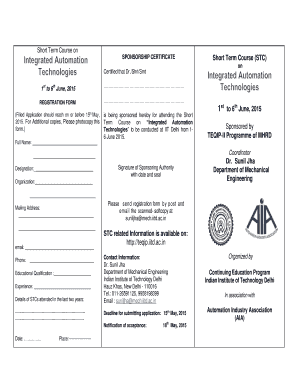

Bridging Loan Agreement Template free printable template

Show details

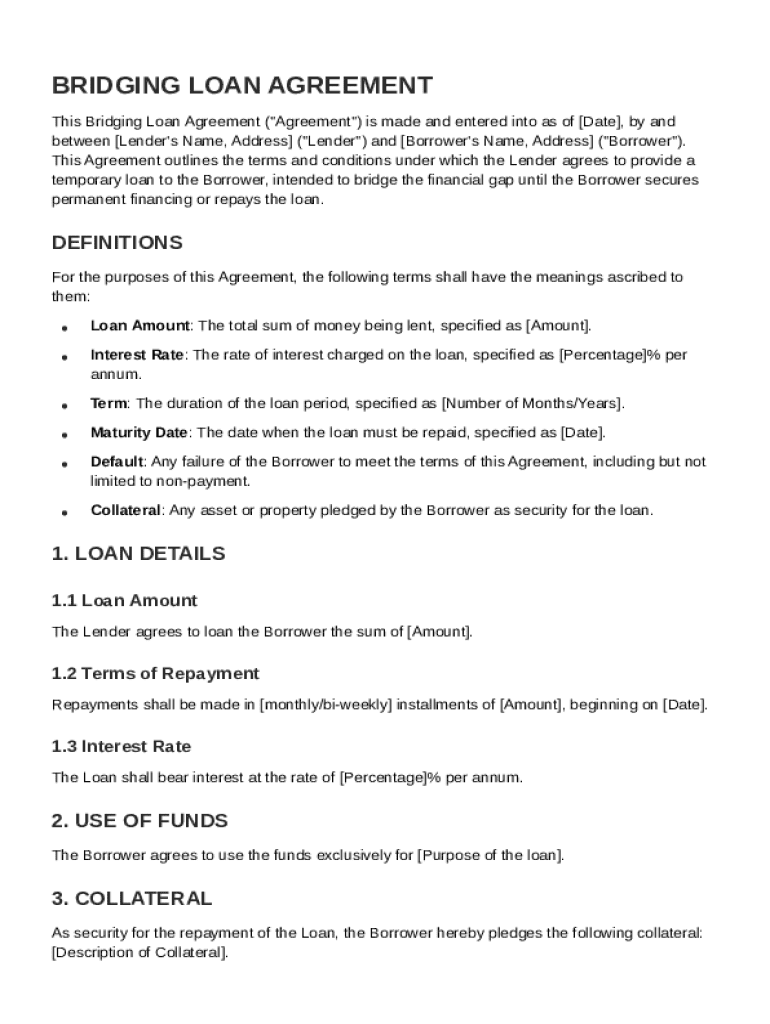

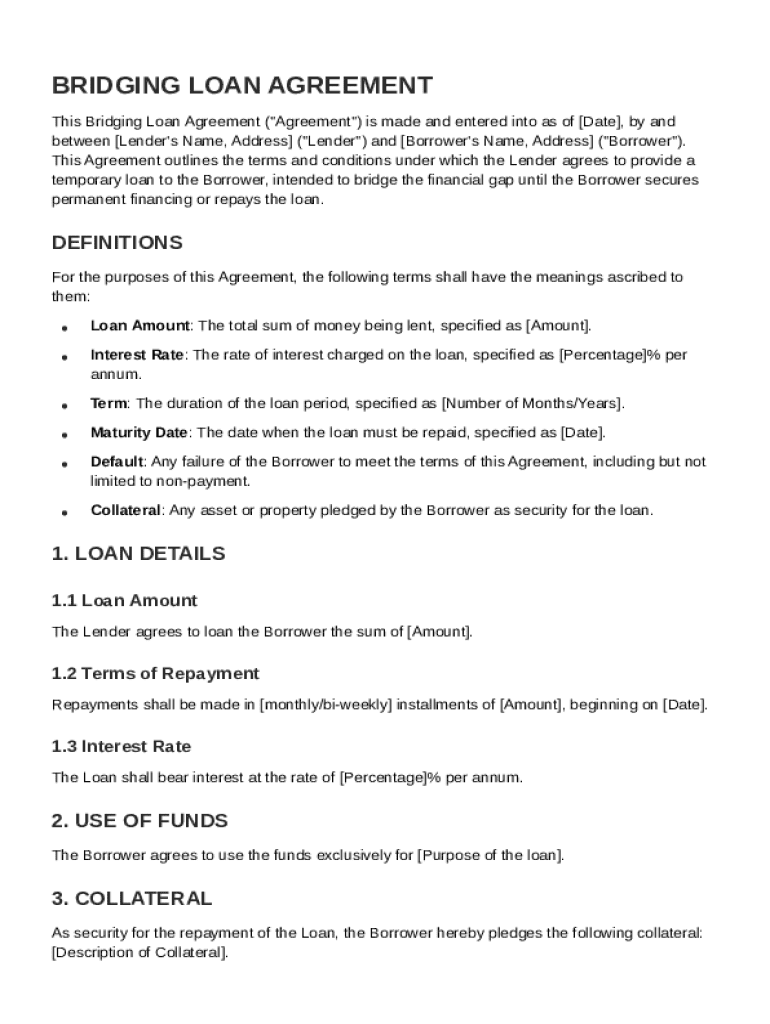

This document outlines the terms and conditions of a temporary loan provided by a lender to a borrower to bridge a financial gap until permanent financing is secured or the loan is repaid.

We are not affiliated with any brand or entity on this form

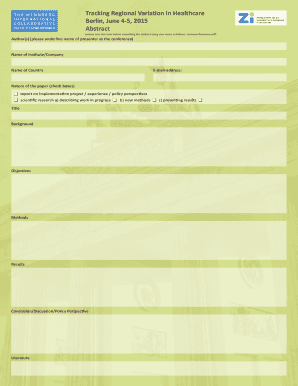

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Bridging Loan Agreement Template

A Bridging Loan Agreement Template is a legal document that outlines the terms of a temporary loan used to bridge the gap between the purchase of a new property and the sale of an existing one.

pdfFiller scores top ratings on review platforms

done what i needed easily

thanks

Easier than acrobat!

Love it

Very easy to use for my business.

Help's out a bunch when your in a pinch.

Who needs Bridging Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Bridging loan agreement template guide on pdfFiller

Filling out a Bridging Loan Agreement Template form is straightforward. You start by defining loan specifics like the amount, interest rate, and terms before signing. Make sure to gather all necessary documents to ensure a smooth process.

What are bridging loans?

Bridging loans serve as temporary financing, often used to bridge a gap between immediate financial needs and longer-term funding. These loans are especially popular when buyers need quick funding to secure new property before selling their current one.

-

A bridging loan is a short-term financing tool, crucial for facilitating timely real estate transactions.

-

Bridging loans are frequently used in real estate, such as purchasing a new home before selling the current one.

-

Unlike traditional mortgages, bridging loans are available for short durations and typically bear higher interest rates, reflecting their risk and urgency.

What are the key components of a bridging loan agreement?

Understanding the key components of a bridging loan agreement helps clarify responsibilities. Each section outlines essential details crucial for the agreement's validity.

-

This specifies how much you're borrowing. It's vital to determine this based on realistic needs, ensuring repayments are manageable.

-

Know whether you're opting for a variable or fixed interest rate. This decision can significantly impact your repayment amounts over time.

-

The typical loan term for bridging loans can range from a few months to a year, balancing immediacy with repayment structure.

-

The maturity date indicates when the loan must be repaid. Understanding default conditions can prevent penalties and ensure compliance.

-

Many agreements necessitate collateral, often real estate, to secure the loan. Failure to meet collateral requirements could jeopardize the loan.

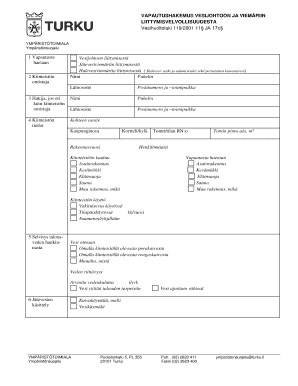

How do you fill out the bridging loan agreement?

Completing the Bridging Loan Agreement Template requires attention to detail. You must accurately enter information from both the lender and borrower, along with loan details, repayment terms, and collateral.

-

Ensure that you fill out the details of all parties involved exactly as they appear in their official documents.

-

Follow prompts closely to avoid missing any crucial aspects of the agreement.

-

Utilize pdfFiller’s online tools to simplify form completion, ensuring correctness and efficiency.

How to manage your bridging loan agreement?

Managing your bridging loan agreement effectively ensures it remains relevant and legally binding. Effective digital management enhances accessibility and security.

-

pdfFiller provides electronic signing options, streamlining the signing process while maintaining legal compliance.

-

After signing, you may find changes necessary. pdfFiller allows you to revisit and modify your agreement seamlessly.

-

Leverage cloud storage solutions for backing up your agreements and utilize sharing features for team access.

What legal considerations should you know?

Understanding legal considerations related to bridging loan agreements provides essential knowledge for compliance. Each jurisdiction, including [region], has unique requirements.

-

Bridging loan agreements must abide by local laws; consultation with legal experts ensures adherence.

-

Staying updated on legislation can mitigate issues that arise from non-compliance.

-

Seeking legal advice can safeguard against pitfalls in drafting or signing agreements, ensuring all parties are protected.

How does bridging loan financing compare to alternatives?

Navigating alternatives to bridging loans is essential for informed decision-making. Different financing options cater to varying needs.

-

Traditional lenders offer low-interest loans, whereas hard money lenders are more lenient but usually charge higher rates.

-

Evaluate the advantages of speed and flexibility versus the risks associated with high costs.

-

For urgent financial needs and quick property transactions, bridging loans offer unmatched convenience.

How can you leverage pdfFiller for document management?

pdfFiller's platform enhances how you manage your bridging loan agreements, offering versatile digital solutions. Utilizing its features can significantly improve your document handling experience.

-

The platform is designed for ease, meaning you can edit, sign, and share your agreements efficiently.

-

pdfFiller allows multiple team members interactive access, simplifying workflow and enhancing collaboration.

-

Many users appreciate how pdfFiller's streamlined processes have led to effective management of their agreements.

How to fill out the Bridging Loan Agreement Template

-

1.Open the Bridging Loan Agreement Template in pdfFiller.

-

2.Review the template to understand the sections included, such as borrower information and loan terms.

-

3.Begin by filling in the borrower's full legal name and contact information in the designated fields.

-

4.Next, enter the lender's details, including name and contact information.

-

5.Specify the loan amount being requested as well as the interest rate, if applicable.

-

6.Fill in the purpose of the loan, detailing how the funds will be used, such as purchasing a new property.

-

7.Outline the repayment terms, including the date when the loan must be repaid in full.

-

8.Include any additional clauses or conditions that might be relevant, such as default terms or prepayment penalties.

-

9.Once all sections are completed, review the document thoroughly for accuracy.

-

10.Finally, save the completed form and consider sending it electronically or printing it for signatures.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How to get a $100 bridging loan?

Can I Get a 100% Bridging Loan? You'll need additional assets (usually property) to secure your loan against. You'll probably need a broker to help you find a willing lender (the lending pool is much smaller) It will likely be more expensive due to the added risks to the lender.

How to organise a bridging loan?

If you decide on a bridging loan, consider using a bridging loan broker who can research the market for you. Brokers can often access exclusive rates and deals but will often charge a fee for their services. Check what fees are included before you sign on the dotted line.

How to write a loan agreement between two people?

Information included on personal loan agreements include the names of both parties, the date of the agreement, the principal loan amount, the interest rate, and repayment terms. Personal loan agreements can be used as evidence in court if you fail to make payments.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.