Last updated on Feb 17, 2026

Get the free Retainage Bond template

Show details

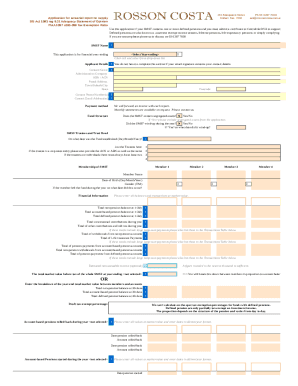

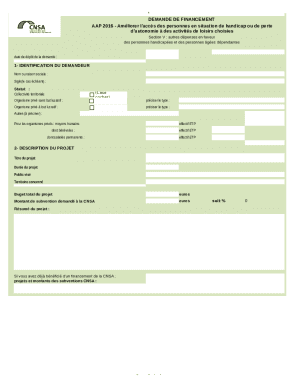

This retainage bond holds payment to a government contractor in accordance with the law of the state of Washington. The contract involves a public university project. Washington statutes require

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is retainage bond

A retainage bond is a type of surety bond that guarantees the performance of a contractor by allowing the client to withhold a portion of payment until the project is completed satisfactorily.

pdfFiller scores top ratings on review platforms

It was difficult to locate the correct form. The search engine seems weak. As I scrolled down the pages, they often skipped ahead.

it's great to be able to type my forms out with this service!

Very very convenient. Easy to use. The annual fee is well worth the price.

Sometimes when returning to filled documents, some text is in the wrong place.

Great tools, however I don't use them as often

Does what I need to do. a bit slow. a few fields need to be manipulated to enter info. all in all I'm pleased.

Who needs retainage bond template?

Explore how professionals across industries use pdfFiller.

Retainage Bond Form Guide

How to fill out a retainage bond form

Filling out a retainage bond form requires attention to detail and compliance with specific regulations. Each field, such as Principal, Surety, and Amount, must be accurately completed to avoid delays in the bonding process. Here’s an in-depth guide to ensure you fill out the form correctly.

Understanding retainage bonds in construction

A retainage bond is a type of surety bond used in construction projects to manage the retention amount withheld by owners until project completion. Its purpose is to guarantee that contractors fulfill their contractual obligations and to protect project owners from potential default.

-

A financial instrument that ensures that a contractor will complete the terms of the contract. If they fail to do so, the surety company will step in to fulfill the obligation.

-

Usually set at a percentage of the project cost, this retention serves as a safeguard for owners against incomplete or defective work.

-

Washington State has specific laws governing the use of retainage bonds, requiring contractors to understand these regulations when bidding for projects.

What is the role of retainage in construction projects?

Retainage plays a crucial role in the cash flow management of construction projects. Typically set at a percentage like 5%, this amount can significantly alter a contractor's financial planning.

-

It's common for owners to withhold around 5% of the final payment to ensure the project is completed satisfactorily.

-

For contractors, having a portion of their payment withheld can strain cash flow, necessitating careful financial planning.

-

These may include project type, contractor reliability, and specific contractual agreements.

What are the benefits of purchasing a retainage surety bond?

Acquiring a retainage surety bond can provide multiple advantages for both contractors and project owners.

-

A surety bond protects owners from the risk of non-payment and contractor default, ensuring project completion.

-

Having a bond in place boosts confidence among owners and project stakeholders, knowing that their investment is secure.

-

In many jurisdictions, including Washington State, retainage bonds are required to comply with local laws.

How much do retainage bonds cost?

The cost of retainage bonds can vary widely based on several factors, including project size and risk. Understanding these factors can help contractors budget effectively.

-

Bond rates may depend on the contractor’s creditworthiness, the project’s complexity, and the overall retention amount.

-

Generally, bond costs range from 1% to 3% of the total bond amount, but individual quotes may vary.

-

Shop around for quotes and consider bundling services to lower overall costs.

How to avoid overpaying for your retainage bond?

To avoid overpaying for a retainage bond, contractors should be strategic in their approach and leverage various options available in the marketplace.

-

Evaluate different providers based on their rates, customer service, and reliability to find the best fit for your needs.

-

Be ready to negotiate terms based on your project’s value and your track record as a contractor.

-

Knowledge of what underwriters look for can help you present your case effectively.

What is the process of obtaining a retainage surety bond?

Obtaining a retainage surety bond is a structured process, ensuring that all requirements are met before securing the bond.

-

Reach out to various bond providers to get a quote tailored to your project’s specifications.

-

Prepare and send the required documentation which may include financial statements and project details.

-

Carefully review all terms and conditions before signing to ensure clarity on your obligations.

How to complete the retainage bond form?

Completing the retainage bond form requires precision to ensure all necessary fields are filled correctly.

-

Essential fields include Principal (contractor name), Surety (bonding company), and Amount (retention value).

-

Begin by entering the required details in the specified fields carefully and review before submission.

-

Check for incomplete fields, incorrect values, and outdated information to prevent processing delays.

How to manage your retainage bond effectively?

Managing your retainage bond effectively involves keeping track of its status and ensuring compliance with all bond conditions.

-

Stay informed about any changes to the bond which may impact your obligations or rights.

-

Be prepared to navigate claims or disputes by understanding the bond’s conditions and your rights.

-

Always comply with the terms to avoid defaulting and impacting future bonding capacity.

How to fill out the retainage bond template

-

1.Obtain a blank retainage bond form from pdfFiller or your bonding company.

-

2.Begin by entering the names and addresses of the principal (contractor) and obligee (client) in the designated fields.

-

3.Specify the bond amount, which is the retainage amount being guaranteed for the project.

-

4.Fill in the project description, including the location and nature of the work being performed.

-

5.Enter the effective date of the bond, which typically coincides with the project start date.

-

6.Review the terms of the bond to ensure that they align with the contractual obligations regarding retainage.

-

7.Have the principal sign the bond in the designated area, ensuring that it is dated appropriately.

-

8.Ensure that a witness or notary is present if required by state law or the terms of the contract.

-

9.Submit the completed bond to the client and retain a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.