Get the free Independent Contractor Agreement (Form 1099)

Show details

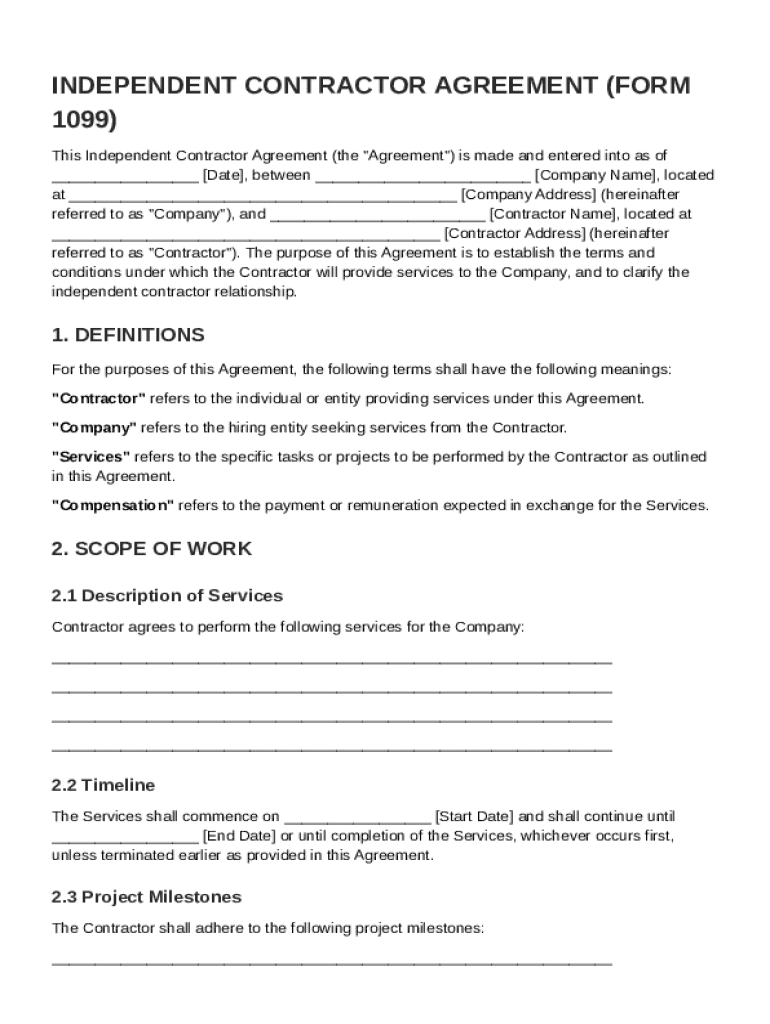

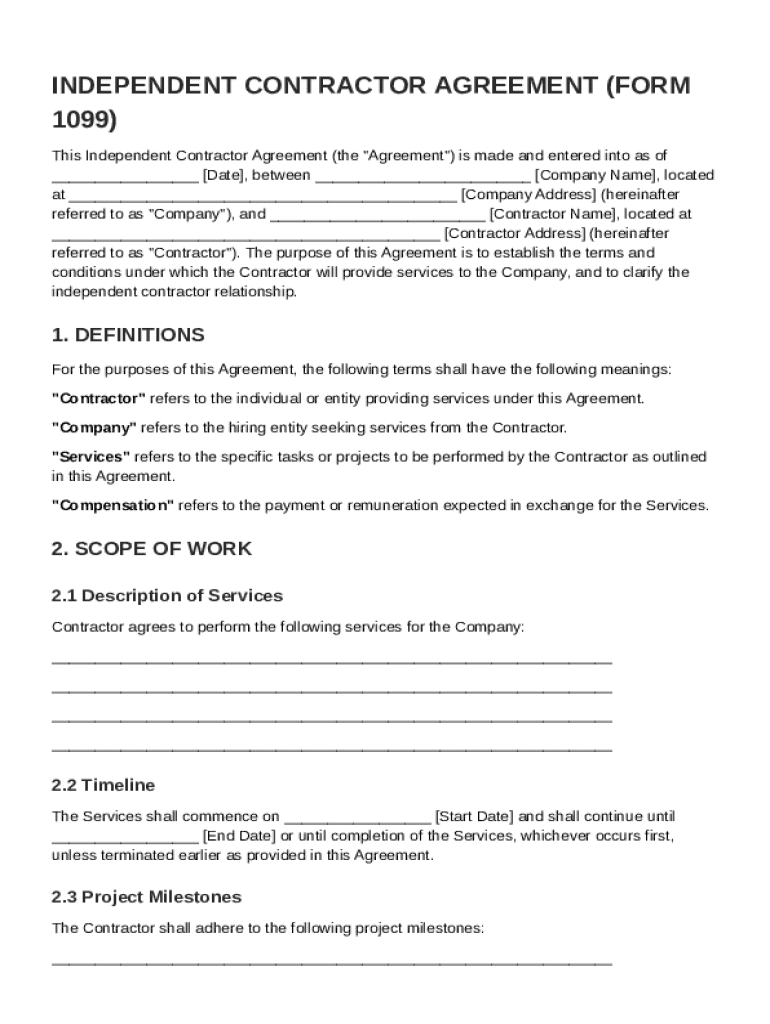

INDEPENDENT CONTRACTOR AGREEMENT (FORM 1099) This Independent Contractor Agreement (the \"Agreement\") is made and entered into as of ___ [Date], between ___ [Company Name], located at ___ [Company

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is independent contractor agreement form

An independent contractor agreement form is a legal document outlining the terms and conditions between a contractor and a client for services provided.

pdfFiller scores top ratings on review platforms

love it

easy to use and love convertion features

Easy to use!

Easy to use!!

Great system.

Great system.

good stuff

nooooo

i

dont

want

to

ok

worked for me

worked for me

Who needs independent contractor agreement form?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Independent Contractor Agreement Form on pdfFiller

How do you understand the independent contractor agreement?

An Independent Contractor Agreement is a critical document that outlines the terms and conditions between a contractor and the company hiring them. This form is essential because it defines the roles, responsibilities, and compensation in a clear and legally binding manner, safeguarding the interests of both parties.

-

The agreement formally recognizes the independent contractor's role, ensuring that there is no ambiguity regarding their status as a non-employee.

-

Understanding the differences between independent contractors and employees is crucial for compliance with labor laws and taxation.

-

Such agreements are commonly used in various scenarios, including freelance projects, consulting engagements, and when hiring specialists for short-term tasks.

What are the key components of the agreement?

Every Independent Contractor Agreement should include essential components to ensure clarity. The foundational elements, such as the date, the company name, the contractor’s name, and both parties' addresses, are crucial for identification purposes.

-

Defining key terms such as Contractor, Company, Services, and Compensation helps prevent misunderstandings.

-

It is vital to clarify the independent contractor relationship to differentiate from an Employee Agreement, which has different legal implications.

-

Including a termination clause that outlines the conditions under which the agreement may be ended is also recommended.

How do you define the scope of work?

Defining the scope of work in your Independent Contractor Agreement is essential to set clear expectations. This section should detail the services provided by the contractor, leaving little room for ambiguity.

-

Start and End Dates must be included, making it clear when the services will commence and when they are expected to conclude.

-

Projects can benefit from clearly established milestones and deliverables, helping to manage timelines and expectations effectively.

What should compensation terms include?

Compensation terms are vital for ensuring that the contractor understands how they will be paid for their services. These terms should specify the payment rate, invoicing procedures, and payment schedules.

-

Indicate the specific payment rate depending on the types of services provided to avoid confusion.

-

Clearly outline invoicing procedures, including how often invoices should be submitted and what information must be included.

-

Understanding the accepted payment methods and applicable timelines for payments aids in maintaining good relations.

What are the expense reimbursement guidelines?

Establishing guidelines for expense reimbursement is key to ensuring that the contractor is adequately compensated for any out-of-pocket costs incurred while performing their job.

-

Clearly define what qualifies as a reimbursable expense, which can create transparency and trust.

-

Detail the documentation needed for pre-approved expenses to facilitate effective processing.

-

Establishing steps to ensure timely reimbursement shows professionalism and respect for the contractor’s time.

How can you utilize pdfFiller tools for seamless agreement management?

pdfFiller offers a streamlined platform for managing your Independent Contractor Agreement effectively. Users can access, fill, and edit the form conveniently online, eliminating the need for physical document handling.

-

The eSign features allow users to finalize agreements electronically, ensuring quick and secure transactions.

-

Collaborative tools enable easy sharing and managing of documents among team members, enhancing productivity.

What compliance considerations should be made?

Compliance is an essential aspect of any Independent Contractor Agreement. Understanding regional legal considerations can help both parties remain compliant with labor laws and tax regulations.

-

Data privacy and security considerations must be addressed, especially when handling sensitive contractor information.

-

Keeping the agreement updated with current laws and regulations is important for long-term validity.

How to fill out the independent contractor agreement form

-

1.Access the independent contractor agreement form on pdfFiller.

-

2.Begin by entering the date at the top of the form.

-

3.Fill in the names and contact information of both the contractor and the client.

-

4.Define the services to be provided in detail, specifying the scope of work.

-

5.Include the payment terms, such as rate, schedule, and method of payment.

-

6.State the project timeline, including start and end dates.

-

7.Insert any confidentiality clauses relevant to the project.

-

8.Add termination conditions that outline how either party can end the agreement.

-

9.Review the form for accuracy and completeness, ensuring all sections are filled out.

-

10.Sign the document electronically, and ensure both parties receive copies for their records.

What is a 1099 contract in the USA?

A 1099 employee is an independent contractor. The name comes from Internal Revenue Service (IRS) Form 1099, which contract workers must complete to report their earnings.

Does a foreign company need to issue a 1099 to a US contractor?

1099s for US Contractors Abroad You will then use these forms to report your worldwide income on your US tax return. Foreign clients may not be required to send you a Form 1099. In that case, you will be responsible for tracking your own income so you can report it accurately on your US taxes.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.