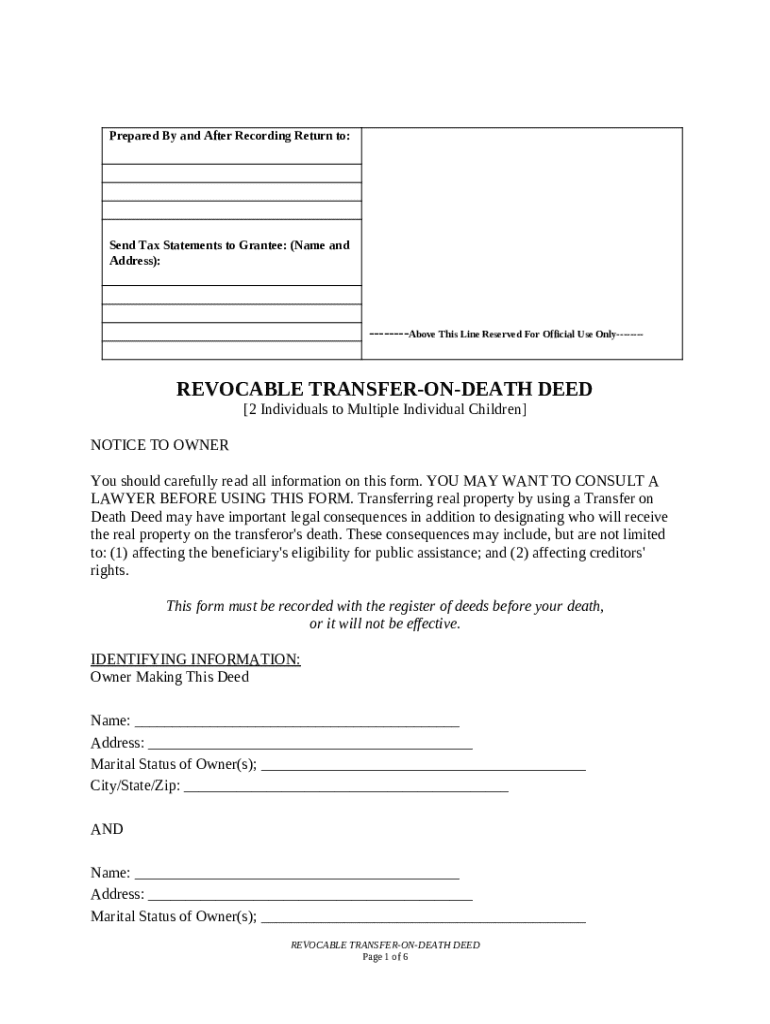

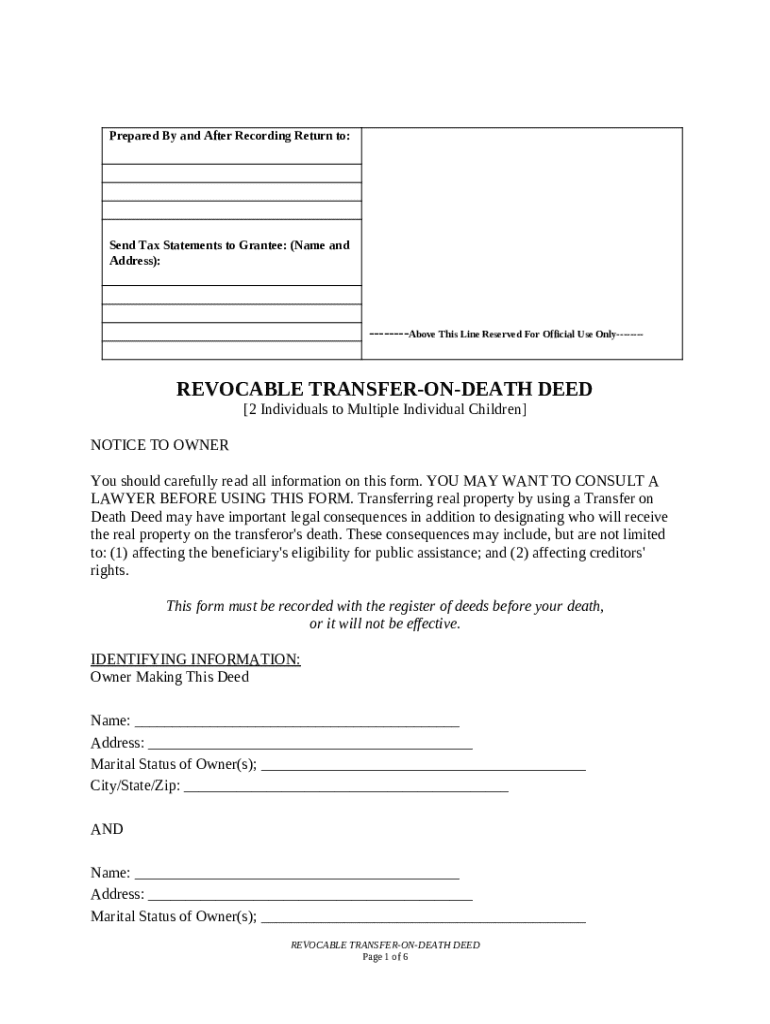

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Ind...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer ownership of real property to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

The PDF filler is great. The fields are easy to navagate and the the form gets to the numbrs easilly

So far all is formatted well for my document needs..

Excelente ferramenta para vários tipos de trabalhos.

This is an excellent platform for editing PDF's. I dare say I prefer it to Adobe!

Filled version was great, but was not able to save a blank copy.

PDF filler is great and easy to use.. Love it

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Transfer on Death Deed Form on pdfFiller

How does a transfer on death deed work?

A transfer on death deed allows individuals to directly transfer real estate to beneficiaries upon their death, avoiding the probate process. Essentially, this deed acts as a way to manage property after death without the complexities and costs associated with traditional wills. For anyone involved in estate planning, understanding this form is crucial for ensuring property is passed on smoothly.

-

A Transfer on Death Deed is a legal document that enables the owner of property to designate beneficiaries who will receive their real estate upon death.

-

Utilizing a Transfer on Death Deed can impact how property is inherited and may carry specific regulations depending on local laws.

-

The primary benefits include avoidance of probate and control over asset distribution. However, there are risks such as unintended disinheritance or effects on creditors.

What are the key considerations before drafting a transfer on death deed?

Before creating a Transfer on Death Deed, consulting with an attorney is highly advisable. They can provide guidance on state-specific laws and potential consequences. Understanding eligibility requirements for beneficiaries is also crucial, as missteps can lead to legal disputes among heirs.

-

A lawyer will help in navigating the complexities of estate law and ensure the deed is executed correctly.

-

Beneficiaries must meet certain criteria, which vary by jurisdiction, to avoid disputes after your passing.

-

Transferring a property this way may affect beneficiaries' eligibility for certain public assistance programs.

-

Creditors may still have claims against the property unless explicitly noted in the deed.

How do you fill out a transfer on death deed?

Filling out a transfer on death deed form is a straightforward process but requires attention to detail. Make sure to accurately enter each necessary piece of information to avoid delays in transferring your property. Here’s a step-by-step guide on what to include in each section.

-

Include your names and addresses; your marital status is also crucial for legal purposes.

-

Provide a complete legal description of the property, the county in which it's located, and any parcel identification numbers that apply.

-

Clearly specify your primary beneficiaries, and if necessary, outline guidelines for naming alternate beneficiaries in case the primary cannot inherit.

What are the final steps after completing a transfer on death deed?

Once the deed is filled out properly, the next step is filing and recording it with the appropriate county office. Each county may have different recording procedures, so it’s essential to confirm these before submission. Understanding what happens post-filing can also save you from future complications.

-

Ensure that you file the completed deed with the county recorder where the property is located.

-

Recording the deed is crucial as it publicly establishes the intended transfer upon death.

-

Expect to receive confirmation from the recorder’s office, which serves as proof of the deed’s validity and record.

How can pdfFiller assist you with your transfer on death deed form?

pdfFiller offers a wide range of tools to help you manage your transfer on death deed form seamlessly. From filling out and signing the form to storing it securely online, pdfFiller empowers users to efficiently handle their documentation needs.

-

You can easily edit, complete, and sign your transfer on death deed form using pdfFiller’s intuitive interface.

-

Share forms with legal advisors for immediate feedback and collaboration, which simplifies the drafting process.

-

Keep all your important documents, including your transfer on death deed, securely in the cloud for easy access.

What are the key reminders about transfer on death deeds?

Remember that while transfer on death deeds can simplify property transfers, they must be executed with care. Understanding the legal ramifications is vital to ensure your wishes are honored after your passing. Proactive estate planning can significantly ease the burden on your loved ones.

-

Be aware of the legal implications and ensure you comply with all requirements in your jurisdiction.

-

Regularly review your transfer on death deed to accommodate any changes in personal circumstances.

-

Establishing clearly defined plans today can prevent family disputes down the line.

How to fill out the transfer on death deed

-

1.Open the PDF form of the Transfer on Death Deed.

-

2.Begin by entering the names of the property owner(s) at the top of the document.

-

3.Fill in the legal description of the property; this can usually be found on the property deed.

-

4.Next, designate the beneficiary or beneficiaries who will receive the property upon your death by writing their full names.

-

5.If there are multiple beneficiaries, indicate how the property will be divided among them.

-

6.Include your signature and the date in the designated areas at the bottom of the document.

-

7.Some jurisdictions may require a witness signature or notarization, so check local laws accordingly.

-

8.Finally, ensure that the completed form is filed with the appropriate local recording office to be valid.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.