Get the free CIT 0480 E

Get, Create, Make and Sign cit 0480 e

How to edit cit 0480 e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cit 0480 e

How to fill out cit 0480 e

Who needs cit 0480 e?

CIT 0480 E Form - How-to Guide

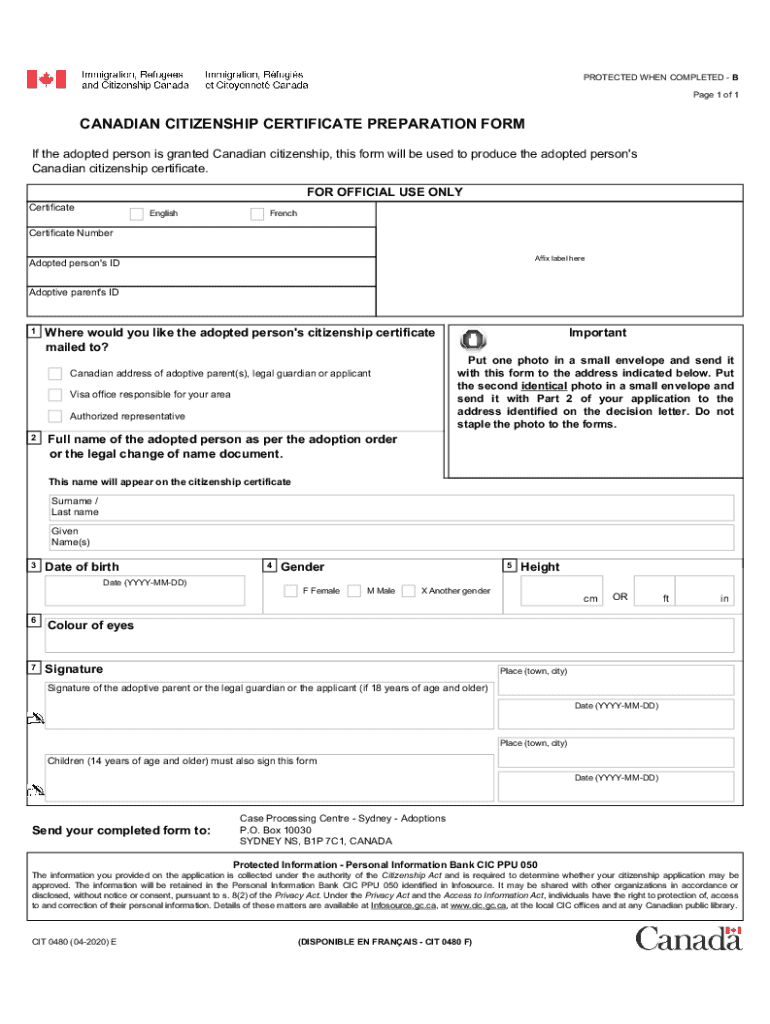

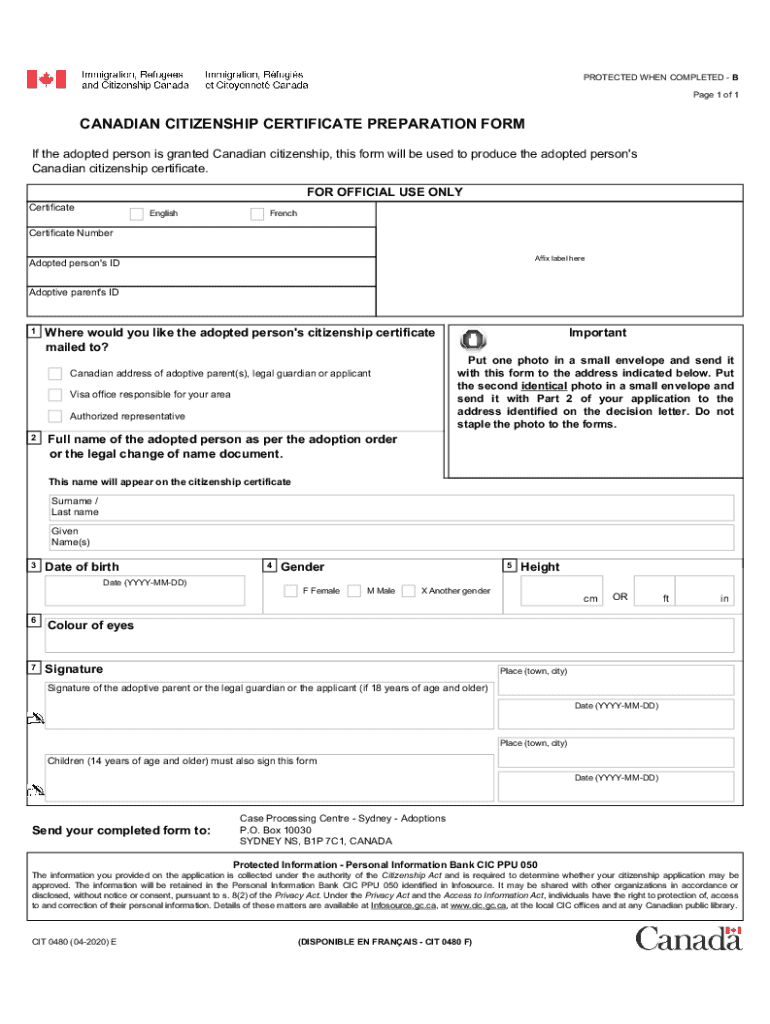

Overview of the CIT 0480 E Form

The CIT 0480 E Form is a crucial document utilized for specific compliance and reporting purposes within certain jurisdictions. It serves to collect necessary financial data and tax-related information from individuals or businesses. The primary goal of the CIT 0480 E Form is to ensure transparency and accurate reporting in financial dealings, which helps maintain regulatory standards.

This form is especially important for organizations operating within sectors that require detailed financial disclosures. Accuracy is paramount when filling out the CIT 0480 E Form, as any discrepancies may lead to compliance issues or financial penalties.

Step-by-step instructions for filling out the CIT 0480 E Form

Filling out the CIT 0480 E Form can seem daunting, but breaking it down into manageable steps aids in a smoother process. The first step involves gathering all necessary information and documents that you will need to complete the form accurately.

1. Gather necessary information

Before accessing the form, ensure you have all relevant documents on hand. These typically include previous financial statements, identification documents, and any specific tax identification numbers. Common pitfalls include not having all necessary data upfront, which can lead to delays and inaccuracies.

2. Access the CIT 0480 E Form via pdfFiller

Finding the CIT 0480 E Form on pdfFiller is straightforward. Simply navigate to the search function on the pdfFiller homepage and type 'CIT 0480 E Form.' This will direct you to the correct document among various templates.

For easy navigation, familiarize yourself with the layout of pdfFiller. Utilize their intuitive website to access filters and sorting options which can help streamline your search.

3. Detailed completion guidelines

The next step involves carefully completing the form, section by section. Start with your personal information, ensuring all entries are up-to-date and accurate.

Editing the CIT 0480 E Form with pdfFiller's tools

Once the form is filled out, you may want to review and edit your entries for accuracy. pdfFiller offers various editing features that allow you to enhance the document as needed. With these tools, you can easily add notes, remove erroneous information, or modify existing fields.

For repetitive entries, consider utilizing templates to standardize your information more effectively and save time during future submissions.

How to eSign the CIT 0480 E Form

The inclusion of an electronic signature (eSignature) is essential in validating your submission of the CIT 0480 E Form. ESigning not only saves time but also enhances the security of your documents.

To eSign, follow these steps: select the eSignature option within pdfFiller, choose your preferred method (typing your name, drawing your signature, or uploading an image), and place it in the designated field on the form. It’s important to understand that eSignatures hold legal validity across many jurisdictions, ensuring your document is recognized and accepted.

Collaborative options for teams

For teams working on the CIT 0480 E Form, pdfFiller offers several collaborative tools. These features allow for seamless teamwork, as you can assign different roles and responsibilities to members based on their expertise.

Additionally, pdfFiller enables users to utilize in-document comments and feedback sections, fostering clear communication throughout the editing process; this helps maintain a collaborative environment.

Managing submissions of the CIT 0480 E Form

After completing the CIT 0480 E Form, you’re ready to submit it. pdfFiller simplifies the submission process; you can send your document directly from the platform. Keep track of your submission status within pdfFiller to ensure your form is received and processed.

Once submitted, remember to keep a copy of the completed form for your records. This will assist you in future correspondences or audits.

Additional tools for document management

pdfFiller offers a utility bar that enhances document management beyond just filling forms. Users can enjoy the option to save on printing costs by managing electronic copies seamlessly.

Moreover, cloud storage benefits allow you to access your documents from anywhere, providing a high level of convenience. Integration with other applications also enables setting calendar reminders for renewal or follow-up tasks, streamlining your workflow.

Troubleshooting common issues with the CIT 0480 E Form

Even seasoned users may encounter occasional issues when dealing with the CIT 0480 E Form. Frequently asked questions usually revolve around submission errors or difficulties in accessing filled forms.

Solutions to common errors include checking for incomplete fields or mismatched information. In the event of persistent issues, contacting pdfFiller support can provide the assistance you need to resolve problems quickly and efficiently.

Related documents and forms

Often, the CIT 0480 E Form is accompanied by several related documents for comprehensive reporting. Commonly needed documents may include tax receipts, detailed financial disclosures, or previous filings for reference.

Users can explore related templates or forms available within pdfFiller to enhance their documentation efforts and ensure compliance.

Explore more with pdfFiller

pdfFiller enhances the document management experience significantly. Users report time savings and increased accuracy by leveraging the features associated with the CIT 0480 E Form. Case studies show improved efficiency in form submissions, which can be attributed to the streamlined processes that pdfFiller provides.

Exploring pdfFiller’s additional features can lead to newfound efficiencies across your document handling tasks, making it a valuable resource for both individuals and teams.

Navigating legal and compliance aspects

Understanding the legal requirements surrounding the CIT 0480 E Form is crucial for compliance. Regularly updating your knowledge regarding legislative changes ensures you're current with requirements and procedural modifications.

Keeping up with regulatory developments is essential in avoiding future penalties and maintaining proper reporting practices.

Tips for efficient document management

Best practices for maintaining organized digital documents include consistently naming files using a structured format, regularly backing up data, and utilizing folders effectively within cloud storage.

Additionally, consider ongoing learning opportunities, such as webinars offered by pdfFiller, to keep your skills sharp and ensure you're utilizing features to their fullest potential.

Community insights on using the CIT 0480 E Form

Engagement within the pdfFiller community can yield valuable insights about the CIT 0480 E Form. User stories highlight practical tips and common strategies that can enhance your experience.

Connecting with others who use pdfFiller fosters a support network where individuals share their experiences, challenges, and solutions regarding document management.

Further learning opportunities

To help users navigate the complexities of document creation and management, pdfFiller offers various learning opportunities. Webinars and tutorials provide insights into advanced features and practical tips on using the CIT 0480 E Form efficiently.

Keep an eye out for ongoing updates to document handling practices to maintain proficiency and enhance your overall experience with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the cit 0480 e electronically in Chrome?

How can I fill out cit 0480 e on an iOS device?

How do I fill out cit 0480 e on an Android device?

What is cit 0480 e?

Who is required to file cit 0480 e?

How to fill out cit 0480 e?

What is the purpose of cit 0480 e?

What information must be reported on cit 0480 e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.