Get the free Sample Mortgage

Show details

Sample Mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

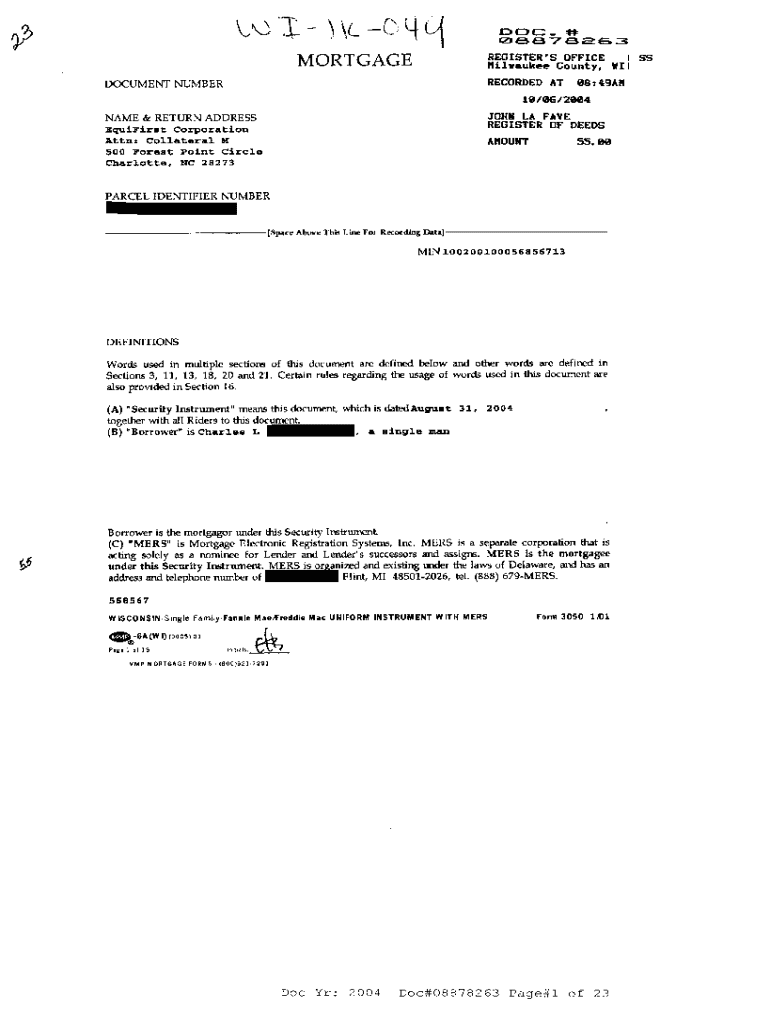

What is sample mortgage

A sample mortgage is a template document that outlines the terms and conditions of a mortgage loan agreement.

pdfFiller scores top ratings on review platforms

Awesomeness that is all one of the best pdf editing programs I have worked with.

I think this program will serve my needs very well. I'm still learning to use it.

It has been great so far I would like to learn more

Very user friendly but wish there was a way to print Copy A and W3 which could be sent to IRS.

I'm not always sure where it saves the documents to and would prefer to have a regular folder in which to save my documents

So far I'm loving the seamless editing features.

Who needs sample mortgage?

Explore how professionals across industries use pdfFiller.

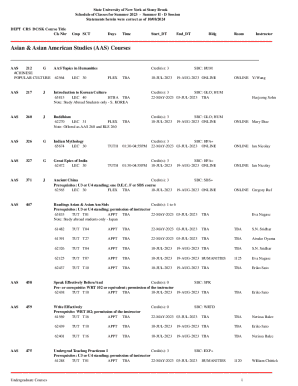

The Ultimate Guide to Sample Mortgage Forms

This guide details the essentials of a sample mortgage form form, including how to fill it out, variations, and best practices for smooth processing in the loan journey.

What are mortgage forms?

Mortgage forms are standardized documents used in the loan process, serving essential functions in both the application and closing phases of home financing.

-

These provide borrowers with an overview of loan terms, anticipated payments, and closing costs.

-

These outline the final terms of the loan, allowing buyers to understand what they are agreeing to before signing.

-

Different forms may include applications, agreements, or disclosures that contribute to the overall mortgage process.

How does a loan estimate form work?

Understanding a loan estimate form is crucial for potential homeowners, as it details vital information regarding the loan, including interest rates and terms. In addition, knowing how to interpret these details helps borrowers make informed decisions.

-

Typically organized into distinct sections, it covers loan terms, projected payments, and estimated closing costs in a structured manner.

-

A blank loan estimate serves as a template that shows various sections without filled-out information.

-

Completed loan estimates provide a practical reference, illustrating how each section can look in real scenarios.

What is a closing disclosure form?

A closing disclosure form is a five-page document containing details about the mortgage loan, including terms and final closing costs. Understanding its components is essential for the buyer to navigate the final steps of acquiring a property.

-

Buyers should focus on the loan terms, monthly payments, and total closing costs among other important details.

-

Studying both empty forms and completed ones allows buyers to prepare adequately for closing.

-

Awareness of significant fields, including total interest paid and final cash to close, ensures surprising expenses are mitigated.

What other forms are essential in mortgage processing?

Alongside loan estimates and closing disclosures, various other forms are required to facilitate a complete mortgage application. These may include employment verification and asset documentation, essential for lenders to assess borrower stability.

-

Forms such as credit reports and proof of income play critical roles in forming the full picture of a borrower's financial status.

-

Clear directions on each type help borrowers to increase the likelihood of prompt approval.

-

Utilizing templates with instructions can aid individuals in correctly completing these forms.

How to navigate loan estimate and closing disclosure forms?

Filling out mortgage forms can be daunting. This section will guide borrowers through the process step-by-step, ensuring accuracy and awareness of common pitfalls.

-

Structured instructions for completing sections help ensure all necessary details are accurately recorded.

-

Awareness of frequent errors, such as missing signatures or wrong amounts, can save time and frustration.

-

Leveraging pdfFiller functionalities can facilitate the editing, signing, and managing of various forms.

Are printable forms accessible?

Yes, many mortgage forms can be printed for manual filling. However, accessible digital formats can streamline the application process significantly.

-

Providing direct links allows users to easily access and download necessary forms.

-

Guidelines on how to print and fill out forms ensure clarity during the process.

-

Using pdfFiller simplifies online access and is convenient for those who prefer to complete forms digitally.

What customization features does pdfFiller offer?

pdfFiller provides advanced features allowing users to customize their mortgage forms effectively. Taking advantage of electronic signing, cloud storage, and collaborative tools enhances the overall experience.

-

Users can modify forms easily, ensuring personalization to meet specific needs.

-

Efficient and legally binding, e-signatures cut down processing time and improve convenience.

-

Collaborative features support team efforts in document completion, maximizing efficiency.

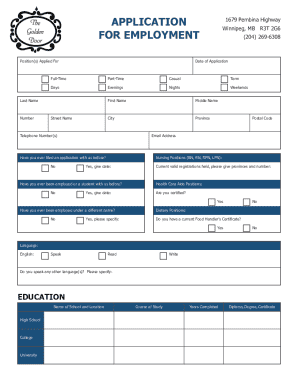

How to fill out the sample mortgage

-

1.Download the sample mortgage template from pdfFiller.

-

2.Open the pdfFiller website and upload the sample mortgage document.

-

3.Begin by filling in the borrower's personal information, including name, address, and contact details.

-

4.Provide the details of the property being mortgaged, such as the address and legal description.

-

5.Input the loan amount requested, interest rate, and repayment term in the designated fields.

-

6.Review the section regarding monthly payments and any applicable fees or penalties.

-

7.Complete the area concerning the lender's information, ensuring all contact details are accurate.

-

8.Sign the document electronically or prepare it for printing if a physical signature is required.

-

9.Once all fields are filled, review the completed mortgage document for accuracy before saving or sending for further processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.