Accounting Firm Partnership Agreement Template free printable template

Show details

This document is a partnership agreement for accounting firms, outlining the terms, conditions, rights, and obligations of the partners involved. It includes sections on formation, capital contributions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

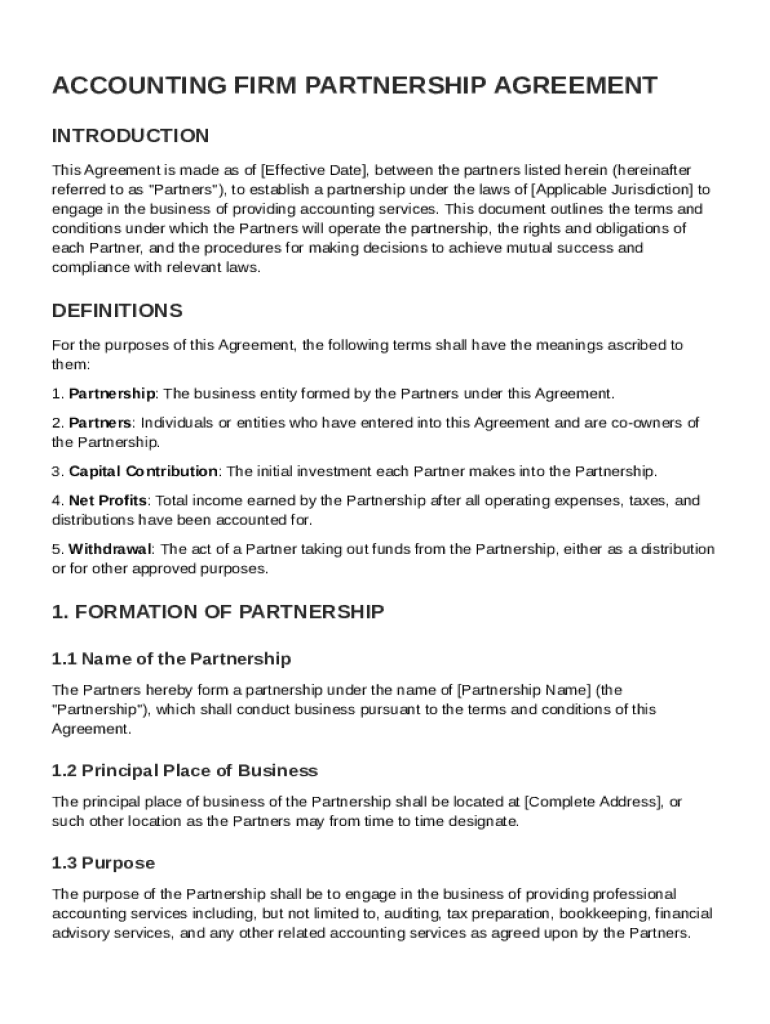

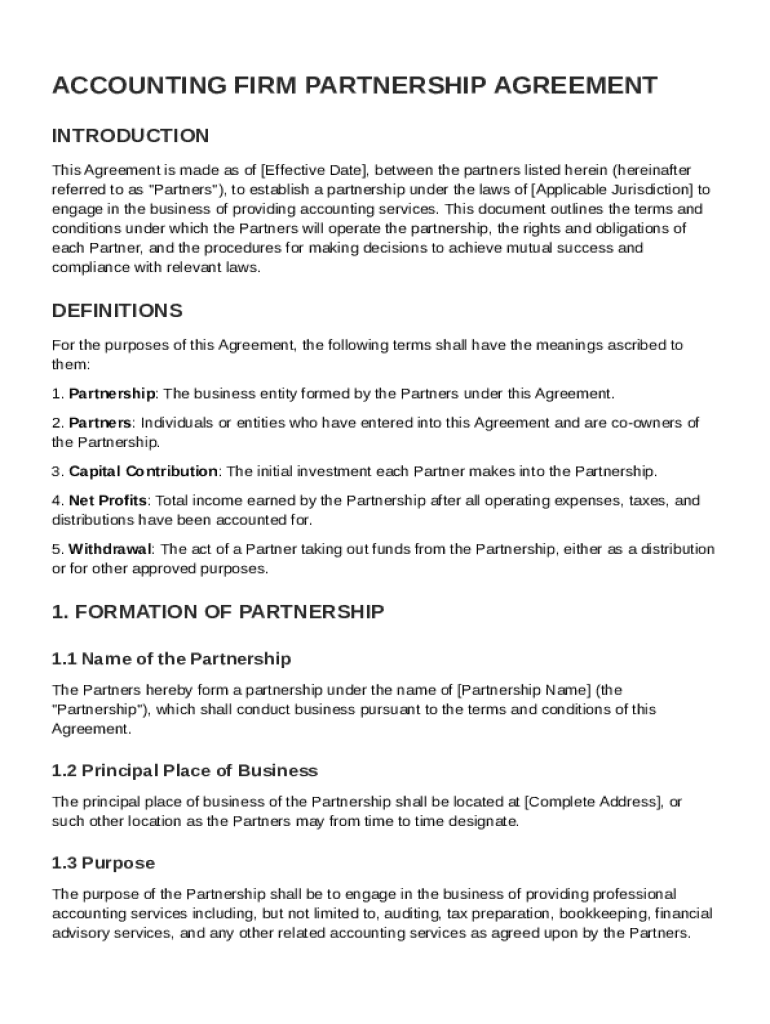

What is Accounting Firm Partnership Agreement Template

An Accounting Firm Partnership Agreement Template is a legal document that outlines the terms and conditions of a partnership between accounting firms.

pdfFiller scores top ratings on review platforms

very easy to use// efficient.

maybe making more clear the necessity to enroll in order to use it.

I love PDFfiller. Its a great service for editing, filling out forms, signing contracts. I don't know how I went without it for so long.

I have had nothing but and outstanding experience with PDFfiller.

frustrating at first but when I got the hang of things a piece of cake

I was immediately asssited and my question was answered. Thank you.

It solved a problem with PDF applications that didn't allow for information to be saved. Once I figured it out, it works well.

Who needs Accounting Firm Partnership Agreement Template?

Explore how professionals across industries use pdfFiller.

A complete guide to accounting firm partnership agreements

How to fill out an accounting firm partnership agreement form

Filling out an accounting firm partnership agreement form involves gathering necessary information, including partner details and contributions, while ensuring compliance with local regulations. Utilize templates available at pdfFiller to streamline the editing process, incorporate eSignatures for approval, and manage document versions effectively.

What is a partnership agreement?

A partnership agreement is a legally binding document outlining the rights and responsibilities of partners within a business. For accounting firms, this document is paramount as it defines each partner's role, profit-sharing structure, and operational procedures, thus ensuring clarity and reducing potential conflicts.

Why is a partnership agreement important in accounting firms?

Having a partnership agreement is crucial in accounting firms to establish clear expectations and responsibilities. It not only guides daily operations but also helps in decision-making and conflict resolution, safeguarding the interests of all partners involved.

Common misconceptions about partnership agreements

-

Many believe that partnership agreements are only necessary for large firms. However, even small firms benefit from having a structured agreement.

-

Some think that verbal agreements suffice. A written partnership agreement is essential for legal protection and clarity.

-

It's often assumed that these agreements are permanent. In reality, they should be reviewed and amended as the business evolves.

What are the key components of an accounting firm partnership agreement?

-

Clearly listing the names of all individuals entering into the partnership provides legal identification of each party.

-

The date when the agreement comes into effect helps establish the timeline of partnership terms.

-

Defining the legal structure (e.g., LLP) and relevant jurisdictions ensures compliance with local laws.

-

Detailing each partner's financial investment clarifies ownership stakes and responsibilities.

-

This section outlines how profits and losses will be shared among partners, crucial for financial management.

-

Establishing procedures for partners wishing to leave the agreement protects the business's stability.

What types of partnership agreements exist for accounting firms?

-

All partners share equal responsibility and liability, making business management straightforward but risky.

-

Includes both general and limited partners, where limited partners have reduced liability based on their investment.

-

Protects partners from personal liability for certain business debts, ensuring greater security.

-

When involving real estate, specific clauses must address property management and investment returns.

How do you draft your partnership agreement?

-

Gather essential details about each partner's roles and contributions to create a comprehensive agreement.

-

Select a format that is easy to read and edit, enhancing understanding and accessibility.

-

Ensure clarity by describing sections thoroughly and addressing all partners' concerns.

-

Consult legal resources or advisors to ensure the document meets all regulatory standards.

-

Openly discussing terms with partners can facilitate better understanding and avoid future disputes.

How to fill out the accounting firm partnership agreement form

-

Navigate to pdfFiller to find a ready-to-use partnership agreement template tailored for accounting firms.

-

Use pdfFiller's interactive tools to adjust terms and conditions to fit your partnership needs.

-

Incorporate eSignature functionality for a secure and legally binding signature process.

-

Keep track of document revisions to maintain an updated partnership agreement as conditions change.

-

Allow multiple partners to collaborate on the document simultaneously, ensuring everyone's input is included.

How to manage your partnership post-formation?

-

Schedule regular meetings to discuss operations and important decisions, fostering transparent communication.

-

Establish a clear method for dispute resolution in the partnership agreement to mitigate conflicts.

-

Review and amend the partnership agreement periodically to reflect changes in business dynamics.

-

When dissolving a partnership, ensure compliance with legal obligations regarding asset distribution and liabilities.

What compliance and legal considerations should be addressed?

-

Familiarize yourself with accounting laws and regulations affecting partnership operations in your jurisdiction.

-

Ensure that the partnership adheres to professional standards and ethics within the accounting industry.

-

Being aware of tax liabilities and deductions can optimize financial outcomes for partners.

-

Evaluate the need for insurance to protect partners from potential mishaps or claims related to their work.

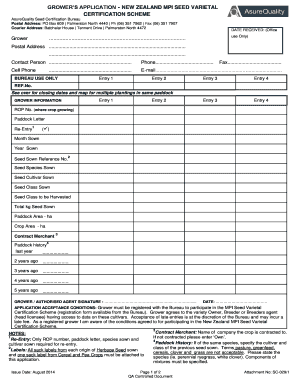

How to fill out the Accounting Firm Partnership Agreement Template

-

1.Download the Accounting Firm Partnership Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Start by entering the name of the partnership at the top of the document.

-

4.Fill in the names and addresses of all partners involved.

-

5.Specify the nature of the partnership and its purpose in the designated section.

-

6.Detail the capital contributions each partner will make to the business.

-

7.Outline the distribution of profits and losses among the partners.

-

8.Include clauses on decision-making processes, responsibilities, and duties of each partner.

-

9.Add sections for dispute resolution and termination of the partnership if necessary.

-

10.Review all information for accuracy before finalizing the document.

-

11.Save your filled template and consider printing it for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.