Get the free A03 Mortgage

Show details

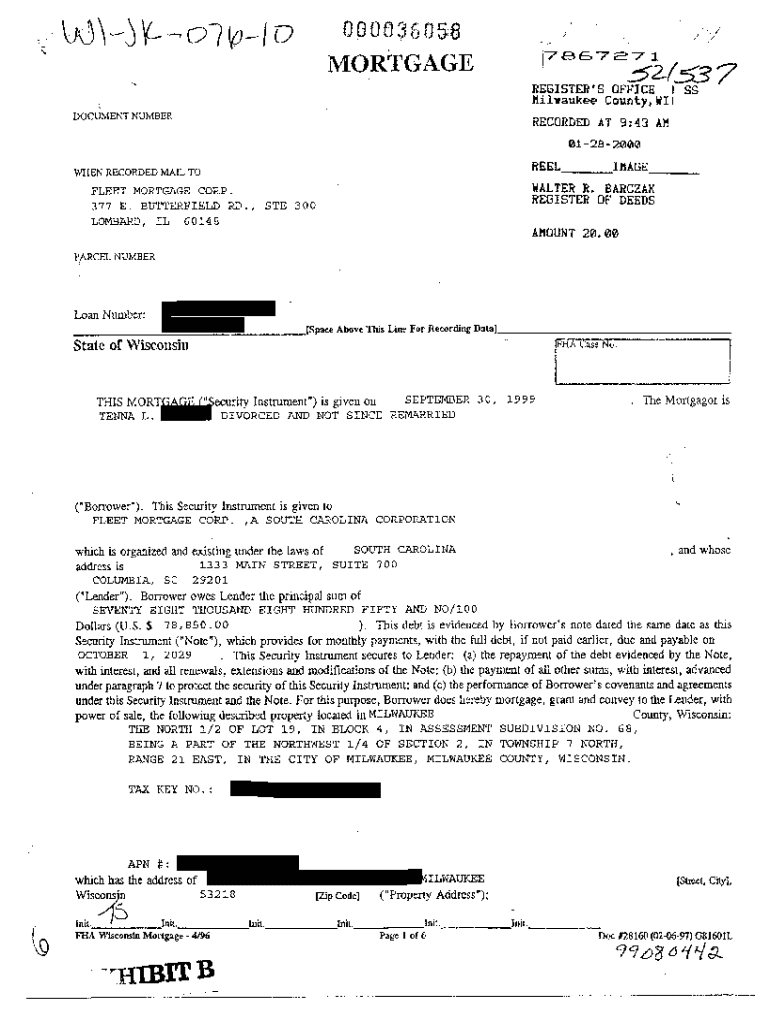

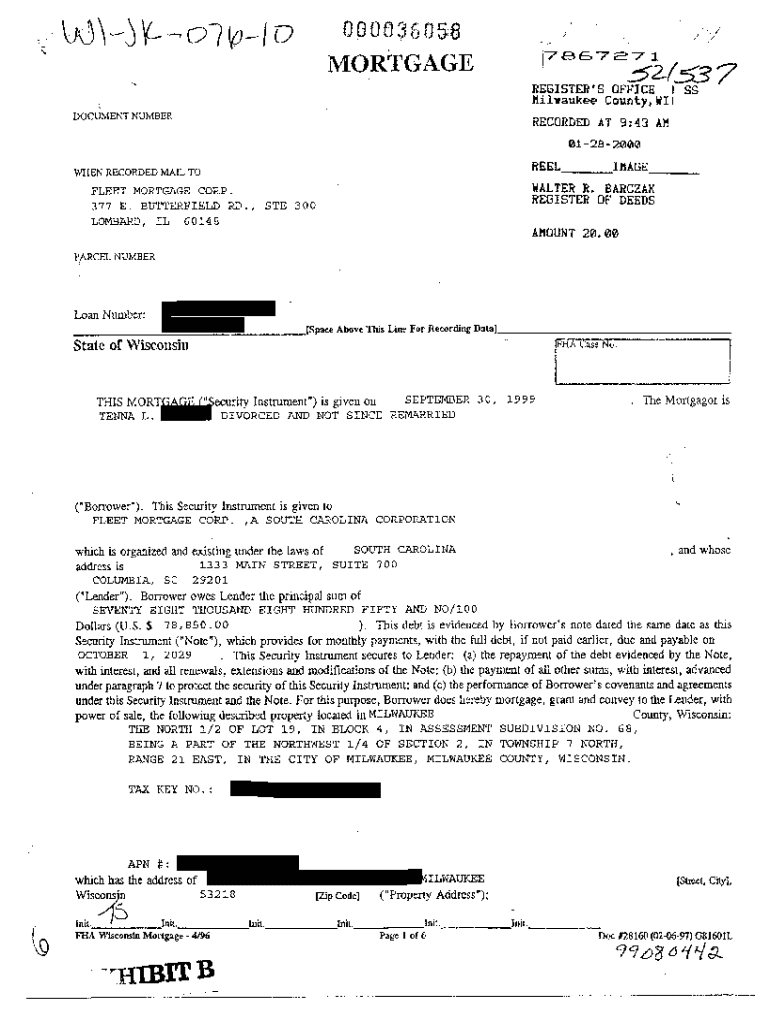

A03 Mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is a03 mortgage

The A03 mortgage is a specific form used in the mortgage application process for borrowers seeking financial assistance for property purchase.

pdfFiller scores top ratings on review platforms

Pretty friendly user

Pretty friendly user. Thanks.

SO far so good..

SO far so good... has saved me from having to leave the house to submit some important documents.

thank you so so very much

thank you for the help its was well worth it

Simple

Simple, detailed, and very helpful!

pdf filler is filling to my needs i…

pdf filler is filling to my needs i love the site and program

PDF Filller Frendly Support Person

I had Anna, as a PDF friendly support person and she was extremely helpful. I had issues with the account and she was eager to fix it and then I had issues with the form and the same excellent response. She was not only knowledgeable, but fast and very, very helpful. She used many ways to explain the issued including screen shot. Thank you Anna.Carolina

Who needs a03 mortgage?

Explore how professionals across industries use pdfFiller.

How to fill out the a03 mortgage

-

1.Access the A03 mortgage document on pdfFiller.

-

2.Begin by entering your personal information such as name, address, and contact details in the designated fields.

-

3.Provide details about the property you intend to purchase, including its address and current market value.

-

4.Fill in financial information, including your annual income, employment status, and any existing debts or liabilities that may affect your borrowing capacity.

-

5.Review the terms and conditions outlined in the document, ensuring you understand the obligations before proceeding.

-

6.Include necessary documentation, such as proof of income or tax returns, by uploading files as required in the form.

-

7.Double-check all entered information for accuracy to prevent any delays in processing your application.

-

8.Submit the form electronically through pdfFiller, ensuring you receive confirmation of submission for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.