Get the free pdffiller

Show details

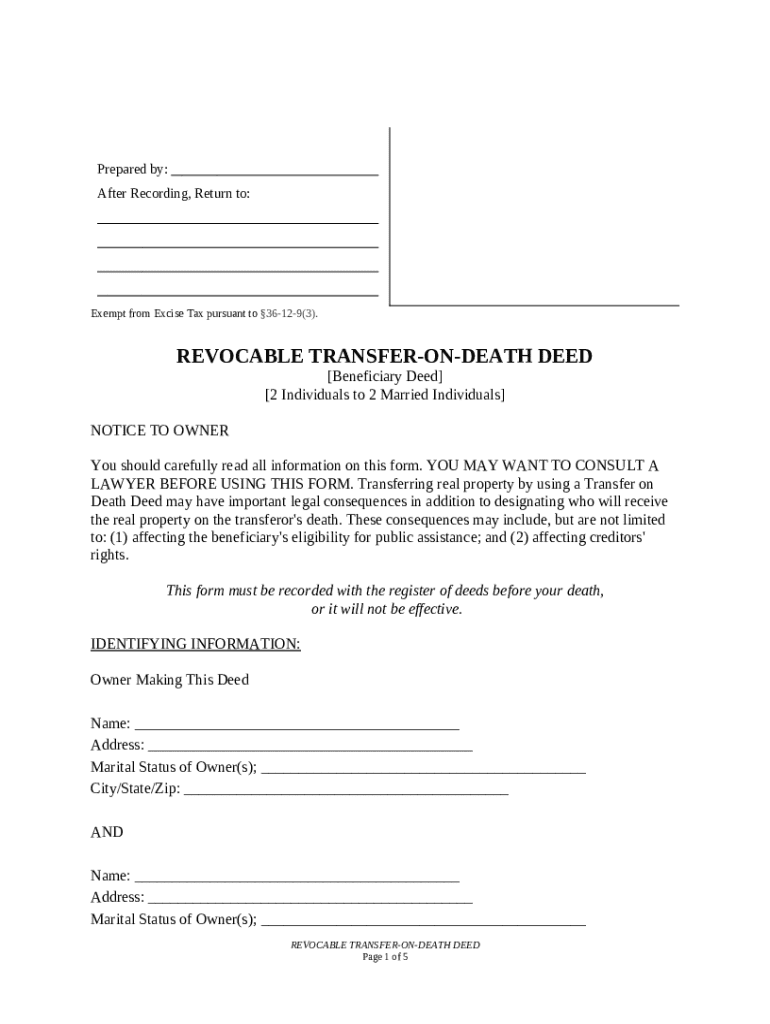

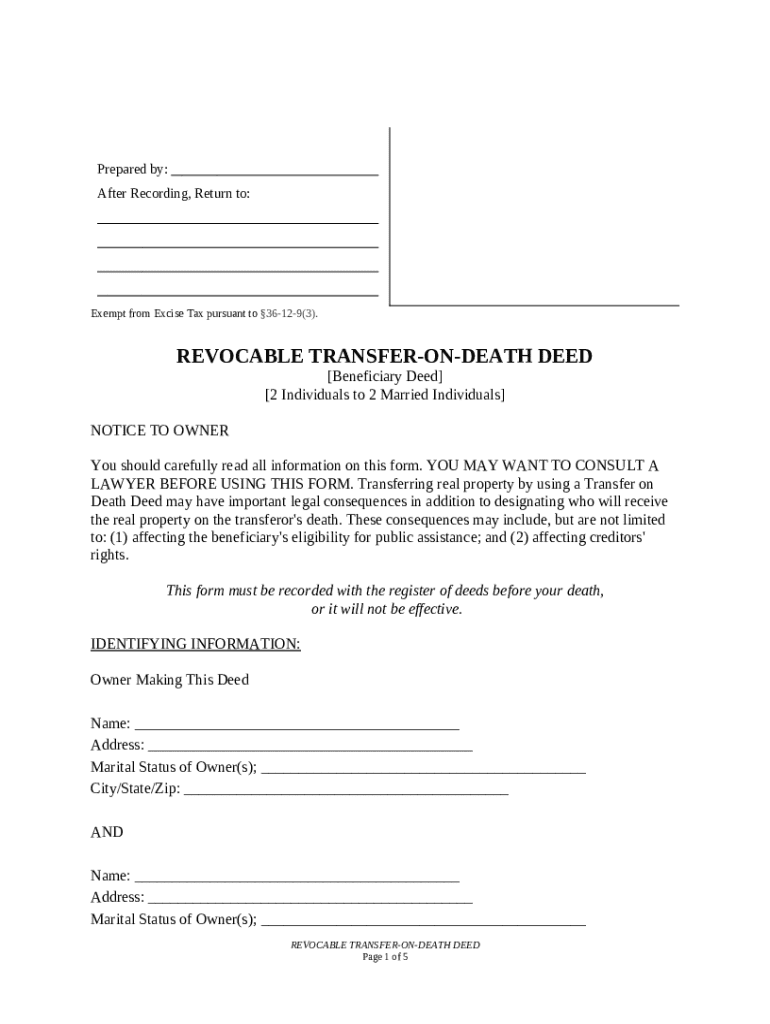

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to transfer their real estate to one or more beneficiaries upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Very easy to use and super convenient options to share by email, fax, USPS, etc.!

Fantastic But I want more features here such as pdf compressor and pdf merge

interesting

PdfFiller is absolutely THE BEST! Beneficial and Convenient

I was able to reregister my daughter for Prep. school.

Only through PdfFiller I was able to email her to sign the form. She is in a whole other county. It would of taken me weeks to get all this done!

I even able to find the custody form in another state.

Most importantly I am able to handle my personal business, catch up on my work ALL in ONLY ONE Place! - *PdfFiller* Thank You for making my life easier.

With appreciation and gratitude,

A Loyal Fan - KJ

After using this platform personall for…

After using this platform personall for many things I find it very useful in business also

Great for making a pdf fillable planner

I've tried Adobe & SODA pdf & both were a nightmare:/

From ctrl not being able to multi-selesct, text boxes not duplicating with a new names (meaning I would have to re-name or re-make 10000 boxes manually...)

I've had a really good experience with pdf filler! It has everything I need to easily add fillable fields & make my planner useable. Thank you finally a product that matches my requirements.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Transfer on Death Deed Form

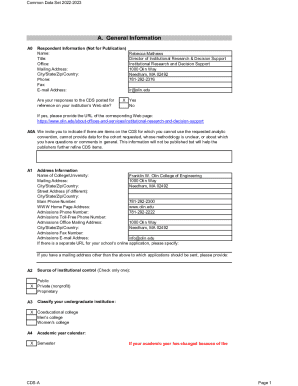

Understanding Transfer on Death Deeds

A Transfer on Death Deed (TOD deed) allows an individual to transfer real estate to a beneficiary upon their death without going through probate. This type of deed can simplify the transition of property and help circumvent the lengthy and potentially costly probate process.

-

The TOD deed must be valid to ensure the property transfers correctly. Understanding state-specific requirements is crucial.

-

The designated beneficiaries generally gain rights to the property without interference from the estate.

-

Beneficiaries should be aware of how a TOD deed might affect their eligibility for public assistance.

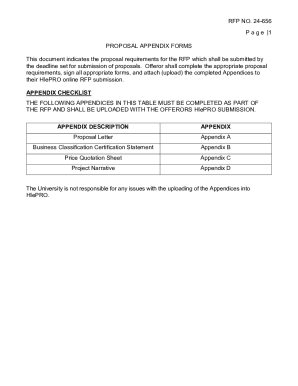

Navigating the Transfer on Death Deed Form

Understanding how to fill out the transfer on death deed form is essential for smooth processing. Each section has specific requirements that need careful attention.

-

Key information needed includes the names and addresses of all parties involved and their marital status.

-

Clearly detailing the property is critical. This should include the property's exact address and legal description.

-

It's important to fill out both primary and alternate beneficiaries correctly to ensure seamless transfer.

Vital Information Before You Start

Before filling out the transfer on death deed form, consider the potential impacts of your decisions carefully. Taking time to assess your individual situation can prevent complications later.

-

Reflect on your property, family dynamics, and your beneficiaries’ capabilities in managing received assets.

-

Consulting with a lawyer is highly recommended to navigate laws specific to your state.

-

Make sure to understand the significance of filing the deed timely with the register of deeds to ensure its validity.

Completing the Transfer on Death Deed Form

Completing the transfer on death deed form accurately is critical for it to function as intended. Each section provides important details that directly affect the effectiveness of the deed.

-

Follow section-by-section guidance to ensure accuracy in completion.

-

Understand legal meanings of terms as they pertain to transfer on death deeds.

-

Ensure beneficiaries are named clearly to avoid confusion and ensure proper transfer.

Recording the Transfer on Death Deed

To ensure the transfer on death deed operates effectively after your passing, it must be properly recorded. Each state has specific rules regarding where and how to file.

-

File the deed with the appropriate county office where the property is located.

-

Research local recording offices to ensure compliance with state regulations.

-

Failing to record the deed can lead to unintended legal complications and possible disputes among heirs.

After Recording: What’s Next?

Once you have recorded the transfer on death deed, it is important to take specific actions to ensure everything runs smoothly.

-

Communicate with beneficiaries about the deed and its implications.

-

Keep lines of communication open with your beneficiaries to prevent misunderstandings.

-

Understand the process for how to amend or revoke a transfer on death deed if your circumstances change.

Handling Complications and Legal Consequences

Complications can arise in the execution of a transfer on death deed, especially concerning beneficiary disputes.

-

Be prepared for potential challenges, such as disputes over the property or the deed’s validity.

-

Establish clear communication among beneficiaries to mitigate disputes.

-

Failing to adhere to state requirements can lead to legal challenges and affect asset transfer.

How to fill out the pdffiller template

-

1.Go to pdfFiller and access the template for the transfer on death deed.

-

2.Begin by entering the grantor's name, who is the person creating the deed.

-

3.Provide a clear and accurate legal description of the property that is being transferred.

-

4.List the beneficiary or beneficiaries, ensuring that their names are correctly spelled and their relationship to the grantor is noted if necessary.

-

5.Include any alternate beneficiaries in case the primary beneficiary predeceases the grantor.

-

6.Specify whether the transfer is to happen upon the grantor's death without any conditions.

-

7.Review all entered information for accuracy and completeness before finalizing the document.

-

8.Sign and date the deed according to your state's requirements, which may include having it notarized.

-

9.File the completed transfer on death deed with the appropriate county recorder or land registry office to make it effective.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.