Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two ...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to designate beneficiaries to receive property upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Ive only used it a few times. Find it harder than the other one I have used - I think it was Adobe.

No comment

Awesome!

Thank you

the best pdf editor and easy to use. Well Done

I immediately was connected to a support person via chat, and he walked me through what I need and was very professional and supportive. I truly had a great experience.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form

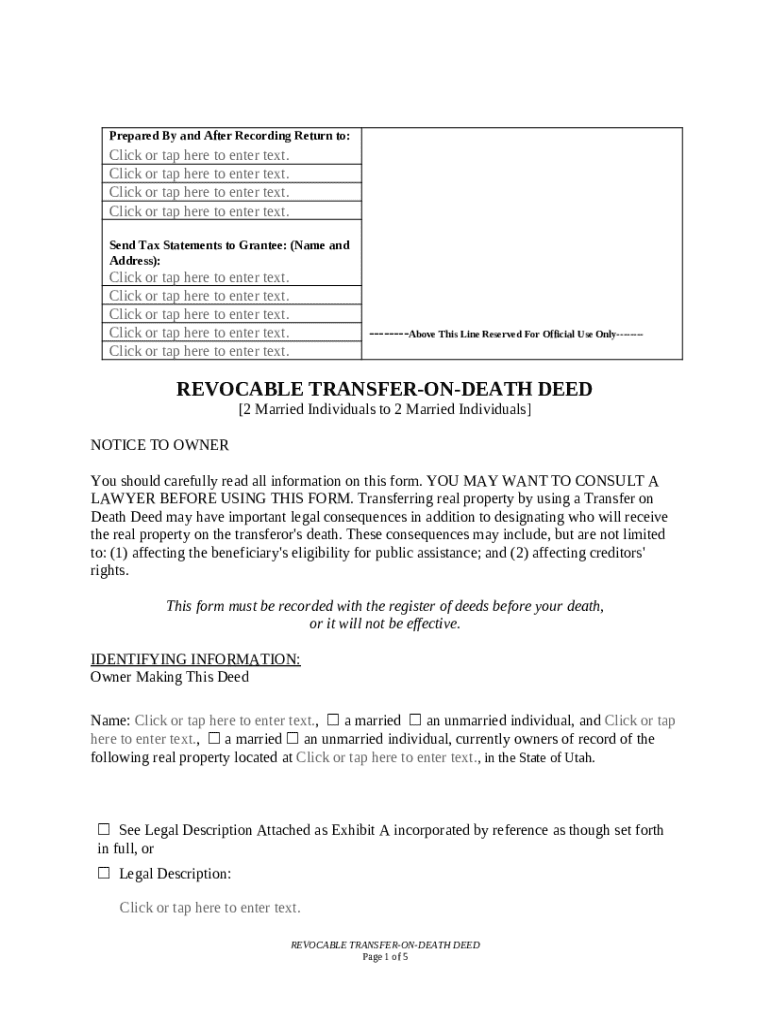

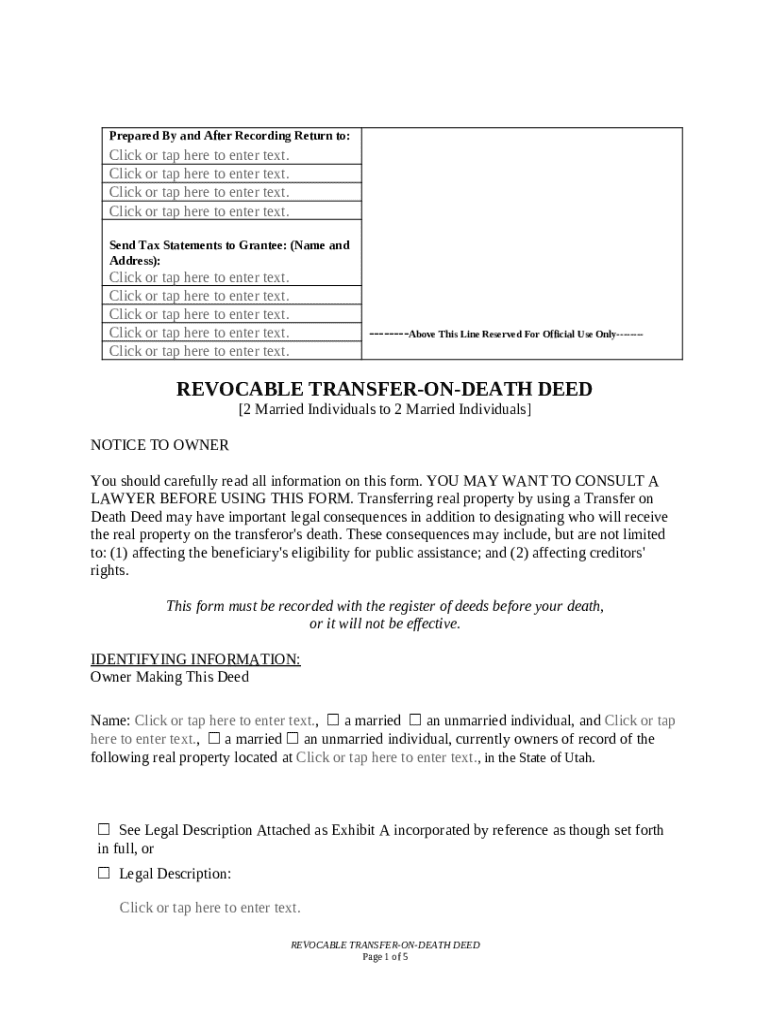

Understanding the Transfer on Death Deed

A Transfer on Death Deed (TODD) is a legal instrument that allows an individual to transfer real property to a designated beneficiary without going through probate upon their death. This form is particularly beneficial as it avoids costly and time-consuming probate procedures, ensuring your loved ones receive their inheritance promptly.

-

Direct transfer of property upon death.

-

No immediate tax implications for the transferor.

-

Flexibility to revoke the deed if conditions change.

Despite its advantages, individuals should be aware of key legal consequences, such as the deed's effect on the right of creditors or obligations regarding property taxes.

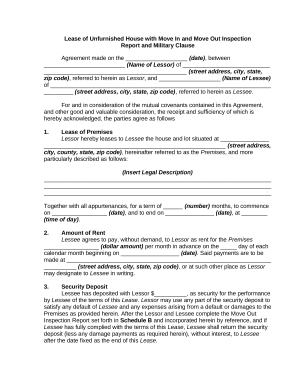

Preparing the Transfer on Death Deed Form

To initiate the process of filling out a transfer on death deed form, it's essential to complete several key fields that ensure the deed is valid. Specifically, accurate information regarding property ownership is required.

-

Include your full name and contact information clearly.

-

This should include the name and address of the person you want the recorded deed to be sent.

Last but not least, be careful with the Owner Making This Deed information. This section must match the name on the property title to ensure a valid transfer.

Filling Out the Necessary Information

When filling out a transfer on death deed form, precise information is critical. This includes providing legal descriptions of the property, ensuring beneficiaries will have accurate information post-death.

-

This should detail the property’s boundaries and location to avoid ambiguity.

-

This unique identifier helps officials recognize the specific piece of property.

-

Include names or identifiers related to where the property is recorded.

-

Understand how marital status impacts ownership and rights to designate beneficiaries.

Reviewing Legal and Compliance Considerations

Before finalizing the deed, consider engaging a legal professional for guidance. Consulting with a lawyer can clarify how a transfer on death deed interacts with your estate planning and overall intentions.

-

Understand how this deed might impact any benefits your beneficiaries receive.

-

Using a TODD may influence the rights of creditors seeking repayment from your estate.

Recording Your Transfer on Death Deed

The significance of timely recording cannot be emphasized enough. Failing to record your transfer on death deed can lead to undue confusion and potentially undermine your estate planning efforts.

-

Visit your local recording office with the completed form.

-

Pay any recording fees that may apply.

-

Keep a copy of the recorded deed for your records.

Be aware that if the deed is not recorded before your death, the property could revert to probate proceedings, which could counteract the intention behind using a transfer on death deed.

Utilizing pdfFiller for Your Transfer on Death Deed

pdfFiller streamlines the process of filling out, signing, and managing your transfer on death deed form. With the platform’s flexible editing tools, users can ensure accuracy and compliance easily.

-

Make necessary adjustments in real-time without any hassle.

-

Teams can work together seamlessly on real estate documents, ensuring everyone is informed.

-

Access your documents securely from anywhere, which is ideal for busy professionals.

Additional Notes for Successful Completion

Careful attention to detail is a must when completing your transfer on death deed form. Common mistakes can lead to significant challenges for your heirs, so avoid pitfalls.

-

Double-check all names and addresses for accuracy.

-

If personal circumstances change, be sure to update your deed accordingly.

Taking a proactive approach in compiling and filing the transfer on death deed ensures that your loved ones can handle their inheritance smoothly, shielding them from administrative burdens at a challenging time.

How to fill out the transfer on death deed

-

1.Obtain a blank transfer on death deed form from pdfFiller or your local legal authority.

-

2.Start by entering your name as the property owner clearly at the top of the form.

-

3.Provide the legal description of the property that will be transferred, including address and any relevant parcel numbers.

-

4.List the beneficiaries' names and relationship to you, ensuring they are clear and correctly spelled.

-

5.Include the date when the deed will take effect, typically the date of your death.

-

6.Sign the deed in the presence of a notary public to ensure its legal validity.

-

7.Some states may require the deed to be recorded with the local government; check local regulations.

-

8.Finally, provide copies of the signed deed to the beneficiaries to inform them of the arrangement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.