Get the free Promissory Note - Horse Equine s template

Show details

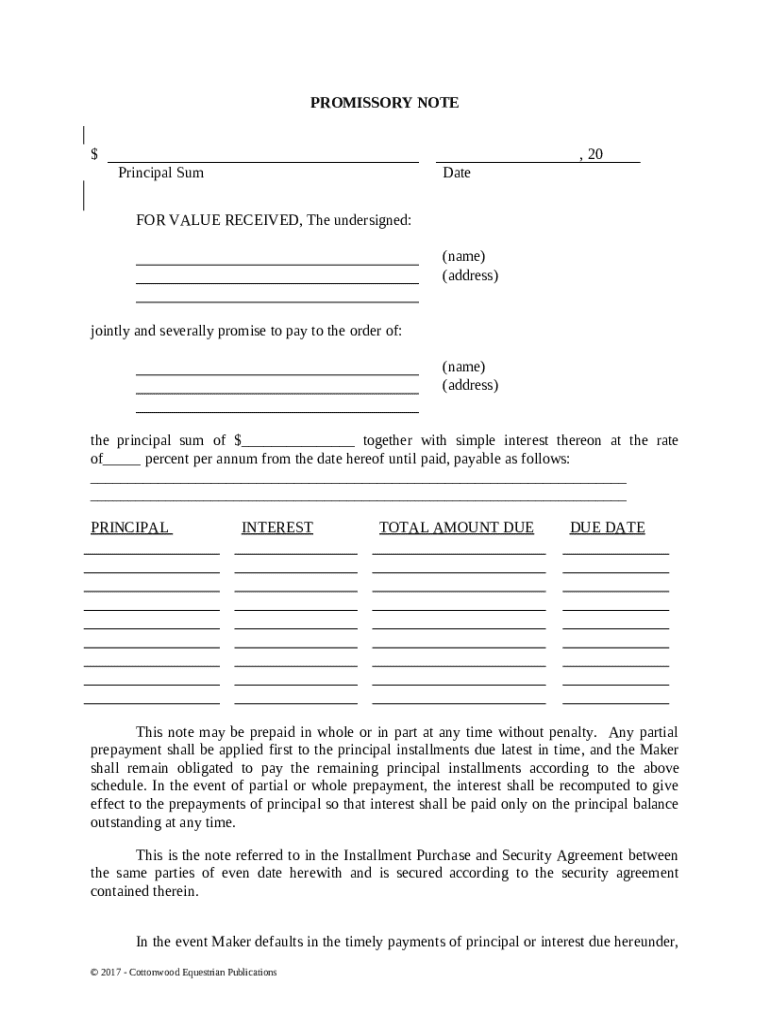

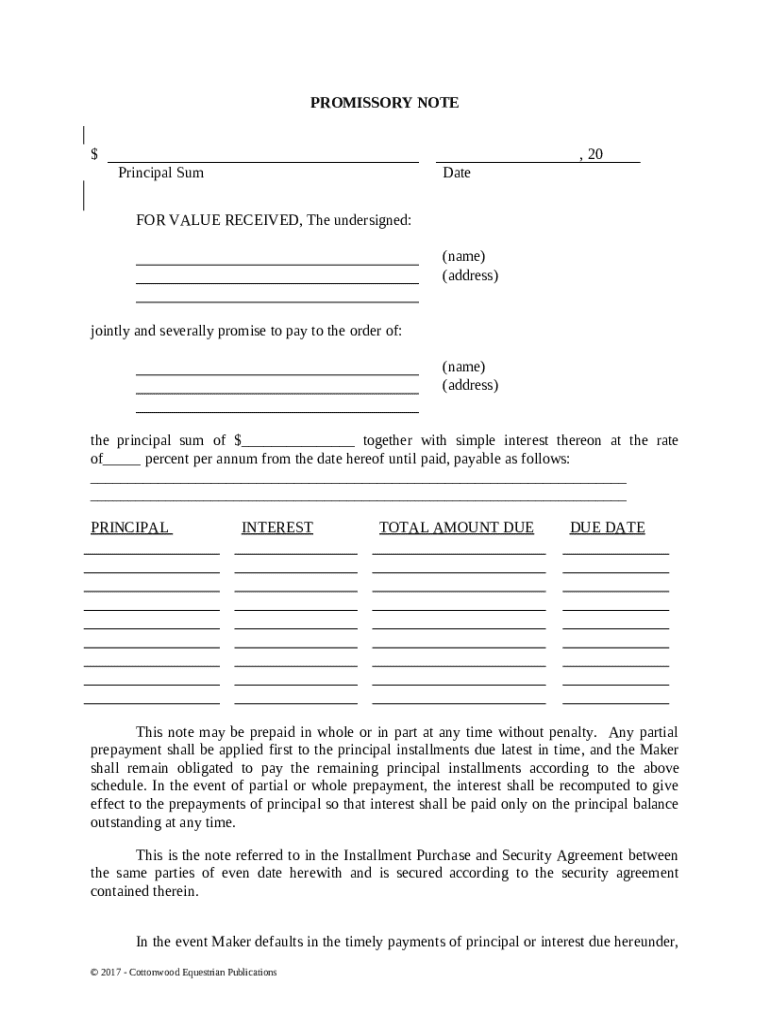

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

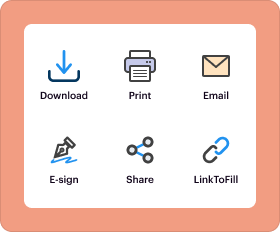

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document in which one party promises to pay a specific amount to another party for the purchase or loan of a horse.

pdfFiller scores top ratings on review platforms

I've an active subscription but keep getting prompts to reactivate it.

love the options in editing very easy…

love the options in editing very easy to use , all around excellent program

Easy to use

Easy to use. If I worked with PDF more, I would love to have this.

very good i recomend it!

very good i recomend it!

Fast effective

Fast effective. Well done!

Remy is extremely helpful. He made the session simple to understand. Thank you again, Remy!

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

How to fill out a promissory note - horse form form

Understanding the promissory note structure

A promissory note is a written promise to pay a specified sum of money to a designated person or entity, either on demand or at a predetermined date. The key components of a promissory note include the Principal Sum, which is the total amount borrowed; the Interest Rate, which specifies how much extra will be paid on top of the borrowed amount; and the Payment Terms, which outline when and how payments will be made. Filling out the form accurately is crucial, as any errors can lead to confusion or legal issues.

-

A legal document that confirms a promise to pay.

-

Principal Sum, Interest Rate, and Payment Terms define the agreement.

-

Errors can lead to disputes or complications in enforcement.

Essential fields in a promissory note

To create a valid promissory note, certain fields are essential. The Principal Sum represents the amount borrowed, which should be determined through clear communication and documented thoroughly. Understanding the types of Interest Rates is also important; fixed rates remain constant, while variable rates can fluctuate over time. Additionally, Payment Terms must be defined, indicating due dates for payments and how the total amounts are calculated.

-

Determine the monetary amount the borrower promises to repay.

-

Clarify whether the rate is fixed or variable, influencing total repayment costs.

-

Clearly define due dates and total calculations for transparency.

Filling out the promissory note

Filling out a promissory note requires a structured approach to ensure clarity. Start by entering the date and parties involved, followed by the agreed-upon Principal Sum and Interest Rate. Common mistakes include omitting crucial information or making incorrect calculations. To avoid these errors, it is highly recommended to double-check all entries for accuracy before finalizing the document.

-

Write down the date, parties, amount, interest, and payment terms clearly.

-

Do not leave fields blank, and ensure calculations are correct.

-

Review for errors to prevent future disputes.

Legal implications and consequences

Understanding the legal aspects of a promissory note is critical. Default terms indicate what happens if payments are missed or late. The Payee, who receives payments, has specific legal rights to recover the owed amounts, while the Maker—the person who signs the note—must understand the consequences of failing to meet these obligations. This can include late fees, additional interest, or even legal action.

-

Know what constitutes a default and the steps that follow.

-

Both parties have distinct rights and obligations under the law.

-

Late fees and legal repercussions may arise from missed payments.

Managing your promissory note after signing

Once a promissory note is signed, proper management is essential. Keeping track of payments can prevent misunderstandings and potential defaults. It is also crucial to manage any prepayments correctly, as this may require recalculating interest amounts. In case of disputes or defaults, having a clear tracking system will aid in resolving issues effectively.

-

Implement a system to note each payment and track the remaining balance.

-

Understand how prepayments affect overall interest and repayment.

-

Have a process in place to address any issues that may arise.

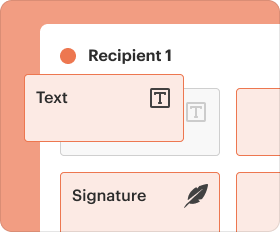

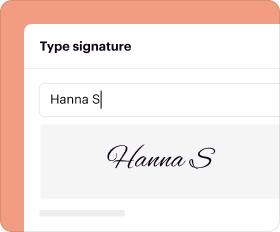

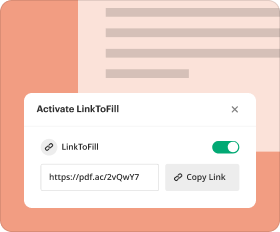

Using pdfFiller for your promissory note needs

pdfFiller offers robust solutions for editing and signing promissory notes. The platform's features allow for easy collaboration with others involved in the agreement. With interactive tools, users can manage their documents efficiently, utilizing cloud-based solutions for access and storage. This empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single platform.

-

Utilize pdfFiller's tools for a streamlined editing and signing process.

-

Cloud integrations allow for better organization and retrieval.

-

Enhance your document management experience with user-friendly interfaces.

Conclusion

Filling out a promissory note - horse form form is a straightforward process if approached methodically. Understanding the key components, adhering to legal obligations, and utilizing tools like pdfFiller can simplify the management of these documents. Whether for personal loans or business dealings, ensuring clarity and accuracy is paramount to avoid conflicts down the line.

How to fill out the promissory note - horse

-

1.Open pdfFiller and upload the promissory note - horse template.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the borrower's full name and address in the designated fields.

-

4.Enter the lender's full name and address next to the relevant label.

-

5.Specify the amount of money being loaned in the section provided.

-

6.Indicate the interest rate, if applicable, and any specific terms of repayment.

-

7.Outline the payment schedule, including start date and payment frequency.

-

8.Add any collateral details, such as horse registration number or description.

-

9.Include a section for signatures, ensuring both parties sign and date the document.

-

10.Review all information for accuracy and completeness before saving or printing the document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.