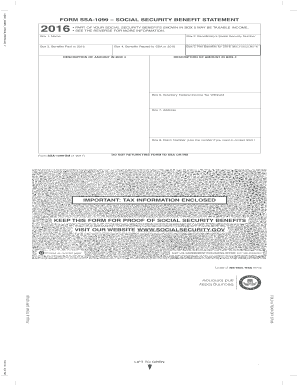

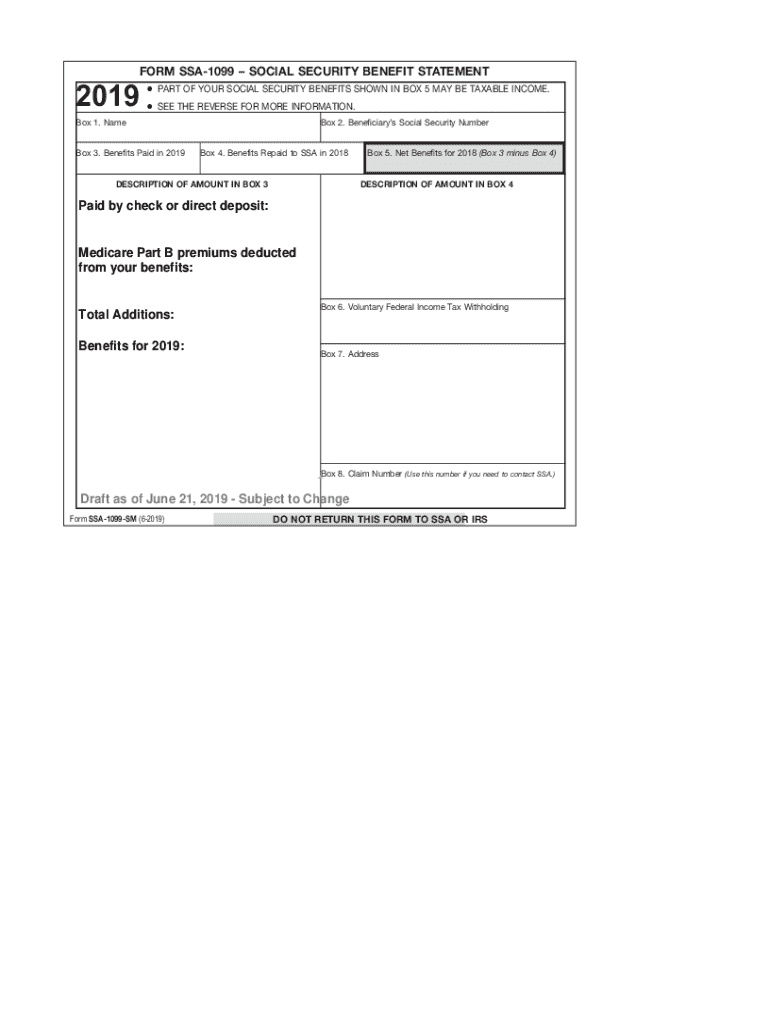

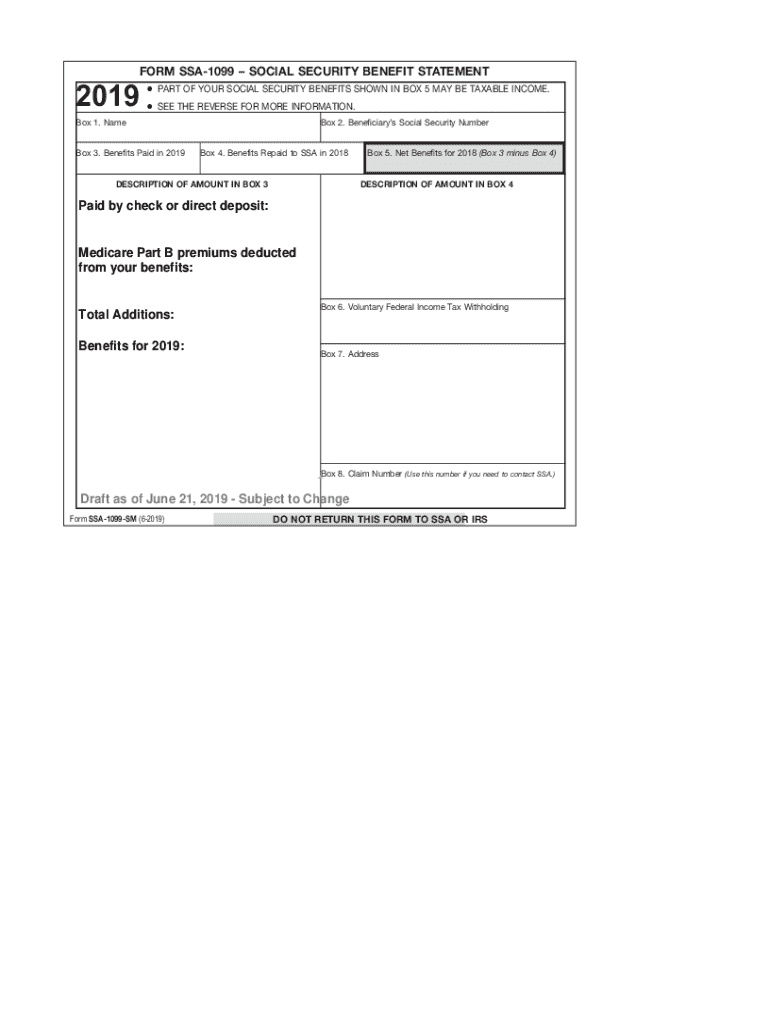

SSA-1099 2019-2025 free printable template

Show details

19 %!! % #$ % $

" 28&0*

28*1*+.65&.).11928*1*+.(.&4952(.&/*(74.6970'*4

28 *1*+.65*3&.)62.1018 28 *6 *1*+.65 +24 18 Paid by check or direct deposit:Medicare Part B premiums deducted

from

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssa form ssa 1099

Edit your social security statement ssa 1099 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa 1099 sm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit social security form ssa 1099 online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ssa statement 1099 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-1099 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ssa social security 1099 form

How to fill out 2006 publication 678-w

01

Gather necessary personal information: Name, address, Social Security Number, and any relevant financial details.

02

Obtain a copy of the 2006 Publication 678-W from the IRS website or request one from a tax professional.

03

Read the instructions carefully to understand the purpose and requirements of the form.

04

Fill out the personal information section, ensuring accuracy and completeness.

05

Complete the sections that pertain to your specific tax situation, referring to the guide as needed for explanations.

06

Review the filled-out form for any errors or omissions.

07

Sign and date the form, if required.

08

Submit the form according to the instructions, either electronically or via mail.

Who needs 2006 publication 678-w?

01

Individuals or businesses that need to report specific tax-related information to the IRS in 2006.

02

Tax professionals preparing returns for their clients that are required to use this publication.

03

Anyone who is involved with tax matters related to the publication's contents, which may include tax deductions, credits, or information reporting.

Fill

benefit statement form ssa 1099

: Try Risk Free

People Also Ask about ssa 1099 copy

Can I get a copy of my SSA-1099 form online?

If you did not receive your SSA-1099 or have misplaced it, you can get a replacement online if you have a My Social Security account. Sign in to your account and click the link for Replacement Documents. You'll be able to access your form and save a printable copy.

How do I get my Social Security SSA 1099?

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online. Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm.

What is a 1099 for Social Security?

A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

Do you get a 1099 for Social Security payments?

Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations. Also, there are many exceptions to the $600 rule, meaning you may receive a 1099 even if you were paid less than $600 in non-employment income during the tax year.

How can I get a 1099 form from Social Security?

How can I get a form SSA-1099/1042S, Social Security Benefit Statement? Using your personal my Social Security account, and if you don't already have an account, you can create one online. Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm.

How do I find my 1099 online?

Online Log in to Benefit Programs Online and select UI Online. Select Payments. Select Form 1099G. Select View next to the desired year. Select Request Paper Copy to request an official paper copy of your Form 1099G. Confirm your address on the Form 1099G Address Confirmation screen.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my social security 1099 form directly from Gmail?

1099 social security form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find ssa social security 1099?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific security ssa 1099 form and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the ssa social 1099 online in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form ssa1099 form and you'll be done in minutes.

What is publication 678-w?

Publication 678-w is a specific IRS publication that contains instructions and information regarding certain tax obligations and reporting requirements.

Who is required to file publication 678-w?

Certain taxpayers who meet specific criteria related to their tax situation or business activities are required to file publication 678-w.

How to fill out publication 678-w?

To fill out publication 678-w, taxpayers need to follow the instructions provided in the publication, including entering accurate financial data and ensuring all relevant sections are completed.

What is the purpose of publication 678-w?

The purpose of publication 678-w is to provide guidance on the tax implications and requirements for specific financial transactions or taxpayer obligations.

What information must be reported on publication 678-w?

Information that must be reported on publication 678-w typically includes taxpayer identification, income details, deductions, and any other relevant financial information required by the IRS.

Fill out your ssa 1099 2019-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Social 1099 Security is not the form you're looking for?Search for another form here.

Keywords relevant to social security ssa1099 form

Related to ssa ssa 1099 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.