Bank of Mum and Dad Loan Agreement free printable template

Show details

This document outlines the terms and conditions under which a loan is provided by parents to their children, including details about loan amount, interest rate, term, repayment schedule, and default

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Bank of Mum and Dad Loan Agreement

The Bank of Mum and Dad Loan Agreement is a legal document outlining the terms and conditions of a loan provided by parents to their children for purposes such as buying a home or financing education.

pdfFiller scores top ratings on review platforms

This app has helped in so many ways. Great to have.

So far my experience has been limited but I do appreciate the ability to fill in forms created in PDF format and being able to send and save them.

you guys are the best and are making my jobs easier, thank you a lot what a great product and the trial is going to make me subscribe to the product which proves if you are confident in your product you don't have to scam people into signing up for it.

It' a good way to get things done, and user friendly.

Love it, I would love to have a cut and paste ability

i can appreciate your easy access to changing pdf's

Who needs Bank of Mum and Dad Loan Agreement?

Explore how professionals across industries use pdfFiller.

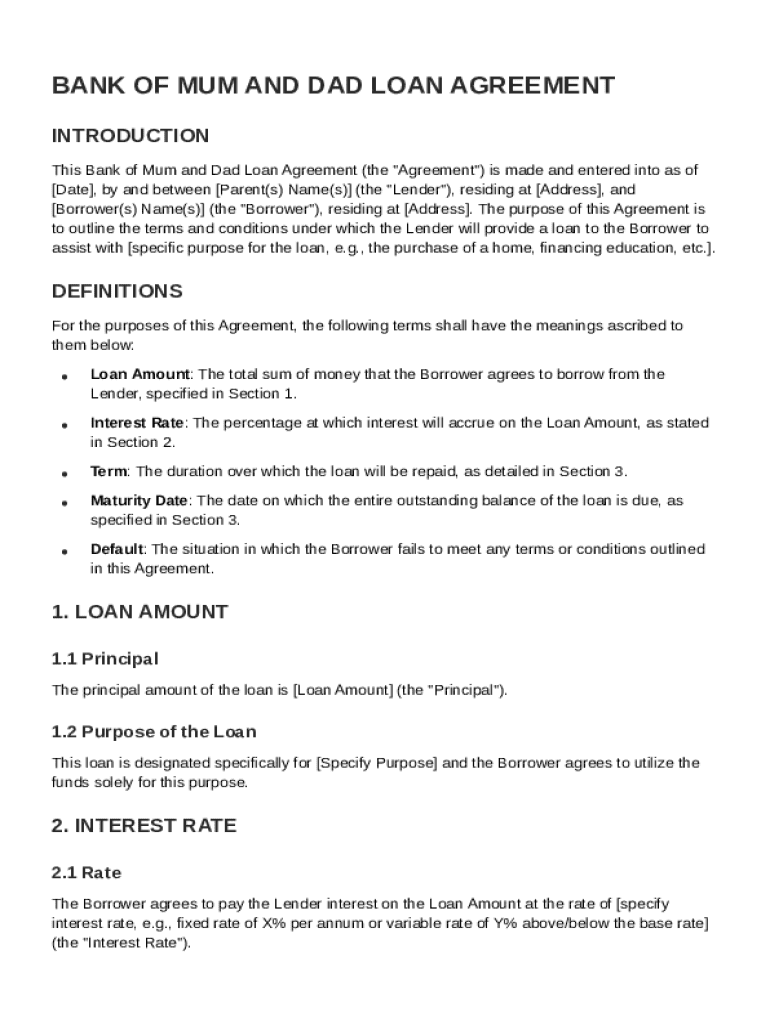

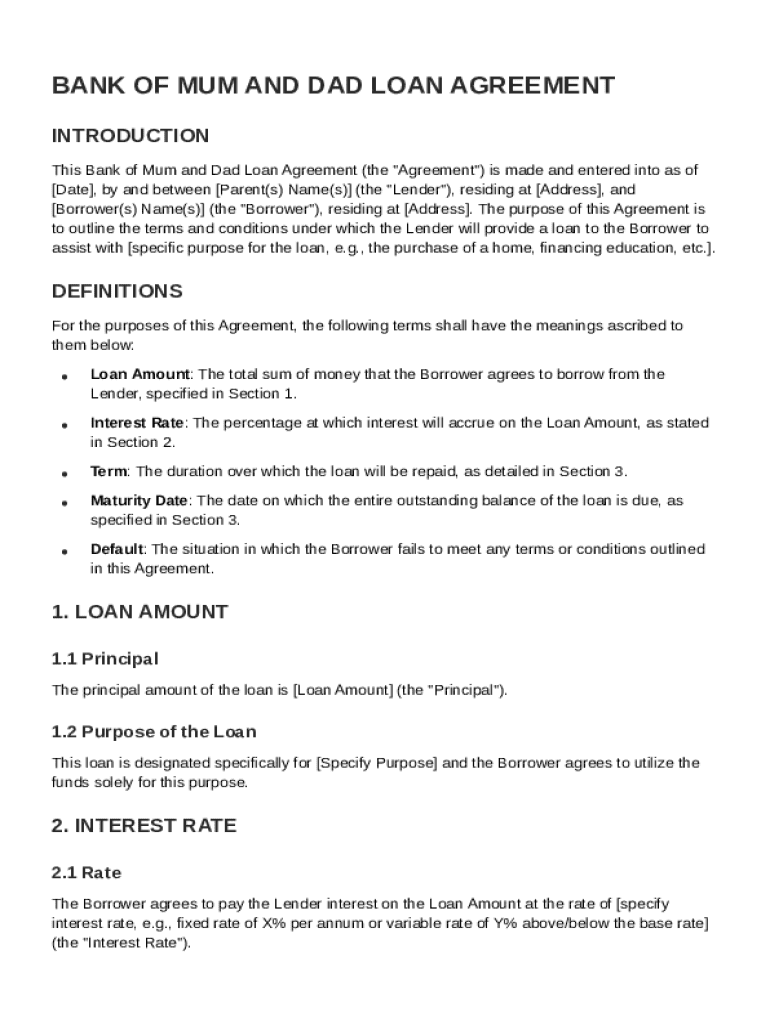

Comprehensive Guide to the Bank of Mum and Dad Loan Agreement Form

How to fill out a Bank of Mum and Dad loan agreement form?

To fill out a Bank of Mum and Dad Loan Agreement form, start by clearly defining the loan amount, interest rate, and repayment terms. Specify the purpose of the loan, ensuring both parties understand the expectations. Once all details are agreed upon, utilize an editing platform like pdfFiller to customize the document, sign electronically, and share it easily.

What is the Bank of Mum and Dad loan agreement?

The Bank of Mum and Dad Loan Agreement is a legal document that outlines the terms of a loan provided by family members, typically parents, to their children. This type of agreement is significant as it not only formalizes the lending process but also protects both parties involved. Families often use this agreement to assist their children with large expenses, such as housing or education.

-

The agreement serves to clarify loan terms and can prevent misunderstandings.

-

Many families utilize this type of loan for home purchases, debt consolidation, or education funding.

-

Benefits include potential lower interest rates for borrowers and more flexible repayment plans for lenders.

What are the key components of the loan agreement?

A comprehensive Bank of Mum and Dad Loan Agreement includes several critical components. Each term within the agreement must be precisely defined to avoid future disputes. Here’s a breakdown of the essential elements.

-

Key definitions include the loan amount, interest rate, term, maturity date, and what constitutes a default.

-

It's crucial to specify the principal loan amount and detail the intended use of the funds.

-

Interest rates can be fixed or variable, and understanding how it accrues over the loan term is vital.

What are the pros and cons of the loan agreement?

While there are numerous benefits to using a Bank of Mum and Dad Loan Agreement, potential downsides must be evaluated. It's essential for both lenders and borrowers to consider these factors to make informed choices.

-

Lenders enjoy control over loan terms, allowing for flexibility in repayment options.

-

Borrowers often benefit from lower interest rates and faster processing times compared to traditional lenders.

-

Establishing a loan with family can create emotional strain and complicate family dynamics if repayment terms are not adhered to.

What considerations should be made before signing a loan agreement?

Before signing any loan agreement, several important considerations should be discussed. Understanding the legal implications is crucial, and it's advisable to document everything clearly.

-

Engaging a legal professional ensures the agreement meets all necessary legal standards.

-

Clear and open communication between both parties can prevent misunderstandings.

-

It is advisable to consult a financial advisor or lawyer before finalizing the agreement.

How to fill out the loan agreement on pdfFiller?

Using pdfFiller to complete the Bank of Mum and Dad Loan Agreement form simplifies the process significantly. The platform provides user-friendly editing features that allow for easy customization.

-

Follow the pdfFiller prompts to complete the form accurately.

-

Utilize tools to tailor the agreement to your needs, ensuring clarity and compliance.

-

E-sign the document for fast completion and share it seamlessly with involved parties.

What to do after signing the loan agreement?

Post-signing management of your loan agreement is crucial for maintaining records and compliance. An organized approach after signing is essential to ensure everything remains on track.

-

Use pdfFiller to securely store and organize your agreements.

-

Utilize pdfFiller’s tools to set reminders for repayment dates.

-

Continue collaboration with all parties to ensure transparency and adherence to the agreement.

How to fill out the Bank of Mum and Dad Loan Agreement

-

1.Start by downloading the Bank of Mum and Dad Loan Agreement form from a reliable source like pdfFiller.

-

2.Open the form in pdfFiller and review the sections such as lender and borrower details.

-

3.Fill in the lender's information, typically the parent's name and contact details.

-

4.Enter the borrower's information, which will generally be the child’s name and contact details.

-

5.Specify the loan amount being provided in clear terms.

-

6.Set the repayment terms, including interest rates, payment schedule, and due dates, if applicable.

-

7.Detail any collateral or security that may be involved in the loan agreement.

-

8.Review the entire document for accuracy and completeness, ensuring all necessary sections are filled in.

-

9.Once completed, save the document and consider having it reviewed by a legal professional for additional security and compliance with local laws.

-

10.Finally, print the agreement for both parties to sign, making sure each party retains a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.