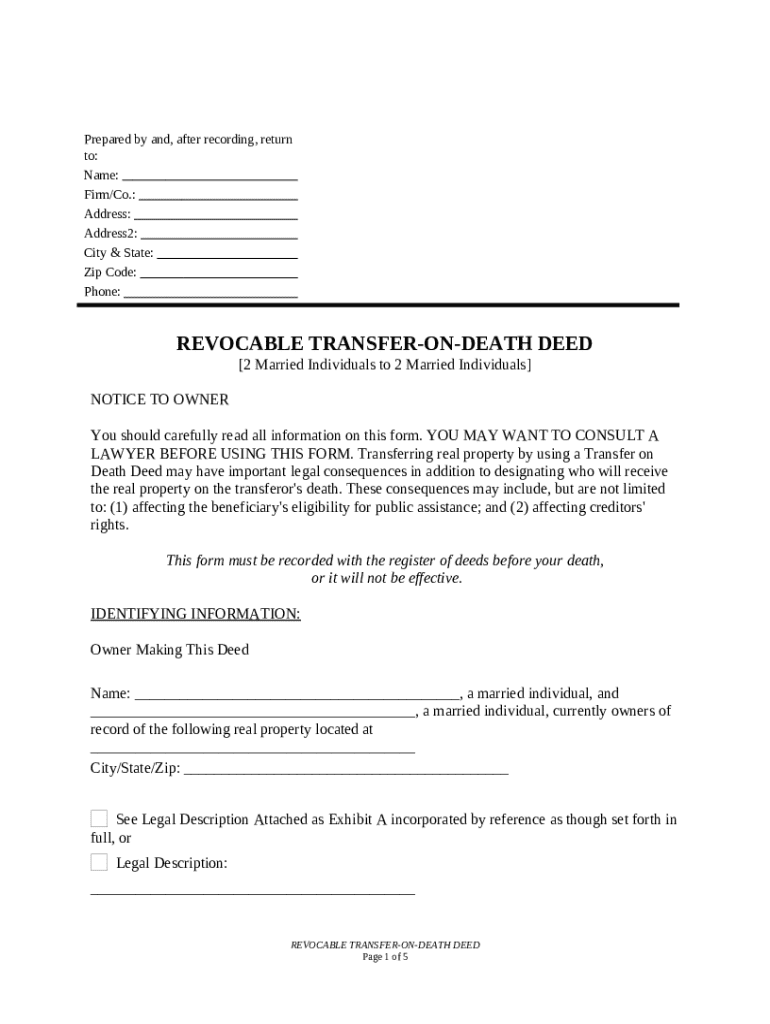

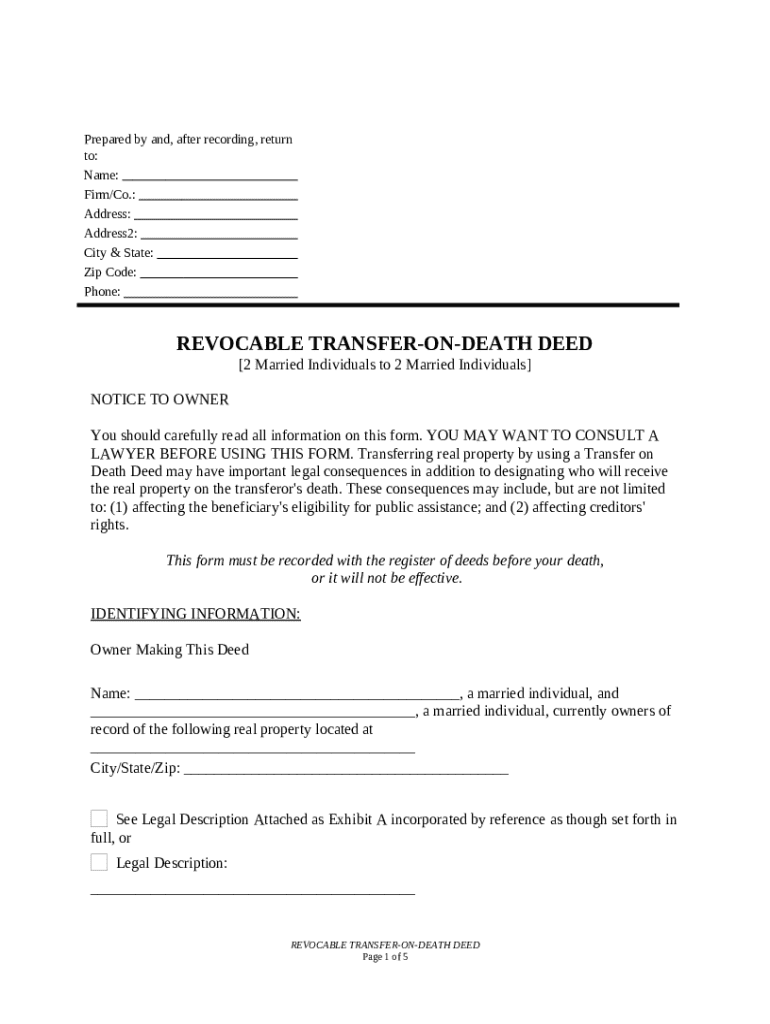

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer property directly to a beneficiary upon their death, bypassing probate.

pdfFiller scores top ratings on review platforms

This software helps me to organize my workflow and general productivity in preparing reportss

The very best document management platform I have ever experienced.

great system overall.....sometimes the response time is a bit slow, otherwise, flawless.

The convenience and encrypted security are the best reasons I use PDFfille

Even though I have Adobe Acrobat - I like using PDF Filler for documents. It is easy to navigate and they keep my files organized and secure!

It was a great find. I hate Printing and filling out forms using pen is so old school and requires extra step of scanning everything back in. It was also Free! Adobe is way too expensive for the handful of times a year I would need it.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form: A comprehensive guide

What is a transfer on death deed?

A Transfer on Death Deed (TODD) is a legal document that allows property owners to specify a beneficiary who will inherit their real estate upon their death without going through probate. This form serves as a straightforward means to transfer property, thereby avoiding the complexities and delays often associated with traditional inheritance processes.

-

It is primarily designed for estate planning, allowing a seamless transfer of property to designated heirs while ensuring that the property remains under the control of the owner during their lifetime.

-

One significant benefit is the avoidance of probate, thereby reducing legal costs and expediting the transfer process. Furthermore, property owners maintain full control over their estates until they pass away.

-

With joint tenancy, property passes automatically to surviving owners, while tenants in common allows for a share of property to be transferred to heirs without affecting the stakes of other co-owners.

What should you consider before starting?

Before downloading or completing a transfer on death deed form, it's essential to consult legal professionals. This ensures that you understand the nuances of the deed and its implications based on your particular situation.

-

Engaging an attorney experienced in estate planning can help clarify any complex legal terms or consequences of your decisions.

-

Gather the legal description of your property, the names and contact information of your beneficiaries, and any previous deeds that need to be revoked.

-

Be aware that designating beneficiaries can impact your property management and may have tax implications.

How do you fill out the transfer on death deed form?

Filling out the transfer on death deed form requires attention to detail to ensure that your wishes are clearly articulated and legally recognized.

-

Begin by clearly listing all current property owners whose names will appear on the deed.

-

Include the full legal description of your property, which can often be found on the current deed or tax records.

-

Clearly state the full names and addresses of the intended beneficiaries to prevent any confusion later.

-

Consider including alternate beneficiaries to ensure that your property is inherited as intended, especially if the primary beneficiaries cannot fulfill their role.

-

If other transfer on death deeds exist, ensure that they are properly revoked to avoid conflicts.

How to record your transfer on death deed

After completing the form, timely recording with local authorities is essential. This formalizes the transfer and upholds its legality.

-

Typically, the deed should be recorded in the county where the property is located. Check your local government’s website for specific guidance on recording procedures.

-

Failing to record the deed before the owner's death may render the document invalid, leaving the property subject to probate.

-

Improper recording can lead to disputes among surviving family members and potential legal challenges during the inheritance process.

What to do after filling out and recording your deed?

After the deed is recorded, it’s necessary to confirm its official status and communicate with beneficiaries.

-

Contact your local recording office to verify that the deed has been properly filed and is publicly accessible.

-

Keep copies of the officially recorded deed as evidence of your property transfer instructions.

-

Inform your beneficiaries about the deed and its implications. Open communication can prevent misunderstandings later.

What are common mistakes to avoid?

Filling out a transfer on death deed can be straightforward, but several common mistakes can complicate the process and lead to unintended consequences.

-

Always double-check that the legal description of the property is accurate.

-

Failing to use full legal names can lead to confusion and legal issues during the transfer.

-

Ensure that all previous directives regarding the property are officially revoked to avoid conflicts.

-

Each state may have differences in requirements and potential recording fees, so review your local regulations.

What resources are available for managing your transfer on death deed?

Utilizing tools and resources can simplify the completion and management of your transfer on death deed.

-

pdfFiller offers user-friendly tools that allow you to fill, edit, and sign documents, ensuring accuracy and compliance.

-

Download accessible templates and comprehensive guides tailored to your needs for effective form completion.

-

Contact customer support for assistance or clarification regarding any legal questions about the form.

How to fill out the transfer on death deed

-

1.Open pdfFiller and upload the transfer on death deed form.

-

2.Fill in your name as the grantor, including marital status if applicable.

-

3.Provide a legal description of the property to be transferred; this can usually be found on the current deed.

-

4.Enter the name of the beneficiary or beneficiaries who will receive the property upon your death.

-

5.Add the current date and your signature to confirm the document's validity.

-

6.If required, have the document notarized to meet your state’s legal requirements.

-

7.Save a copy of the completed form and distribute copies to involved parties, including the beneficiary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.