Bank of Mum and Dad Lending Agreement free printable template

Show details

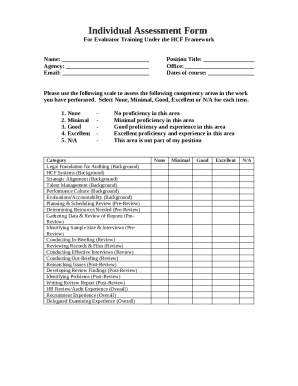

This document outlines the terms and conditions of a loan agreement between family members, specifically between a lender (parent/guardian) and a borrower (child/relation). It includes details on

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

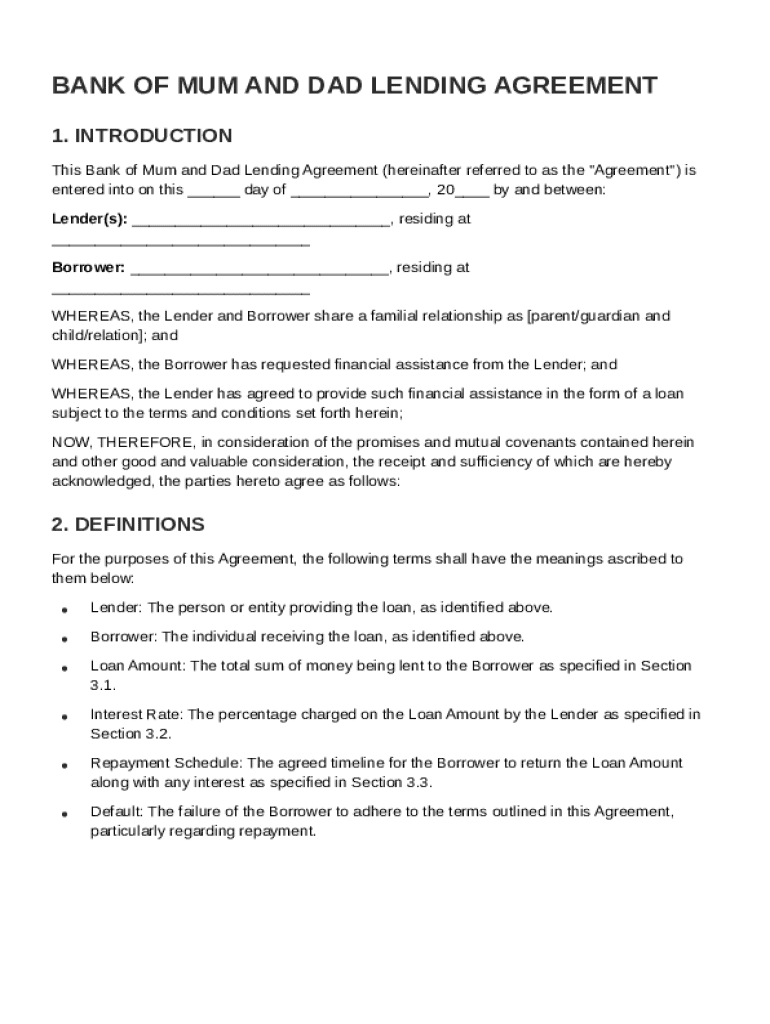

What is Bank of Mum and Dad Lending Agreement

A Bank of Mum and Dad Lending Agreement is a legal document outlining the terms of a loan made by parents to their children for purposes such as purchasing a home or financing education.

pdfFiller scores top ratings on review platforms

Very impressed with responsiveness of…

Very impressed with responsiveness of customer service!

Live support Chat

i had a issue with my suscription an they resoved my issue.

Sam was absolutely awesome

Sam was absolutely awesome! i explained my issue and needless to say i had been trying to figure this out all day and within 5 mins Sam had me on the right path. His excellent customer service and knowledge was a winning combination. Sam is definitely an asset to this companyRhonda W

Great idea

Great idea. I'm glad this exist.

It was easy and convenient for quick access

Fairly easy to use with a bit of an initial learning curve.

Who needs Bank of Mum and Dad Lending Agreement?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the Bank of Mum and Dad lending agreement

TL;DR: To fill out a Bank of Mum and Dad lending agreement form, define the loan amount, establish repayment terms, and clarify the roles of the lender and borrower. This ensures clarity and understanding between family members involved in the transaction.

What is a lending agreement between family members?

A Bank of Mum and Dad lending agreement is a formal document that outlines the terms of a loan made by a family member to another. Understanding the importance of such an agreement is critical, especially when financial assistance is involved. It helps to minimize misunderstandings and establishes clear expectations for both parties. Recent socioeconomic shifts, particularly due to events such as COVID-19, have led to an increase in family lending as individuals seek to achieve home ownership.

Who are the key parties involved in the agreement?

In a Bank of Mum and Dad lending agreement, the key parties are the lender and the borrower. The lender is typically a family member who provides financial support, while the borrower is the family member receiving the loan. Clarity regarding each party's roles and expectations is pivotal to avoid disputes. Additionally, when extended family members are involved, it’s important to consider how each party’s relationship may affect the agreement.

What essential components should be included in the agreement?

Several critical components must be included in a lending agreement to ensure its effectiveness:

-

It is vital to specify the exact loan amount. This not only defines the financial obligation but also clarifies what specific expenses the loan is meant to cover, such as home purchasing costs.

-

Deciding whether to impose an interest rate is essential in a family loan. If applicable, optional clauses regarding interest rates can significantly influence repayment and financial planning.

-

A clearly laid out repayment schedule helps avoid potential misunderstandings between family members. Examples include setting a timeline for monthly installments or arranging for a single lump-sum payment.

What are the pros and cons of family lending?

Family lending offers distinct advantages and disadvantages from both the lender's and borrower's perspectives.

-

Lending money to a family member can help them achieve home ownership faster. However, lenders should consider the emotional and financial risks involved, such as strained relationships in case of repayment issues.

-

Borrowers often benefit from lower interest rates or favorable repayment terms compared to traditional loans. However, failing to honor these terms can lead to significant stress on family relationships.

-

Both parties must balance the act of providing financial aid with the nuances of family dynamics. Having open communication and setting healthy boundaries is necessary for a successful lending experience.

How to create a formal lending agreement?

Creating a lending agreement doesn’t have to be a complex task. With tools from pdfFiller, you can draft, edit, and customize the agreement according to specific needs.

-

Follow the instructions on how to draft your agreement securely and effectively using the pdfFiller platform, which provides interactive features for easy collaboration.

-

Using pdfFiller’s templates, you can edit specific clauses to meet your requirements while ensuring that you cover all necessary aspects.

What important legal considerations should you keep in mind?

Drafting a lending agreement also involves understanding the local regulatory framework. Certain regulatory requirements must be adhered to when formalizing family loans, ensuring compliance with applicable laws.

-

Both lenders and borrowers may face tax liabilities depending on the loan structure and amount. It is crucial to address these potential tax implications in the agreement.

-

Ensure that all terms included in the agreement comply with local laws and regulations to avoid future disputes.

How to fill out the Bank of Mum and Dad Lending Agreement

-

1.Begin by downloading the Bank of Mum and Dad Lending Agreement form from pdfFiller.

-

2.Open the PDF in pdfFiller's editing platform.

-

3.Fill in the names and addresses of both the lender (parent) and borrower (child) at the top of the document.

-

4.Specify the loan amount and the purpose for which the loan is being given.

-

5.Outline the repayment terms, including due dates and amounts, ensuring clarity on interest rates if applicable.

-

6.Detail any collateral involved in the loan agreement, if relevant.

-

7.Include a section for signatures, where both parties will agree to the terms outlined in the document.

-

8.Finally, save the completed document, and consider printing copies for both parties to retain for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.