm.

super!

super! Its amazing

I’m new to using any type of online…

I’m new to using any type of online filler, and the support I got from pdffiller was beyond my expectations, I highly recommend.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

What is a transfer on death deed?

A transfer on death deed allows individuals to transfer ownership of their property to a designated beneficiary upon their death without going through probate. This legal document simplifies the estate planning process, ensuring that loved ones can inherit property directly.

-

A transfer on death deed (TODD) facilitates the seamless transfer of property to beneficiaries without the need for probate, thus avoiding legal complexities that can arise after someone's passing.

-

This deed becomes effective upon death, meaning the owner retains full control over the property during their lifetime, and it must be recorded according to state laws to be valid.

-

It's crucial to obtain legal advice before completing a transfer on death deed to ensure compliance with local laws and to understand the potential implications for your overall estate plan.

How to get started with the form?

Before filling out the transfer on death deed form, certain prerequisites need to be addressed. Understanding what documents are necessary can streamline the process.

-

You need to be the owner of the property and of sound mind to execute the deed.

-

Gather any necessary legal documents, including the current property deed and the beneficiary's information.

-

The transfer on death deed form can be easily accessed through services like pdfFiller, allowing for convenient editing and management.

How do you fill out the form step by step?

Filling out the transfer on death deed form requires careful attention to detail and accurate information about both the property and the beneficiaries.

-

Include the owner's name, address, and a legal description of the property.

-

Document the primary beneficiary details along with any optional alternate beneficiary information.

-

Clearly state the intent to transfer property upon death, ensuring the declaration aligns with legal requirements.

Why is recording the transfer on death deed important?

Recording the deed is a crucial step that formalizes the transfer of property. Failure to record it in a timely manner can lead to complications in transferring ownership.

-

Recording the deed ensures that it is legally recognized and that the beneficiary's interests are protected.

-

The deed must be recorded in the local county recorder's office in accordance with state regulations.

-

Not recording the deed before death can lead to costly probate proceedings, undermining the purpose of the transfer on death deed.

What legal considerations should you keep in mind?

When dealing with a transfer on death deed, it's essential to understand the legal ramifications and potential challenges that might arise.

-

Disputes may arise if the beneficiary is challenged, or if the property has encumbrances affecting the transfer.

-

Consulting legal experts can provide clarity and mitigate risks associated with transferring property rights.

How can pdfFiller assist with your transfer on death deed?

pdfFiller offers a user-friendly platform for editing and managing your transfer on death deed, ensuring a smooth and efficient experience.

-

pdfFiller provides tools for easy editing, eSigning, and management of legal documents, all in one place.

-

Utilizing a cloud-based platform ensures your documents are accessible anytime, anywhere, providing peace of mind.

-

Interactive features streamline the process, allowing for collaborative document handling, ideal for families planning estates.

What happens after you submit your transfer on death deed?

Once the transfer on death deed has been recorded, it’s important to monitor your estate plan regularly and make updates as circumstances change.

-

You can expect the deed to be effective upon your passing, provided all conditions are met.

-

Regularly review your estate plan to ensure all documentation aligns with your current wishes.

-

Update your beneficiaries as needed, especially after major life changes such as marriage or divorce.

How to fill out the transfer on death deed

-

1.Go to pdfFiller and access the template for the transfer on death deed.

-

2.Begin by entering the grantor's name, who is the person creating the deed.

-

3.Provide a clear and accurate legal description of the property that is being transferred.

-

4.List the beneficiary or beneficiaries, ensuring that their names are correctly spelled and their relationship to the grantor is noted if necessary.

-

5.Include any alternate beneficiaries in case the primary beneficiary predeceases the grantor.

-

6.Specify whether the transfer is to happen upon the grantor's death without any conditions.

-

7.Review all entered information for accuracy and completeness before finalizing the document.

-

8.Sign and date the deed according to your state's requirements, which may include having it notarized.

-

9.File the completed transfer on death deed with the appropriate county recorder or land registry office to make it effective.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.