B2B Loan Agreement Template free printable template

Show details

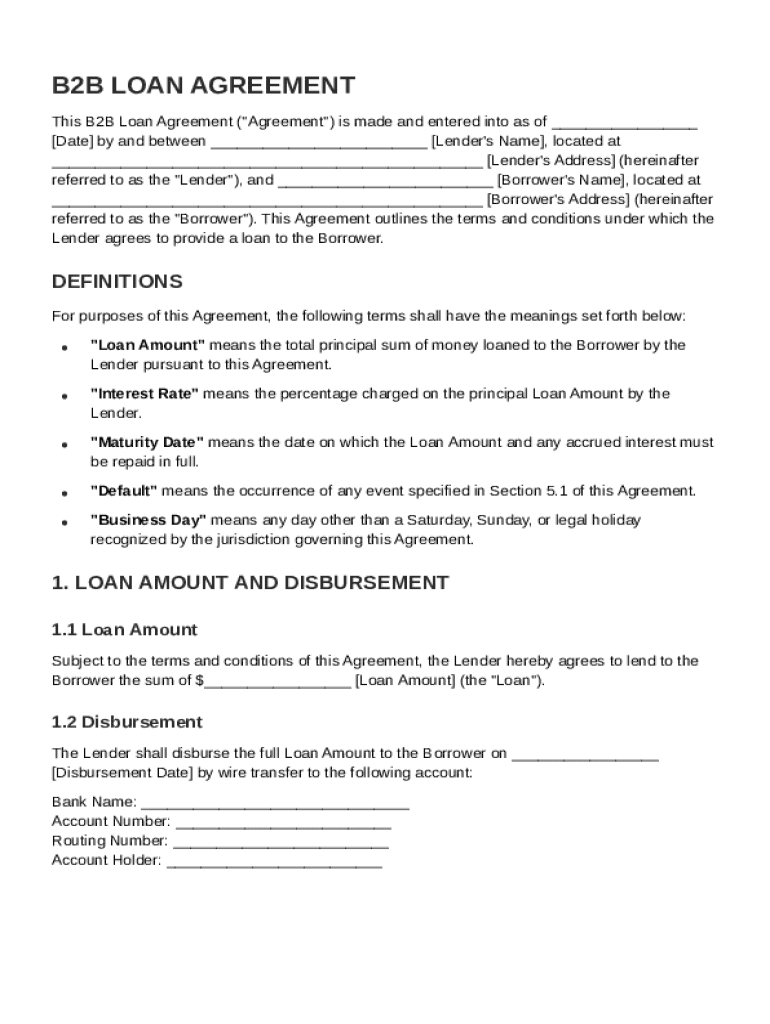

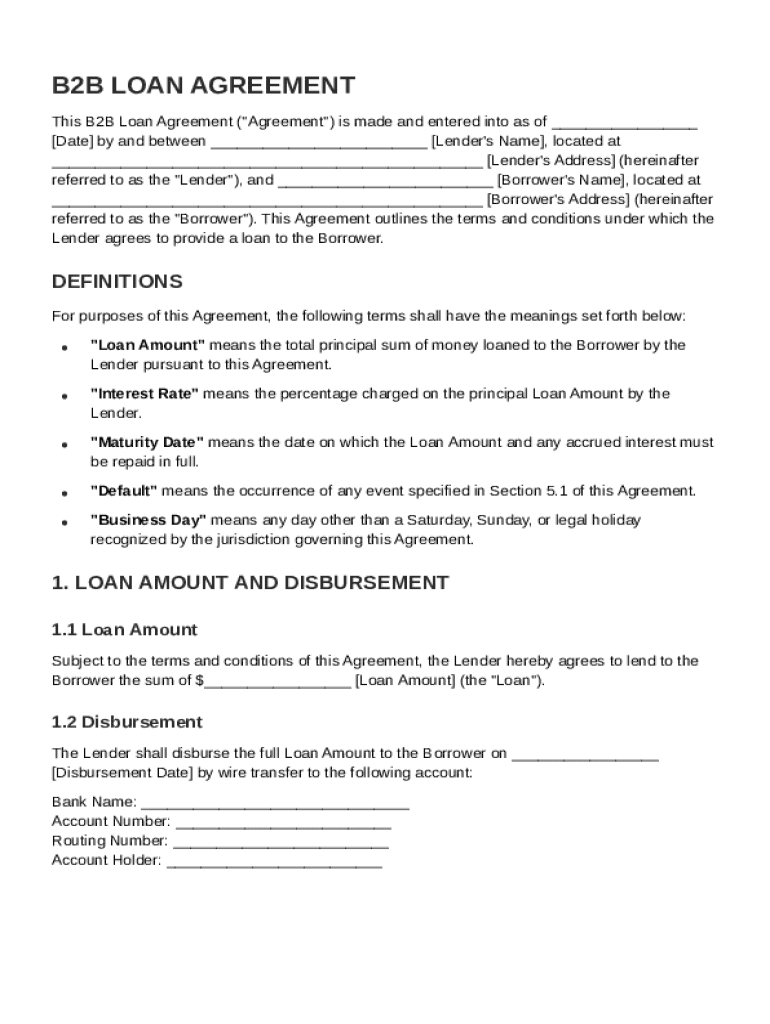

This document outlines the terms and conditions under which the Lender agrees to provide a loan to the Borrower, including loan amount, interest rate, repayment terms, and events of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is B2B Loan Agreement Template

A B2B Loan Agreement Template is a pre-formatted document that outlines the terms and conditions of a loan between two businesses.

pdfFiller scores top ratings on review platforms

It took me a second or two to figure it out. now it's good.

I am just beginning to use... happy to answer when I learn more.

Brilliant! Easy to use. Fast. Highly recommend

The features are very nice, however I would like a demo on navigation.

wonderful service. have all the forms I need and very easy to use

Very surprised how easy it was to start completing a form once I had registered - will use all the time in future!

Who needs B2B Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to create a B2B Loan Agreement Template form

How does a B2B Loan Agreement function?

A B2B loan agreement serves as a formal document detailing the terms of a loan between businesses. Its significance lies in providing clear expectations for both the lender and borrower, ensuring accountability and minimizing risks associated with financial transactions. Several scenarios such as securing funds for inventory purchases or equipment financing often necessitate B2B loans.

What are the key components of a B2B Loan Agreement?

-

Clearly define who is lending and who is borrowing, including the legal names and business structures of each party.

-

These fundamental components outline the financial aspects, ensuring both parties understand the total amount borrowed, how much interest will be charged, and the timeline for repayments.

-

Specify what constitutes a default, the consequences, and the set maturity date for the loan term to provide clarity.

How to draft your B2B Loan Agreement: A step-by-step guide

Creating an effective B2B loan agreement involves careful consideration of various elements. Start by setting the effective date, then proceed to identify the loan amount and payment terms relevant to the transaction.

-

Evaluate whether a fixed or variable interest rate best serves the interests of both parties, considering market trends.

-

Ensure compliance with local laws and regulations to mitigate legal risks, making legal considerations clear within the document.

-

Finalize the agreement with authorized signatures to validate the document, often facilitated using an eSignature solution.

Where can you find a sample template for a B2B Loan Agreement?

pdfFiller offers an editable PDF template for a B2B loan agreement designed to streamline the process of agreement creation. This template includes customizable fields to input essential information such as the lender's name, borrower's name, and loan amount.

-

Utilize a ready-made template that you can adapt to your specific needs, ensuring you don't overlook essential details.

-

Each field in the template guides you to include pertinent details crucial for clarity in the agreement.

-

Leverage pdfFiller's features to edit, eSign, and store your B2B loan agreement securely without hassle.

How to manage your B2B Loan Agreement effectively?

Effective management of your B2B loan agreement ensures smooth transactions and mitigates disputes. Best practices include maintaining organized document storage for easy retrieval and tracking loan repayments meticulously.

-

Utilize cloud-based solutions to keep your agreements easily accessible while securing sensitive data.

-

Make use of the eSignature option in pdfFiller to facilitate quick and secure signing processes for all involved parties.

-

Implement tracking systems within your financial software to alert you to upcoming payments and potential need for amendments.

What common pitfalls in business loan agreements should you avoid?

Identifying common pitfalls in business loan agreements can help prevent costly errors. A frequent mistake is overlooking default clauses, which can create significant complications down the line.

-

Not specifying consequences for default can put the lender at risk, creating ambiguity in the agreement.

-

Ensure clarity on how interest is calculated, whether it’s simple or compound, to avoid surprises over time.

-

Vagueness in repayment terms can lead to misunderstandings, highlighting the need for explicit loan schedules.

How to fill out the B2B Loan Agreement Template

-

1.Download the B2B Loan Agreement Template from pdfFiller.

-

2.Open the document using the pdfFiller application.

-

3.Start by entering the date of the agreement at the top of the template.

-

4.Fill in the names and addresses of the borrower and lender in the designated fields.

-

5.Specify the loan amount clearly, including currency, in the appropriate section.

-

6.Detail the interest rate applicable to the loan and any fees associated with the borrowing.

-

7.Outline the repayment schedule, including the start date and the duration of the loan.

-

8.Include any collateral or guarantees if applicable, detailing what is being secured against the loan.

-

9.Review all entered information for accuracy and completeness before finalizing.

-

10.Save the filled document and choose whether to email, print, or share it with the involved parties.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

What is a contract to repay borrowed money?

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according to the terms).

How do you write a loan agreement between two people?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What is the document of a personal loan agreement?

Information included on personal loan agreements include the names of both parties, the date of the agreement, the principal loan amount, the interest rate, and repayment terms. Personal loan agreements can be used as evidence in court if you fail to make payments.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.