1099 Subcontractor Agreement Template free printable template

Show details

This document outlines the agreement between a company and a subcontractor regarding the provision of services, payment terms, and confidentiality obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

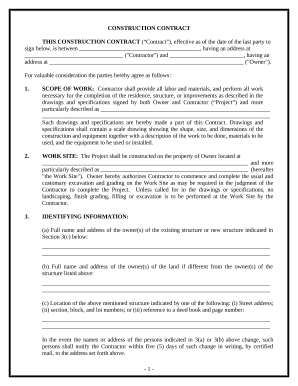

What is 1099 Subcontractor Agreement Template

A 1099 Subcontractor Agreement Template is a formal document that outlines the terms and conditions between a business and a subcontractor for services provided, ensuring compliance with tax reporting requirements.

pdfFiller scores top ratings on review platforms

Use it for photography contracts and freelancing

I am looking for a company wide solution that works for us to electronically fill out pool construction contracts and then have customers sign them and notify our accounting department of the signed contracts

My only complaint thus far is can't change text font larger or make it bold.

Very simple to use, I am not very well versed on computer lingo

Working excellently for filling out federal job application.

Its been wonderful being able to fill in forms on PDFFille

Who needs 1099 Subcontractor Agreement Template?

Explore how professionals across industries use pdfFiller.

1099 Subcontractor Agreement Guide

How to fill out a 1099 subcontractor agreement form

To fill out a 1099 Subcontractor Agreement Template form, you should start by collecting the necessary information about both parties, including names and addresses. Clearly define the scope of work and payment terms, and ensure to include signatures for verification. Utilizing platforms like pdfFiller can simplify the process by allowing you to edit the document easily.

Understanding the 1099 subcontractor agreement

A 1099 Subcontractor Agreement is a formal document that outlines the terms and conditions between a business and a freelancer or subcontractor. This agreement serves as a legal safeguard for both parties, ensuring clarity on the expectations and responsibilities involved. Having a written agreement not only protects the interests of both parties but also lays the groundwork for a professional relationship.

-

It formalizes the working relationship between a contractor and a company, detailing the nature of the work and compensation.

-

A written agreement minimizes misunderstandings and provides a reference point in case of disputes.

-

It outlines legal responsibilities, ensuring compliance with IRS regulations and protecting rights.

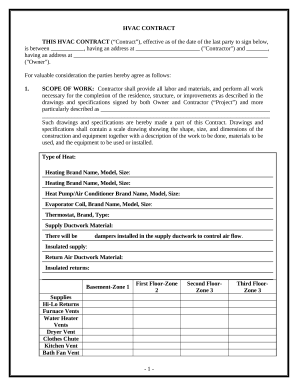

What are the key components of a subcontractor agreement?

A well-structured subcontractor agreement includes several critical components that define the working relationship. These components specify roles, services expected, payment details, and other essential terms that affect the collaboration. Clarity in these areas ensures both parties are aligned regarding expectations and responsibilities.

-

Clearly state the names of both the company and the subcontractor to avoid confusion.

-

Describe the work that the subcontractor will perform in detail to minimize ambiguity.

-

Set clear deadlines for when services and deliverables should be completed.

-

Outline how and when the subcontractor will be paid, whether hourly, per project, or in installments.

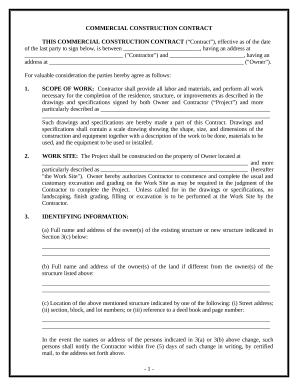

How to define roles and responsibilities?

Defining roles and responsibilities in a 1099 subcontractor agreement is crucial for project success. This ensures that both the company and subcontractor have a clear understanding of their respective duties and the expectations in terms of performance and accountability. A detailed description of tasks helps prevent scope creep and misunderstandings.

-

List specific tasks and milestones that the subcontractor is expected to complete.

-

Define the deliverables expected and the quality standards required for those deliverables.

-

Address how proprietary information will be handled and protected.

What are the compensation terms and invoicing process?

Compensation terms are a vital aspect of the 1099 subcontractor agreement, determining how the subcontractor will be paid for their services. The agreement can also outline specific invoicing processes that must be followed, ensuring both parties have a clear understanding of payment timelines and expectations.

-

Choose between hourly rates, flat fees, or project-based payments based on the nature of the work.

-

Detail how and when invoices should be submitted, including any documentation required for payment.

-

Define the expected timeline for payments after receipt of invoices, increasing transparency.

How to navigate compliance and tax considerations?

Navigating compliance and tax considerations is essential for both parties involved in a 1099 subcontractor agreement. Understanding IRS classifications and state-specific regulations helps mitigate risks associated with misclassifying workers. Proper record-keeping and tax reporting also safeguard businesses from potential penalties.

-

Ensure workers are correctly classified to comply with federal tax laws and regulations.

-

Research local laws to confirm adherence to state-specific employment rules.

-

Maintain organized records of payments made and retain copies of related contracts.

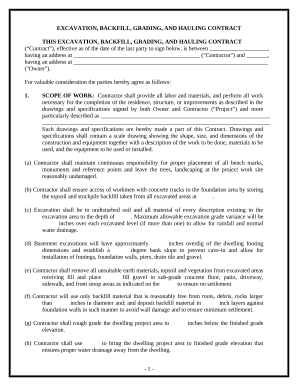

How to modify the agreement and manage termination clauses?

Modification and termination clauses provide flexibility within a subcontractor agreement. These clauses outline how the agreement can be amended and under what conditions it can be terminated. Understanding these factors can help mitigate disputes and misunderstandings over the course of the partnership.

-

Both parties should agree to any changes in writing to maintain clarity.

-

Specify valid reasons for terminating the agreement, ensuring fairness.

-

Clarify how pending work and payments will be handled upon termination.

How to utilize pdfFiller for your agreement?

pdfFiller provides an efficient platform to edit and manage your 1099 Subcontractor Agreement Template. The platform allows users to customize templates, add electronic signatures, and collaborate with team members in real-time, enhancing efficiency in document management.

-

Easily modify sections to ensure the agreement meets your specific needs.

-

Utilize e-signature options to streamline the approval process.

-

Collaborate with clients or team members directly within the platform for effective communication.

What are common mistakes to avoid?

Avoiding common pitfalls in creating a 1099 subcontractor agreement can prevent future disputes and complications. Simple oversights like neglecting to define the scope of work or misinterpreting tax obligations can lead to significant issues down the line.

-

Ensure all important points are addressed to avoid ambiguities.

-

Clearly articulate expectations to prevent overlap and dissatisfaction.

-

Stay informed about current IRS guidelines and maintain proper records.

How to fill out the 1099 Subcontractor Agreement Template

-

1.Open the 1099 Subcontractor Agreement Template in pdfFiller.

-

2.Enter the date at the top of the document to denote when the agreement is made.

-

3.Fill in the name and contact information of the business on the first line.

-

4.Provide the name and contact information of the subcontractor below the business information.

-

5.Specify the services the subcontractor will provide in the designated section.

-

6.Clearly outline the payment terms, including the amount and payment schedule.

-

7.Add any additional clauses or terms that are relevant to the specific work arrangement.

-

8.Review the entire document for accuracy and completeness before finalizing it.

-

9.Save and download the completed agreement for both parties to sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.