Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Ind...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer property directly to a beneficiary upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

great experience, user friendly

TY

good

Easy and fast

ok

ITS GREAT

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

How to fill out a transfer on death deed form?

Filling out a transfer on death deed form involves several key steps, ensuring that the transfer of your property to your chosen beneficiaries occurs seamlessly upon your death. Begin by accurately identifying property ownership and the beneficiaries, then properly record the deed according to state requirements so that it is legally enforceable.

Overview of transfer on death deed

A transfer on death deed (TOD deed) is a legal document that allows property owners to designate one or more beneficiaries to inherit their real estate automatically upon their death, without going through probate.

-

A TOD deed specifies how property is to be transferred upon the owner's death without the need for a will or probate.

-

The main purpose is to simplify the transfer of real estate. Advantages include avoiding probate, maintaining control over the property during the owner’s life, and providing a straightforward means to ensure loved ones receive property.

-

It's crucial to understand local laws and see that the deed is recorded properly to be valid; failure to do so can lead to legal disputes.

What are the important legal notices?

-

Legal advisement is highly recommended to ensure all aspects of the deed comply with state laws and will function as intended.

-

Transferring property may affect the beneficiary’s eligibility for public assistance programs and can expose the inheritor to claims from creditors.

-

For a transfer on death deed to be effective, it must be properly recorded with the appropriate county office during the owner's lifetime.

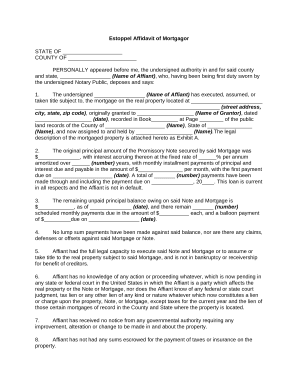

How to identify the parties involved?

-

You need to provide the full name, address, and marital status of the property owner creating the deed.

-

If the property is jointly owned, details of all owners must be included. This ensures clarity on ownership rights.

-

A precise legal description (often included as Exhibit A) must accompany the deed to clarify exactly which property is subject to the transfer.

What is the beneficiary designation process?

-

Clearly list each beneficiary's name and relationship to ensure there is no ambiguity about who inherits the property.

-

Specify how the property is to be divided if multiple beneficiaries are designated, such as equal distribution or specific portions.

-

Include contingencies for if a designated beneficiary dies before the owner, such as naming alternate beneficiaries.

How to record the transfer on death deed?

Recording the deed is a crucial step to ensure its validity. This involves submitting the completed form to the local register of deeds.

-

Visit your local register of deeds office with the completed form, paying required fees, and making sure it is filed appropriately.

-

If the property spans multiple counties, ensure you understand each county's recording requirements to avoid complications.

-

Expect to pay recording fees which vary by location. Processing times can differ, often taking from a few days to several weeks.

What are the final thoughts on managing your transfer on death deed?

-

Regularly review the deed to ensure it reflects your current wishes, especially after significant life events.

-

Consider storing your deed and related documents in a secure cloud platform for easy access by trusted individuals in emergencies.

-

pdfFiller offers a seamless way to edit, sign, and store your transfer on death deed, integrating all your document management needs in one secure cloud platform.

How to fill out the transfer on death deed

-

1.Open pdfFiller and upload the transfer on death deed form.

-

2.Fill in your name as the grantor, including marital status if applicable.

-

3.Provide a legal description of the property to be transferred; this can usually be found on the current deed.

-

4.Enter the name of the beneficiary or beneficiaries who will receive the property upon your death.

-

5.Add the current date and your signature to confirm the document's validity.

-

6.If required, have the document notarized to meet your state’s legal requirements.

-

7.Save a copy of the completed form and distribute copies to involved parties, including the beneficiary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.