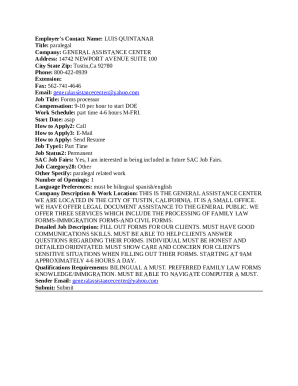

Assignment of Debt Agreement Template free printable template

Show details

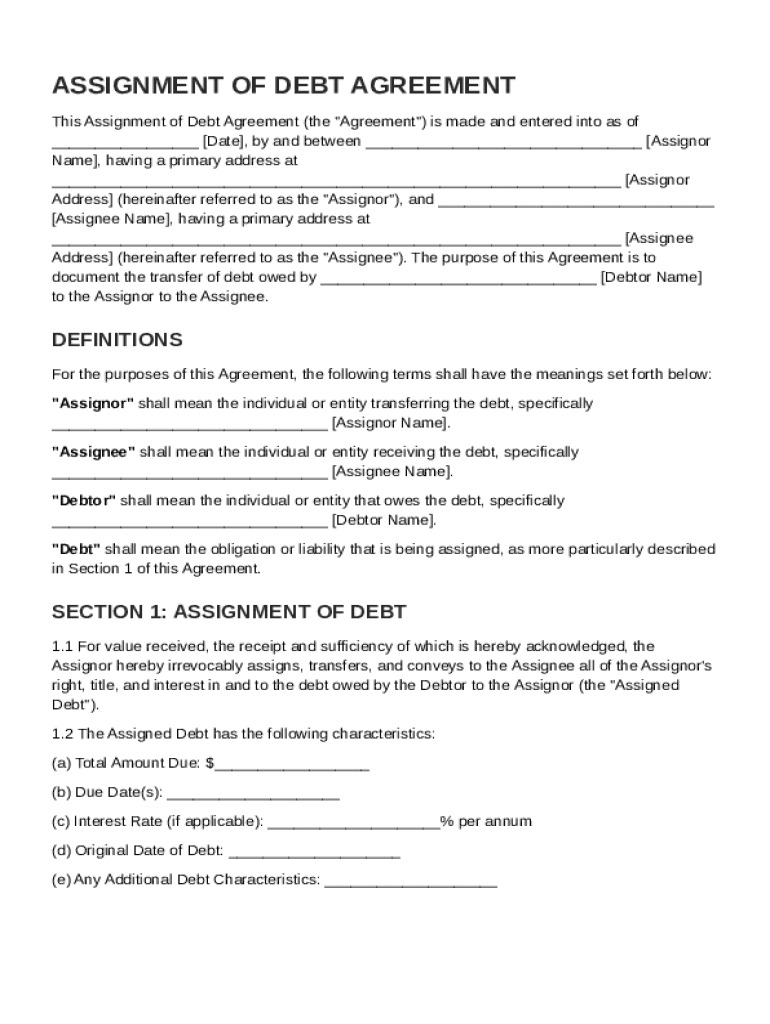

This document serves to formally assign a debt from the Assignor to the Assignee, detailing the rights, responsibilities, and terms involved in the transfer of the debt owed by the Debtor.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Assignment of Debt Agreement Template

An Assignment of Debt Agreement Template is a legal document that outlines the transfer of a debt obligation from one party to another.

pdfFiller scores top ratings on review platforms

easy to use BUT take time to learn more how to fill the various form.

Good experience so far, but just started using.

works well. not many ways to fill a pdf.

I find the little post notes that follow you through forms somewhat annoying. can they be turned off

I really like it so far. The snap to grid text editing is fantastic. The cloud options and email sync are perfect. Nice job. The UI is almost exactly like my Neat scanner software so it's very intuitive.

Started using a day ago and so far it is great!!

Who needs Assignment of Debt Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Assignment of Debt Agreement Template

How to fill out an Assignment of Debt Agreement form?

Filling out an Assignment of Debt Agreement involves understanding each section of the form and accurately providing necessary details. Begin by clearly identifying the key parties: the assignor, assignee, and debtor. Next, detail the financial obligations being transferred, including due amounts and dates.

What is the assignment of debt agreement?

An assignment of debt agreement is a legal document used to transfer a debtor's obligations from one creditor (assignor) to another (assignee). This agreement is crucial in managing debt relationships and ensuring the legitimacy of the transaction.

-

Definition of a Debt Assignment Agreement: It is a contract where the assignor transfers their rights to receive payment from a debtor to the assignee.

-

Purpose and importance: It formalizes the transfer of debt and safeguards the interests of all parties, ensuring that the new creditor can enforce payment.

-

Key parties involved: The assignor (original creditor), assignee (new creditor), and debtor (the party responsible for repayment).

What are the key components of the assignment agreement?

The assignment agreement contains several crucial sections that outline the details of the debt transfer. Every aspect should be clearly detailed to avoid any potential disputes.

-

Date: Indicates when the agreement is effective.

-

Assignor Name: The name of the original creditor transferring the debt.

-

Assignee Name: The name of the new creditor receiving the rights to the debt.

-

Debtor Name: The individual or entity responsible for fulfilling the debt obligations.

-

Financial details: This includes the total amount due, due dates, and interest rates applicable to the agreement.

-

Standard representations and warranties: Additional assurances made by the assignor regarding the legitimacy of the debt and their authority to assign it.

How do you fill out the assignment of debt agreement?

To properly fill out the Assignment of Debt Agreement, it's essential to follow a systematic approach, ensuring accuracy at every step.

-

Step-by-step instructions: Begin by entering the date at the top of the form, followed by the names of the assignor and assignee.

-

Include debtor information: Ensure that the details are accurate and complete.

-

Financial details: Clearly outline the total amount due and conditions related to repayment, including interest rates.

-

Use interactive tools: Consider using platforms like pdfFiller for an easier and streamlined process.

-

Review: Double-check all information before finalizing the agreement to avoid mistakes.

What are the legal considerations in debt assignments?

Engaging in debt assignments involves various legal considerations that must be managed to ensure compliance and avoid disputes. Legal counsel is often necessary for navigating these complexities.

-

Compliance requirements: Specific regulations vary based on the region, which may dictate how debt assignments should be structured.

-

Potential legal pitfalls: Awareness of common issues, such as failing to obtain consent from the debtor or misunderstandings regarding the terms of the assignment.

-

Importance of legal counsel: Professional advice can facilitate negotiations and preparation of terms that comply with local laws.

How can pdfFiller help with assignment of debt agreement management?

pdfFiller offers a robust suite of tools designed to streamline the assignment of debt agreement process. By utilizing these features, users can enhance their document management experience significantly.

-

Document editing and eSigning: Easily modify existing documents and provide electronic signatures, making the process more efficient.

-

Collaboration tools: Utilize features that allow teamwork and communication around the agreement, ensuring all parties are informed.

-

Cloud-based management: Storing documents in the cloud offers accessibility and security, providing peace of mind regarding sensitive information.

What common questions arise about debt assignment agreements?

Debt assignment agreements can lead to numerous queries from individuals and businesses alike. Understanding common concerns can clarify the process.

-

How do I know if I can assign my debt? Understanding the terms of your contract and your rights as a creditor.

-

What happens if the debtor refuses the assignment? Typically, assignments are valid even without the debtor's consent, unless stated otherwise in the agreement.

-

Are there fees associated with debt assignments? Depending on the jurisdiction and specifics of the assignment, there may be administrative fees.

-

How is an assignment legally enforced? Generally, enforcement may involve notifying the debtor and ensuring they are aware of the new creditor.

-

Can I reverse a debt assignment? Once executed, reversing an assignment can be complex and typically requires the consent of all parties involved.

How to fill out the Assignment of Debt Agreement Template

-

1.Download the Assignment of Debt Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by entering the date at the top of the document.

-

4.Input the name and contact details of the Assignor (the original creditor) and the Assignee (the new creditor).

-

5.Clearly state the amount of debt being assigned.

-

6.Include the original debt agreement details for clarity, such as reference number and terms.

-

7.Add any conditions or stipulations related to the assignment of the debt if necessary.

-

8.Review the document for accuracy and completeness.

-

9.Sign the agreement as the Assignor; the Assignee should also sign for acknowledgement.

-

10.Save the completed document, and consider sending copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.