Borrower Agreement Template free printable template

Show details

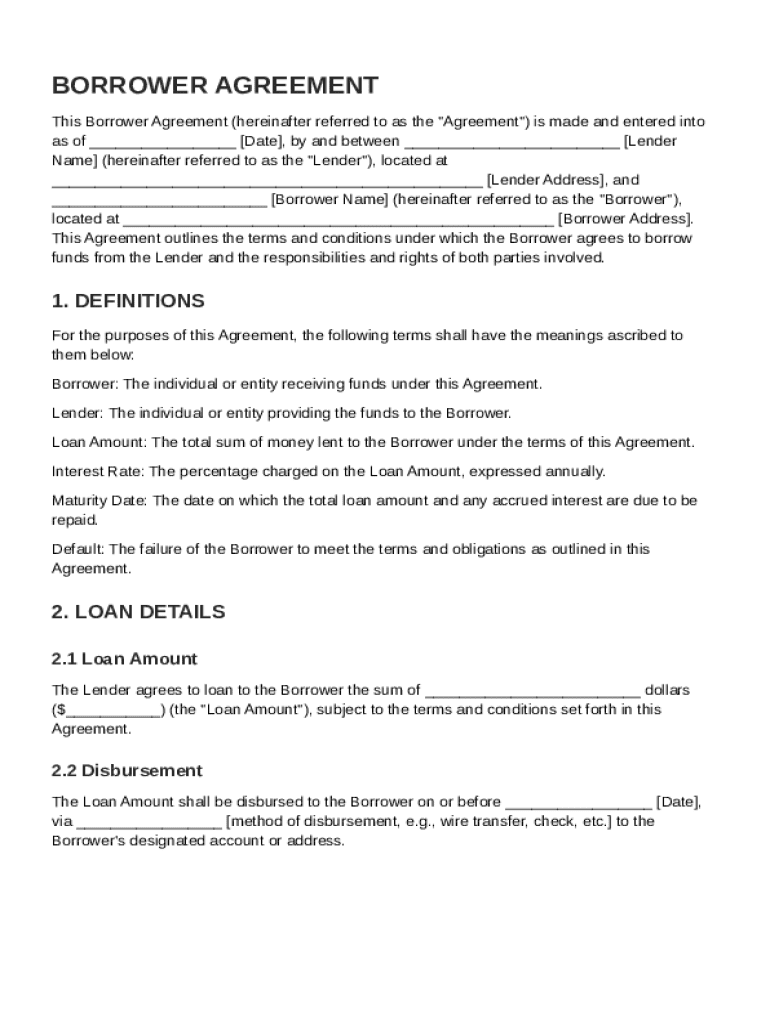

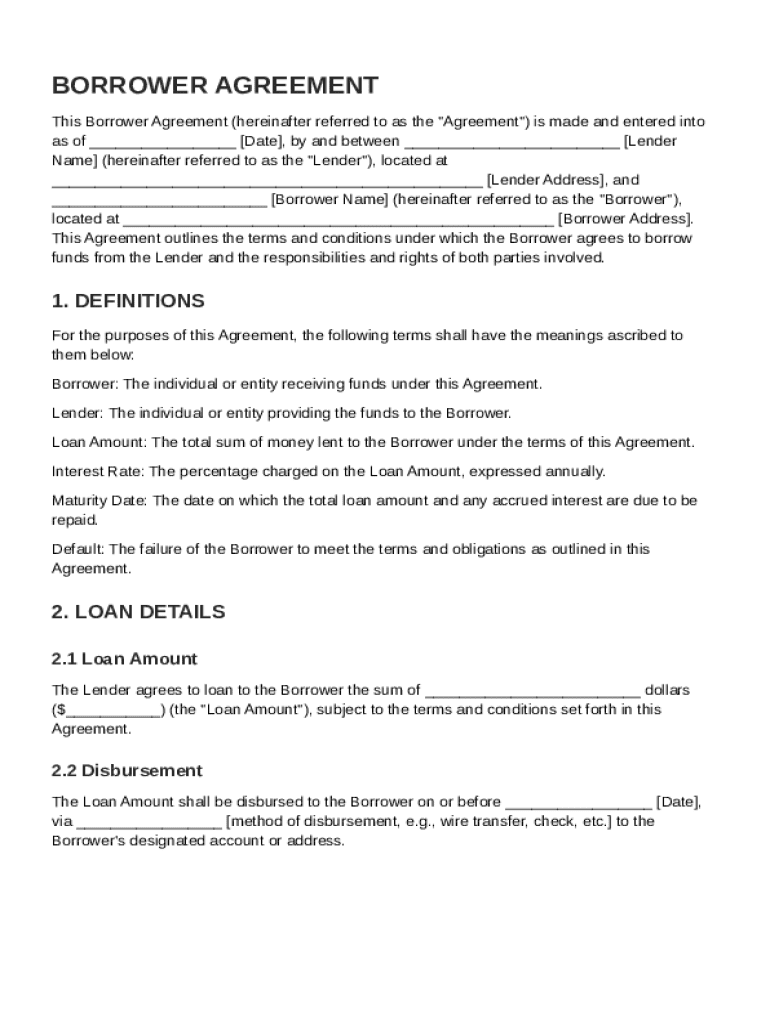

This document outlines the terms and conditions under which the Borrower agrees to borrow funds from the Lender, detailing responsibilities, rights, loan amount, interest rate, repayment terms, and

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Borrower Agreement Template

A Borrower Agreement Template is a legal document outlining the terms and conditions under which one party borrows money from another, ensuring clarity and protection for both parties involved.

pdfFiller scores top ratings on review platforms

Big help in filling out Florida probate forms.

I run a business and this is the most user friendly editor I have ever used.

Good program.. needs a desktop application to work with windows in full.

some recipients cannot open the link to sign. Must have compatibility issues?

LOVE how easy this system is to use! Honestly, this has been so beneficial for my real estate career.

I really like the program; however, when I save I get logged out. I have not been successful at using any form except the Offer to Purchase. I need addendums.

Who needs Borrower Agreement Template?

Explore how professionals across industries use pdfFiller.

Borrower Agreement Template: Comprehensive Guide

How does a borrower agreement work?

A Borrower Agreement Template form is a legally binding document between a borrower and a lender that outlines the terms of a loan. This document plays a crucial role in formalizing the borrowing process and minimizing misunderstandings. Both parties need to clearly understand their obligations and rights to prevent potential disputes.

-

A Borrower Agreement is an arrangement that specifies the terms under which a borrower can access funds from a lender.

-

Having a Borrower Agreement ensures clarity in the loan terms, safeguarding both parties' interests.

-

The two main entities are the borrower, who receives the funds, and the lender, who provides them.

What are the essential components of a borrower agreement?

-

Each party's roles, along with critical loan terms should be defined for clarity.

-

This includes the principal amount, repayment timeline, and any other specifics.

-

A breakdown of applicable interest rates and additional fees ensures mutual understanding.

-

Clearly outlining repayment conditions, including dates and acceptable payment methods, is crucial.

How can fill out the Borrower Agreement Template form?

Filling out the Borrower Agreement Template can be straightforward if you follow a methodical approach. Begin by carefully reviewing the template's sections and fill in the required information accurately. Using pdfFiller offers features that simplify this process, ensuring a smooth experience.

-

Follow a structured approach to input data into each section, ensuring accuracy.

-

Be cautious of inaccuracies in loan amount or dates, as these can lead to significant issues.

-

Utilize tools offered by pdfFiller for editing and customizing your agreement to fit specific needs.

How can edit the borrower agreement using pdfFiller?

Editing a Borrower Agreement Template with pdfFiller is simple and user-friendly. Users can easily modify fields, update terms, and utilize interactive tools designed for customization. Emphasis should always be placed on ensuring legal compliance when making any necessary changes.

-

You can click on fields to edit directly within the Borrower Agreement Template.

-

pdfFiller provides various tools that enhance document customization while facilitating ease of use.

-

Always review amendments to confirm they meet applicable legal standards in your region.

What are the benefits of signing the borrower agreement digitally?

Digital signatures have transformed how contracts, such as borrower agreements, are executed. Utilizing pdfFiller's eSigning capabilities offers several advantages, including faster processing times and a reduced carbon footprint. Equally important is understanding the legal validity of these signatures.

-

eSigning with pdfFiller allows for quick modifications and avoids lengthy paperwork.

-

Users can effortlessly add their eSignature to the Borrower Agreement Template with just a few clicks.

-

Familiarize yourself with regulations regarding digital signatures to ensure validity in your jurisdiction.

How can manage my borrower agreement post-signing?

Once you have signed the Borrower Agreement Template, managing the completed document is vital for both parties. Options such as secure storage, easy sharing, and compliance tracking are essential to maintaining document integrity. pdfFiller offers tools for efficient management of signed agreements.

-

Cloud storage options ensure your documents are easily accessible while remaining secure.

-

Using pdfFiller, you can monitor any changes made to your signed agreement for compliance.

-

Ensuring your document’s security involves using strong passwords and encrypted storage options.

How to fill out the Borrower Agreement Template

-

1.Download the Borrower Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the borrower’s name and contact information at the top of the document.

-

4.Fill in the lender's details in the appropriate section.

-

5.Specify the loan amount clearly in numerical and written form.

-

6.Indicate the interest rate applicable to the loan, if any.

-

7.Set the repayment terms, including due dates and payment frequency.

-

8.Include any collateral securing the loan, if applicable.

-

9.If there are any fees associated with the loan, list them clearly.

-

10.Review all entered information for accuracy and completeness.

-

11.Save the document and export it in your desired format or send it directly to the involved parties.

How to write a borrowing agreement?

How to write a loan agreement contract. Agree to terms. First, negotiate terms with the other party. Create a draft for everyone to review. Make adjustments if needed. Add signatures (and notarization). Distribute copies of the executed agreement.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

What is the structure of a loan agreement?

Key sections include definitions, credit facilities, terms of borrowing, interest computations, security documentation, conditions precedent, representations and warranties, covenants, events of default, and agent provisions.

How to write a borrow money letter?

To improve the chances of loan approval, consider loan guidelines carefully, detail the reasons for the loan, attach supporting documentation, outline the requested loan amount and repayment plan, and maintain a polite, professional tone throughout the letter.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.