Get the free Non-Standardized 401(k) Profit Sharing Plan 2008 ... - Infi.biz - infi

Show details

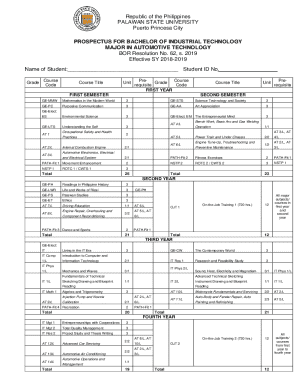

Non-Standardized 401(k) Profit Sharing Plan ADOPTION AGREEMENT FOR SOUTHWEST SECURITIES, INC. NON-STANDARDIZED 401(K) PROFIT SHARING PLAN CAUTION: Failure to properly fill out this Adoption Agreement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-standardized 401k profit sharing

Edit your non-standardized 401k profit sharing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-standardized 401k profit sharing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-standardized 401k profit sharing online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-standardized 401k profit sharing. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-standardized 401k profit sharing

How to Fill Out Non-Standardized 401k Profit Sharing:

Gather the necessary documents:

01

Obtain a copy of the non-standardized 401k profit sharing plan document from your employer or plan administrator. This document outlines the specific rules and regulations that govern the plan.

02

Review any additional forms or instructions provided by your employer or plan administrator.

Understand the plan provisions:

01

Carefully read the non-standardized 401k profit sharing plan document to familiarize yourself with the plan provisions, including eligibility requirements, contribution limits, vesting schedules, and distribution options.

02

Consult with your employer or plan administrator if you have any questions or need clarification on any aspect of the plan.

Determine your eligibility:

01

Verify if you are eligible to participate in the non-standardized 401k profit sharing plan based on the plan document's criteria, such as length of service, age, or employment status.

02

If you are unsure about your eligibility, reach out to your employer or plan administrator for guidance.

Choose your contribution amount:

01

Determine the amount you wish to contribute to the non-standardized 401k profit sharing plan.

02

Consider factors such as your financial goals, income level, and any employer matching contributions when deciding on your contribution amount.

03

Remember to stay within the limits set by the plan document and applicable tax laws.

Complete the necessary paperwork:

01

Fill out any required forms provided by your employer or plan administrator accurately and completely.

02

Include all requested information, such as your personal details, contribution amount, and chosen investment options.

03

Keep a copy of the completed forms for your records.

Submit your forms:

01

Submit the completed paperwork to your employer or plan administrator within the designated timeframe.

02

Ensure that all required signatures are obtained and the forms are delivered through the preferred method specified by your employer or plan administrator.

Review and monitor your account:

01

Regularly review your non-standardized 401k profit sharing account statements to track the progress of your contributions and investments.

02

Stay informed about any updates or changes to the plan provisions and take any necessary actions when required.

Who needs non-standardized 401k profit sharing?

01

Self-Employed Individuals: Self-employed individuals who wish to contribute a portion of their earnings to a retirement plan can benefit from a non-standardized 401k profit sharing plan.

02

Small Business Owners: Small business owners who want to offer retirement savings options for themselves and their employees, but also desire flexibility in plan design, can opt for a non-standardized 401k profit sharing plan.

03

Companies with Unique Contribution Structures: Organizations that want to customize their employer contributions based on individual employee characteristics, rather than a uniform formula, can benefit from a non-standardized 401k profit sharing plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is non-standardized 401k profit sharing?

Non-standardized 401k profit sharing refers to a type of retirement plan where the employer contributes a non-uniform percentage of profits to the plan based on individual employee compensation.

Who is required to file non-standardized 401k profit sharing?

Employers who offer non-standardized 401k profit sharing plans are required to file the necessary documentation with the IRS.

How to fill out non-standardized 401k profit sharing?

Employers must accurately report the contributions made to non-standardized 401k profit sharing plans for each eligible employee using the appropriate IRS forms.

What is the purpose of non-standardized 401k profit sharing?

The purpose of non-standardized 401k profit sharing is to provide a retirement savings vehicle for employees and allow employers to share profits with their workforce in a tax-efficient manner.

What information must be reported on non-standardized 401k profit sharing?

Information such as employee contributions, employer contributions, investment earnings, and any distributions must be reported on non-standardized 401k profit sharing documents.

How do I complete non-standardized 401k profit sharing online?

pdfFiller makes it easy to finish and sign non-standardized 401k profit sharing online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out non-standardized 401k profit sharing using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign non-standardized 401k profit sharing and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit non-standardized 401k profit sharing on an Android device?

You can make any changes to PDF files, such as non-standardized 401k profit sharing, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your non-standardized 401k profit sharing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Standardized 401k Profit Sharing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.