Bridge Loan Agreement Template free printable template

Show details

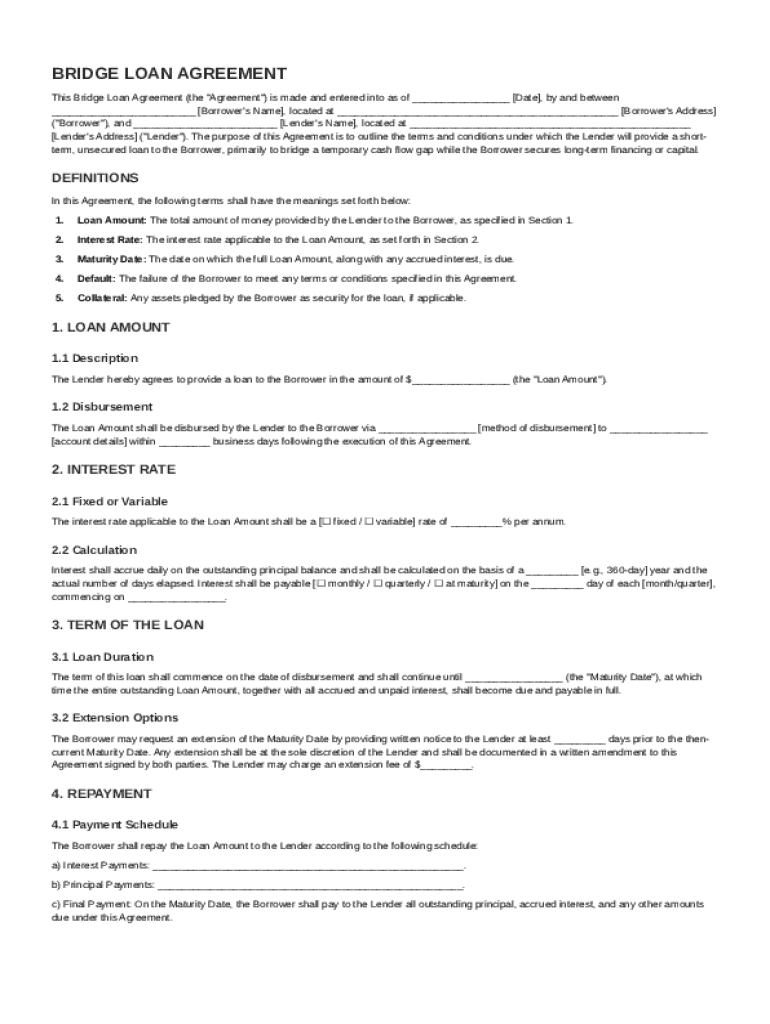

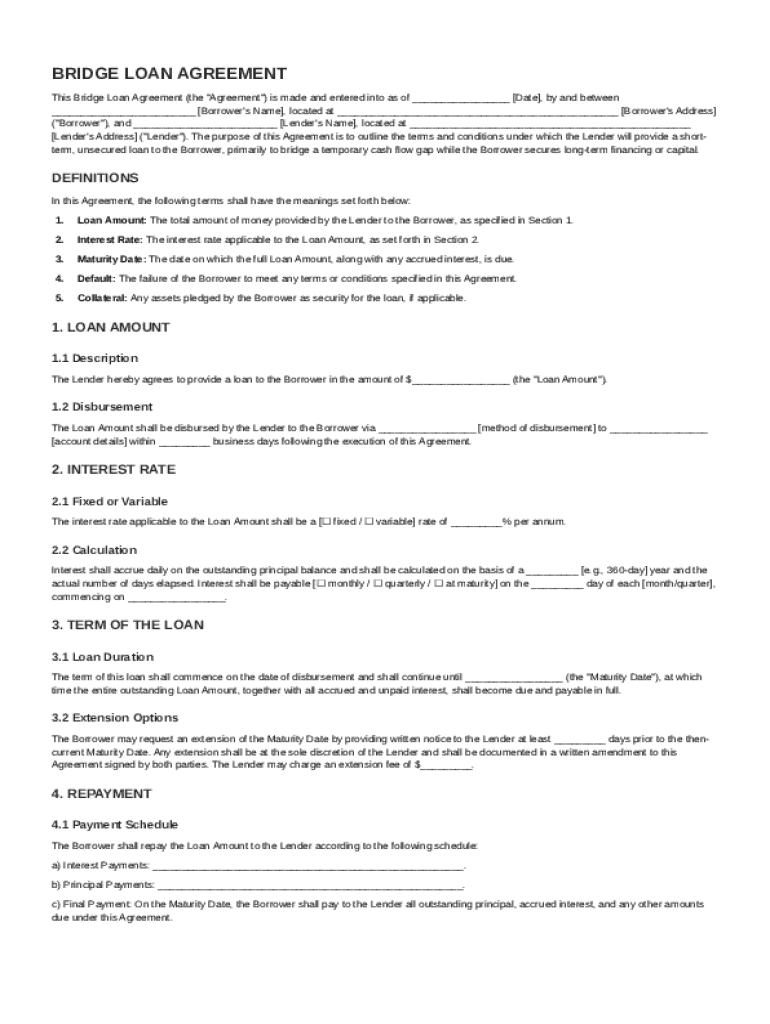

This document outlines the terms and conditions under which a lender will provide a shortterm, unsecured loan to a borrower to address a temporary cash flow gap.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Bridge Loan Agreement Template

A Bridge Loan Agreement Template is a legal document outlining the terms and conditions for a short-term loan used to bridge a financial gap until permanent financing is secured.

pdfFiller scores top ratings on review platforms

Good tool. Training to would help to enjoy it.

I think its a great way to grow in law.

Great

Great experience for a less than tech…

Great experience for a less than tech savvy person

This comes in very handy

This comes in very handy. It is easy and convenient.

This app has been my life saver signing…

This app has been my life saver signing documents for my job and getting them to the right place in a timely manner!

Who needs Bridge Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Bridge Loan Agreement Template form

TL;DR: Quick guide on filling out the template

To fill out a Bridge Loan Agreement Template, start with accurate borrower and lender information, specify the loan amount, interest rate, and maturity date, and ensure that both parties sign the document digitally using platforms like pdfFiller. This will streamline the entire process and make your documentation straightforward and compliant.

Understanding bridge loan agreements

A Bridge Loan Agreement is a short-term loan designed to bridge the gap between the need for immediate financing and the availability of long-term financing. It serves a temporary purpose and is commonly used in real estate transactions. Understanding its key components will help borrowers and lenders navigate the agreement effectively.

-

This is a binding contract that outlines the terms and conditions under which a bridge loan is issued.

-

Bridge loans are often utilized to provide immediate funding during transitional periods, such as purchasing new property before selling the existing one.

-

These typically include borrower and lender information, loan amount, interest rate, maturity date, and other relevant terms.

Essential terms defined

Understanding key financing terms is crucial for both borrowers and lenders when entering into a bridge loan agreement. Familiarity with these terms can prevent misunderstandings and disputes.

-

The loan amount is typically based on the equity in the property or the borrower's creditworthiness.

-

A fixed interest rate remains constant over the term, while a variable rate can fluctuate based on market conditions.

-

This is the date by which the loan must be repaid, significantly impacting financial planning.

-

If a borrower defaults, the lender has the right to seek legal remedies, including asset forfeiture.

-

Collateral can include real estate or other valuable assets that serve as security for the loan.

Step-by-step guide to completing the bridge loan agreement

Completing a bridge loan agreement requires careful attention to detail and understanding of the required information. Here’s a systematic approach.

-

The date should be correctly stated as it marks the beginning of the loan period.

-

This includes the legal name, address, and contact information of the borrower.

-

Include all necessary details about the lender, ensuring accuracy for lawful processing.

-

Clearly state the loan amount while supporting it with any required financial documentation.

-

Choose between fixed or variable rates based on financial advice or personal preference.

-

Clearly declare the maturity date to avoid financial mismanagement.

-

Utilize pdfFiller's eSigning capabilities to secure the agreement and manage future edits.

Managing your bridge loan: What to expect

Once the bridge loan is secured, effective management becomes crucial for financial health. Knowing what to anticipate can help prepare borrowers.

-

Payment schedules will detail the frequency and amount due, ensuring timely payments and maintaining good standing.

-

Understanding how interest is calculated can assist in financial planning – always refer to the agreement for specifics.

-

In case of a missed payment, communication with the lender is essential to prevent escalation.

Utilizing pdfFiller for your bridge loan agreement

pdfFiller offers a state-of-the-art platform for filling out and managing bridge loan agreements effectively and securely.

-

With pdfFiller, documents can be quickly edited online, ensuring real-time collaboration.

-

Sharing features allow for multiple stakeholders to review and comment on agreements, making the process more efficient.

-

The eSigning feature simplifies the signing process, reducing paperwork and enhancing security.

-

Document management is simplified through pdfFiller’s cloud capabilities, allowing access from multiple devices.

Common pitfalls in bridge loan agreements

While drafting a bridge loan agreement, it’s vital to avoid common mistakes that can lead to costly delays and disputes.

-

Failing to anticipate the actual duration can lead to unexpected financial strain; hence, proper forecasting is essential.

-

Ambiguity in terms can lead to conflicts; a clearly defined agreement protects all parties involved.

-

Different states may have regulations governing bridge loans; compliance is crucial to avoid legal issues.

Glossary of key terms related to bridge loans

A solid understanding of the terminology associated with bridge loans can enhance clarity and comprehension for all parties.

-

A critical ratio used to assess the risk of a mortgage by comparing the loan amount to the property value.

-

The assessment of a borrower's ability to repay based on credit history and score.

-

A fee that some lenders charge if a borrower pays off their loan early, which can affect overall financing costs.

How to fill out the Bridge Loan Agreement Template

-

1.Download the Bridge Loan Agreement Template from pdfFiller.

-

2.Open the document using pdfFiller's platform.

-

3.Begin by filling in the date at the top of the agreement.

-

4.Provide the names and contact information for both the lender and borrower in the designated sections.

-

5.Specify the loan amount in the corresponding field clearly and accurately.

-

6.Outline the repayment terms, including the interest rate and payment schedule, using the provided fields.

-

7.Include details about any collateral securing the loan, if applicable.

-

8.Review the terms to ensure all information is accurate and complete, then sign the document electronically.

-

9.Save the filled document and, if necessary, send it to the other party for their signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.