Account Agreement Template free printable template

Show details

This document outlines the terms and conditions for maintaining an account with the Provider, including account opening, maintenance, access, and dispute resolution processes.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Account Agreement Template

An Account Agreement Template is a formal document that outlines the terms and conditions governing the use of an account between a financial institution and the account holder.

pdfFiller scores top ratings on review platforms

I think the service is great, but the new additional login feature is a bit cumbersome

Very helpful in creating, editing and completing forms.

This is my first time using PDF filler. So far I think it is easy to understand and easy to use.

It's great so far! Except how do I change my email address? Thank you!

Makes completing form much easier. Allows more time to work on other project.s

Very good. Quick start up--easy to use. But, I do need some instruction on how to better edit documents.

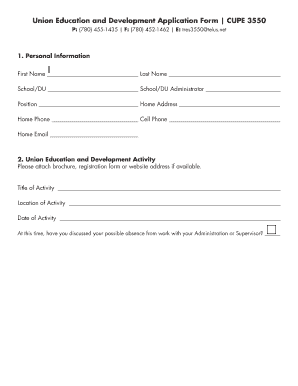

Who needs Account Agreement Template?

Explore how professionals across industries use pdfFiller.

Account Agreement Template on pdfFiller

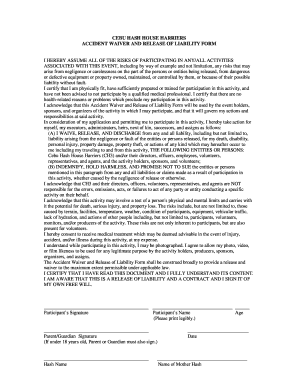

How to fill out an account agreement template form

To fill out an Account Agreement Template form, first gather all necessary identification and documentation. Then, use pdfFiller's editing tools to complete the template. Finally, review the document carefully before eSigning and submitting it.

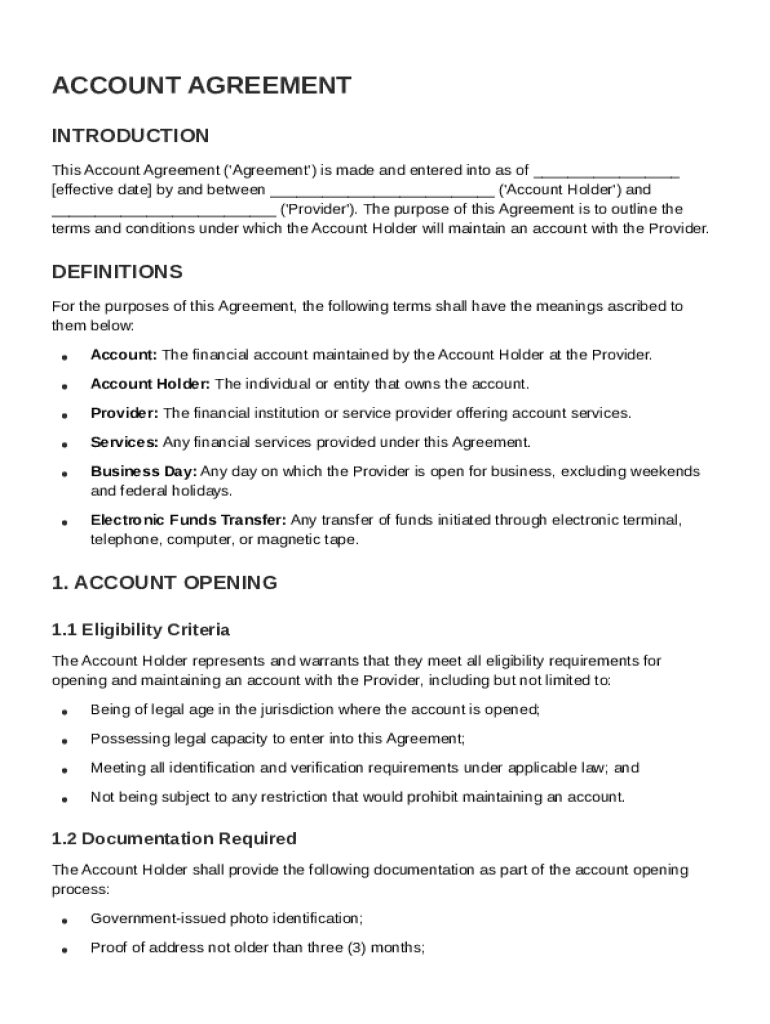

Understanding the Account Agreement

An Account Agreement is a legally binding document outlining the relationship between an account holder and a financial service provider. It serves to establish the rights, responsibilities, and services available to both parties. Clarity in these terms is crucial as it protects the interests of each party involved.

-

It specifies the expectations and commitments from both the account holder and the provider.

-

The main parties in the agreement are the account holder, who utilizes services, and the provider, who offers those services.

-

Clearly defined terms help prevent misunderstandings and provide legal protection if disputes arise.

What are the core definitions within the agreement?

Understanding specific terminology in the account agreement helps users navigate its complexities. Here are essential terms to know:

-

A record that tracks all transactions, balances, and services linked to the account holder.

-

Eligibility criteria typically vary, but it includes individuals or entities of legal age with capacity to enter into a contract.

-

Financial institutions that cater to account holders by offering services like transfers, savings, and loans.

-

Account services can range from basic banking functions to advanced investment options.

-

Any day that is not a weekend or public holiday when the provider conducts business operations.

-

Methods of electronically transferring funds, such as wire transfers or direct deposits.

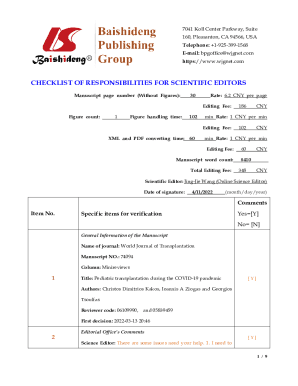

What are the eligibility criteria for opening an account?

Before applying for an account, potential holders must meet specific eligibility criteria, ensuring they can responsibly manage the account.

-

Applicants must usually be of legal age and demonstrate the capacity to engage in a contract.

-

Commonly needed documents include government-issued identification, proof of address, and possibly social security numbers.

-

Regions may impose unique regulations, and applicants must be aware of local laws to ensure compliance.

How do navigate the account opening process?

The process of opening an account involves several key steps that applicants must follow to ensure successful completion.

-

The journey begins with filling out the application, followed by submission and awaited confirmation of approval.

-

Ensure all required documents accompany the application to prevent any delays.

-

Most accounts require an initial deposit; be prepared to meet this requirement when opening the account.

How can pdfFiller streamline document workflow?

Using pdfFiller can significantly simplify the entire process of creating and managing your account agreement template.

-

Easily modify your account agreement template to suit your specific needs using pdfFiller's user-friendly editing tools.

-

Enjoy the convenience and security of digitally signing your agreements, making the entire process quicker and more efficient.

-

Utilize features designed for team collaboration, allowing multiple users to work on the document simultaneously for improved workflow.

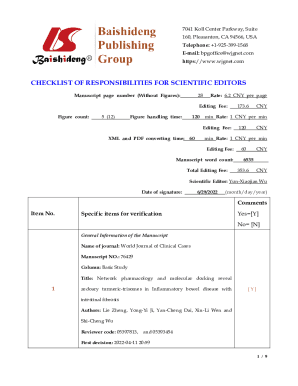

How to fill out the Account Agreement Template

-

1.Visit the pdfFiller website and log in to your account or create a new one.

-

2.Search for 'Account Agreement Template' in the template library.

-

3.Select the desired template and click 'Fill Now' to open it in the editor.

-

4.Carefully read through the agreement to understand its terms before filling it out.

-

5.Begin by entering the account holder's personal information, including name, address, and contact details in the designated fields.

-

6.Provide information about the account type, such as savings, checking, or business account.

-

7.Fill in any required identification numbers or accounts numbers as specified in the template.

-

8.Review the terms and conditions sections and ensure you agree with them by signing where required.

-

9.Double-check all entered information for accuracy and completeness before submission.

-

10.Once done, save your changes, then either print it for your records or email it directly to the relevant parties.

What is an account agreement?

An account agreement is a formal contract defining the terms and conditions of a bank serving as a securities mediator between a borrower and the financial institution. Throughout the term of the agreement, the bank keeps the borrower's securities and deposits.

How do you write a simple agreement?

How to write an agreement letter Title your document. Provide your personal information and the date. Include the recipient's information. Address the recipient and write your introductory paragraph. Write a detailed body. Conclude your letter with a paragraph, closing remarks, and a signature. Sign your letter.

What are the four types of agreements?

The four common types of contracts are express, implied, unilateral, and bilateral. Express and implied contracts are based on how they are formed, while unilateral and bilateral contracts are classified by the nature of consideration exchanged between the parties.

How to write a user agreement?

What to Include in a User Agreement? Introduction. Registration, Termination, Security of Accounts. Intellectual Property Rights. Acceptable Use and User Restrictions. User-Generated Content. Conditions of Sale. Limitations of Liability. Dispute Resolution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.