Get the free Promissory Note - Horse Equine s template

Show details

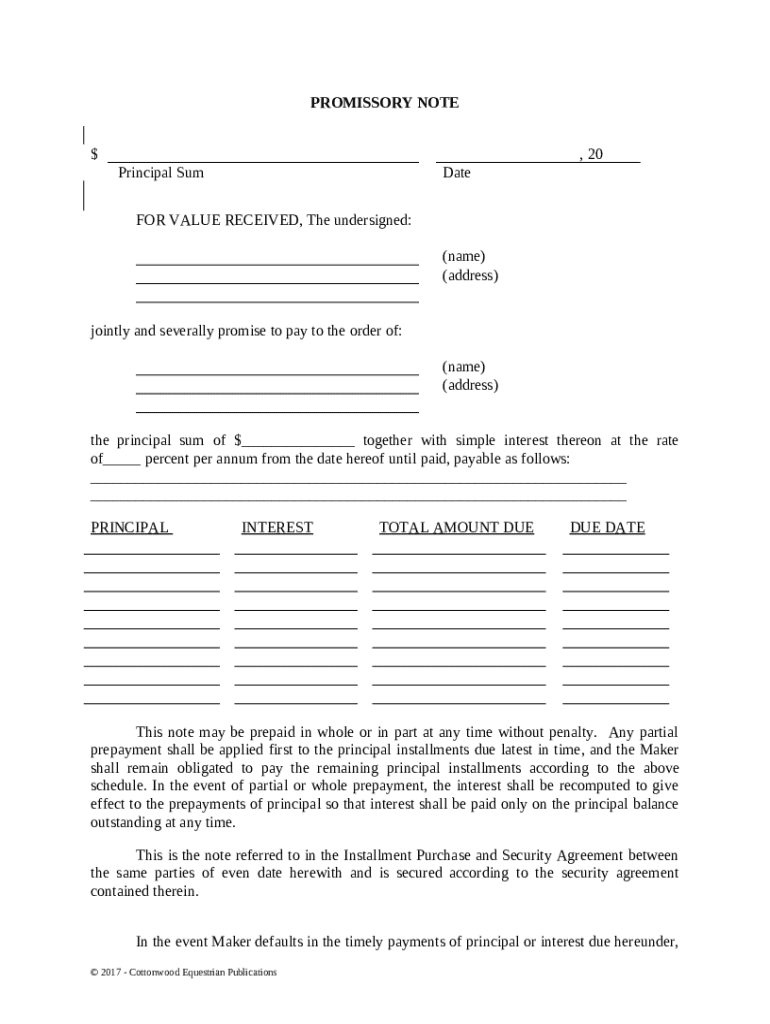

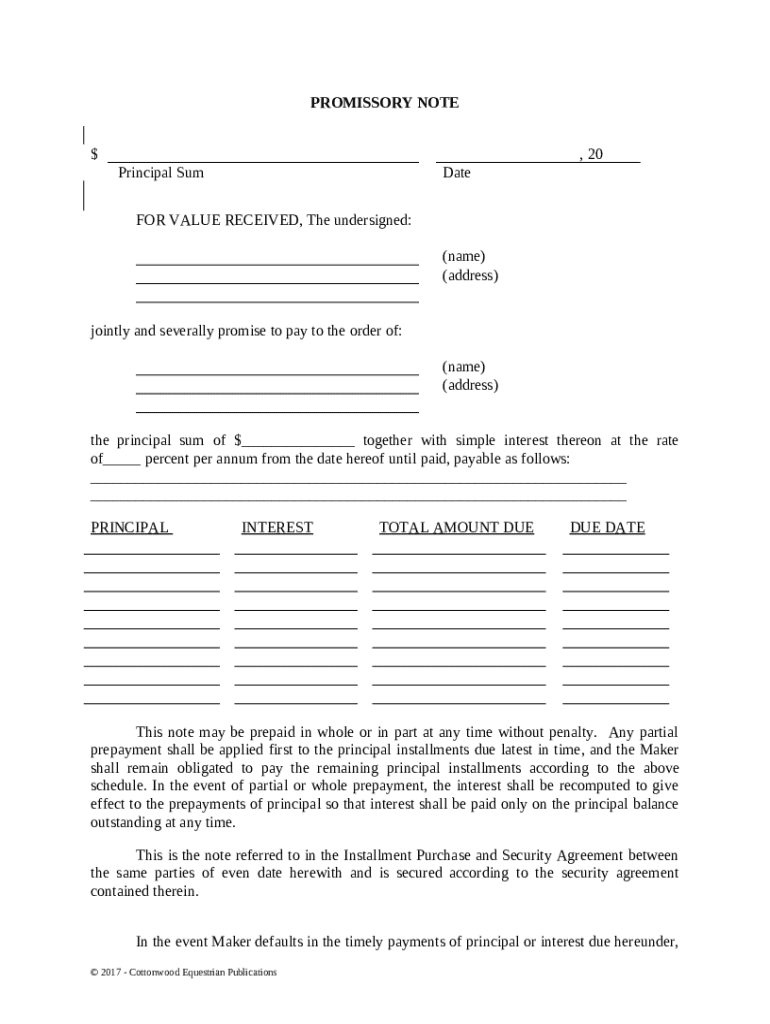

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

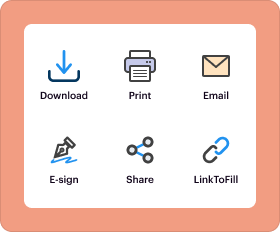

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document wherein one party promises to pay a specified amount for the purchase or loan of a horse.

pdfFiller scores top ratings on review platforms

4

Great program to use for filling

Great program to use for filling, and creating pdf files. The site is easy to navigate and very user-friendly.

I'm just primarily looking to quickly print resumes.

I love this program makes tax season easy

It took me some 'playing around' to…

It took me some 'playing around' to figure out a few things but very easy to input and export your resume and/or Cover letter or anything else needed

ease of subbitting

It can be a little confusing and I thought my docs from previous years were saved so they would populate but they didn't but I like the ease of submitting the forms to the IRS.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Guideline for completing a promissory note - horse form

How can you understand the promissory note?

A promissory note is a written promise to pay a specified amount of money to a designated party at a defined future date. In the equestrian context, correctly filling out a promissory note, especially a horse form, is crucial for legal protections and maintaining trust among parties involved. Often, this document is utilized in transactions involving horse sales, loans for purchasing equine properties, or agreements for breeding services.

-

A legal instrument wherein one party makes a written promise to pay a specified sum of money to another party.

-

Ensures mutual understanding of the terms and legal enforceability in any potential dispute.

-

Involves financing horse purchases or securing loans related to equine business operations.

What are the key components of a promissory note?

A well-structured promissory note includes critical components that ensure clarity and enforceability. These components serve to outline the obligations of both borrower and lender clearly, forming a solid foundation for the agreement.

-

The total amount borrowed, determined based on the horse’s market value or agreed purchase price.

-

It’s essential to record the date to denote when the agreement commences and to establish the timeline for repayment.

-

Clearly identify the lender and borrower, including their contact information and relationship to the transaction.

-

Specify the agreed-upon interest rate, detailing whether it is fixed or variable, and how it impacts repayment.

-

Outline payment schedules, including due dates and any penalties for late payments to avoid potential misunderstandings.

How do you fill out the promissory note - step-by-step guide?

Filling out a promissory note may seem daunting, but breaking it down into manageable steps helps simplify the process. Following this structured approach ensures all necessary information is accurate and complete.

-

Record borrower and lender details accurately, ensuring all names and addresses are correct.

-

Specify the principal sum and interest rate clearly; avoid ambiguity to prevent future disputes.

-

State repayment terms, including due dates and penalties for late payments, for transparency.

-

Discuss options for prepayment without penalties, giving both parties flexibility in repayment.

-

Include signature requirements and the date of signing; ensure all parties consent to the terms discussed.

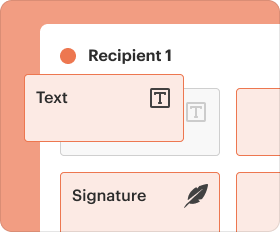

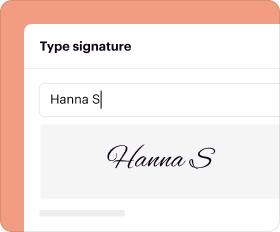

How can you utilize interactive tools and templates for promissory notes on pdfFiller?

pdfFiller provides an efficient platform for managing promissory notes, especially those tailored to horse transactions. Utilizing interactive tools can streamline the completion, signing, and collaboration process.

-

Choose from various promissory note templates specifically designed for equine transactions and modify them to suit your needs.

-

Follow straightforward steps to electronically sign your promissory note, enhancing convenience and security.

-

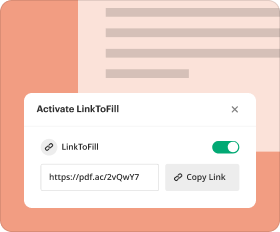

Invite other parties to review and sign the document, ensuring everyone involved is informed and in agreement.

-

Utilize industry-specific templates for relevant agreements, ensuring compliance with equestrian practices.

What should you do after completing your promissory note?

Once your promissory note is completed, proper management is key to preventing issues and ensuring smooth transactions. pdfFiller offers robust features for overseeing your agreements effectively.

-

Use pdfFiller to store your promissory note securely, ensuring easy access and protecting against loss.

-

Monitor due payments and remaining balances through pdfFiller’s tracking tools to stay organized.

-

Be prepared to navigate defaults by understanding the implications on repayment and knowing your rights.

-

Keep detailed records and notices for any agreements on prepayments or defaults to maintain clarity.

What legal considerations and compliance issues should you be aware of for promissory notes?

Understanding the legal landscape surrounding promissory notes is essential to avoid complications. The laws governing these documents may vary by state and can affect the terms of your agreement.

-

Research state-specific laws to ensure compliance and understand local requirements for promissory notes.

-

Pay attention to regulations related to interest rates and repayment terms to avoid legal disputes.

-

Understand the consequences of default and your rights, including the ability to accelerate loan repayment.

-

Know how these agreements may influence your promissory note, especially with regard to securities and collateral.

How to fill out the promissory note - horse

-

1.Begin by downloading the promissory note template from pdfFiller or uploading your existing document.

-

2.In the first section, enter the borrower's full name and address, ensuring accuracy for legal purposes.

-

3.Next, specify the lender's name and address in the following section.

-

4.In the principal amount field, clearly state the total loaned amount or the purchase price of the horse.

-

5.Include the interest rate, if applicable, indicating whether it is fixed or variable on the respective line.

-

6.Specify the payment due date and any additional payment schedule details, such as monthly or quarterly payments.

-

7.Include a description of the horse being financed, detailing its breed, age, color, and any identifying features.

-

8.It’s important to state the consequences of default and any late payment penalties within the terms section.

-

9.Lastly, both the borrower and lender should sign and date the document for legal validation, ensuring all fields are filled out correctly before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.