ATG Form 3018-B 2023-2025 free printable template

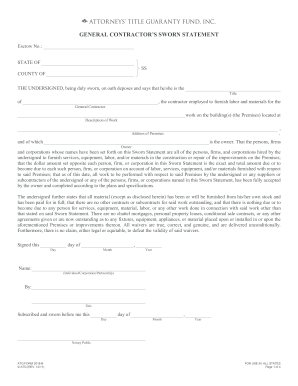

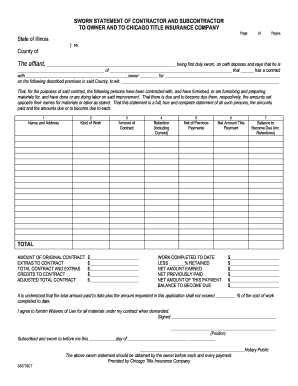

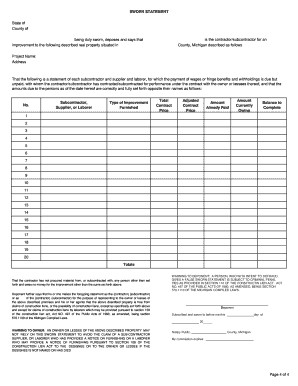

Get, Create, Make and Sign general contractors sworn statement

Editing general contractors sworn statement online

Uncompromising security for your PDF editing and eSignature needs

ATG Form 3018-B Form Versions

Instructions and Help about general contractors sworn statement

Hi my name is Alex Barth vet I'm a construction lawyer at the bar that firm today we're going to talk about four very specific traps that exist in the lien law that we see clients fall into all the time let's get started first when is your last date on the job it's important to know that punch list work and warranty work does not count as last work it has to be work that would entitle you to compensation under your contract or a change order second it's critical that you respond to requests for sworn statement of account a request for a sworn statement of account is a document that you will usually receive via certified mail that includes a warning and that warning says that if you fail to respond under oath within 30 days you will lose your lien rights and make no mistake if you don't respond timely, or you don't respond under oath you will lose your lien rights third is amending your claim of lien you can amend your lien as many times as you'd like as long as you're only amending it within the original 90 days you have to record the lien to begin with you can record your lien on day 27 amended on day 35 amended on day 89 but whatever exists as of the 90th day from your last day to work on the job that's the lien that you need to stick with throughout the course of any litigation associated with your claim finally it's important that you remember to file suit on your claim of land within the right amount of time normally you have one year from the recording date of the claim of lien however this can be shortened a notice of contest of lien is a document that you'll receive from the clerk's office via certified mail it reduces the amount of time you have to file suit down from one year from the recording date of the claim of lien to 60 days from the date that document was sent to you if you do not file suit within those 60 days you will lose your lien rights sometimes owners aren't happy with reducing it down to 60 days, and they want to reduce it even further they have a means to do that with what's called a 20 a summons to show cause unlike a notice of contest which is sent to you via certified mail a 20-day summons is in fact a lawsuit served upon you by either a process server or the sheriff in that lawsuit the summons will tell you if you don't file suit within 20 days you'll lose your lien rights and the law in this regard is very harsh you need to file a counterclaim or a separate action to foreclose within those 20 days or your lien right will automatically expire well we've covered for very specific traps that exist in Florida's lien law by no means is this list exhaustive Florida's lien law is very harsh to those who do not understand it make sure you consult your attorney to get guidance because it has more traps than it does treasures thanks for watching check out our other videos at the lien zone.com

People Also Ask about

What is sworn statement in writing made upon oath?

What is a sworn statement for a state of Illinois contractor?

How do you write a sworn statement?

What is sworn declaration?

What is a general contractor's sworn statement Illinois?

How do you write a written and sworn statement?

What is an example sworn statement?

What is sworn statement?

What is a formal sworn statement of fact?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit general contractors sworn statement in Chrome?

How do I edit general contractors sworn statement on an iOS device?

How do I complete general contractors sworn statement on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.