Get the free pdffiller

Show details

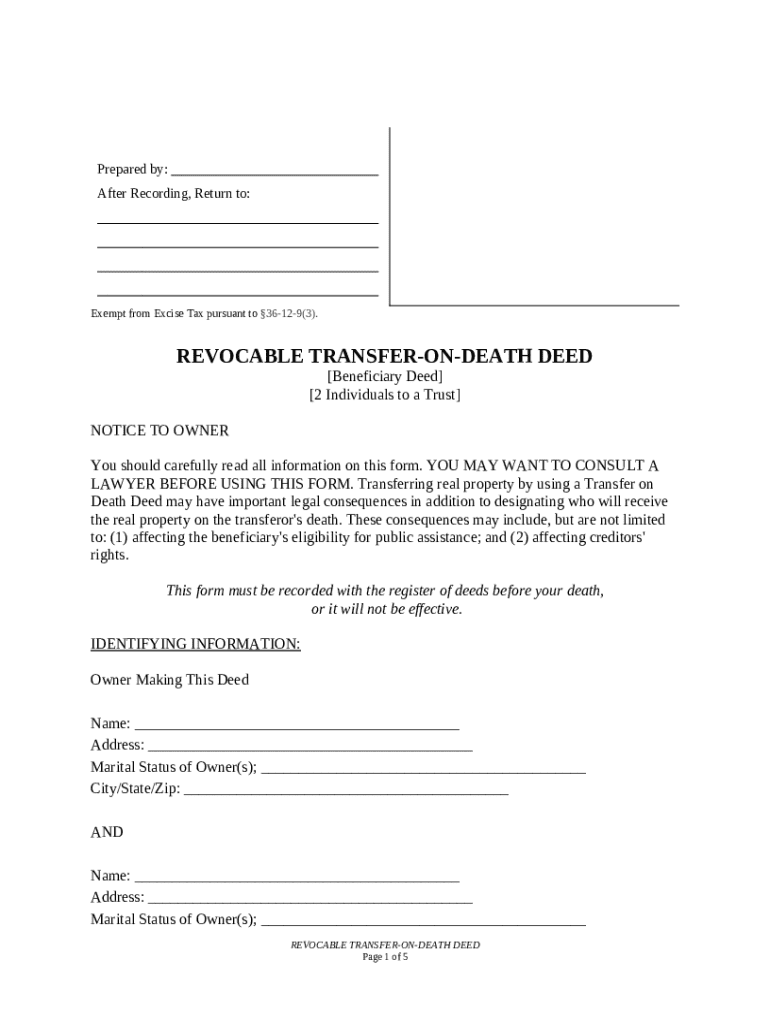

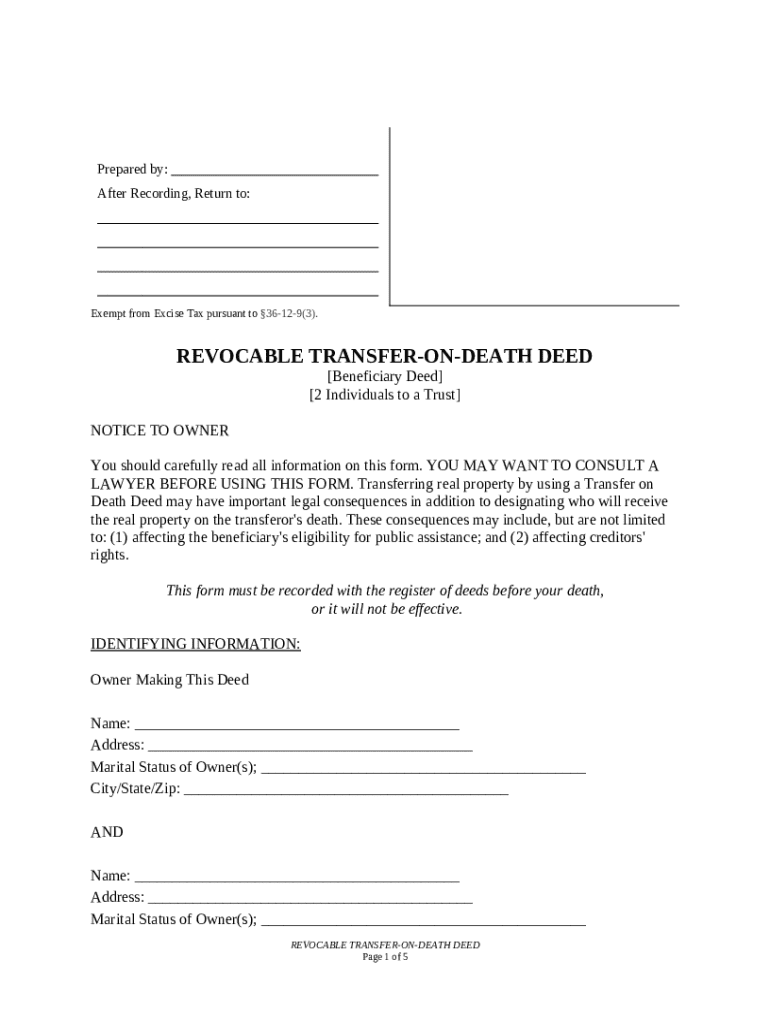

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to transfer real estate to beneficiaries upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Quick and easy to fill out. I needed that for the deadline I was approaching.

I just started using it, will let you know

This is easy to use. Since I have only one document to process and a CPA does my taxes, the cost of month-to-month seems high. I do hope it's easy to unsubscribe. I can't stand the way peoplefinders tries to undermine one-time usage. So thanks for your clarity and integrity.

Easy to use. Like it..Only issue so far is ability to save document with a different name after filling it in.

So far great. Just trying to get use to it and learn ways.

the program is very easy and quick to use.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Transfer on Death Deed Form on pdfFiller

TL;DR: How to fill out a transfer on death deed form

To fill out a transfer on death deed form, you need to gather key information such as owner details and beneficiary names. Utilize platform tools like pdfFiller for easy editing and signing, and ensure that the deed is recorded with the appropriate local authority.

What is a transfer on death deed?

A transfer on death deed (TODD) allows you to designate a beneficiary to inherit your property upon your death without going through probate. The primary purpose of this deed is to simplify the transfer process and help your loved ones avoid the complexities of probate court.

-

The deed ensures a smooth transition of property ownership to your chosen beneficiary, offering peace of mind during estate planning.

-

The use of a TODD makes estate planning more accessible for individuals without a will, allowing everyone to secure their property transfers efficiently.

However, it’s crucial to consult a lawyer to understand the intricate legal implications of using a transfer on death deed, ensuring it aligns with your overall estate strategy.

What to consider before using the form?

Before you create a Transfer on Death Deed, it is essential to confirm your eligibility, which often includes being the sole owner of the property or co-owning with the right of survivorship. Furthermore, potential consequences regarding public assistance for beneficiaries should be considered, as the deed can impact their eligibility.

-

Confirm your ownership of the property and whether a TODD is applicable for your situation.

-

Understand how transferring property via a TODD affects your beneficiaries' eligibility for programs such as Medicaid.

-

Be aware that creditors may have rights to your property after death, which could affect the intended beneficiaries.

How do prepare my transfer on death deed?

The preparation of your Transfer on Death Deed involves gathering essential identifying information, including your name, address, marital status, and the legal description of the property. This information is crucial for creating an accurate and legally binding document.

-

Include your full name and contact information to establish identity.

-

Specify the name, address, and relationship of the beneficiary to ensure clarity on who is to inherit the property.

-

Provide a concise legal description of the property, such as address or parcel number, to ensure accurate identification.

What should include in the beneficiary information?

Providing complete and accurate details for your beneficiaries is key. This includes designating both primary beneficiaries and alternate beneficiaries who will inherit if the primary beneficiary does not survive you.

-

List the main individual designated to receive the property.

-

Assign alternative beneficiaries to ensure your property still transfers if the primary beneficiary passes.

-

If applicable, state clearly that previous deeds are revoked to prevent any ambiguity during the property transfer.

How do record my transfer on death deed?

Recording your Transfer on Death Deed correctly is crucial for its legal validity. Ensure the deed is submitted to the register of deeds in your area, and it must be completed before your passing for it to take effect.

-

Visit your local register of deeds office or website to learn about the specific filing process in your area.

-

Submitting the deed promptly ensures it is valid upon your death.

-

If you own property in multiple counties, you may need to record the deed in each respective area.

What post-completion steps should take?

Once you have completed and recorded your deed, confirm its recording and ensure the document's legal validity. Keeping copies of the signed document is important, as are instructions for any potential future updates.

-

Check with the registry to ensure your deed was properly recorded.

-

Maintain copies for your records and future reference.

-

Be aware that changes in your life may require updates to your deed.

How can use pdfFiller for document management?

pdfFiller provides powerful tools for editing and signing your Transfer on Death Deed. You can collaborate with stakeholders for input and approval, making the process efficient and organized.

-

Use pdfFiller to easily make necessary changes and electronically sign documents.

-

Invite others to review and approve the document directly through the platform.

-

Store your documents securely online for easy access anytime, anywhere.

What common mistakes should avoid?

Being aware of common pitfalls can save time and ensure your deed’s effectiveness. Common mistakes include neglecting to provide complete beneficiary details and failing to research property descriptions accurately.

-

Double-check that all necessary details for beneficiaries are included to avoid confusion.

-

Ensure you have the correct and complete legal description of your property to avoid complications.

-

Research and adhere to specific state laws to validate your deed.

How to fill out the pdffiller template

-

1.Open the pdfFiller website and log into your account.

-

2.Search for 'transfer on death deed' in the template library.

-

3.Select the appropriate template you want to use.

-

4.Fill in the required fields such as your name, address, and the legal description of the property.

-

5.Designate the beneficiary or beneficiaries by entering their names and addresses correctly.

-

6.Include any necessary notary or witness sections to comply with state laws.

-

7.Review the document for accuracy and completeness before finalizing.

-

8.Once you're satisfied, save the completed deed and prepare it for signing.

-

9.Print the document and sign it in front of a notary or required witnesses as necessary.

-

10.Finally, record the signed deed with the appropriate local government office to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.