Business Credit Agreement Template free printable template

Show details

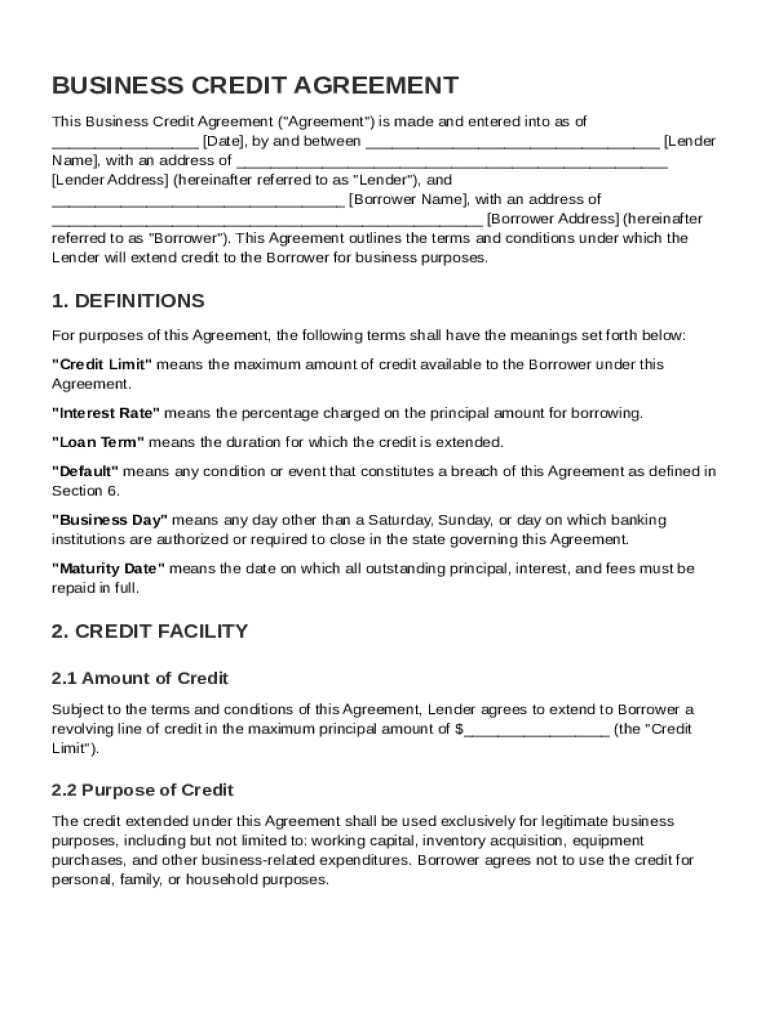

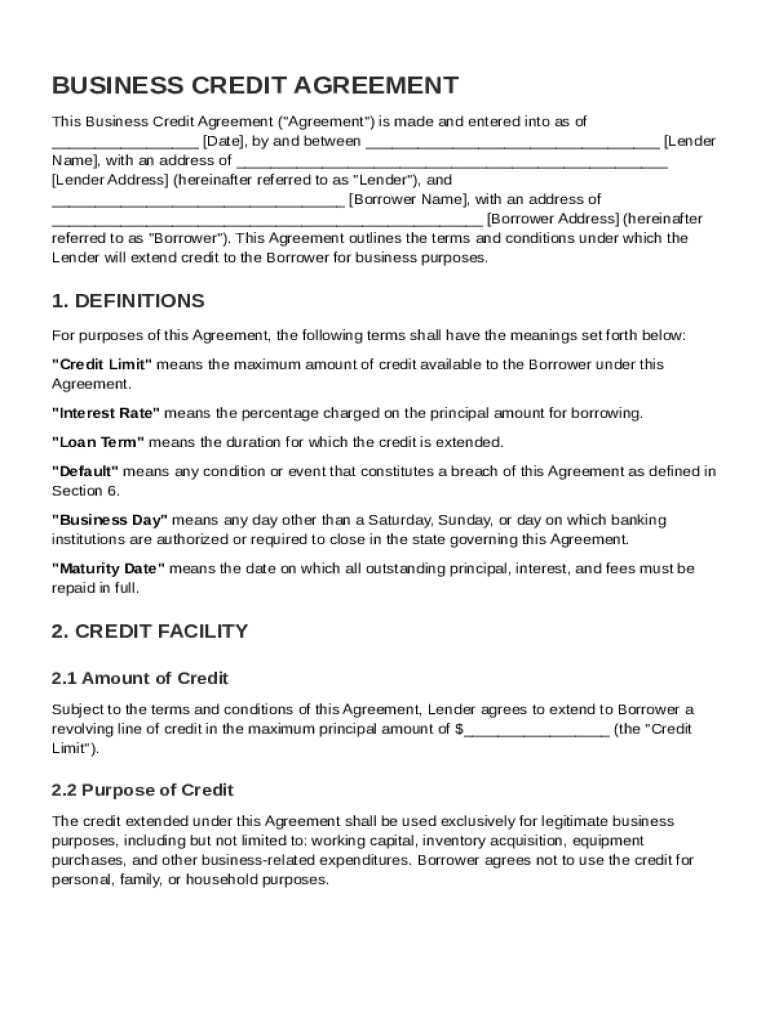

This document is a legal agreement between a lender and a borrower outlining the terms and conditions for extending credit for business purposes.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Business Credit Agreement Template

A Business Credit Agreement Template is a legal document outlining the terms under which a lender extends credit to a business.

pdfFiller scores top ratings on review platforms

The filler form was OK; however, it would have been better to know there was a cost and subscription up front before putting all the time in to fill out the form. Especially when it was shown as "FREE"

Best PDF filler I've found for ease of application, font size, positioning, saving, amending, and printing.

It has been exceptional EXCEPT it was a little underhanded the way you tell the user how much it will really cost. NOT Free as advertised. I am okay with it but thought it should be state up front.

Wonderful product. Much needed in the workplace.

Excellent product, I appreciate the 30 day FREE trial so I can fill out some job applications

WISH I KNEW IT WAS A PAID SUBSCRIPTION BEFORE I FILLED OUT THE 14 PAGE FORM

Who needs Business Credit Agreement Template?

Explore how professionals across industries use pdfFiller.

How to create a Business Credit Agreement Template

A Business Credit Agreement Template is a crucial document that outlines the terms and conditions of credit extended to a business. It ensures clarity and protects both the lender and borrower. This guide provides a comprehensive overview of creating and managing a Business Credit Agreement effectively.

-

Fill out your Business Credit Agreement Template by clearly defining the terms, parties, and obligations, while utilizing pdfFiller to edit, sign, and manage your document securely.

What is a Business Credit Agreement?

A Business Credit Agreement is a legally binding document that stipulates the conditions under which credit is extended to a business. It outlines relevant terms, limiting instances of miscommunication and disputes between the lender and borrower.

-

This agreement serves as a contract specifying the loan amount, interest rates, repayment timeline, and required collaterals.

-

Establishing a formal agreement helps mitigate risks by clearly defining expectations and responsibilities.

-

The key participants in this agreement are the lender, usually a bank or financial institution, and the borrower, which is the business seeking credit.

What are the essential terms of the agreement?

To effectively understand a Business Credit Agreement, familiarity with specific terminology is essential. These terms clarify expectations and industry standards.

-

This represents the maximum amount of credit that can be used by the business.

-

This is the cost of borrowing and is calculated based on the principal amount borrowed.

-

This defines the duration over which the credit is extended, often ranging from months to years.

-

This term outlines circumstances that may lead to a violation of the agreement, often leading to legal repercussions.

-

These are defined as days when banks and financial institutions operate and process transactions.

-

This is the date by which the borrower must repay the total amount owed.

How does a credit facility work?

Understanding the framework of the credit facility is vital for businesses looking to leverage credit.

-

This typically describes a revolving line of credit, which allows borrowing up to a certain limit and paying it back over time.

-

Funds are usually reserved for specific business purposes like inventory purchases or equipment financing.

-

Details on how businesses can access the funds, whether through transfers, checks, or electronic payments.

What are the form fields and requirements?

Filling out a Business Credit Agreement Template requires careful attention to detail to ensure all essential information is included.

-

Critical fields include the date, lender name, and borrower name.

-

Both parties should include their legal business addresses.

-

A clear articulation of how the credit may be used and the obligations thereafter.

How to use pdfFiller for your Business Credit Agreement?

pdfFiller provides functionalities that can ease the often cumbersome process of drafting and executing Business Credit Agreements.

-

Users can easily modify the template to fit their specific terms and conditions.

-

Digital signatures can be added securely, making execution of the document simple and legal.

-

Team members can work together in real-time, enhancing efficiency and reducing errors.

What compliance considerations should be aware of?

Knowing the compliance landscape is vital, as it helps ensure that your Business Credit Agreement meets all regulatory standards.

-

Keep updated on the specific regulations that apply in your region to avoid legal issues.

-

Familiarizing yourself with established practices in your industry can guide effective drafting.

-

Beware of vague language or missing critical details, which can lead to disputes.

How to get started with your Business Credit Agreement?

It’s essential to approach the completion of a Business Credit Agreement Template comprehensively.

-

Start by navigating to pdfFiller to find and select the relevant template.

-

Filling out the agreement requires careful input of all requisite information in the form fields.

-

Understand the options for downloading or sharing the completed agreement with stakeholders.

How to fill out the Business Credit Agreement Template

-

1.Start by downloading the Business Credit Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and initiate the editing mode.

-

3.Begin by entering the date of the agreement in the designated field.

-

4.Provide the full legal name of the borrowing business, including the business structure.

-

5.Next, enter the lender's details, ensuring accuracy in contact information.

-

6.Specify the credit limit agreed upon by both parties in the section provided.

-

7.Detail the interest rates applicable to the credit, including any variable rates if applicable.

-

8.Outline the repayment terms, including schedules and methods of payment.

-

9.If there are any fees or penalties for late payments, make sure to specify these clearly.

-

10.Review all entered information for accuracy and completeness before finalizing the agreement.

-

11.Once everything is correct, save the edited version and export it in your preferred format, such as PDF or Word.

How to write a credit agreement?

The Lender agrees to loan (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before , along with any interest incurred on the unpaid monies at the rate of _% per year, beginning on (date).

What is a contract to repay borrowed money?

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according to the terms).

How do you write a loan agreement between companies?

A well-structured loan agreement should follow established practice and include these key sections in order: parties' details (names and addresses), loan amount and purpose, interest rates and calculation method, repayment schedule, security provisions (if applicable), and default conditions.

How do you write a simple written agreement?

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.