Last updated on Feb 17, 2026

Get the free Washington Weekly Payroll Record

Show details

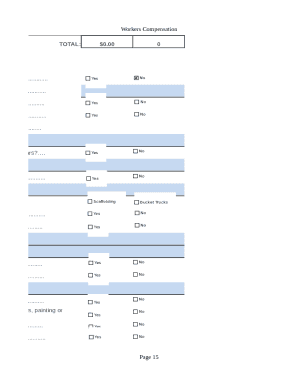

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is washington weekly payroll record

The Washington Weekly Payroll Record is a document used to track and summarize employee work hours and wages for payroll processing on a weekly basis.

pdfFiller scores top ratings on review platforms

Plenty of useful options

Plenty of useful options, convenient design. I like the feature of editing pdf files online ans storing them in the cloud

Has worked perfectly fine with editing…

Has worked perfectly fine with editing non-fillable pdf forms. No issues with saving in various forms to my computer. Works just as expected.

Very satisfy with software

Very satisfy with software. Easy to use.

This is a very good pdf creator

This is a very good pdf creator. Relatively straightforward to use. I just don't need this functionality right now, and the team was super helpful and fast in responding to my request. They're good people!

so far been very satisfied. Have some additional forms to process so hopefully all will go well

Can l talk to somebody on the phone?

Who needs washington weekly payroll record?

Explore how professionals across industries use pdfFiller.

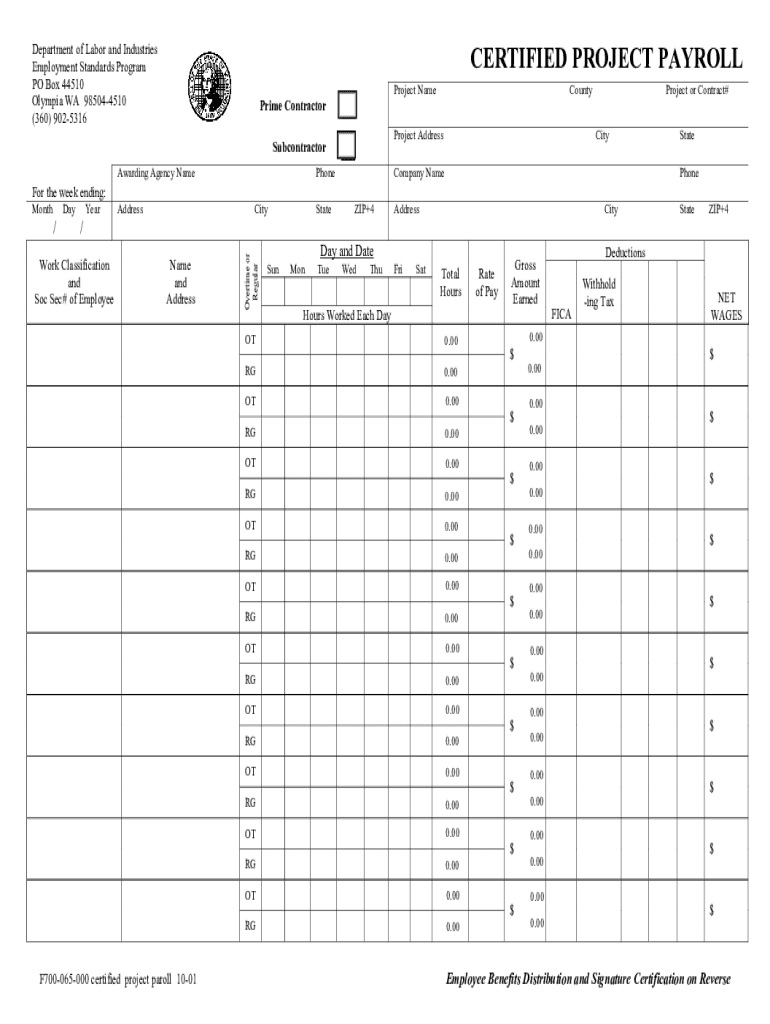

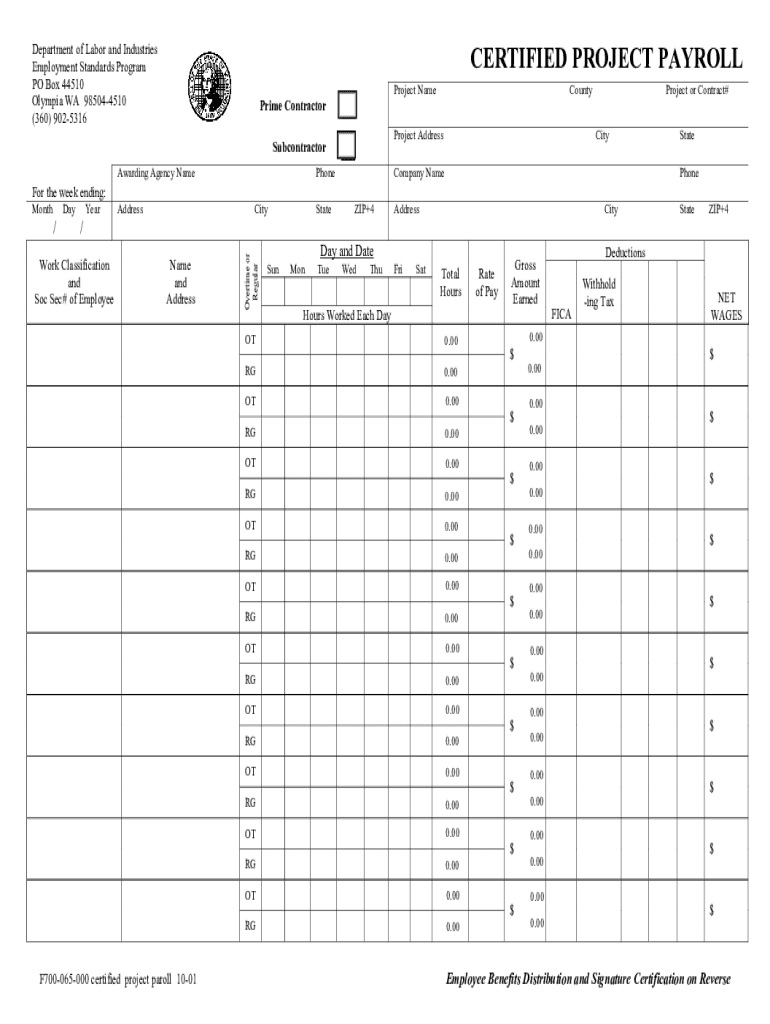

Understanding the Washington Weekly Payroll Record Form

What is the purpose and importance of the payroll record?

The Washington weekly payroll record form serves as a critical tool for documenting payroll and ensuring compliance with state labor laws. This legal requirement safeguards employee rights by providing a transparent record of hours worked and wages paid, which can be essential in resolving disputes. Accurate payroll records not only benefit employees but also enhance administrative efficiency by allowing employers to streamline their payroll processes.

-

The form defines the legal compliance standards for payroll documentation in Washington.

-

By maintaining clear records, employers protect employee rights regarding wages and hours worked.

-

Accurate payroll records contribute to a more efficient payroll management system.

What are the key elements of the payroll record?

A comprehensive understanding of the key components of the Washington weekly payroll record form is vital for proper completion. Essential details include project names, contractor information, and specific employee data which significantly impact payroll transparency and compliance.

-

Details about the project name, prime contractor, and subcontractor ensure accountability.

-

Addresses and contact details for relevant parties keep communication clear.

-

Includes work classifications and social security numbers for proper record-keeping.

-

Information on regular and overtime hours helps in accurate wage computation.

How do you fill out the Washington weekly payroll record form?

Filling out the form requires meticulous attention to detail. Start with a step-by-step guide to each section, ensuring you calculate the total hours worked and distinguish between regular and overtime hours clearly.

-

Review each section of the form for clarity before filling to ensure no area is overlooked.

-

Learn to track total hours and differentiate between regular and overtime accurately.

-

Understand how to document the correct rate of pay and total gross amount earned.

-

Be aware of FICA and withholding tax deductions that impact final pay.

What are the compliance requirements for Washington state labor laws?

Compliance with Washington's labor laws is non-negotiable when managing payroll records. Employers must ensure that their payroll practices are transparent and accessible to employees to mitigate the risk of disputes.

-

Employees have the right to access their payroll data, aiding in transparency.

-

Understand the consequences of failing to meet payroll documentation standards.

-

Importance of submitting correct payroll records to avoid legal repercussions.

How to maintain confidentiality and data security?

Protecting payroll records is critical to preserving employee privacy. Implementing robust data security measures safeguards against unauthorized access and potential data breaches.

-

Payroll records must be secured to protect sensitive employee information.

-

Adopt secure document management techniques to ensure data integrity.

-

Consider using tools like pdfFiller to enhance document security through encryption.

What is the signature and certification process?

Correctly documenting signatures is vital for the validity of the payroll records. Understanding who needs to sign and the implications of the affirmation statement is essential for compliance.

-

Identify who must sign the payroll record to ensure its legality.

-

Understand the implications of the affirmation statement included in the form.

-

Utilize eSignature tools to expedite and simplify the certification process.

How to handle disputes and record corrections?

Errors in payroll records can lead to significant disputes. Establishing procedures for addressing discrepancies is essential for maintaining trust between employees and employers.

-

Provide employees with clear procedures to challenge discrepancies in records.

-

Lay out steps to rectify any errors promptly and efficiently.

-

Offer resources to help employees understand their rights regarding payroll documentation.

How can you leverage pdfFiller for efficient payroll management?

Utilizing pdfFiller for payroll management can significantly enhance workflow efficiency. Its range of features simplifies the editing, signing, and storage processes for payroll documents.

-

pdfFiller offers a user-friendly interface for editing and signing payroll documents.

-

Teams can collaborate seamlessly to manage payroll records from anywhere.

-

The cloud-based platform allows easy access to documents, enhancing workflow efficiency.

How to fill out the washington weekly payroll record

-

1.Access the Washington Weekly Payroll Record template on pdfFiller.

-

2.Begin by entering the pay period dates at the top of the form.

-

3.List the names and employee ID numbers of all workers in the designated columns.

-

4.In the hours worked section, indicate the total number of hours each employee worked for the week.

-

5.Input the hourly wage for each employee in the corresponding column next to their hours.

-

6.Calculate the total wages for each employee by multiplying their hours worked by their hourly wage.

-

7.Ensure all information is accurate, including overtime hours if applicable, and make adjustments as necessary.

-

8.Once all entries are complete, review the document for any errors or missing information.

-

9.Save the filled-out form and submit it to the payroll department for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.